WHAT HAPPENED YESTERDAY

As of New York Close 13 Apr 2020,

FX

U.S. Dollar Index, -0.23%, 99.38

USDJPY, -0.77%, $107.63

EURUSD, -0.08%, $1.0920

GBPUSD, +0.51%, $1.2521

USDCAD, -0.72%, $1.3874

AUDUSD, +0.95%, $0.6399

NZDUSD, +0.23%, $0.6101

STOCK INDICES

S&P500, -1.01%, 2,761.63

Dow Jones, -1.39%, 23,390.77

Nasdaq, +0.48%, 8,192.42

Nikkei Futures, -1.91%, 19,118.0

COMMODITIES

Gold Futures, +0.87%, 1,768.00

Brent Oil Spot, +1.84%, 29.34

SUMMARY:

There were no notable economic prints on Monday as several markets were closed for Easter Monday. Dollar sold off when the U.S. opened, in an otherwise flat Asian and European Session. Financial markets remain on edge over the spread of the Covid-19 as severe restrictions on personal movement drag the global economy into a deep recession. However, a slower flow of news in the past few days has boosted risk assets modestly, and the Dollar, which serves as a safe-haven asset, has drifted modestly lower.

The greenback has also been pressured in the last few weeks by Federal Reserve measures that have flooded the financial system with dollars to address a liquidity crunch caused in part by demand for the greenback.

S&P 500 declined 1.01% on Monday in a slight reversal from last week’s rally, while relative strength in the technology stocks helped lift the Nasdaq Composite (+0.48%). The Dow Jones Industrial Average fell 1.39%, and the Russell 2000 fell 2.8%. U.S. 2yr yields rose 2bp to 0.25% and U.S. 10yr yields rose 3bp to 0.76%.

NEW YORK, CALIFORNIA, AND OTHER STATES PLAN FOR REOPENING AS COVID-19 CRISIS EASES

Seven Northeastern U.S. states and three on the West Coast formed regional pacts on Monday aimed at coordinating a gradual reopening of their economies without a resurgence of Covid-19 infections just as the outbreak appeared to be starting to wane.

“Nobody has been here before, nobody has all the answers,” Cuomo said during an open conference call with five counterparts. “Addressing public health and the economy: Which one is first? They’re both first.”

IMPACT: New York, by far the hardest-hit state, will work closely with nearby New Jersey, Connecticut, Delaware, Pennsylvania, and Rhode Island to devise strategies for jointly easing stay-at-home orders imposed last month to curb coronavirus transmissions, New York Governor Andrew Cuomo said.

Political leaders said reopening of the economy may hinge on more widespread testing and cautioned that lifting of stay-at-home orders prematurely could reignite the outbreak. The Trump administration has signaled May 1 as a potential date for easing the restrictions.

SPAIN PARTIALLY LOOSENS LOCKDOWN AS COVID-19 DEATH RATE SLOWS

Spain let some businesses get back to work on Monday, but one of the strictest lockdowns in Europe remained in place despite a slowing in the country’s Covid-19 death rate.

Spain recorded its smallest proportional daily rise in the number of deaths and new infections since early March, with the cumulative toll rising by 517 to 17,489. The Health Ministry said on Monday confirmed Covid-19 cases totalled 169,496, up from 166,019 the previous day.

IMPACT: Although some activities, including construction and manufacturing, were allowed to restart, Health Minister Salvador Illa said that Spain remained in lockdown. Shops, bars, and public spaces are set to stay closed until at least April 26.

Business association CEOE warned that many companies, particularly the small firms that make up the bulk of the Spanish economy, do not have access to protective equipment like gloves and masks needed to guarantee the safety of staff. Some regional leaders also criticized the moves, fearing a resurgence of the coronavirus outbreak, which is weighing heavily on the Spanish economy, with some 900,000 jobs lost since mid-March.

TRUMP SAYS HE IS ON THE SAME PAGE WITH FAUCI, IS NOT FIRING HIM

Trump said on Monday he liked leading health expert Anthony Fauci and did not intend to fire him after Fauci said in an interview that earlier mitigation efforts against the Covid-19 outbreak could have saved more lives. On Sunday, Trump had retweeted a call to fire Fauci after the top U.S. expert on infectious diseases said lives could have been saved if the country had shut down sooner during the Covid-19 outbreak.

Trump in the past has repeated critical tweets of officials or enemies rather than make the criticism himself. The retweet fueled speculation Trump was running out of patience with the popular scientist and could fire him, prompting a White House denial before Trump’s briefing.

White House spokesman Hogan Gidley said Trump’s retweet addressed what he considered a false report on his travel restriction involving China, where the Covid-19 originated.

IMPACT: Fauci has assumed national prominence – and a degree of affection – as a leader in the fight against the Covid-19. He has contradicted or corrected Trump on scientific matters during the public health crisis, including whether the anti-malaria drug hydroxychloroquine is effective against the virus. Last week during the daily White House Covid-19 briefing, Trump stepped in and prevented Fauci from answering a question about hydroxychloroquine. Sacking Fauci would likely cause an erosion in the trust of the government’s ability to make decisions based on scientific evidence instead of focusing on the economy and the stock market.

DAY AHEAD

U.S. Retail Sales and Industrial Output prints coming out tomorrow are expected to be dismal. American shoppers had turned cautious in February, even before the disease had taken hold in the United States. U.S. Retail sales were down 0.5% over the month and the decline is expected to have accelerated to 8% in March. That may not seem incredibly dramatic given that most consumers were advised to stay at home, as panic-buying frenzy in supermarkets will likely hide the even gloomier reality in other sectors of the retail industry. Similarly, industrial output is also seen slipping sharply, with forecasts of a 4.2% month-on-month drop.

SENTIMENT

OVERALL SENTIMENT: Stocks tried higher, but failed, and yet it couldn’t break lower. Bonds remained in a tight range. Gold, however, continues to power higher without much of any news. Sometimes, you just have to listen to what the markets are telling you.

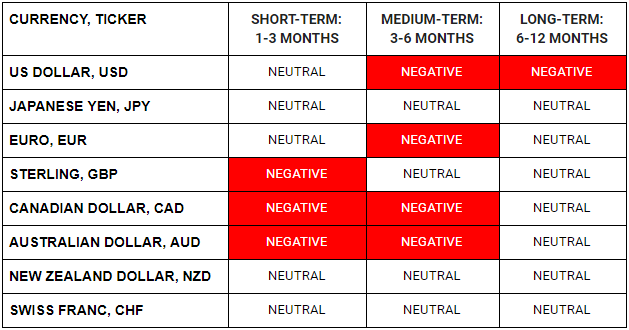

FX

STOCK INDICES

TRADING TIP

Of Bazookas and the Kitchen Sinks

When the credit market started to crack in late 2007, it took the US Federal Reserve more than a full year from the first rate cut to the implementation of the “whatever it takes” Quantitative Easing programmes before they finally succeeded in stabilising the markets.

Compared to the slow and reactionary response by the Fed in the 08 crisis, the Covid-19 crisis has seen the Fed aggressively cut rates to zero and introduced unprecedented QE and fiscal measures all within less than a month. This is much like pumping the patient full of steroids, painkillers, and antibiotics as soon as he turns up in the Emergency Room. Yes, of course, in 2007-08, rates were much higher than and the crisis is not comparable to the scale of the current Covid-19 crisis. However, doing whatever it takes in such a short time and in such a resolute manner did stem the panic and helped the patient numb the pain and prevented a sudden death.

This massive boost of free and easy money soothed the markets and led to the fierce rally in the stock market that we are currently witnessing. Some are even calling for a V-shaped recovery and new highs. That’s the “good news”.

The bad news, though, is the patient is not cured. The damage will continue to be done as more jobs are lost, earnings get crushed and businesses start to fail. The reckoning has only been postponed, but eventually, it comes.