WHAT HAPPENED YESTERDAY

As of 3 Mar, Singapore Time zone UTC+8

FX

U.S. Dollar Index, -0.63%, 97.51

USDJPY, +0.42%, $108.53

EURUSD, +1.07%, $1.1144

GBPUSD, -0.42%, $1.2767

USDCAD, -0.54%, $1.3325

AUDUSD, +0.60%, $0.6549

NZDUSD, +0.21%, $0.6266

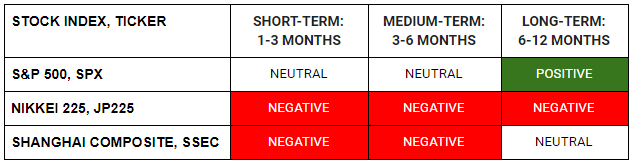

STOCK INDICES

S&P500, +4.60%, 3,090.23

Dow Jones, +5.10%, 26,706.17

Nasdaq, +4.49%, 8,952.17

Nikkei Futures, +2.83%, 21,677.5

COMMODITIES

Gold Futures, +1.65%, 1,592.60

Brent Oil Futures, +5.09%, 53.09

SUMMARY:

FX markets started off risk-averse with a gap lower in AUD and USDJPY (about 0.5% lower than previous close at 0.6466 and 107.46 respectively) and steadily climbed higher throughout the day as rumours that coordinated action from the major central banks will be forthcoming. As the day progressed, risk-seeking sentiment started to dominate with FX recovering the opening losses and AUD testing above 0.6560s, more than 1.5% above the day’s low.

EUR stole the show as it relentlessly marched higher again. Stocks selling off? Oh, risk aversion, buy some EUR! Stocks rising fast? Oh, rate cuts from the Fed, buy some EUR! For now, this seems to be dynamic. How long can this last? Till all the shorts capitulate and everyone you know is long, and there’s no one left to buy the next EUR!

At the end of the Tokyo session, the BOJ announced that they bought a record total of 101 bn JPY worth of ETFs to support the stock market. Confirmations of a teleconference between G7 officials, including central bankers, on Tue, cheered the battered bulls and we were off to the races.

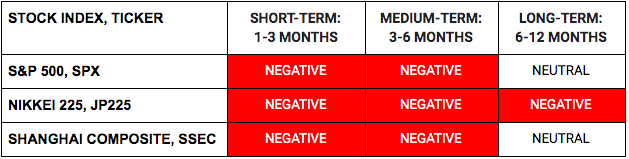

The major stock indices surged with the S&P 500 (+4.6%) recording its first gain since February 19, Nasdaq (+4.49%), while the Dow Jones Industrial Average (+5.1%) outperformed.

Equities started the new week on a firmly higher note even though the number of new Covid-19 cases in the United States continued increasing while China reported its worst Manufacturing (35.7) and Non-Manufacturing PMI (29.6) readings in history.

China’s PMI readings were much weaker than what was reported at the depth of the financial crisis, which promptly led to more calls for stimulus from the People’s Bank of China. The Bank of Japan, meanwhile, offered to purchase JPY500 bln worth of JGBs. The fed funds futures market continued pointing to expectations for a 50-basis point cut at the March 18 meeting or before.

Growing stimulus hopes contributed to another day of gains in the Treasury Yield market, pressuring the 10-yr yield to a record low of 1.043%, and 2-yr yield to a record low of 0.713% in early U.S. trading. However, as the stock markets stabilised and climbed higher, yields recovered and closed the day relatively unchanged with the 10y at 1.163% and 2-yr at 0.909%.

Small, medium and long term investors are all long US Treasuries. If things start to calm down, there could be a washout if aggressive Fed action is not forthcoming. If the Fed is aggressive in cutting, the curve could steepen with the 10year sector underperforming. A positioning washout much like what we saw in Gold previously could be on the cards if stocks rally further.

US MANUFACTURING

The ISM Manufacturing Index for February managed to eke out an expansion reading at 50.1 (consensus 50.5), but that was weaker than expected and down from 50.9 in January. The dividing line between growth and contraction is 50.0.

IMPACT: The key takeaway from the report is that there were noted concerns in respondents’ commentary about the negative impact of Covid-19, which is telling, because the virus has continued to spread globally since the report was compiled, implying there is an increased risk of the index falling below 50.0 in March. Reports from around the world on Monday also showed factories taking a beating from the Covid-19 outbreak, with activity in China shrinking at a record pace. Japan’s PMI showed its factory activity was hit by the sharpest contraction in nearly four years in February. In South Korea, factory activity also shrank faster in February.

A sharp contraction in manufacturing has raised calls for stimulus from central banks, this was one of the primary reasons for the risk rally yesterday. If central banks do not provide the stimulus the market calls for or provide adequate jawboning and manufacturing continues to contract, risk assets will be re-priced much lower.

CHILD DROWNS AT SEA OFF GREECE IN THE FIRST FATALITY AFTER TURKEY OPENS BORDER

A young Syrian boy died on Monday after being pulled from the sea when a boat capsized off the Greek island of Lesbos, Greek officials said, the first reported fatality since Turkey opened its border last week to let migrants reach Europe. The surge, which has led to Greek and Turkish police firing tear gas into crowds caught in the no-man’s land between the two borders, has revived memories of the 2015-16 refugee crisis when more than a million people arrived in Europe from Turkey.

IMPACT: The latest migrant surge follows Turkey’s decision to stop enforcing a 2016 accord with the European Union whereby it stopped migrants entering the bloc in return for cash. Turkey, already home to 3.7 million Syrian refugees, has another million arriving on its doorstep from a new surge of fighting in northern Syria and says it cannot handle anymore.

The migrant crisis coupled with Covid-19 may just be the straw that breaks the camel’s back in the EU, tipping them over to embrace a fiscal package to stimulate the economy. Migrants in Turkey are already putting a lot of stress on the Turkish economy and as the war in Idlib rages on, more waves of migrants will arrive on Turkish and Greek shores (turkey will probably open the borders for them to pass through to Europe) and this will create more political turmoil in the EU.

COVID-19 DEATHS RISE TO SIX IN SEATTLE AREA AS U.S. PUSHES FOR MORE TESTING

Six people in the Seattle area have died of the illness caused by the new Covid-19, health officials said on Monday, as authorities across the United States scrambled to prepare for more infections with the emphasis on increasing testing capacity.

The total number of cases detected by the public health system in Washington state now stands at 18, the most of any state. In addition to the 14 King County cases, four residents of nearby Snohomish County have tested positive for the virus, officials said. In addition to confirmed cases, King County has about 29 potential cases awaiting test results, so the number there could soon rise, officials said. Tests were being conducted on about 200 samples per day, and health officials said they expect to boost the number of tests to at least 1,000 a day in the near future.

IMPACT: Federal health officials have said the number of test kits for coronavirus would be radically expanded in the coming weeks. The United States appeared poised for a spike in cases, partly because there would be more testing to confirm infections. Trump said his administration has asked pharmaceutical companies to accelerate work on the development of a coronavirus vaccine, but provided no details. Top U.S. health officials have said any vaccine is up to 18 months away and there is no treatment for the respiratory disease, although patients can receive supportive care.

A spike higher in U.S. Covid-19 cases may cause a knee-jerk selloff in risk assets, but the extent of the spike will play a role in how the Covid-19 narrative in the western hemisphere will develop. (will it be mania or confidence that it might be under control?)

DAY AHEAD

‘Hard Brexit’ fears have unnerved investors after both the UK and the EU set out tough negotiating positions for future trade talks. UK PM Boris Johnson went a step further and warned he could walk away from the talks in June if by then the broad outline of a deal does not conform to that of a Canada-style agreement.

With negotiations due to formally start later today, Brexit headlines are likely to be the main driver for Sterling over the coming days as it will be extremely quiet on the data front apart from the final UK PMI readings.

SENTIMENT

OVERALL SENTIMENT:

The news of the G7 teleconference reassured investors that help from the governments will be forthcoming. Fear ebbed and battered bulls are vindicated for holding on for now. Sentiment remains fragile and volatility will remain elevated.

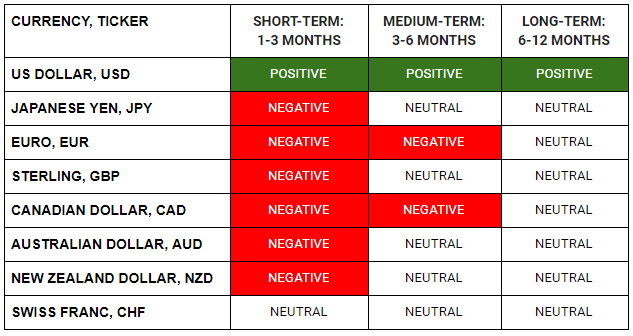

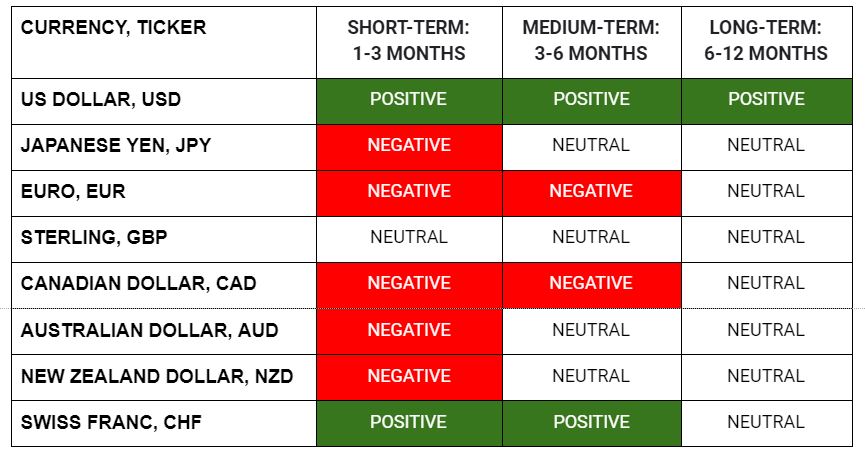

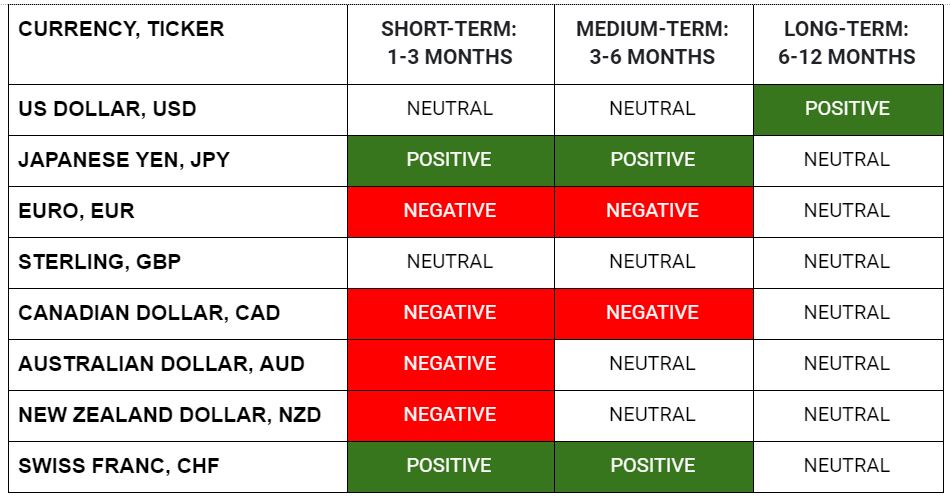

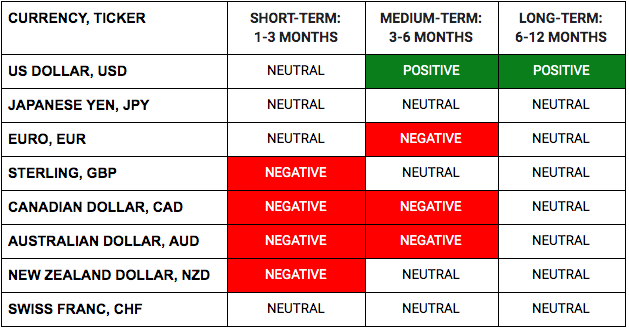

FX

MARKETS

TRADING TIP

It doesn’t really fall like a rock…

With governments showing again their propensity in implementing policies to support asset prices, the battered bulls are now heaving a sigh of relief and high-fiving themselves for not giving up. In a market conditioned to years of buying the dip, many would-be kicking themselves at this moment on why they lost their nerves and didn’t just close their eyes and stick a bid into the falling stock market.

It remains to be seen if this is the start of a bear market or just another retracement in a long multi-year bull market where it has always paid off to buy any dips that occur.

What is different this time though is that the Covid-19 crisis is causing not just a shock to confidence and demand, but also to supply. The question you have to ask yourself is, “Will more easy money from central banks and tax cuts from governments solve all that?”

If this is a bear market, it will be filled with relief rallies much like what we saw yesterday. Bear markets don’t just fall like a rock in a straight line. Be wary, and tread carefully. The key is to survive till the clear good risk vs reward trades appear. There is no rush to get into marginal positions. Do not give in to FOMO and find yourself out of the game.

Be sure to stick around. The markets are just beginning to get interesting!