WHAT HAPPENED YESTERDAY

As of New York Close 9 Apr 2020,

FX

U.S. Dollar Index, -0.51%, 99.61

USDJPY, -0.32%, $108.47

EURUSD, +0.65%, $1.0929

GBPUSD, +0.57%, $1.2457

USDCAD, -0.28%, $1.3975

AUDUSD, +1.78%, $0.6339

NZDUSD, +1.35%, $0.6087

STOCK INDICES

S&P500, +1.45%, 2,789.82

Dow Jones, +1.22%, 23,719.37

Nasdaq, +0.77%, 8,153.58

Nikkei Futures, +3.01%, 19,490.0

COMMODITIES

Gold Futures, +4.07%, 1,752.80

Brent Oil Spot, -4.82%, 28.81

SUMMARY:

The Dollar has been pressured by Federal Reserve measures which have flooded the financial system with dollars to address a liquidity crunch caused in part by demand for the greenback. In the U.S., it was another dismal initial claims report, with 6.606 million jobless claims filed for the week ending April 4 (consensus 5.000 million), bringing the three-week total to 16,780,000 after revisions. Continuing claims for the week ending March 28 hit a record high 7.455 million. The key takeaway from the jobless claims data is that the number of filings is simply astounding and a true sign of the vast impact of the sudden economic stop. Unfortunately, it likely still doesn’t capture the full impact as it’s reasonable to assume that the system for filing claims is overwhelmed and not facilitating every effort to file for jobless benefits.

The stock market climbed to end the holiday-shortened week, the S&P 500 gained 1.45%, extending this week’s advance to 12.1% while the Nasdaq (+0.77%) underperformed but still gained 10.6% for the week. U.S. 2yr Yield fell 4bp to 0.23% and U.S. 10yr Yield fell 4bp to 0.73%.

The market climbed out of the gate after the release of another horrific weekly initial claims report was masked by news of more unprecedented action from the Fed, the central bank added another $2.30 trln in emergency lending capacity for businesses and municipalities. Fed Chairman, Jay Powell, said that the central bank will continue using its powers forcefully, proactively, and aggressively.

In Europe, the Bank of England announced that it will begin directly financing the U.K.’s fiscal needs by buying bonds from the government instead of through the secondary market while German Chancellor, Angela Merkel, rejected Italy’s demand for the issuance of joint euro debt. Also of note, the Japanese government will reportedly spend up to 237 bln Yen ($2.20 bln) to help Japanese manufacturers move their production facilities out of China.

UNITED STATES LOGS WORLD’S HIGHEST COVID-19 DEATH TOLL

The United States surpassed Italy on Saturday as the country with the highest reported Covid-19 death toll, recording more than 20,000 deaths since the outbreak began. The U.S. has seen its highest death tolls to date in the epidemic with roughly 2,000 deaths a day reported for the last four days in a row, the largest number in and around New York City. Even that is viewed as understated, as New York is still figuring out how best to include a surge in deaths at home in its official statistics.

The current federal guidelines advocating widespread social-distancing measures run until April 30. Trump, who is seeking re-election in November, will then have to decide whether to extend them or start encouraging people to go back to work and a more normal way of life. Trump has said he will unveil a new advisory council, possibly on Tuesday, that will include some state governors and will focus on the process of reopening the economy.

IMPACT: Public health experts have warned the U.S. death toll could reach 200,000 over the summer if unprecedented stay-at-home orders that have closed businesses and kept most Americans indoors are lifted when they expire at the end of the month. Most of the curbs, however, including school closures and emergency orders keeping non-essential workers largely confined to home, flow from powers vested in state governors, not the president.

Nonetheless, Trump has said he wants life to return to normal as soon as possible and that the measures aimed at curbing the spread of the Covid-19 disease carry their own economic and public-health cost.

Speaking by telephone with Fox News on Saturday evening, Trump said he would make a decision “reasonably soon,” based on the advice of “a lot of very smart people, a lot of professionals, doctors and business leaders.” He said “instinct” would also play a role.

TRUMP ORDERS U.S. GOVERNMENT TO HELP ITALY IN COVID-19 FIGHT

Trump on Friday ordered top U.S. administration officials to help Italy in fighting the Covid-19 by providing medical supplies, humanitarian relief, and other assistance. In a memo to several Cabinet ministers, Trump ordered a variety of measures to help Italy, including making U.S. military personnel in the country available for telemedicine services, helping set up field hospitals, and transporting supplies.

“The Italian Republic, one of our closest and oldest Allies, is being ravaged by the Covid-19 pandemic, which has already claimed more than 18,000 lives, brought much of the Italian healthcare system to the brink of collapse, and threatens to push Italy’s economy into a deep recession,” Trump said in the memo.

IMPACT: Italy requested aid from the U.S., according to the White House. The aid granted by the U.S. comes in the form of technical assistance for Italy’s health sector through the Department of Health and Human Services and support for Italian businesses as well as international organizations and nongovernmental organizations. The U.S. is taking this opportunity to demonstrate its leadership in the face of the Chinese public relations campaign.

OPEC+ APPROVE OIL CUT TO SUPPORT PRICES

OPEC+ agreed on Sunday to a record cut in output to prop up oil prices amid the coronavirus pandemic and said they had an unprecedented deal with fellow oil nations, including the United States, to curb global oil supply by 20%. The group said it had agreed to reduce output by 9.7 million barrels per day (bpd) for May and June, after four days of talks and following pressure from Trump to arrest the price decline.

IMPACT: Commodity Currencies slipped against the Dollar on Monday as a record output cut agreed by OPEC+ failed to offset broader concerns about global demand for resources, there is an estimated 30 million bpd drop in worldwide fuel consumption caused by the Covid-19 pandemic.

DAY AHEAD

As much of the world is stuck in a lockdown, one country where life has started to return to normal will shed some light on the toll of the virus outbreak on its economy as China reports GDP growth estimates. The data could either spread misery or provide a glimmer of hope to those countries still heavily stricken by the virus. US indicators will also be scrutinized as March numbers for retail sales and industrial production are released. But aside from these highlights, market sentiment will continue to be driven by virus headlines, with investors hoping to see signs that the spread is at least slowing in big economies such as the United States.

SENTIMENT

OVERALL SENTIMENT:

The situation in Singapore and Japan has become increasingly worrying as the community spread resulting from imported cases continue to worsen. China is now implementing social distancing measures in their north-eastern cities and strengthening border controls to prevent importing infected cases from Russia which is currently seeing a surge in cases. OPEC+ finally agreed on cuts that may eventually prove to not be enough to compensate for the demand destruction that the world is currently undergoing. Currently, the market is still in the glass is half full mood, but with more corporate earnings and projections to be unveiled in the week ahead, that could be in for a change soon.

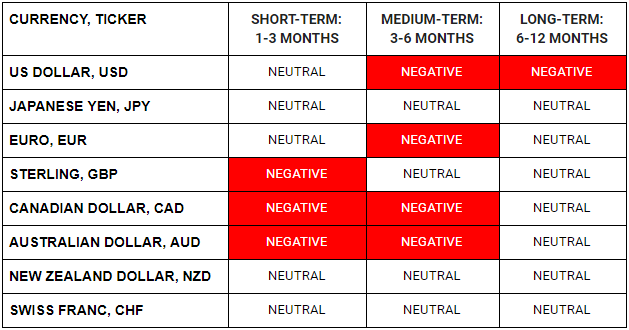

FX

STOCK INDICES

TRADING TIP

Hear the Printing Press

Forget the noise and focus on the inevitable. With the relentless wall of money, asset markets will be caught in the tussle between wave after wave of cheap/free money and the unimaginable economic damage that will be wrought by the virus.

However, what is clear is with the tireless printing press churning out fiat money at all hours of the day, the value of fiat money will depreciate against hard assets. The path of gold to much higher levels is clear, and the journey has only just begun.

Of course, it’s easy to say this today after the nearly 4% move after the Fed announcement last night. Here, you can listen to us talk about why a higher Gold is inevitable hours BEFORE it happened yesterday:

It sure pays to listen, doesn’t it? Have a peaceful Easter and a Happy Holidays!