WHAT HAPPENED YESTERDAY

As of New York Close 2 Apr 2020,

FX

U.S. Dollar Index, +0.69%, 100.19

USDJPY, +0.81%, $108.04

EURUSD, -1.08%, $1.0846

GBPUSD, +0.12%, $1.2392

USDCAD, -0.42%, $1.4131

AUDUSD, -0.10%, $0.6065

NZDUSD, +0.13%, $0.5915

STOCK INDICES

S&P500, +2.28%, 2,526.90

Dow Jones, +2.24%, 21,413.44

Nasdaq, +1.72%, 7,487.31

Nikkei Futures, +0.59%, 17,925.0

COMMODITIES

Gold Futures, +2.83%, 1,636.40

Brent Oil Spot, +16.57%, 25.96

SUMMARY:

The Dollar rose against a basket of currencies for a second straight day on Thursday as investors, worried about the prospect of a global recession, continued to take shelter in the greenback. With the increase in the Covid-19 impact around the world, investors are looking at the Dollar as a safe haven.

The stock market ended a two-day skid on Thursday, and oil prices spiked more than 30% before closing the day up 24% on Trump’s tweet that Saudi and Russia may agree to a 10-15 million barrels per day cut in production. Stocks rose even as weekly initial claims doubled to a record 6.6 million, depicting the dire economic situation caused by Covid-19. The S&P 500 (+2.28%) and Dow Jones Industrial Average (+2.24%) set the pace with gains over 2.0%, followed by the Nasdaq Composite (+1.72%) and Russell 2000 (+1.3%).

Although more discussions are reportedly needed between Saudi Arabia, Russia, and possibly even the U.S. to reach an agreement, news that Saudi Arabia is asking for an emergency OPEC+ meeting supported the market’s price-truce hopes. Conversely, some investors were wary that the lack of oil demand would still weigh on the industry despite attempts to control supply.

US initial jobless claims spiked by 3.341 million to a seasonally adjusted 6.648 million (consensus 2,800,000) for the week ending March 28. Continuing claims for the week ending March 21 reached 3.029 million, which is the highest level since July 6, 2013. The positive price action in the market suggested that the shocking numbers may already have been priced in.

TRUMP TOUTS ‘GREAT’ SAUDI-RUSSIA OIL DEAL TO HALT PRICE ROUT, BUT DETAILS UNCLEAR

Trump said on Thursday he had brokered a deal with top crude producers Russia and Saudi Arabia to cut output and arrest an oil price rout amid the global Covid-19 pandemic, though details of how cuts would work were unclear. Trump said the two nations could cut output by 10 to 15 million barrels per day (bpd) – an unprecedented amount representing 10% to 15% of global supply, and one that would require the participation of nations outside of OPEC and its allies.

Trump said he spoke with both Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman on Thursday. “I expect & hope that they will be cutting back approximately 10 Million Barrels, and maybe substantially more which, if it happens, will be GREAT for the oil & gas industry!” Trump wrote on Twitter.

IMPACT: A senior U.S. administration official familiar with the matter said Trump would not formally ask U.S. oil companies to contribute to the production cuts, a move forbidden by U.S. antitrust legislation. Saudi Arabia, the de facto head of OPEC, called on Thursday for an emergency meeting of OPEC and non-OPEC oil producers, an informal grouping known as OPEC+, state media reported, saying it aimed to reach a fair agreement to stabilize oil markets. Trump is separately set to meet with U.S. oil industry executives on Friday.

But the question remains: even if the world’s top three producers reach an unprecedented pact to curb oil output, can any deal remove enough oil when the Covid-19 has destroyed a third of global demand for crude? Oil demand has dropped by as much as 30 million barrels per day (bpd) – according to Trafigura, roughly equivalent to the combined output of Saudi Arabia (12M), Russia (10M) and the United States (12M).

Saudi immediately responded by confirming that they are open to cuts but must be accompanied by other producers outside of OPEC. Back in the late 80s and 90s when oil prices went all the way below $10, the whole way had OPEC agreeing to production cuts but many were cheating on their quota as they needed the cash flow. That is likely to be the case again even if production cuts get the buy-in from all the producers.

FRANCE’S COVID-19 DEATH TOLL JUMPS AS NURSING HOMES INCLUDED

The Covid-19 death count in France surged to nearly 5,400 people on Thursday after the health ministry began including nursing home fatalities in its data. More than two-thirds of all the known nursing home deaths have been registered in France’s Grand Est region, which abuts the border with Germany.

It was the first region in France to be overwhelmed by a wave of infections that has rapidly moved west to engulf greater Paris, where hospitals are desperately trying to add intensive care beds to cope with the influx of critically ill patients.

IMPACT: The country’s broad lockdown is likely to be extended beyond April 15, Prime Minister Edouard Philippe said on Thursday, extending a confinement order to try and deal with the crisis that began on March 17.

GLOBAL COVID-19 CASES SURPASS ONE-MILLION

Global Covid-19 cases surpassed 1 million on Thursday with more than 52,000 deaths as the pandemic further exploded in the United States and the death toll climbed in Spain and Italy, according to a tally of official data.

Morgues and hospitals in New York City, the epicenter of the U.S. outbreak, bent under the strain on Thursday, struggling to treat or bury casualties, as New York state’s Governor Andrew Cuomo offered a grim prediction the rest of the country would soon face the same misery.

In Italy, which hit a daily peak of 6,557 new cases on March 21 and accounts for around 28% of all global fatalities, the death toll climbed to 13,915 on Thursday. But it was the fourth consecutive day in which the number of new cases stayed within a range of 4,050-4,782, seeming to confirm government hopes that the epidemic had hit a plateau.

In Tokyo, at least 97 new Covid-19 infections were confirmed on Thursday, the biggest daily increase yet. The figure follows 66 reported on Wednesday and 78 on Tuesday, and brought the total number of confirmed cases in Tokyo to 684, raising pressure for Prime Minister Shinzo Abe to declare a state of emergency to curb the rapid spread of the virus. A resurgence of cases in Tokyo is a clear and present danger that must be watched closely.

IMPACT: There has been particular concern about the spread of the virus in countries that are already struggling with weakened health systems. In Iraq, three doctors involved in the testing, a health ministry official and a senior political official said there were thousands of cases of Covid-19, many times more than it has publicly reported. The health ministry denied it.

DAY AHEAD

For the first time in a decade, US Nonfarm Payrolls (NFP) will most certainly turn negative in March, indicating that Americans are losing jobs at a rapid pace. Forecasts suggest that NFP will clock in at -124k, from +273k in February, pushing the unemployment rate up to 3.8% from 3.5% previously. Average hourly earnings are projected to hold steady at 3.0% in yearly terms but admittedly, with so much attention on job losses, wage growth might be of secondary importance.

Yet, investors might view these figures as somewhat outdated. The data was collected during the first half of March, which means that they won’t reflect most of the damage from the virus-fighting lockdowns, as those came into effect during the second half of the month. Hence, although this week’s employment report will show some weakness, that might only be a small taste of the real damage in the labour market, and the true fallout will be revealed when the numbers for April are released next month.

SENTIMENT

OVERALL SENTIMENT: Situation continues to worsen in the UK and US while Trump is focused on boosting the stock markets with various initiatives. The debate on whether using masks work is an example of how idiotic it has become. You would think that it would just be common sense to ask the governments which have managed to keep the outbreak under control (China, South Korea, Taiwan, Singapore etc). The US Initial and Continuing Claims are telling signs of all the jobs that are being lost all around the world. Who’s rushing out to spend money on frivolities at this moment?

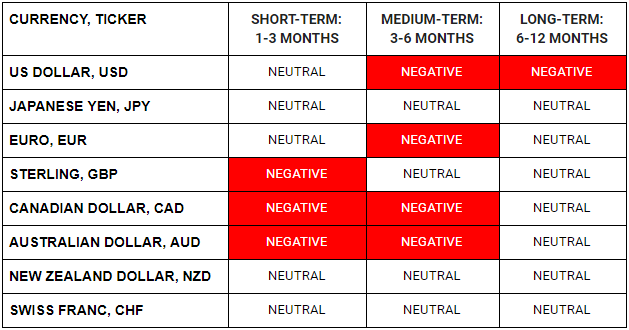

FX

STOCK INDICES

TRADING TIP

Let Go of the Past

Historical data points should be used as reference points to compare what’s currently happening to the world against previous crises that have happened before. However, we should avoid being anchored to the worst-case scenarios of the past.

What is currently happening is unprecedented. That is why the monetary and fiscal policies that have been announced and will continue to be announced are multiple times in orders of magnitude vs what has been implemented before.

That is because the economic damage that is being wrought and that will continue to be wreaked is in orders of magnitude of what we have seen before. Start seeing the world through this lens and you will begin to understand what is about to come in the months ahead.