WHAT HAPPENED YESTERDAY

As of New York Close 3 Apr 2020,

FX

U.S. Dollar Index, +0.39%, 100.58

USDJPY, +0.51%, $108.46

EURUSD, -0.45%, $1.0809

GBPUSD, -1.07%, $1.2262

USDCAD, +0.49%, $1.4203

AUDUSD, -1.06%, $0.5996

NZDUSD, -0.79%, $0.5871

STOCK INDICES

S&P500, -1.51%, 2,488.65

Dow Jones, -1.69%, 21,052.53

Nasdaq, -1.53%, 7,373.08

Nikkei Futures, -1.01%, 17,628.0

COMMODITIES

Gold Futures, +0.49%, 1,645.70

Brent Oil Spot, +17.68%, 30.55

SUMMARY:

The Dollar firmed against major currencies for a third straight day on Friday, as investors took shelter in the U.S. currency amid worsening economic fallout from the Covid-19 outbreak. The Dollar largely shrugged off the U.S. non-farm payrolls report that showed massive job losses of 701,000 last month, compared with expectations of 100,000 lost jobs. March’s contraction abruptly ended a historic 113 straight months of employment growth. The Labor Department also revised February’s number upward to 275,000 job gains. The unemployment rate rose to 4.4% from 3.5% the previous month.

The non-farm payrolls report followed Thursday’s data showing initial claims for U.S. unemployment benefits rose to 6.65 million in the latest week from an unrevised 3.3 million the previous week.

The key takeaway from the report is that it still isn’t adequately capturing the full extent of the weakness in the labor market. Things are even worse than the headlines suggest, as the Initial Jobless Claims report released last Thursday made abundantly clear. Those filings are not embedded in Friday’s report, which was formulated mostly on the basis of an employment survey conducted the week of March 12. In actuality, the unemployment rate is likely closer to 10.0% at this juncture.

The stock market ended the down week on a lower note, though the S&P 500 (-1.51%) was able to remain above its low from Wednesday. The benchmark index surrendered 2.1% for the week. Small caps had a more difficult go, as the Russell 2000 (-3.1%) lost 7.1% for the week, stopping the decline just a bit above its March low. Dow Jones, -1.69% and Nasdaq, -1.53%.

OPEC+ MEETING DELAYED

OPEC and Russia have postponed a Monday meeting to discuss oil output cuts until April 9, OPEC sources said on Saturday, as a dispute between Moscow and Saudi Arabia over who is to blame for plunging crude prices intensified. OPEC+ is working on a deal to cut the production of oil equivalent by about 10% of world supply, or 10 million barrels per day, in what member states expect to be an unprecedented global effort including the United States.

Washington, however, has yet to make a commitment to join the effort and Russian President Vladimir Putin on Friday put the blame for the collapse in prices on Saudi Arabia – prompting a firm response from Riyadh on Saturday. OPEC sources later downplayed the Saudi-Russia row, saying the atmosphere was still positive, although there was no draft deal yet nor agreement on details such as a reference level from which to make the production cuts.

IMPACT: US oil prices soared 25% — their biggest one-day gain on record — on Thursday after Trump tweeted that he hopes and expects Saudi Arabia and Russia will slash output by between 10 million and 15 million barrels per day.

The United States is not part of OPEC+ and the idea of Washington curbing production has long been seen as impossible, not least because of U.S. antitrust laws. Still, the oil price crash has spurred regulators in Texas, the heart of U.S. oil production, to consider regulating output for the first time in nearly 50 years.

Russian Energy Minister Alexander Novak told Russian state media he understood that the United States had legal restrictions on output cuts but it should still be flexible. Other oil producers that do not belong to OPEC+ have indicated a willingness to help. Canada’s Alberta province, home to the world’s third-largest oil reserves, is open to joining any potential global pact. Norway, Western Europe’s largest oil and gas producer, said on Saturday it would consider cuts to its oil output if a wide global deal is agreed.

TRUMP: ‘GOING TO BE A LOT OF DEATH” IN U.S. NEXT WEEK FROM COVID-19

Trump told Americans to brace for a big spike in Covid-19 fatalities in the coming days, as the country faces what he called the toughest two weeks of the pandemic. “There’s going to be a lot of death,” Trump said at a briefing with reporters.

White House medical experts have forecast that between 100,000 to 240,000 Americans could be killed in the pandemic, even if sweeping orders to stay home are followed. “We are coming up to a time that is going to be very horrendous,” Trump said at the White House. “We probably have never seen anything like these kinds of numbers. Maybe during the war, during World War One or Two or something.”

IMPACT: New York, the hardest-hit state, reported on Sunday that for the first time in a week, deaths had fallen slightly from the day before, but there were still nearly 600 new fatalities and more than 7,300 new cases. Places such as Pennsylvania, Colorado and Washington, D.C., are starting to see rising deaths. Once the peak of the epidemic passes, Cuomo said a mass rollout of rapid testing would be critical to help the nation “return to normalcy.”

BRAZIL LAWMAKERS PASS ‘WAR BUDGET’ AS COVID-19 CASES TOP 10,000

Brazil’s lower house of Congress approved a constitutional amendment for a “war budget” to separate Covid-related spending from the government’s main budget and shield the economy as the country surpassed 10,000 confirmed cases.

The war budget still needs the Senate’s approval by three-fifths of the votes in two rounds expected to take place this week. Late on Friday, the lower house approved the main text of the bill with 423 votes in favor and one opposed in the second round of voting after the first score of 505 in favor and two against.

Besides easing fiscal and budgetary constraints to speed up measures tackling the outbreak, the war budget also grants the Brazilian central bank emergency bond-buying powers to stabilize financial markets. “We must ensure money reaches key sectors, so as of this week we’ll start discussing what we want to buy and what kind of intervention we want to make,” Brazil’s central bank president, Roberto Campos, said in a live presentation to XP brokerage on Saturday evening.

IMPACT: Bolsonaro’s approval rating has fallen to its lowest level since he took office last year amid mounting criticism of his handling of the public health crisis. Brazil is among a number of countries struggling to get medical supplies from China. Earlier on Saturday, President Jair Bolsonaro asked Indian Prime Minister Narendra Modi for support in supplying pharmaceutical inputs for the production of hydroxychloroquine.

DAY AHEAD

The pandemonium in financial markets has calmed down somewhat, but that serenity seems fragile and investors will keep a close eye on how fast the virus is spreading in America, which is now entering the most painful phase. On the bright side, Europe looks close to a ‘peak’ in new cases. That said, markets will probably remain nervous until the US shows signs of stabilization too, and since that point might be weeks away, risk aversion will linger.

As Trump said today in his press briefing that he expects the peak to be seen in 2 weeks, the market is starting off the week on a positive note. The peak he’s talking about is only referring to the early epicenters of outbreaks such as New York, and the other states are still seeing an increase. History has shown that optimism from Trump on the Covid-19 front should always be taken with a generous handful of salt.

With regards to events and data, the weekly US jobless claims and the OPEC+ meeting would be the most market moving.

SENTIMENT

OVERALL SENTIMENT:

The market is now focused on the improving situation in Italy, Spain, France and New York. With the aggressive social distancing measures that they have implemented, the peak is bound to arrive someday and that someday has finally arrived. That is the good news.

The bad news is, though, you may declare victory on the virus, but that is just a battle and the war is not over. As evidenced by the increase in social distancing measures in Singapore and the impending declaration of state of emergency in Japan, the 2nd wave is just starting to hit the places which let their guard down.

The only defence against the virus is social distancing and the economic costs that need to be paid will be paid. The only difference is if the governments are proactive, the economic costs do not come with the costs of lives and infected cases which could have been prevented and if they are reactive, it will come with huge costs to the lives of the citizens and residents.

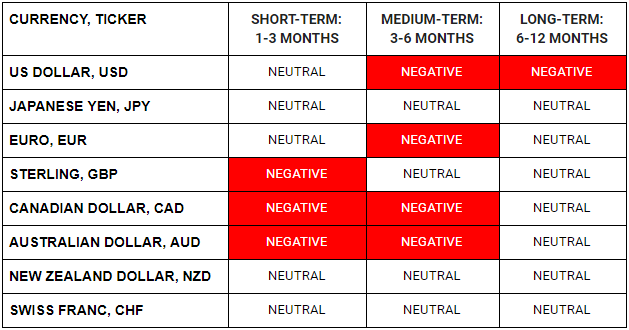

FX

STOCK INDICES

TRADING TIP

Run to where the Ball is going to be

When you watch little children play football, they spend most of their time and energy chasing the ball. When they learn how to play the game properly, they do less of that, but more of running into spaces where they expect the ball will be.

That is how successful traders find good trading opportunities as well. Many were confused as to why the dramatic loss of more than 700K jobs as shown by the US Non-farm Payrolls number (vs expected -100K) did not elicit much a market reaction, but with the latest weekly Initial Jobless claims coming in at more than 6.6 million and Continuing Claims at 3.0 million, is anyone really surprised to see 700K jobs being lost?

The world is now being conditioned to seeing outsized unemployment numbers. The economic damage that will be caused by the ripples will soon be felt. We will see consumption booms in certain sectors (grocery shopping, health supplement, online entertainment platforms etc) and a collapse in sectors which require group participation (bazaars, cinemas, clubs, bars, restaurants etc). Some sectors will face a cash crunch as their revenue streams dry up. There will be defaults, and the governments will try their utmost to save all these industries.

In times of upheavals, there will be many opportunities if and only if you are looking ahead and not behind. Figure out where the ball will go next because that will give you goalscoring opportunities.