WHAT HAPPENED YESTERDAY

As of New York Close 30 Apr 2020,

FX

U.S. Dollar Index, -0.38%, 99.11

USDJPY, +0.54%, $107.29

EURUSD, +0.65%, $1.0946

GBPUSD, +0.91%, $1.2581

USDCAD, +0.53%, $1.3953

AUDUSD, -0.69%, $0.6511

NZDUSD, -0.11%, $0.6126

STOCK INDICES

S&P500, -0.92%, 2,912.43

Dow Jones, -1.17%, 24,345.72

Nasdaq, -0.28%, 8,889.55

Nikkei Futures, -1.17%, 20,060

COMMODITIES

Gold Spot, -1.60%, 1,685.05

Brent Oil Spot, +9.74%, 23.54

SUMMARY:

Central banks remained committed to supporting the financial system. The Fed expanded the scope and eligibility for its Main Street Lending Program, and the ECB said it will conduct net asset purchases under its EUR750 billion pandemic emergency purchase program through at least the end of the year. Yesterday was month-end and around the London fixing, the EUR, CHF and GBP surged versus the US dollar on flow demand, while the JPY, AUD, NZD and CAD fell vs the greenback. Overall the dollar was marginally lower on the day but mixed overall. Dollar Index fell -0.38%, 99.11.

S&P 500 declined 0.92% on Thursday to end a strong April with some light profit-taking activity. Mega-cap technology stocks outperformed and limited the Nasdaq Composite’s decline to 0.28%, while the Dow Jones Industrial Average declined 1.17% and the Russell 2000 declined 3.7%. U.S. 2yr yield remained unchanged at 0.20% and U.S. 10yr yield rose 1bp to 0.64%.

Economic data continued to reveal the damage caused by the Covid-19, specifically a 7.5% plunge in personal spending for March (consensus -3.6%) and 3.839 million initial jobless claims (consensus 3.050 million) filed for the week ending April 25. The positive spin regarding the jobs data was that it marked a 603,000 decline from the prior week.

Notably, mega-cap technology stocks remained in favor, with Amazon (AMZN 2474.00, +101.29, +4.3%) and Apple (AAPL 293.95, +6.22, +2.2%) rallying in front of their earnings reports after the close. Facebook (FB 204.35, +10.16, +5.2%) and Microsoft (MSFT 179.13, +1.70, +1.0%) also finished higher following their earnings.

Apple shares were down more than 2% in the after hours market on Thursday after the company reported a slight increase in second-quarter revenue to $58.3 billion, during a period in which supply and demand for Apple’s products were negatively affected by the Covid-19 pandemic. Apple will also continue to buy back its stock amid the pandemic, the company said. It has authorized an increase of $50 billion in the company’s share repurchase program, in addition to a dividend of $0.82 per share. In Apple’s fiscal 2019, it spent $67.1 billion repurchasing shares and $14.1 billion on dividends.

Amazon reported its first-quarter earnings after the bell on Thursday, revealing the pandemic’s impact on the business that has been a rare bright spot on the stock market. The stock fell about 5% after hours after missing estimates on earnings while beating revenue expectations.

TRUMP THREATENS NEW TARIFFS ON CHINAS AS U.S. MULLS RETALIATORY ACTION OVER VIRUS

Trump said on Thursday his hard-fought trade deal with China was now of secondary importance to the Covid-19 pandemic and he threatened new tariffs on Beijing, as his administration crafted retaliatory measures over the outbreak.

Trump’s sharpened rhetoric against China reflected his growing frustration with Beijing over the pandemic, which has cost tens of thousands of lives in the United States alone, sparked an economic contraction, and threatened his chances of re-election in November.

IMPACT: Two U.S. officials, speaking on condition of anonymity, said a range of options against China were under discussion, but cautioned that efforts were in the early stages. Recommendations have not yet reached the level of Trump’s top national security team or the president. Trump made clear, however, that his concerns about China’s role in the origin and spread of the Covid-19 were taking priority for now over his efforts to build on an initial trade agreement with Beijing that long dominated his dealings with the world’s second-largest economy. Now the word used is tariffs, but who knows when it could be sanctions that are floated. If and when that happens, risk assets will come under heavy pressure and currencies such as AUD and NZD will be in trouble.

Consistent with the narrative we have been advocating that the U.S’ rhetoric against China will ramp up into the Nov elections, expect increasing geopolitical tensions and risk assets like the Aussie Dollar and Emerging Market currencies to be more volatile for the remainder of the year.

GILEAD TO WORK WITH PARTNERS TO RAMP UP PRODUCTION OF POTENTIAL COVID-19 TREATMENT

The company said it still expects to have more than one million remdesivir treatment courses manufactured by December, “with plans to be able to produce several million treatment courses in 2021.” By the end of next month, Gilead said it expects to have manufactured enough of the drug to treat more than 140,000 patients, and it plans to donate that supply to hospitals.

The company said it has been in constant dialogue with the U.S. Food and Drug Administration about making remdesivir, which is given to hospitalized patients by intravenous infusion, available to patients as quickly as possible.

IMPACT: This is positive development from Gilead and any concrete rollout of the drugs will be positive for risk sentiment as it’s a boost for morale globally. Risk currencies like the Aussie Dollar will do well from near term exuberance.

HALF OF U.S. STATES EASING COVID-19 RESTRICTIONS AS JOBLESS NUMBERS GROW

As White House economic reopening guidance expired on Thursday after two weeks in place, half of all U.S. states forged ahead with easing restrictions on restaurants, retail, and other businesses in hopes of reviving Covid-19-stricken commerce.

The enormous pressure on states to reopen, despite a lack of wide-scale virus testing and other precautions urged by health experts, was highlighted in new Labor Department data showing some 30 million Americans seeking unemployment benefits since March 21.

The jobless toll amounts to more than 18.4% of the U.S. working-age population, a level not seen since the Great Depression of the 1930s.

IMPACT: In recurring fashion, we reiterate that there is a good possibility of a second wave of infection as the U.S. relaxes its measures prematurely. Any spike in Covid-19 deaths will dampen risk sentiment and strengthen the U.S. Dollar when risk aversion hits. One caveat is that markets may view remdesivir as a hedge against Covid-19 deaths, hence if the drug is available and reinfections pick up, the impact on risk assets may not be as severe as before, but deaths is a key barometer to watch.

DAY AHEAD

Financial markets closed April in a cheerful mood. US stocks had their best month in decades, beaten-down commodity currencies are on the mend, and the defensive dollar is losing some of its shine. It seems that the incredible stimulus measures by governments and central banks, alongside the announcement of plans to re-open many economies and positive signals on the medical front about a treatment, have all done their part to calm investors.

At present, stock market valuations imply a quick, V-shaped rebound for the world economy. Alas, that assumption is probably overly optimistic. First, many small businesses will shut down permanently due to lockdowns. Secondly, the impact on consumption from soaring unemployment is likely to be underestimated. The US just lost all the jobs it created in the last decade, how long will it take to recover those, and what does that imply for consumption? Third, consider the lasting behavioural shock to some consumers, who might be much more defensive with their spending even after things open up, as we’ve seen in China.

Markets are starting the first day of May negatively on the back of Trump’s anti-China rhetoric and poor earnings reports from tech giants, Apple and Amazon. Is the old adage “Sell in May and go away” going to be that name of the game again? With all but the most ardent of bears having capitulated, and bad news finally getting a bearish reaction, this may indeed be time for the massive rally from the lows to end.

SENTIMENT

OVERALL SENTIMENT:

Finally, the market reacts to the incessant anti-China rhetoric from the US policymakers and bad news elicit the appropriately bearish response. Trump now talks of imposing tariffs to punish China for their lack of transparency or “letting it spread”. Now tariffs, the next word could be sanctions as the same rhetoric could be coming from other US allies soon.

Apple’s disappointing earnings report should not be that big of a surprise to the market given that Apple stores have been closed in various countries due to the virus situation. Yet, the market is not brushing it off as it has tended to do so with most bad news of late. When bad news causes bearish reactions once again, it is time for the wounded bear to awaken once again.

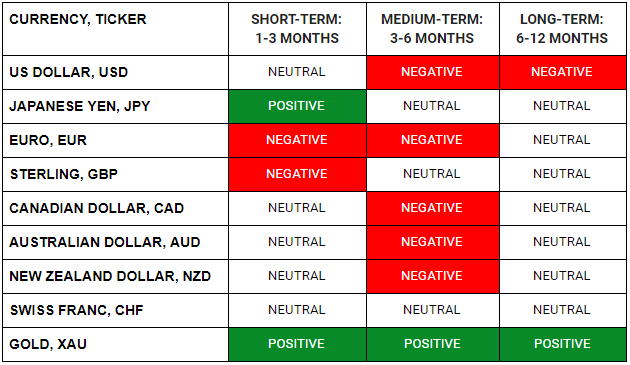

FX

STOCK INDICES

TRADING TIP

Chickens Will Eventually Come Home To Roost

The serenity that has encompassed global markets lately will be put to the test next week when America’s nonfarm payroll data reveal how much destruction the pandemic has left in its wake. The Bank of England and the Reserve Bank of Australia are unlikely to deliver anything new at their meetings, though both will likely maintain a very dovish tone. Overall, the recent flood of liquidity and stimulus has helped stabilize markets, but ultimately, the V-shaped recovery that is now baked into stocks seems unrealistic.

To be clear, all this doesn’t mean the world will end. Rather, that markets may be underplaying the real magnitude of this crisis, how long it will take to get out of it, and its longer-term damage. All told a lot of optimism has been priced back into stocks, suggesting that there’s a lot of room for disappointment if anything goes wrong and that the risk of another move lower from here seems dangerously high.