WHAT HAPPENED YESTERDAY

As of New York Close 8 Apr 2020,

FX

U.S. Dollar Index, +0.17%, 100.12

USDJPY, +0.21%, $108.94

EURUSD, -0.28%, $1.0860

GBPUSD, +0.42%, $1.2391

USDCAD, +0.06%, $1.4004

AUDUSD, +1.05%, $0.6234

NZDUSD, +0.65%, $0.6015

STOCK INDICES

S&P500, +3.41%, 2,749.98

Dow Jones, +3.44%, 23,433.57

Nasdaq, +2.58%, 8,090.90

Nikkei Futures, +0.93%, 19,328.0

COMMODITIES

Gold Futures, -0.19%, 1,680.45

Brent Oil Spot, +4.38%, 30.27

SUMMARY:

Dollar gained slightly on Wednesday in choppy trading as some optimism faded that the Covid-19 crisis may be nearing a peak faded and as investor concerns remained over the economic fallout of the pandemic. The Dollar’s firmer tone came even as stocks rallied, but held below intraday highs reached on Tuesday.

Euro was weighed down by the failure of European Union finance ministers to agree on further support for their Covid-19-hit economies. The talks, intended to get an agreement on a package of measures for governments, companies, and individuals, were suspended until Thursday. A feud between Italy and the Netherlands over what conditions should be attached to eurozone credit for governments was blocking progress, sources said.

AUD gained 1.10% to a three-week high of $0.6234, erasing earlier losses after ratings agency S&P cut the outlook for its sovereign AAA rating from stable to negative, clawed back losses and turned positive on the day.

The stock market rallied on Wednesday, though the advance found resistance near Tuesday’s opening high. The S&P 500 gained 3.41% while the Russell 2000 (+4.6%) outperformed. U.S. 2yr Yield fell 1bp to 0.27% and U.S. 10yr Yield rose 2bp to 0.77%.

The rally took place as participants remained optimistic about the recent slowdown in new Covid-19 cases, which led to speculation about parts of the U.S. economy being able to reopen soon. NIAID Director Fauci said death models are improving and that a turnaround in Covid-19 would be likely after this week.

The optimism about the future overshadowed a couple of reminders about how dire the recent past has been. The World Trade Organization expects that global GDP will be down between 2.5% and 8.8% this year while the Organization for Economic Cooperation and Development noted today that its leading indicators are pointing to a sharp slowdown in all major economies except for India, where a less drastic slowdown has been observed.

U.S. PLANNING WAYS TO ‘EASE’ BACK TO NORMAL IF VIRUS EFFORTS WORK: FAUCI

U.S. health officials are planning ways for the country to return to normal activities if distancing and other steps to mitigate Covid-19 this month prove successful in curbing the outbreak, Fauci, the top U.S. infectious disease official said on Wednesday.

The Trump administration has called for 30 days of measures, including staying at least six feet away from other people, that have upended American life as most people stay isolated at home, shuttering schools and closing businesses through at least the end of April, with some states continuing certain closures through May and June.

IMPACT: Countries need to be cognisant of another spike in cases from re-infection. Researchers analysed blood sampled from 175 patients who had been released and the results showed nearly a third had low levels of antibodies and in some patients, they could not be detected at all.

COMING NEXT FROM THE FED: HOW MUCH FOR MAIN STREET?

Treasury Secretary Steven Mnuchin said Wednesday his department and the Federal Reserve hope to provide more details this week on an emergency lending facility directed toward medium-sized businesses, which have not yet benefited from the $2 trillion economic rescue package signed into law last month.

“We are actively working with the Fed on a Main Street lending facility,” Mnuchin said on CNBC Wednesday morning. “We hope to have an announcement this week with the details on that and get it up and running as soon as we can.”

IMPACT: The facility would be aimed at businesses with more than 500 employees that don’t have access to the Fed’s corporate credit facilities, which will buy debt issued by large companies. The Fed and Treasury have been working for weeks to set up that emergency program, which is supposed to be funded by some of the $500 billion set aside by Congress for loans to businesses and municipalities. Fed Chair Jerome Powell is set to speak later today at a virtual event hosted by the Brookings Institution, where he could provide more information on the Main Street facility.

SANDERS QUITS U.S. PRESIDENTIAL RACE, SETTING UP BIDEN BATTLE WITH TRUMP

Sanders, a one-time front-runner who promised to lead a grassroots political revolution into the White House, acknowledged he no longer had a path to victory after a string of decisive nominating contest losses to Biden but promised to work with his more moderate former rival to oust Trump.

The independent U.S. senator from Vermont said the Covid-19 outbreak, which has taken him off the campaign trail and limited his ability to get his message out, required a broad response and urgent attention in Congress.

Sanders called it a “difficult and painful decision” but said he would stay on the ballot in future primaries and continue to gather delegates in order to push the Democratic platform toward his populist anti-corporate agenda, including a government-run healthcare system and tax hikes for the rich.

IMPACT: The departure of Sanders, Biden’s last remaining rival in a field that once included more than two dozen candidates, sets up a long battle for the White House between the 77-year-old Biden and Trump, 73, who is seeking a second four-year term in office.

That matchup for the foreseeable future will revolve around Trump’s handling of the public health crisis that has upended all aspects of American life and rocked the country’s economy. Biden on Wednesday signaled he was ready for a bruising general election fight and the challenge he now faces in trying to unite the Democratic Party’s liberal and moderate wings.

DAY AHEAD

It’s OPEC+ meeting today, even though we saw a sizable rebound after Trump said that Saudi Arabia and Russia will cut 10-15 million barrels from their production, those gains look fragile. The Kingdom said it’s willing to cut its own production only if many countries – beyond Russia and OPEC members – also cut theirs.

Moreover, the size of the proposed cuts is extremely large. Even if everything goes smoothly with this production deal and everyone chips in, which is a big assumption, it’s still difficult to imagine any cut bigger than 5 million barrels per day, and that would do next to nothing to balance an oil market that is about to see more than 30 million barrels per day in-demand wiped out. In other words, even if this deal happens, there’s a good chance markets will be disappointed by its size, which makes the latest recovery look quite vulnerable.

SENTIMENT

OVERALL SENTIMENT:

It’s hot and it’s cold, all on the same day. Tussle continues and for now, the wall of easy money seems to be prevailing. The US stock and bond markets will be closed for Good Friday and the bond market will have an early close (2pm NY) on Thursday, so expect some risk reduction ahead of the long weekend. With decreasing liquidity, expect more whipsawing price and tread carefully!

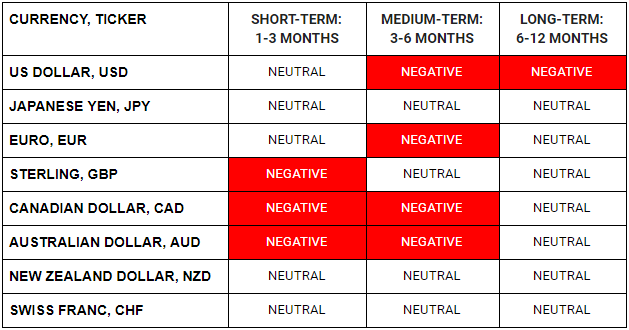

FX

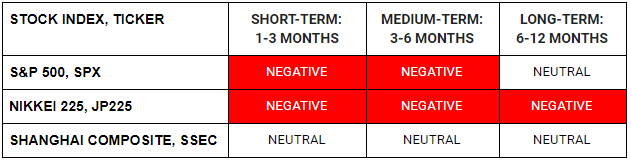

STOCK INDICES

TRADING TIP

Expect to be Confused

In a career of trading, there will be times when what’s happening in the market just “makes no sense” to you. This is to be expected, and this is especially true when prices are moving against all that you believe to be fundamentally true. The key to success is not to expect the market to always make sense, but to insulate yourself against losses when it doesn’t.

There will be occasions when prices are moving against you and you can’t make sense of it, and your gut reaction is to respond with anger and fight the moves with your capital. That may work sometimes, but more often than not, it will lead to financial ruin. It is imperative to keep your emotions in check and respond with humility and accept that sometimes, you can’t win all the time. It is imperative to then reduce your risk and wait for things to start to make sense to you again.

On that note, Happy Easter to those who celebrate and Happy Holidays to the rest!