WHAT HAPPENED YESTERDAY

As of New York Close 1 May 2020,

FX

U.S. Dollar Index, -0.03%, 99.08

USDJPY, -0.22%, $106.94

EURUSD, +0.26%, $1.0985

GBPUSD, -0.71%, $1.2504

USDCAD, +1.01%, $1.4086

AUDUSD, -1.41%, $0.6419

NZDUSD, -0.93%, $0.6069

STOCK INDICES

S&P500, -2.81%, 2,830.71

Dow Jones, -2.55%, 23,723.69

Nasdaq, -3.20%, 8,604.95

Nikkei Futures, -2.14%, 19,630.0

COMMODITIES

Gold Spot, +0.91%, 1,700.41

Brent Oil Spot, +0.04%, 23.55

SUMMARY:

Safe-haven Japanese Yen gained on Friday and riskier currencies, including the Australian Dollar, dropped as risk sentiment soured after Trump threatened to impose new tariffs on China over the Covid-19 crisis. Trump said on Thursday his hard-fought trade deal with China was now of secondary importance to the Covid-19 pandemic and he threatened new tariffs on Beijing, as his administration crafted retaliatory measures over the outbreak.

Expect AUD and NZD, which have rallied off the lows of late, to give back some gains as risk aversion continues to take hold. US-China trade tensions rising will be most keenly felt by these growth dependent currencies

S&P 500 declined 2.81% on Friday, as investors increased profit-taking efforts after Amazon (AMZN 2286.04, -187.96, -7.6%) underwhelmed investors with its earnings report and U.S.-China tensions appeared to escalate. The Dow Jones Industrial Average lost 2.55%, the Nasdaq Composite lost 3.2%, and the Russell 2000 lost 3.8%. U.S. 2yr yield remained unchanged at 0.20% and U.S. 10yr yield remained unchanged at 0.64%.

Amazon warned that Covid-19-related expenses would likely wipe out its expected $4 billion operating income in Q2, providing investors a good excuse to take some profits after a 50% rally off its March low. The notion that stocks have come too far too fast was bluntly put by Tesla (TSLA 701.32, -80.56, -10.3%) CEO Elon Musk tweeting that Tesla’s stock price is too high.

As for the broader market, investors had to contend with Trump threatening new tariffs on China for its handling of the Covid-19 outbreak, as well as the ISM Manufacturing Index for April declining to its lowest level since 2009 with a 41.5% reading (consensus 39.0%). The latter wasn’t too shocking for investors.

Aside from Amazon, Apple (AAPL 289.07, -4.73, -1.6%), Exxon Mobil (XOM 43.14, -33.33, -7.2%), Chevron (CVX 89.44, -2.56, -2.8%), and Visa (V 175.57, -3.15, -1.8%) also succumbed to losses after reporting earnings. Note, Apple shares still rose 2.1% for the week. Separately, the FDA approved Gilead Sciences’ (GILD 79.95, -4.05, -4.8%) remdesivir for emergency use in treating COVID-19, Gilead shares recouped some losses after the news (+2.25% After Hours) but did not aid the overall market sentiment.

AMERICANS BEGIN TO SURFACE FROM ISOLATION AS STATES EASE CLAMP-DOWNS

Americans in about half of U.S. states, led by Texas and Georgia, began emerging on Friday from home confinement while California and New York held fast to business closures and other restrictions. Texas began a phased-in reopening of businesses shuttered more than a month ago, with restaurants, retail stores, and malls allowed to open at 25% capacity. A second phase is planned for May 18 if infection rates continue to decline.

IMPACT: As of Friday, the number of known infections nationwide had climbed to more than 1 million, including nearly 64,000 deaths. As had happened in other nations, keep an eye out for the second spike in Covid-19 infection the weeks ahead. Any resurgence will cause safe-haven currencies like the Japanese Yen and U.S Dollar to trade stronger against risk assets like the AUD.

U.S. EMERGENCY APPROVAL BROADENS USE OF GILEAD’S COVID-19 DRUG REMDISIVIR

Gilead Science Inc’s antiviral drug remdesivir was granted emergency use authorization by the U.S. Food and Drug Administration for Covid-19 on Friday, clearing the way for broader use of the drug in more hospitals around the United States. U.S. Vice President Mike Pence said the 1.5 million vials would start being distributed to hospitals on Monday.

Gilead said the federal government will coordinate the donation and distribution of remdesivir to hospitals in cities hardest hit by Covid-19. Citing the drug’s limited supply, the company said hospitals with intensive care units and other hospitals that the government deems most in need will receive priority.

IMPACT: Gilead did not immediately respond to a request for the price it plans to charge for the drug after its pledged donations are used up. The Institute for Clinical and Economic Review, which assesses the effectiveness of drugs to determine appropriate prices, but the cost of producing a 10-day course of remdesivir at $10, but suggested that the price would rise to $4,500 based on patient benefits shown in clinical trials. Near term risk appetite will be driven by the effectiveness and availability of cure, watch out for any remdesivir headlines as it should cause knee jerk reactions in risk assets.

TRUMP VS CHINA

Some top Trump administration officials are moving to take a more aggressive stand against China on economic, diplomatic, and scientific issues at the heart of the relationship between the world’s two superpowers, further fraying ties that have reached their lowest point in decades.

White House aides last week have prodded Trump to issue an executive order that would block a government pension fund from investing in Chinese companies, officials said — a move that could upend capital flows across the Pacific. Trump announced on Friday that he was restricting the use of electrical equipment in the domestic grid system with links to “a foreign adversary” — an unspoken reference to China.

IMPACT: Trump’s announcement on electrical equipment on Friday appeared to be another attempt to constrain China. He declared a national emergency and ordered the energy secretary to ban the import of foreign equipment for power plants and transmission systems, arenas where China is becoming increasingly active around the world.

Some White House advisers, including Mnuchin, have cautioned against the steps, saying they could disrupt American financial markets or the trade deal that the United States signed with China in January. Banking executives have also warned of adverse consequences.

In addition, Secretary of State Mike Pompeo said on Sunday there was “a significant amount of evidence” that the Covid-19 emerged from a Chinese laboratory, but did not dispute U.S. intelligence agencies’ conclusion that it was not man-made. “There is a significant amount of evidence that this came from that laboratory in Wuhan,” Pompeo told ABC’s “This Week,” referring to Covid-19.

As the theme of U.S. ratcheting tensions with China develops, any escalation should see Chinese trade dependent currencies like the Aussie, Kiwi and Singapore Dollar weaken against the greenback.

DAY AHEAD

In Australia, the Reserve Bank is unlikely to act on Tuesday, but that doesn’t mean the meeting will be boring. The Aussie has rallied quite sharply in recent weeks, partly as market participants rewarded the government’s impressive response to the pandemic and partly because the RBA itself has been slightly less aggressive than other central banks, for instance by ruling out negative rates.

Yet, a stronger currency is probably the last thing the RBA wants, as that could depress the nation’s exports even more. That implies policymakers may try to implicitly talk down the Aussie, for example by highlighting that they can still do much more, like buying corporate bonds.

SENTIMENT

OVERALL SENTIMENT:

Trump’s bashing of China and efforts to pin the blame on China to distract from his abysmal response to the Covid-19 crisis finally took its toll on market sentiment. The stock market weakness was also attributed to underwhelming earnings reports from tech giants, Amazon and Apple. Even Elon Musk’s tweet that Tesla shares was too high was partly to blame.

Whatever the reasons are, it has been a while since the market reacted negatively to negative news. With share markets in the Middle East down on Sunday (Saudi’s Tadawul All Share Index down 7.4%) as the Saudi Finance Minister warns of “painful measures” ahead due to the Covid-19 crisis and the oil price crash, the Asian trading session is set to start of the week on the backfoot.

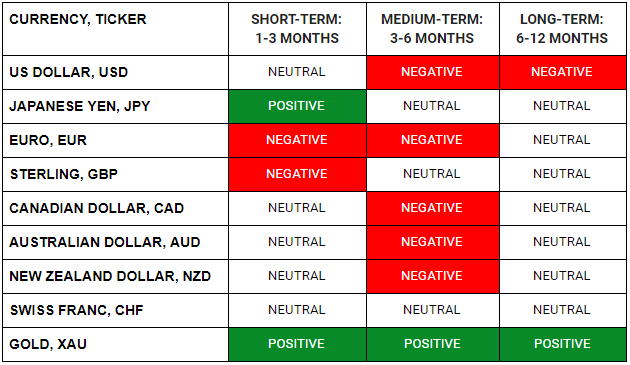

FX

STOCK INDICES

TRADING TIP

The Battered Bear Reawakens

Bears have been sent back running into their caves to lick their wounds in recent weeks as the aggressive rally in global stock markets from the low have defied the overwhelmingly bad data on the economic front. For weeks, good news was celebrated, no matter how trivial they are, and bad news was ignored and brushed over. That was a clear sign of a market that was looking for reasons to rally.

Finally, bad news is being priced as bad and the bears are regaining some signs of life. This is the cue for us to dip our toes once again on risk averse positions. The old adage of “Sell in May and go away” may yet again prove to be good advice.