WHAT HAPPENED YESTERDAY

As of New York Close 31 Mar 2020,

FX

U.S. Dollar Index, -0.18%, 99.00

USDJPY, -0.29%, $107.51

EURUSD, -0.20%, $1.1026

GBPUSD, -0.09%, $1.2407

USDCAD, -0.65%, $1.4079

AUDUSD, -0.57%, $0.6138

NZDUSD, -1.09%, $0.5950

STOCK INDICES

S&P500, -1.60%, 2,584.59

Dow Jones, -1.84%, 21,917.16

Nasdaq, -0.95%, 7,700.10

Nikkei Futures, -1.29%, 18,557.5

COMMODITIES

Gold Futures, -3.12%, 1,592.00

Brent Oil Futures, -1.96%, 25.94

SUMMARY:

Dollar fell against a basket of major currencies on Tuesday modestly pressured by the weight of Federal Reserve measures meant to ensure there was enough liquidity in the global financial system. The Dollar earlier in the session benefited from quarterly and fiscal year-end demand from portfolio managers and Japanese firms, but trading was choppy, with the Dollar alternating between gains and losses.

Markets ended the tumultuous first quarter in negative territory on Tuesday, while investors continued to assess the latest news on Covid-19 and the policies proposed to address its impact. The S&P 500 closed near session lows with a 1.6% decline after a brief stay in positive territory early in the session. The Dow Jones Industrial Average lost 1.84%, the Nasdaq Composite lost 0.95%, and the Russell 2000 lost 0.5%.

Notably, Trump said a $2 trillion infrastructure bill should be included in the fourth part of a stimulus bill with U.S. interest rates near zero. Prior to the statement, Bloomberg reported that White House officials were looking into a $600 billion relief bill for mortgage markets, the travel industry, and state governments.

On the Covid-19 front, NIAID Director Dr. Fauci said there have been “glimmers of hope” that social distancing is helping to curtail the spread of COVID-19, but the situation remained dire with the number of infections continuing to rise in the U.S. On a related note, Texas Governor Abbott issued a “stay at home” order until May 4.

FED’S NEW REPO FACILITY

The Federal Reserve announced Tuesday the opening of a new repurchase agreement or repo facility aimed at supplying foreign central banks with US dollars. The pool will allow monetary authorities abroad to swap US government bonds for Dollars. Global demand for the US currency has soared as the Covid-19 crisis drives investors to stable assets and forces firms to shore up their cash reserves. The Fed’s facility “should help support the smooth functioning of the US Treasury market,” the bank said in a statement. The facility will open on April 6 and operate for at least six months, the Fed added.

IMPACT: Dollar pared gains in the aftermath of the latest Fed move on Tuesday to expand the ability of dozens of foreign central banks to access Dollars during the Covid-19 crisis. Essentially, the Fed is allowing foreign central banks to exchange their holdings of U.S. Treasury securities for overnight Dollar loans. It is one of a slew of measures that the Fed unleashed to address liquidity problems caused by the economic fallout from the Covid-19 pandemic. That has dented the Dollar’s luster a bit as the supply of the U.S. currency expands.

CHINA MANUFACTURING PMI REBOUNDS

China’s manufacturing PMI was 52 and its non-manufacturing PMI was 52.3 in March, after an abrupt fall in February to 35.7 and 29.6, respectively. For manufacturing, the good news is that production and new orders rose above 50 but export orders and imports were still below 50. This reflects that domestic demand has recovered faster than external demand (spread of pandemic overseas), which has been affected by the Covid-19 for most of March. Although the survey showed business confidence improved as output resumed gradually, Caixin and IHS Markit noted demand challenges ahead. The positive readings are not as good as they seem because they are survey numbers and even China’s National Bureau of Statistics, which releases the PMI data, expressed caution, “The number above 50 doesn’t mean that economic activity is fully resumed. We need to fully understand the unprecedented austerity and complexity, and should pay great attention to the virus shocks on production and demand,”

It is noteworthy that for the non-manufacturing PMI, only the sub-indices of business activity and business expectations were above 50. All the other sub-indices, e.g. new orders, prices, and employment were in contraction, indicating that companies do not want to hire before they can confirm a solid return of business activity.

IMPACT: China’s manufacturing PMI and non-manufacturing PMI returned to above-50 in March. That improvement could be brief as these are month-on-month comparisons for survey respondents. The >50 readings do not represent a swift recovery, but more representative that those surveyed are seeing a light at the end of the tunnel when the month before they thought they were staring into the abyss.

PUTIN SENDING MEDICAL SUPPLIES TO HELP U.S.

Russia is sending the United States medical equipment to help fight the Covid-19 outbreak, the Interfax news agency reported on Tuesday, citing the Kremlin spokesman Dmitry Peskov. Putin made the proposal in a phone conversation with Trump on Monday, when they discussed the Covid-19 pandemic and oil markets, directing their energy ministers to speak.

“Trump gratefully accepted this humanitarian aid,” Interfax quoted Peskov as saying. A Russian plane with medical and protective equipment may leave for the United States on Tuesday, he added.

IMPACT: According to a senior administration official at the White House, Russia is expected to deliver a planeload of supplies and personal protection equipment on Wednesday.

DAY AHEAD

The lockdown measures taken to slow the spread of the virus will hit companies across the U.S., with industries such as tourism, bars, and restaurants, likely to be decimated first as consumers are told to stay at home. Very little economic data has been released so far that captures the scope of the damage but that changes later today when the ISM business surveys for March is released.

Forecasts suggest that the manufacturing index will drop to 45.0 from 50.1 in February, while the non-manufacturing print is expected to fall to 44.0 from 57.3 previously, both entering contraction territory. If these numbers are met, that would signal the U.S. economy is already in recession, which will probably deepen in the coming months as more states go into quarantine and social distancing measures are tightened further.

As for the risks surrounding these forecasts, it’s possible that we see a positive surprise in the manufacturing print relative to expectations, but a negative surprise in the non-manufacturing index. This has been the case so far in the Eurozone, UK, and US Markit PMIs for March.

SENTIMENT

OVERALL SENTIMENT: With month-end rebalancing flows out of the way, the market now gets back to the tug of war between the bad news from the Covid-19 front and the good news from the fiscal and monetary policies front. With much of the bazookas from the policymakers fired, the market is likely to trade in range, caught between the effects of the deteriorating economic fundamentals and the soothing effects of unlimited money printing.

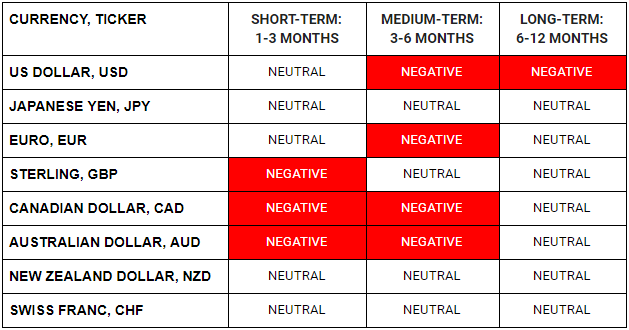

FX

STOCK INDICES

TRADING TIP

Respect the Flow of Money

There are huge amounts of money invested in passively managed funds and these funds have certain benchmarks which they must adhere to. The way that these benchmarks need to be met will lead to flows which can be predicted given significant market moments.

For example, in March, when stocks were down substantially (S&P500 index was down >25% at one stage) and bonds were up significantly, these passively managed funds will need to rebalance their portfolio by reducing the portion of their portfolio which have increased in value and re-allocate the excess cash to the portion that have depreciated in value.

For simplicity, let’s just say the mandate of a $100 million fund is to be invested 50% in stocks and 50% in bonds. At the start of the month, they would have invested $50M in stocks and $50M in bonds. If stocks should fall in value by 20% and bonds rise in value by 10%, what they own would be now $40M in stocks and $55M in bonds. For them to adhere to the mandate of having 50/50 allocation, they would need half the new total value of the portfolio (40+55=$95M/2= $47.5M) be invested in each of the two asset classes.

That would mean selling (55-47.5= $7.5M) worth of bonds and buying (47.5-40= $7.5M) of stocks at the end of the month (or whenever the rebalancing period is). So, this is what we meant when we were talking about rebalancing month-end flows which led to huge amounts of buying in the stock market.

Was it coincidence that yesterday (31 March) marked the highs of the rebound of the S&P500 index from the low? It could be, but the month-end and quarter-end rebalancing purchases definitely did play a part in the up move. These money flows drive asset prices especially in the short term and understanding them is critical to trading success.