WHAT HAPPENED YESTERDAY

As of New York Close 12 May 2020,

FX

U.S. Dollar Index, -0.21%, 100.02

USDJPY, -0.46%, $107.18

EURUSD, +0.36%, $1.0847

GBPUSD, -0.68%, $1.2253

USDCAD, +0.54%, $1.4083

AUDUSD, -0.58%, $0.6452

NZDUSD, -0.25%, $0.6066

STOCK INDICES

S&P500, -2.05%, 2,870.12

Dow Jones, -1.89%, 23,764.78

Nasdaq, -2.06%, 9,002.55

Nikkei Futures, -2.10%, 20,060.0

COMMODITIES

Gold Spot, +0.31%, 1,702.64

Brent Oil Spot, -1.90%, 27.36

SUMMARY:

Dollar was mixed on Tuesday, gaining against commodity currencies but lost ground against EUR and JPY as the mood turned cautious a day ahead of Federal Reserve Chairman Jerome Powell’s speech on economic issues and as investors weighed the chances of negative U.S. interest rates. Although Powell and Fed officials have all but ruled out cutting interest rates below zero, several markets have started to price in such a cut. Fed funds futures on Tuesday priced in negative interest rates of about half a basis point in April 2021.

S&P 500 fell 2.05% on Tuesday, with a bulk of losses coming in afternoon trade and into the close. The Dow Jones Industrial Average (-1.89%) and Nasdaq Composite (-2.06%) declined comparably to the benchmark index, while the Russell 2000 underperformed with a 3.5% decline. U.S. 2yr yield remained flat at 0.17% and U.S. 10yr yield fell 4bp to 0.69%.

The risk-off sentiment might have been fueled by legislation put forth by Senate Republicans to impose sanctions on China and by Los Angeles reportedly planning to extend the county’s stay-at-home order for another three months.

Bank stocks were pressured by a modest decline in Treasury yields and by Trump rehashing calls for negative interest rates. Airline stocks were pressured by Boeing (BA 125.22, -3.69, -2.9%) CEO Calhoun telling NBC’s “Today” show that a major U.S. airline could go bankrupt because of Covid-19 disruptions.

TRUMP ADMINISTRATION SEEKS TO STOP U.S. FEDERAL PENSION FUND INVESTMENT IN CHINESE STOCKS

Trump administration is pressing a board charged with overseeing billions in federal retirement dollars to halt plans to invest in Chinese companies that Washington suspects of abusing human rights or threatening U.S. security. The issue is whether administrators of the Thrift Savings Plan (TSP), a retirement savings fund for federal employees and members of the military, should allow its international fund to track an index that includes some China-based stocks of companies under scrutiny in Washington.

IMPACT: Trump has accused Beijing of failing to alert the world to the severity and scope of the virus, which has killed over 80,0000 Americans and was first reported in the city of Wuhan, China late last year. China has denied the allegations. Expect more geopolitical volatility in the months ahead, any retaliation by China towards the U.S. and its allies will be bad for risk-currencies like the Aussie, especially since China has recently turned its sights onto Australia’s barley and meat export in light of PM Scott Morrison’s suggestion for an investigation on Covid-19.

FAUCI WARNS OF NEW OUTBREAK RISK IF U.S. STATES REOPEN TOO SOON

Fauci on Tuesday warned Congress that a premature lifting of lockdowns could lead to additional outbreaks of the deadly Covid-19, which has killed 80,000 Americans and brought the economy to its knees.

“There is a real risk that you will trigger an outbreak that you may not be able to control and, in fact paradoxically, will set you back, not only leading to some suffering and death that could be avoided but could even set you back on the road to try to get economic recovery,” Fauci said.

IMPACT: Trump, who previously made the strength of the economy central to his pitch for his November re-election, has encouraged states to reopen businesses that had been deemed non-essential amid the pandemic. His administration has largely left it to states to decide whether and how to reopen. State governors are taking varying approaches, with a growing number relaxing tough restrictions enacted to slow the outbreak, even as opinion polls show most Americans are concerned about reopening too soon. As we’ve seen with South Korea and China, a second wave of infection is a highly probable scenario even though strict measures have been taken to prevent the spread of the virus. With America’s relaxed measures, it is almost a certainty we will witness another spike in the number of cases. This will be bad for risk currencies and good for Safe Havens like the Japanese Yen. Opening states up prematurely only to have it shutdown again is amplifying the already protracted impact of the virus.

U.S. HOUSE DEMOCRATS FLOAT $3 TRILLION COVID-19 BILL

Democrats in the U.S. House of Representatives on Tuesday unveiled a $3 trillion-plus Covid-19 relief package with funding for states, businesses, food support, and families, only to see the measure flatly rejected by Senate Republicans.

The new legislation, which would more than double Congress’s financial response to the crisis, includes nearly $1 trillion in long-sought assistance for state and local governments that are bearing the brunt of a pandemic that has infected 1,359,000 in the United States and killed at least 80,600.

It also includes $75 billion for testing people for the novel coronavirus, direct payments of up to $6,000 per U.S. household, $10 billion in emergency grants for small businesses, and $25 billion for the U.S. Postal Service. The bill would also extend enhanced federal unemployment payments through next January.

The House is due to meet at 9 a.m. EDT on Friday for expected votes on the legislation and on a rules change allowing members to vote by proxy during the pandemic.

IMPACT: Republicans say they want to hold off on new coronavirus relief legislation to assess the impact of nearly $3 trillion in response assistance that Congress has allocated since early March, as states move to reopen a shuttered U.S. economy. The Fed and the U.S government has made it clear that they will backstop the American economy. Expect more incessant money printing and stimulus to be thrown at the situation as it turns south. This will be inflationary in the long run and good for Gold.

PROPOSED BILL TO SANCTION CHINA

Sen. Lindsey Graham on Tuesday introduced legislation that would allow Trump to impose a wide range of sanctions on the Chinese government if it refuses to cooperate with an international investigation into the origins of the Covid-19. “I’m convinced that without Chinese Communist Party deception the virus would not be here in the United States,” Graham said in a statement. “China refuses to allow the international community to go into the Wuhan lab to investigate. They refuse to allow investigators to study how this outbreak started. I’m convinced China will never cooperate with a serious investigation unless they are made to do so. This hard-hitting piece of legislation will sanction China until they cooperate with investigators.“

IMPACT: With regards to the bill, it would authorize the president to impose a range of sanctions, including asset freezes, travel bans and visa revocations, as well as restrictions on loans to Chinese businesses by U.S. institutions and banning Chinese firms from listing on U.S. exchanges. Embedded within the bill is the requirement that China releases HK pro-democracy advocates in post Covid-19 crackdowns. The Bill serves no purpose beyond antagonising China and it’s not going to end well. Expect more risk aversion inducing headlines as tensions continue to rise.

TRUMP’S DESIRE FOR NEGATIVE RATES & FED PUSHBACK

Trump on Tuesday tweeted that the US should accept the “gift” of negative interest rates, joining other countries that already have them. “As long as other countries are receiving the benefits of Negative Rates, the USA should also accept the ‘GIFT’. Big numbers!” Trump tweeted.

In an attempt to push back on the idea, St. Louis Federal Reserve Bank President James Bullard said negative rates would interfere with short-term funding markets that U.S. companies use for liquidity. “We’ve talked about negative rates on and off over the years,” Bullard said Tuesday in a webinar sponsored by the Official Monetary and Financial Institutions Forum. “It’s not a good solution in the U.S.”

Federal Reserve Chairman Jerome Powell is also expected to oppose the idea of negative interest rates when he speaks later today.

IMPACT: Fed speakers have so far been consistently against negative rates. However, markets will continue to price for it as things worsen. The Fed funds futures on Tuesday priced in negative interest rates of about half a basis point in April 2021, this inadvertently led to Dollar weakness.

DAY AHEAD

It will be the UK’s turn next to post dire economic output figures as the Covid-19 leaves no country spared. First-quarter GDP estimates are due later today and they will likely only be a taste of what to expect in the second quarter. With Britain resisting the urge to relax social distancing measures too significantly, the economic costs of containing the virus outbreak are mounting, clouding the outlook for the GBP.

The Bank’s quantitative easing (QE) program is one of the most aggressive in the latest wave of central bank easing around the world and at the current rate of purchases, the BoE looks set to achieve its target of £200 billion sometime in early July. Hence, the odds that the size of QE will be boosted at the next meeting are very high and a weaker-than-expected GDP report would reinforce this.

SENTIMENT

OVERALL SENTIMENT:

Stocks weakened aggressively towards NY close as increasingly tough rhetoric from US politicians against China and the bleak economic outlook painted by Fed speakers finally took its toll. Strained relations between the world’s two biggest economies is the last thing the world needs right now, but indications are that China is not about to just lie quietly and take the bashing as its actions against Australia thus far shows.

Expect more headline bombs from this front going forward.

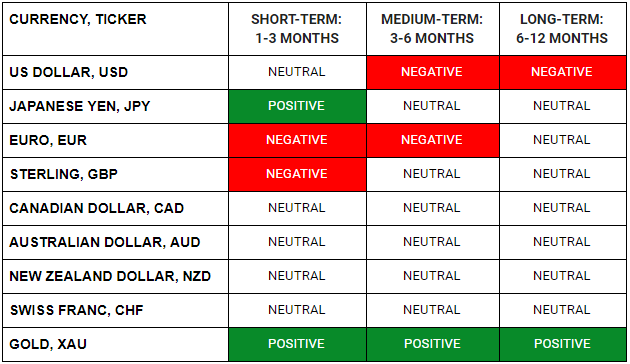

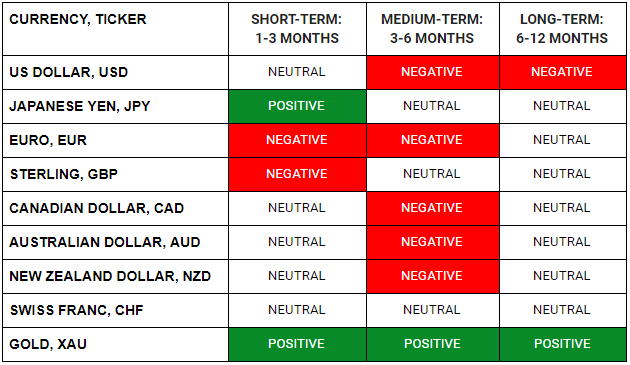

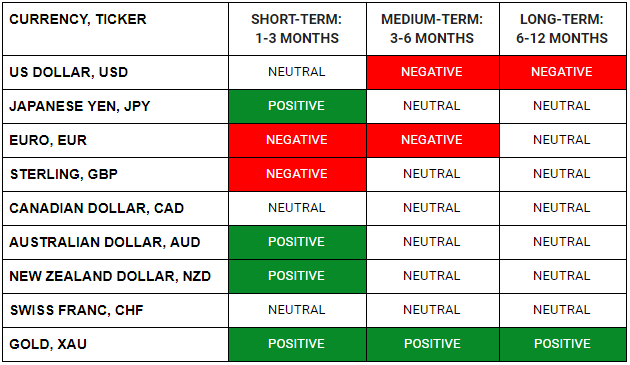

FX

STOCK INDICES

TRADING TIP

There Are Many Ways To Skin A Cat

It is a trying time for many investors and traders alike as a confluence of factors such as unprecedented monetary policies, rising geopolitical tensions, and crushed economic fundamentals are working together concurrently to skew asset prices in unfathomable ways no matter which angle you look at it.

In a time of many unknown unknowns, there are still trends that will make sense in the grand scheme of things, like Gold and Tech Stocks. Do not miss the forest for the trees by focusing on short term myopic trading. If the going gets tough, take a step back and look for the inevitable trend. It may be a slower ride, but it sure is better than death by a thousand cuts in trying to trade the whipsawing market.