WHAT HAPPENED YESTERDAY

As of New York Close 7 Apr 2020,

FX

U.S. Dollar Index, -0.79%, 99.95

USDJPY, -0.50%, $108.68

EURUSD, +0.94%, $1.0894

GBPUSD, +0.87%, $1.2336

USDCAD, -0.67%, $1.4016

AUDUSD, +1.08%, $0.6152

NZDUSD, +0.51%, $0.5962

STOCK INDICES

S&P500, -0.16%, 2,659.41

Dow Jones, -0.12%, 22,653.86

Nasdaq, -0.33%, 7,887.26

Nikkei Futures, +2.29%, 18,995.0

COMMODITIES

Gold Futures, -0.87%, 1,679.15

Brent Oil Spot, -2.23%, 29.00

SUMMARY:

Dollar dropped and risk currencies, including the Aussie, outperformed on Tuesday as risk appetite improved on hopes that lockdowns may be slowing the spread of the Covid-19 in some countries. Action by central banks to ease a scramble for Dollars has helped bring some calm to markets.

The major averages ended Tuesday with modest losses after surrendering their opening gains. The S&P 500 (-0.16%) slipped four points after starting the day with a 3.51% gain while the Nasdaq (-0.33%) underperformed slightly and Dow Jones, -0.12%. U.S. 2yr yield rose 1bp to 0.28% and U.S. 10yr yield rose 8bp to 0.75%.

Equities jumped out of the gate after markets across Asia and Europe had another good outing during their time zones. The sharply higher start was attributed to optimism about a potential plateau in Covid-19 cases, but the key indices hit their best levels within the first five minutes of action, followed by a daylong slide that sent the Nasdaq and S&P 500 into negative territory.

Regarding additional stimulus, House Speaker Nancy Pelosi told Democratic lawmakers that she wants the next spending package to be at least $1 trillion. Meanwhile, Senate Majority Leader, Mitch McConnell, said that he expects the increase to the small business loan program to be approved on Thursday.

RESERVE BANKS INTEREST RATES HELD AT 0.25 PERCENT

The Reserve Bank has kept Australia’s official cash rate at the historic low of 0.25 percent (expected). In a statement, Governor Philip Lowe said the Board had reaffirmed the targets for the cash rate and the yield on three-year Australian government bonds of 25 basis points, as well as the other elements of the package announced on March 19.

IMPACT: Aussie was the leader of the board surging more than 1.5% after a decidedly hawkish statement from the RBA, which while acknowledging the challenges of the Covid-19 pandemic also hinted that its QE operations could be tapered.

The RBA stated, “Since this target was introduced, the Bank has bought around $36 billion of government bonds in secondary markets, including bonds issued by the states and territories. The Bank will continue to promote the smooth functioning of these important markets. If conditions continue to improve, though, it is likely that smaller and less frequent purchases of government bonds will be required.”

AUSTRALIA’S PARLIAMENT SET TO PASS HUGE STIMULUS PLAN

Australia’s parliament will return today to pass an emergency A$130 billion ($80 billion) stimulus package as the Covid-19 pandemic wreaks havoc on the country’s economy. Federal Treasurer Josh Frydenberg said today would become “one of the most important days in the history of the Australian parliament, as we come together across the political divide to save millions of Australian jobs”.

IMPACT: The support measures come as economists predict the worst recession in Australia’s history, with the unemployment rate almost doubling to near 10%. The Reserve Bank of Australia on Tuesday predicted a “very large” economic contraction in the current quarter.

WORLD WATCHES ITALY AS BUSINESSES PLEAD TO RETURN TO WORK

Many Italian companies and academics are pressing the government to reopen factories to prevent an economic catastrophe, as the world watches how the first Western country to impose a lockdown can extricate itself from the unprecedented measures. About 150 Italian academics have published a letter in Italian financial daily (Il Sole-24 Ore), owned by the Italian business lobby Confindustria, urging the government to unblock the economy.

IMPACT: Italy faces among the most pressing dilemmas, not only because it’s lockdown has been in place longer than most nations and it has the world’s highest death toll, but because the Covid-19 has hit hardest in the northern industrial heartlands that generate a third of its economic output.

What worries many in Italy, and elsewhere, is the apparent lack of authoritative plans on how to safely lift measures, as governments wrestle with an unforeseen, invisible and unfamiliar foe and scientific guidance evolves on a weekly basis.

So far, officials have said that work restrictions would probably be lifted on a sector-by-sector rather than a geographical basis. Social distancing, wider use of personal protection devices such as face masks and strengthened local health systems have also been spoken about. Testing and “contact tracing” would be extended, including the use of smartphone apps and other forms of digital technology, following the South Korean playbook.

DAY AHEAD

One of the more important releases this week will be the U.S. Initial Jobless Claims tomorrow. This is the most up-to-date economic indicator right now, and another disappointing print could see the Dollar climb as stocks sell-off. The second most crucial release will be the U.S. University of Michigan consumer sentiment index for April, due tomorrow too, which will reveal how badly the US consumer has been hit.

SENTIMENT

OVERALL SENTIMENT:

Expect the bipolar market sentiment to continue as conflicting forces of free money and economic damage jostle for supremacy. Volatility will remain high as many liquidity providers such as banks are also reducing their risk-taking activities as work-from-home policies are in effect. In light of the much increased volatility and the wild whipsawing price action, it is imperative to size risk positions appropriately to withstand the sudden shifts in sentiment.

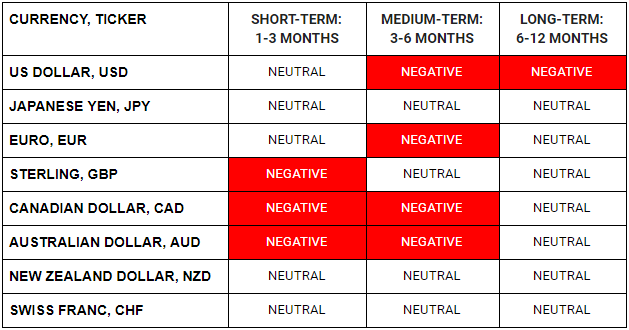

FX

STOCK INDICES

TRADING TIP

Size Does Matter

Do you feel like when you’re making money, you do not have big enough of a position and yet, when you are losing money, your position is too big? This is a common lament of many traders as they do not have a structured framework of sizing their trades. This may eventually lead to reckless risk-taking and having excessive risk positions when markets are at its most manic point.

To stop that from happening, it is imperative to have a framework to guide you through wins and losses and prevent emotions from becoming part of your trading process. The first principle which must always be first and foremost in the minds of every trader is never to risk more than you are comfortable to lose. If you should ever find yourself bargaining with a higher power when the markets are moving against you, your risk is too big!

Getting the sizing of trades right is an essential ingredient of trading success. This is one of the skills that every successful trader I’ve had the privilege of meeting has and is one of the bedrock principles of our TrackRecord trading programmes.