WHAT HAPPENED YESTERDAY

As of New York Close 6 May 2020,

FX

U.S. Dollar Index, +0.40%, 100.20

USDJPY, -0.36%, $106.21

EURUSD, -0.38%, $1.0799

GBPUSD, -0.90%, $1.2325

USDCAD, +0.83%, $1.4164

AUDUSD, -0.63%, $0.6392

NZDUSD, -0.75%, $0.6007

STOCK INDICES

S&P500, -0.70%, 2,848.42

Dow Jones, -0.91%, 23,664.64

Nasdaq, +0.51%, 8,854.39

Nikkei Futures, -0.96%, 19,407.5

COMMODITIES

Gold Spot, -1.01%, 1,690.00

Brent Oil Spot, -6.25%, 27.01

SUMMARY:

Safe-haven Yen and Dollar rose on Wednesday, as investors sought refuge in these currencies in the wake of dire global economic numbers, manufacturing data in the Eurozone and the bleak picture painted by the UK – the country that was “the most reluctant in Europe to impose a lockdown has become the most cautious to start reopening”, with public opinion frightened of the consequences and Boris Johnson eager to avoid breaking Italy’s “sad record” , undermining the Euro and Sterling. U.S. private payroll data also showed a record of more than 20 million jobs lost in April based on the ADP National Employment Report, but the Dollar held gains.

Mega-cap technology stocks carried the Nasdaq Composite to a 0.5% gain on Wednesday, but another late fade in the market left the S&P 500 (-0.7%), Dow Jones Industrial Average (-0.9%), and Russell 2000 (-0.8%) in negative territory. U.S. 2yr yield fell 2bp to 0.17% and U.S. 10yr yield rose 6bp to 0.72%. The fade was attributable to Trump’s comments on China near the close, he cited – “This is really the worst attack we’ve ever had. This is worse than Pearl Harbor. This is worse than the World Trade Center. There’s never been an attack like this,” Trump said at the White House on Wednesday. “And it should’ve never happened. It could’ve been stopped at the source. It could’ve been stopped in China. It should’ve been stopped right at the source, and it wasn’t.” Describing it as an attack worse than Pearl Harbour and 9/11 is not going to help with US-China relations.

For most of the day, money continued to flow into Apple (AAPL 300.63, +3.07, +1.0%), Microsoft (MSFT 182.54, +1.78, +1.0%), Amazon (AMZN 2351.26, +33.46, +1.4%), Facebook (FB 208.47, +1.40, +0.7%), and Alphabet (GOOG 1347.30, -3.81, -0.3%). Typically, wherever these stocks move, the broader market follows.

TRUMP TO REFOCUS COVID-19 TASK FORCE ON ECONOMIC REVIVAL, CONCEDES RISKS

Trump said on Wednesday his coronavirus task force would shift its primary focus to reviving U.S. business and social life while acknowledging that reopening the economy could put more lives at risk.

In a series of tweets, Trump said the White House task force he formed in March would not wind down, as he suggested on Tuesday, but would instead add some advisers and center its attention on “SAFETY & OPENING UP OUR COUNTRY AGAIN.”

Asked later if Americans will have to accept that reopening will lead to more deaths, Trump told reporters: “You have to be warriors. We can’t keep our country closed down for years and we have to do something. Hopefully, that won’t be the case, but it could very well be the case.”

IMPACT: While New York state, New Jersey and other early U.S. hotspots have lowered their infection curves since mid-April, a number of states, mainly in the Midwest, have posted sharp spikes in new cases and deaths. Minnesota has set a record for new cases nine out of the last 14 days, including 728 cases on Wednesday. Safe-haven Dollar and Yen are already trading strongly in the face of geopolitical and economic headwinds, any spike in infections due to reopening should provide continued strength to those two currencies against most counterparts.

CANADA’S BRITISH COLUMBIA THE LATEST PROVINCE TO UNVEIL RESTART PLAN

British Columbia will begin reopening its economy as early as mid-May, the premier said on Wednesday, as new Covid-19 cases dwindle and other parts of the country, including Quebec and Manitoba, begin to loosen their restrictions. British Columbia has a population of about 5 million people and shares a border with Washington state, where the first major U.S. outbreak occurred.

IMPACT: As of Wednesday, there were 62,458 reported Covid-19 cases in Canada and 4,111 deaths, Chief Public Health Officer Theresa Tam said, adding Canada’s epidemic continued to slow. North American states are eager to reopen, Canada should be prudent about this as well, a global spike in reinfection will prolong the demand destruction in oil, and coupled with a protracted economic crisis, will weigh heavily on the oil-linked commodity currency.

NEW ZEALAND TO RUN DEFICITS FOR EXTENDED PERIOD, DEBT TO EXCEED TARGETS

New Zealand’s Finance Minister said on Thursday the government will be running deficits for an extended period and its debt level would increase to levels well beyond previous targets.

He said the budget, to be released next Thursday, will carry on supporting industries hit by Covid-19 and despite the additional borrowing, New Zealand will remain among the least indebted countries.

IMPACT: The RBNZ has been more liberal with its monetary policy since the start of the crisis, even suggesting that they are considering negative interest rates. The trajectory for the Kiwi should be lower in the long run as the economic impact of the virus unfolds.

DAY AHEAD

The Bank of England’s new governor Andrew Bailey will brief markets about the central bank’s policy decision and announce his first quarterly economic projections later today, earlier than the usual timing in order to comment on the interim Financial Stability report as well. Having deployed big stimulus firepower in previous meetings, the bank is likely to stand pat this week, with markets turning attention to growth forecasts after warnings of a painful contraction in Q2. A speech by the UK Prime Minister later in the day could be another driver of volatility for the pound as the market is eager to hear about Boris Johnson’s reopening plans.

Any rebound could prove short-lived if policymakers cast doubts about a rapid economic recovery, leading to a continuation this month’s sell-off in the GBP. A cautious speech by Boris Johnson accompanied by a more gradual removal of restrictions than markets expect could add to the bearish sentiment.

SENTIMENT

OVERALL SENTIMENT:

Stocks tried hard to rally but ended pretty much in the same place. Fixed income tried to sell off, but also ended up pretty much in the same place. Gold futures sold off nearly 2% but managed to recoup about a third of its losses from the low. The EUR continued to trade weak with EURJPY breaking below the 2017 low of around 114.80-85. USD and JPY traded strong for the day, as sentiment seems to be trading on the weaker side. The anti-China rhetoric from Trump and other US

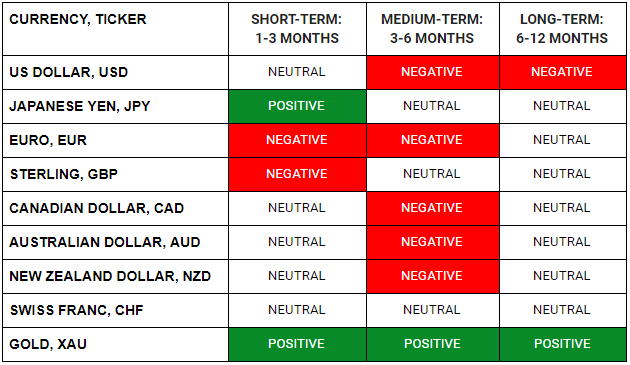

FX

STOCK INDICES

TRADING TIP

Take time to Reflect

There will be times in your trading journey that prices will move in a fashion that is counter to everything you believe to be true. For now, the prices of risk assets seem to be defying the gravity pull of a global economy that is getting devastated by the Covid-19 outbreak.

It is essential at junctures like this to step away from trades that are not working and look instead for trades which are. For instance, a developing theme is the inability of the European governments to agree on a cohesive fiscal policy to save the deteriorating economy. The German court ruling that the ECB’s bond buying programme initiated 5 years ago, for the previous crisis, is unconstitutional is yet another nail in the coffin of European Monetary Union project.

There will always be trade opportunities that do not require you to fight against the market trend. Concentrate on those while you bide your time and wait for what you believe to be true to play out. The object of trading, as always, is not to be right but to make money.

When the markets are going against you, take a step back, reflect and find better opportunities!