WHAT HAPPENED YESTERDAY

As of New York Close 6 Apr 2020,

FX

U.S. Dollar Index, +0.16%, 100.74

USDJPY, +0.62%, $109.13

EURUSD, -0.09%, $1.0799

GBPUSD, -0.25%, $1.2231

USDCAD, -0.64%, $1.4112

AUDUSD, +2.02%, $0.6117

NZDUSD, +1.21%, $0.5948

STOCK INDICES

S&P500, +7.03%, 2,663,68

Dow Jones, +7.73%, 22,679.99

Nasdaq, +7.33%, 7,913.24

Nikkei Futures, +7.81%, 19,005.0

COMMODITIES

Gold Futures, +4.99%, 1,727.75

Brent Oil Spot, -2.91%, 29.66

SUMMARY:

Sterling dropped against the Dollar and the Euro on Monday after it was reported that British Prime Minister Boris Johnson has been moved into intensive care after his Covid-19 symptoms worsened. His Downing Street office said he was still conscious. Johnson was admitted to hospital on Sunday night and had been undergoing tests after suffering persistent Covid-19 symptoms, including a high temperature, for more than 10 days. Britain has no formal succession plan should the prime minister become incapacitated, but Johnson, 55, asked Foreign Secretary Dominic Raab to deputise for him.

Japanese Prime Minister Shinzo Abe moved to declare a state of emergency in seven prefectures including Tokyo and Osaka, and announced a record economic stimulus package as the country braces for a surge in Covid-19 infections. The emergency declaration, which will also cover Kanagawa, Saitama, Chiba, Hyogo and Fukuoka prefectures, hands powers to local governments to try to contain the spread of the virus that causes Covid-19, including by urging residents to stay at home.

The stock market rallied more than 7% to start the shortened trading week, as sentiment was buoyed by encouraging signs that the COVID-19 outbreak may be improving. The Dow Jones Industrial Average (+7.73%) and Russell 2000 (+8.2%) set the pace, followed by the Nasdaq Composite (+7.33%) and S&P 500 (+7.03%). U.S 2yr Yield rose 4bp to 0.27% and U.S 10yr Yield rose 5bp to 0.67%.

The positive bias was formed overnight in the futures trade when data out of Europe showed countries reporting fewer Covid-related deaths, offering hope that the U.S. could follow a similar path. As the death toll in the U.S. approaches 10,000, New York Governor Cuomo said he’s seeing signs that possible flattening of New York’s caseload curve is starting to emerge.

Social distancing efforts have also provided an improved statistical outlook regarding total U.S. deaths, although the trajectory of the Covid-19 is subject to change. Nevertheless, these encouraging signs provided the market some relief that contributed to a broad-based, and steady, advance.

JAPAN PM ABE SAYS FISCAL SPENDING UNDER STIMULUS PLAN TO TOTAL 39 TRILLION YEN

Japanese Prime Minister Shinzo Abe said direct fiscal spending under the government’s stimulus package to combat the Covid-19 pandemic will total 39 trillion yen ($357 billion). Abe said on Tuesday morning the package would have 39 trillion yen in fiscal spending and wouldn’t be limited by what has been done in the past. “This will be among the biggest economic packages in the world,” with a total value of 108 trillion yen (equal to 20% of economic output), he told a meeting of ruling party lawmakers at his official residence.

IMPACT: Details of the package are expected to be announced Tuesday. Abe also said he plans to boost virus testing capacity to 20,000 a day as well as increase the number of hospital beds and ventilators. He pledged cash handouts of 200 million yen to small and mid-sized businesses.

UK PM JOHNSON MOVED TO INTENSIVE CARE AS COVID-19 SYMPTOMS WORSEN

British Prime Minister Boris Johnson was moved to an intensive care unit on Monday after his Covid-19 symptoms worsened though his Downing Street office said he was still conscious. Downing Street had said he was in good spirits and still in charge, though his condition deteriorated in the early evening and he was transferred at about 1800 GMT to an intensive care unit – where the most serious cases are treated – at St Thomas’ hospital in central London. Downing Street said he had been moved to the intensive care unit as “a precaution should he require ventilation to aid his recovery”.

IMPACT: Downing Street has said that Foreign Secretary Dominic Raab, who also holds the title First Secretary of State, would deputise for Johnson if necessary. Raab chaired the government’s emergency daily COVID-19 meeting on Monday and will continue to do so while Johnson is in hospital. But Britain’s constitution — an unwieldy collection of sometimes ancient and contradictory precedents — offers no clear, formal “Plan B” or succession scenario, experts said.

There is no guidance in the Cabinet Manual, which sets out the rules and conventions for the running of government, on precisely what to do should the prime minister and other senior figures become incapacitated.

U.S. ENTERS ‘PEAK DEATH WEEK’ FOR COVID-19

Globally, the Covid-19 figures remain stark and show no sign of plateauing yet. A tally at 1400 GMT put the number of confirmed cases at 1.27 million – just three days after it crossed the 1 million mark – and deaths up by 17,000 over the same period to 70,395.

But a ray of hope came from European nations, including hardest-hit Italy and Spain, which have started looking ahead to easing lockdowns after steady falls in their Covid-related fatality rates. “It’s going to be the peak hospitalization, peak ICU week and unfortunately, peak death week,” Admiral Brett Giroir, a physician and a member of the White House Coronavirus Task Force, told ABC’s “Good Morning America” TV program on Monday. Roughly twice as many people a day are now dying in the United States as in Spain or Italy, and hospitals report chaotic shortages of beds, ventilators, and protective gear.

IMPACT: In Spain and Italy, which account for over 40% of the world’s fatalities, the death rate has been declining for several days and public discussion has turned to how and when to ease weeks of drastic curbs on personal and economic activity.

DAY AHEAD

The Reserve Bank of Australia meets later today. With “no appetite” for negative interest rates and a clear indication that the lower bound of interest rates is 0.25% – where they were cut to in March – further measures by the RBA will likely comprise changes to its QE programme and additional support for the banking system to maintain cheap lending.

The RBA’s QE scheme is different from that adopted by most other central banks and resembles more closely the Bank of Japan’s quantitative and qualitative easing (QQE) programme whereby it targets the yield on government bonds rather than set a specific amount of purchases. The RBA’s target is to keep the yield on 3-year Australian government bonds (AGB) at 0.25%.

SENTIMENT

OVERALL SENTIMENT:

Good news cheered the market and bad news was shrugged off as the shorts were sent running for cover. For now, the bear market rally is hurting the bears and that is a key feature of bear markets. The relentless printing presses of all the central banks of the world are driving asset prices higher and Gold is starting to exert its strength. The dominant trade will change as the crisis progresses. To be bearish stocks is to fight against the printing presses although the economic reality is on your side. Gold, however, has the printing presses and the economic reality which requires low interest rates and quantitative easing for a long time to come on its side.

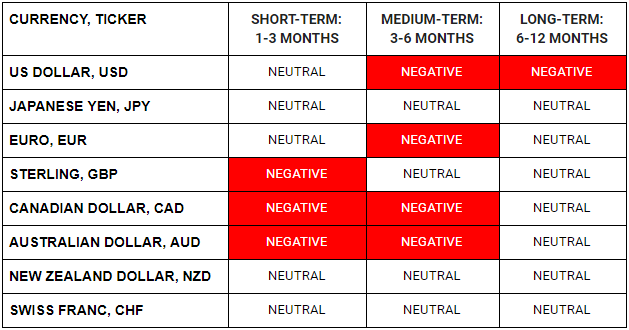

FX

STOCK INDICES

TRADING TIP

The Baton Changes Hands…

The dominant trade at the beginning of the crisis will not stay as the dominant trade throughout the crisis. Prices change, oversubscribed positions get unwound, and market psychology changes. With many now having the mindset of selling instead of all overwhelmingly wanting to buy the dip, the stock markets will now be caught in a tussle between conflicting forces. While selling stocks used to be the dominant trade when many investors were complacently long with leverage while remaining oblivious about the Covid-19 virus risk, the situation has now changed.

To be successful in trading, you must constantly revisit your views and the trades that you have on and ask yourself if this is still the best use of your risk capital. The goal is always to find the best risk reward trade.

With all the money printing going on around the world, it is a matter of time before hard assets start to be repriced against fiat currencies.

If the breakout in Gold holds, the time for it to be the dominant trade may be at hand.