WHAT HAPPENED YESTERDAY

As of New York Close 4 May 2020,

FX

U.S. Dollar Index, +0.42%, 99.50

USDJPY, -0.23%, $106.69

EURUSD, -0.75%, $1.0903

GBPUSD, -0.48%, $1.2444

USDCAD, -0.01%, $1.4085

AUDUSD, +0.11%, $0.6426

NZDUSD, -0.31%, $0.6050

STOCK INDICES

S&P500, +0.42%, 2,842.74

Dow Jones, +0.11%, 23,749.76

Nasdaq, +1.23%, 8,710.71

Nikkei Futures, -1.13%, 19,408.0

COMMODITIES

Gold Spot, +0.20%, 1,703.88

Brent Oil Spot, +6.54%, 25.09

SUMMARY:

Dollar gained on Monday, bolstered by safe-haven flows as risk appetite waned amid fears that last year’s U.S.-China dispute will be reignited, this time over the Covid-19. Trump and Secretary of State Mike Pompeo have pinned the blame for the pandemic on China, where the Covid-19 outbreak is believed to have originated. The latest salvo came on Sunday from Pompeo, who said there was “a significant amount of evidence” that the virus emerged from a laboratory in the central Chinese city of Wuhan.

S&P 500 advanced 0.42% on Monday, closing near session highs, as strength in the mega-cap technology stocks helped the market overcome an increase in U.S.-China tensions and cautious commentary from Warren Buffett. Dow Jones, +0.11% and Nasdaq, +1.23%. U.S. 2yr yield fell 1bp to 0.19% and U.S. 10yr yield remained unchanged at 0.64%.

Over the weekend, the Trump administration stepped up its accusations against China for covering up the Covid-19 outbreak, and Warren Buffett said he has yet to find any attractive opportunities in the market. Buffett, instead, used the uncertainty and volatility in the market to dump Berkshire Hathaway’s (BRK.B 177.95, -4.72, -2.6%) holdings of airline companies.

These events helped send the S&P 500 down 1.2% shortly after the open, but the market gradually regained its familiar resilience, guided by leadership from Microsoft (MSFT 178.84, +4.27, +2.5%), Amazon (AMZN 2315.99, +29.94, +1.3%), Apple (AAPL 293.16, +4.09, +1.4%), and Facebook (FB 205.26, +2.99, +1.5%).

The major U.S. airlines Berkshire sold — Delta (DAL 22.57, -1.55, -6.4%), United (UAL 25.26, -1.36, -5.1%), American (AAL 9.82, -0.82, -7.7%), and Southwest (LUV 27.56, -1.67, -5.7%) — took noticeable hits (again) and weighed on the Dow Jones Transportation Average (-2.0%).

INTERNAL CHINESE REPORT WARNS BEIJING FACES TIANANMEN-LIKE GLOBAL BACKLASH OVER VIRUS

The report, presented early last month by the Ministry of State Security to top Beijing leaders including President Xi Jinping, concluded that global anti-China sentiment is at its highest since the 1989 Tiananmen Square crackdown, the sources said. As a result, Beijing faces a wave of anti-China sentiment led by the United States in the aftermath of the pandemic and needs to be prepared in a worst-case scenario for an armed confrontation between the two global powers, according to people familiar with the report’s content, who declined to be identified given the sensitivity of the matter.

IMPACT: No one could determine to what extent the stark assessment described in the paper (classified) reflects positions held by China’s state leaders, and to what extent, if at all, it would influence policy. But the presentation of the report shows how seriously Beijing takes the threat of a building backlash that could threaten what China sees as its strategic investments overseas and its view of its security standing.

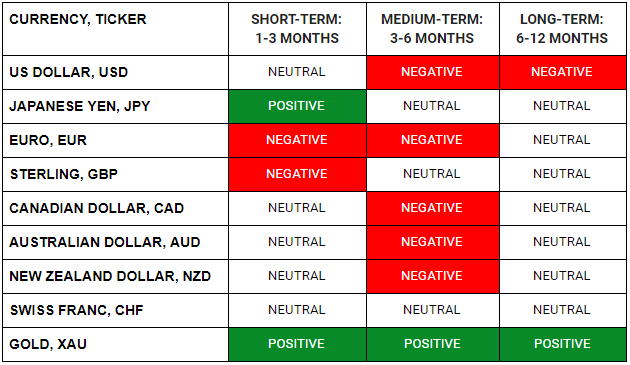

The rhetoric led by Washington will only intensify in the months ahead and this will place more pressure on Chinese dependent trade partners like Australia, New Zealand and the Emerging Market Economies. The push for de-globalization by the U.S. seems uncannily rushed with the world still fighting Covid-19. As Trump’s re-election looms, expect more volatility and risk-assets to finally get the memo that this is indeed a paradigm shift. Expect U.S. Dollar and Safe-Haven currencies (JPY) to trade at a premium in the months ahead.

TRUMP ADMINISTRATION PUSHING TO RIP GLOBAL SUPPLY CHAINS FROM CHINA

Trump administration is “turbocharging” an initiative to remove global industrial supply chains from China as it weighs new tariffs to punish Beijing for its handling of the Covid-19 outbreak, according to officials familiar with U.S. planning.

The U.S. Commerce Department, State, and other agencies are looking for ways to push companies to move both sourcing and manufacturing out of China. Tax incentives and potential re-shoring subsidies are among measures being considered to spur changes, the current and former officials said.

IMPACT: The United States is pushing to create an alliance of “trusted partners” dubbed the “Economic Prosperity Network,” one official said. It would include companies and civil society groups operating under the same set of standards on everything from digital business, energy, and infrastructure to research, trade, education, and commerce.

The U.S. government is working with Australia, India, Japan, New Zealand, South Korea, and Vietnam to “move the global economy forward,” Secretary of State Mike Pompeo said April 29. The re-shoring of global supply chains will be economically bad for China, but beneficial for South-East Asian economies like Vietnam in the future. USD/CNH appears to be trending higher and might test the key 7.20 level soon, a break above that level might warrant a stronger USD/CNH amidst rising geopolitical tensions, trade war and supply chain issues.

RESEARCHERS NEARLY DOUBLE U.S. COVID-19 DEATH PROJECTION DUE TO EASING

The Institute for Health Metrics and Evaluation at the University of Washington’s School of Medicine is now projecting 134,000 Covid-19-related fatalities, up from a previous prediction of 72,000. Factoring in the scientists’ margin of error, the new prediction ranges from 95,000 to 243,000.

The CDC document found some reason for optimism, noting that nationwide, the trajectory of new illnesses in “multiple counties, including hard-hit areas in Louisiana and in the New York City region” has continued to decrease, and that incidence rates have recently plateaued around Chicago.

IMPACT: The alarming modeling comes as some states are already beginning to put parts of the White House’s phased reopening plan into motion despite concerns that the administration’s guidelines for doing so have not yet been met. It also underscores fears that moving too fast to relax strict social-distancing restrictions could fuel a dangerous second wave of infections. Consistent with our theme, if projections come true, expect the US Dollar to trade much higher from here as optimism turns to doom and gloom.

DAY AHEAD

The Reserve Bank of Australia will announce its latest policy decision later today and is not anticipated to make any changes to the cash rate or its quantitative easing (QE) program. But as one of the newest members to the QE club, the RBA may also be the first to exit its emergency programs as the virus is brought under control in Australia and the Bank has had to make fewer purchases lately to keep the target on 3-year government bond yields at 0.25%.

But the Aussie may not be out of the woods just yet. A worrying resurgence of Trump’s anti-China rhetoric in recent days has reawakened trade war fears and this poses a real threat to the global economy’s recovery from the Covid-19 crisis. That prospect has knocked the Aussie’s uptrend off course, and combined with an overly cautious outlook by the RBA, could bring fresh pain for the currency.

SENTIMENT

OVERALL SENTIMENT:

The battered bears got to enjoy just one and half trading days in the sun before yet being sent back into the cave again. On a day with no significant news, a market which started on the backfoot spent the rest of the day grinding back to close at the highs of the session.

If even Warren Buffet is divesting all his airlines stocks rather than holding or adding to his position, it is a clear sign that many industries are impaired for protracted periods of time. The going forth remains tough for the battered bears, but rising trade tensions and the deteriorating relationship between the US and China will eventually temper the relentless optimism of markets.

FX

STOCK INDICES

TRADING TIP

The Widening Rift

As the printing presses of governments continue to work overtime, asset markets relentlessly march higher. Stabilising asset markets which were panicking may well be a necessary policy objective, but there is a cost to these policies of indiscriminate money printing.

While asset prices creep ever higher, and hedge funds and banks profit from positioning for and facilitating the policies, the fate of the everyday Joe could not be more different. Jobs will continue to be lost, and earnings will remain depressed. The stark contrast of the fortunes of Wall Street and Main Street will become clearer as time passes.

The discontent that is inevitable among the masses will eventually boil over if not arrested in time. The masses will soon be looking for someone to blame, and if politicians do not find a convenient bogeyman to pin it on, they will have to bear the brunt of the anger.