WHAT HAPPENED YESTERDAY

As of New York Close 14 Apr 2020,

FX

U.S. Dollar Index, -0.54%, 98.84

USDJPY, -0.61%, $107.11

EURUSD, +0.63%, $1.0984

GBPUSD, +0.91%, $1.2625

USDCAD, -0.19%, $1.3878

AUDUSD, +0.82%, $0.6435

NZDUSD, -0.16%, $0.6100

STOCK INDICES

S&P500, +3.06%, 2,846.06

Dow Jones, +2.39%, 23,949.76

Nasdaq, +3.95%, 8,515.74

Nikkei Futures, +2.40%, 19,528.0

COMMODITIES

Gold Futures, -0.58%, 1,751.20

Brent Oil Spot, -5.21%, 27.81

SUMMARY:

Dollar fell to two-week lows against a basket of currencies on Tuesday as risk sentiment returned to the market following better-than-expected economic data from China, which painted a less gloomy picture than feared. China’s March exports fell 6.6% from a year earlier, compared with a forecast for a 14% drop, while imports fell by less than 1%, compared with a 9.5% drop predicted by economists. China’s Trade Balance came in at a surplus of +139B vs an expectation of +175B, although it missed expectations, it was far better than the previous recorded -43B.

It was a good day for the stock market on Tuesday, as investors expressed optimism in an economic recovery despite the uncertainty signaled by some of the nation’s most influential banks. The Nasdaq Composite rose 3.95%, pulling ahead of the S&P 500 (+3.06%), Dow Jones Industrial Average (+2.39%), and Russell 2000 (+2.1%), for its fourth straight advance. U.S. 2yr yield fell 2bp to 0.23% and U.S. 10yr yield unchanged at 0.76%.

JPMorgan Chase (JPM 95.50, -2.69, -2.7%) and Wells Fargo (WFC 30.18, -1.25, -4.0%) kicked off the Q1 earnings reporting season with underwhelming quarterly results, but more importantly, they stirred some concern by substantially increasing their provisions for credit losses. The provisions represented the challenges the companies are preparing for, given the unprecedented circumstances.

The stock market wasn’t concerned with uncertainty today, though, as it remained comforted in the notion that the economy will strategically reopen through a coordinated plan from federal and state officials. In addition, better-than-feared trade data for March out of China may have also aided investor sentiment.

NEW YORK CITY RECORDS SHARP JUMP IN COVID-19 DEATHS AS PRESUMED CASES ADDED

New York City revised its official Covid-19 death toll sharply upward to more than 10,000 on Tuesday, to include victims presumed to have perished from the lung disease but never tested. The new cumulative figure for “confirmed and probable COVID-19 deaths” released by the New York City Health Department, marks a staggering increase of over 3,700 deaths officially attributed to the highly contagious illness since March 11.

The city’s revised count, 10,367 in all, also raises the total number of lives lost to Covid-19 nationwide to more than 28,300, with New York state, and its largest city, in particular, accounting for the biggest share of deaths by far.

IMPACT: The recalibration of the pandemic’s lethality in New York came as Trump’s May 1 target for restarting the economy was pronounced “overly optimistic” by his top infectious disease adviser, Dr. Anthony Fauci on Tuesday. Trump and a number of state governors, including Cuomo, have clashed sharply this week over who has the power to lift restrictions aimed at curbing the pandemic.

FED LAUNCHES COMMERCIAL PAPER LIQUIDITY BACKSTOP

The Commercial Paper Funding Facility’s (CPFF) special purpose vehicle purchases higher rated, three-month unsecured and asset-backed paper from eligible bank, corporate, special-purpose entity and municipal issuers using financing from the New York Federal Reserve. The vehicle, which was announced on March 17, began making purchases on Tuesday according to the New York Fed.

Short-term credit markets had come under strain as investors worried that companies hit by efforts to slow the spread of the virus would not be able to repay their IOUs. That spurred the Fed to take steps aimed at thawing out markets frozen by spiking lending rates. The facility is funded with $10 billion of loss guarantee from the U.S. Treasury, which the Fed is expected to leverage as much as 10 times should demand warrants.

IMPACT: The program is similar to an operation used during the 2008 financial crisis, in which the central bank acts as a lender of last resort for companies otherwise unable to borrow in the short-term market.

MAJOR U.S. AIRLINES ACCEPT GOVERNMENT AID FOR PAYROLLS

The U.S. Treasury Department said on Tuesday that major passenger airlines have agreed in principle to a $25 billion rescue package, ensuring airline workers jobs until October while the industry works to overcome its biggest-ever crisis.

Major carriers will receive 70% of the funds for payroll in cash assistance that will not need to be paid back, while smaller carriers receiving $100 million or less will not need to repay any funds.

The six largest U.S. airlines – American Airlines Group Inc (AAL.O), United Airlines Holdings Inc (UAL.O), Delta Air Lines Inc (DAL.N), Southwest Airlines Co (LUV.N), JetBlue Airways Corp (JBLU.O) and Alaska Airlines (ALK.N) – as well as four other airlines accepted the support, Treasury said.

IMPACT: Under the terms laid out by Treasury officials last week, the government would receive repayment on 30% of the funds awarded to large carriers and warrants equal to 10% of the loan amount. Two officials said the warrants are priced at last week’s closing share price.

DAY AHEAD

The Covid-19 pandemic has already had a devastating impact on the US labour market and the next data points to get the virus treatment are retail sales and industrial production. Both are due later today. The virus outbreak may have been dominating the headlines since January but the hard data for countries other than China have only now started coming in. Thus, can the latest bout of market optimism prevail, or will the dire numbers reignite fears of economic catastrophe?

SENTIMENT

OVERALL SENTIMENT: US investment bank thinks that the downturn will be 4 times worse than the one experienced in the 2008 crisis but then an “unprecedented recovery” would ensue. The world seems to have to come to terms that things will be very bad, and yet, they are projecting a V-shaped recovery. That is possible if the virus miraculously ceases to be a problem in a few months or a cure or vaccine is found. That, unfortunately, is extremely unlikely to happen in the next few months.

For now, the optimism will last until the market wakes up to the immutable fact that the virus is here to stay, and life will be different until a cure or a vaccine is found.

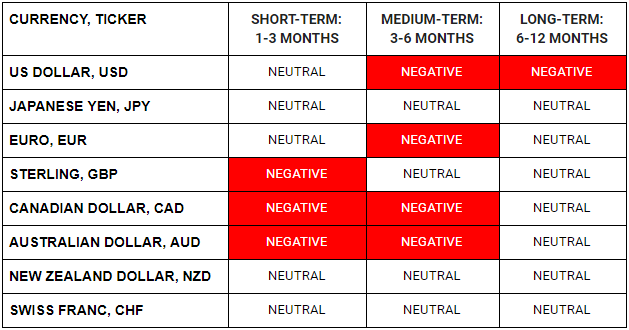

FX

STOCK INDICES

TRADING TIP

Do you want to be Right or Do you want to be Rich?

Bears are all wailing and whining as the bulls have recently left them trampled in the wake of the recent stock market rally off the lows. The S&P500 index has recouped almost 50% of the loss from the highs to the lows. The situation with the virus outbreak has only become worse. However, the markets do not just reflect the present but also discount the future.

For now, the focus is on the flattening of the infection curve in various hotspots such as Italy and New York. There will be times when the market prices relentlessly go against what you believe to be right. However, the purpose of trading is not to be right, but to be rich.

To be successful, you need to be able to remain solvent during the periods when you are wrong. A way to do this is to keep your risk position to a minimum when the markets are going against you. The time to scale up will become apparent when things start going your way.