WHAT HAPPENED YESTERDAY

As of New York Close 1 Apr 2020,

FX

U.S. Dollar Index, +0.50%, 99.50

USDJPY, -0.24%, $107.29

EURUSD, -0.73%, $1.0951

GBPUSD, -0.31%, $1.2380

USDCAD, +0.65%, $1.4153

AUDUSD, -0.74%, $0.6090

NZDUSD, -0.36%, $0.5935

STOCK INDICES

S&P500, -4.41%, 2,470.50

Dow Jones, -4.44%, 20,943.51

Nasdaq, -4.41%, 7,360.58

Nikkei Futures, -5.58%, 17,865.0

COMMODITIES

Gold Futures, +0.52%, 1,604.95

Brent Oil Spot, -0.76%, 22.27

SUMMARY:

The Dollar advanced on Wednesday, with markets bracing for what is shaping up to be one of the worst economic contractions in decades as the world confronts the Covid-19 pandemic. The Dollar rose against the Euro, Sterling and most other major currencies as selling in global shares highlighted growing risks from the pandemic that has shown little sign of easing. Markets were spooked after Trump’s dire press briefing late Tuesday, where he warned Americans of a “painful” two weeks ahead in fighting the Covid-19 even with strict social distancing measures.

The stock market retreated more than 4% to start the second quarter on Wednesday, as Trump warned that the next two weeks will be “very painful” in terms of Covid-19 fatalities. The S&P 500 (-4.41%), Dow Jones Industrial Average (-4.44%), and Nasdaq Composite (-4.41%) each fell 4.4%. The Russell 2000 underperformed with a 7.1% decline.

The Coronavirus Task Force on Tuesday estimated that deaths attributed to Covid-19 could total 100,000-240,000 in the U.S. with daily deaths projected to peak in two weeks. To help contain the outbreak, and hopefully bring these figures down, Florida, Nevada, and Pennsylvania joined the growing list of states to issue ‘stay at home’ orders for 30 days.

Original assumptions made by the medical community were based on the data coming out of China, which the U.S. intelligence community said underrepresented the real number of cases and deaths in the country, according to Bloomberg. The White House’s projections, based on new data being released every day, had the market worried about the social and psychological effects on the economy.

ITALY COVID-19 DEATH RATE SLOWS

Italy’s daily death toll from Covid-19 on Wednesday was the lowest for six days, authorities said, but the overall number of new infections grew and the government extended a national lockdown until at least the middle of April. The Civil Protection Agency said 727 people had died over the last 24 hours, down from 837 the day before, bringing total fatalities from the world’s deadliest outbreak of the viral pandemic to 13,155.

In the wealthy northern region of Lombardy, the epicentre of the outbreak, the daily tally of new infections jumped 50% compared with the day before, reversing a recent downtrend. The daily death toll in the region also grew, and a study suggested the number of fatalities is far higher than officially registered.

IMPACT: A national lockdown in place since March 9 was due to expire on Friday, but Prime Minister Giuseppe Conte announced the restrictions would remain in place until at least April 13. With Italy’s economy on its knees due to the lockdown, a survey of purchasing managers showed manufacturing activity fell in March at its sharpest rate for 11 years (to 40.3 from 48.7), and Economy Minister Roberto Gualtieri said this year would see a steep recession.

RUSSIAN PLANE WITH COVID-19 MEDICAL GEAR LANDS IN U.S. AFTER TRUMP-PUTIN CALL

Trump, struggling to fill shortages of ventilators and personal protective equipment, accepted Putin’s offer in a phone call on Monday. A Russian military transport plane left an airfield outside Moscow and arrived at New York’s John F. Kennedy airport in the late afternoon on Wednesday.

The State Department said that following the call between the two leaders, the United States “has agreed to purchase” needed medical supplies, including ventilators and personal protection equipment, from Russia and that they were handed over to the Federal Emergency Management Agency on Wednesday in New York City.

IMPACT: A U.S. official in Washington said the shipment carried 60 tons of ventilators, masks, respirators and other items. Russia has also used its military to send planeloads of aid to Italy to combat the spread of the Covid-19, exposing the European Union’s failure to provide swift help to a member in crisis and handing Putin a publicity coup at home and abroad.

TRUMP SAYS HE EXPECTS SAUDI-RUSSIA OIL PRODUCTION DEAL IN COMING DAYS

Trump said on Wednesday he expected Saudi Arabia and Russia to reach a deal in the next few days on oil production to end a price war that has “ravaged” the oil industry worldwide. “I think that they will work it out over the next few days. … Both know what they have to do,” Trump told a White House news conference, without elaborating on the reasons for his confidence.

“I think that Russia and Saudi Arabia at some point are going to make a deal, in the not-too-distant future, because it’s very bad for Russia, it’s very bad for Saudi Arabia,” he said, adding he had separate “great” conversations with Saudi Crown Prince Mohammed bin Salman and Russian President Vladimir Putin in recent days.

IMPACT: Trump’s intervention comes as April shapes up to be a calamitous month for the oil market. Saudi Arabia plans to boost its supply to a record 12.3 million barrels a day, up from about 9.7 million in February. At the same time, fuel consumption is poised to plummet by 15 million to 22 million barrels as Covid-19-related lockdowns halt transit in much of the world. Oil demand has been so battered by government lockdowns to stop the spread of the Covid-19 that any conceivable oil production cut agreement between the U.S., Canada, Russia and OPEC members would still fall well short of what’s needed to shore up the market.

DAY AHEAD

Estimates for this week’s US Initial Jobless Claims from economists at major firms range from more than 3 million to as high as 5.5 million. Today’s report is expected to signal even further economic pain ahead.

Tomorrow, the March jobs report – which includes the unemployment rate – will be released. But, it includes data only through March 14, and so will not show the impact of the last two weeks of the month where millions filed for unemployment benefits. Forecasts are for Nonfarm Payrolls to plummet by 123k in March versus a healthy gain of 273k in February. The unemployment rate is expected to jump to 3.9%.

With the markets already having gotten a glimpse of what is to come from last week’s dire jobless claims figures, a poor jobs report may not have much of an impact unless it’s shockingly bad.

SENTIMENT

OVERALL SENTIMENT:

With all the announced fiscal policies baked into the price, the continuing spread of the virus in the US and UK remains as a weight on the market. News of funds caught with investments in corporate bonds which are getting downgraded as the economic conditions deteriorate will continue to plague the headlines. Investment losses, job losses, revenue loss for corporates… where are the wins going to come from?

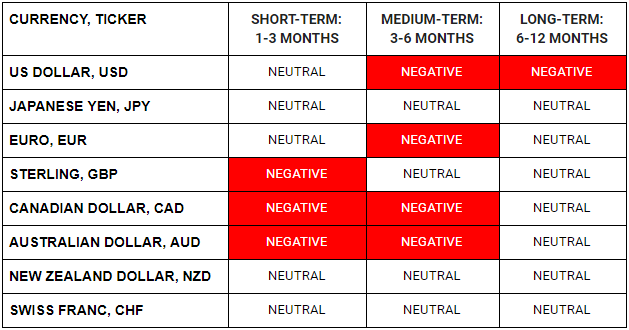

FX

STOCK INDICES

TRADING TIP

Expect Randomness and Irrationality

When markets are uncertain and under stress, the risk appetite of market-makers drop dramatically. This will lead to a decrease in the ability of participants to get a “reasonable” price when they have sizeable trades to execute.

Such illiquid conditions will lead to price spikes and falls that seemingly happen without rhyme or reason. In the chart below, you can see that there was a price spike at 3.45pm London time (2245 in Singapore) that took AUD/USD from .6055 to .6185 within seconds before settling down at 0.6105 for a while before drifting back below 0.6100. Some attribute the price spike to the WMR fix (https://www.investopedia.com/terms/w/wmreuters-benchmark-rates.asp) but that happens at 4.00pm London.

We may never know what the real reason is, and it could just be as simple what we technically call a fat finger error where someone just accidentally typed in and hit the wrong rate. Also, note that there was a sell-off the day before that was just as inexplicable.

Suffice to know that market conditions are illiquid, hence we can only protect ourselves by sizing our risk appropriately. Where you intend to stop out may not be the rate that you get to exit at.