WHAT HAPPENED YESTERDAY

As of New York Close 11 May 2020,

FX

U.S. Dollar Index, +0.48%, 100.21

USDJPY, +0.87%, $107.60

EURUSD, -0.29%, $1.0809

GBPUSD, -0.62%, $1.2332

USDCAD, +0.67%, $1.4021

AUDUSD, -0.69%, $0.6485

NZDUSD, -0.95%, $0.6077

STOCK INDICES

S&P500, +0.02%, 2,930.32

Dow Jones, -0.45%, 24,221.99

Nasdaq, +0.78%, 9,192.34

Nikkei Futures, +1.33%, 20,408.0

COMMODITIES

Gold Spot, -0.27%, 1,697.97

Brent Oil Spot, -1.06%, 27.89

SUMMARY:

Dollar, which typically functions as a safe-haven, rose on Monday even as investors added risk to their portfolios, buying U.S. stocks and selling Treasury bonds. The USD started out weak in the Asian hours with the AUD and NZD leading the charge higher, testing above 0.6550 and 0.6150 respectively. Just when it looked like USD was going to be in for yet another torrid day, Fed speakers’ pushback against negative interest rates started to hit the newswires, and USD started regaining some ground. Stops of weak USD shorts were triggered as new shorts were sent running for cover.

Investors had mixed risk expectations, with an eye on warnings of a second wave of Covid-19 infections as more countries eased lockdown restrictions. Germany reported on Monday that new Covid-19 infections were accelerating exponentially after early steps to ease its lockdown, news that sounded a global alarm even as businesses ranging from Paris hair salons to Shanghai’s Disneyland reopened. South Korean infections also rebounded to a one-month high. Japan said on Monday it could end its state of emergency in many regions this week and New Zealand said it could ease restrictions on Thursday. The UK has also set out plans to ease the lockdown, while in France shops re-opened on Monday.

The S&P 500 finished flat on Monday in a resilient session that started with the benchmark index down 0.9%. The Nasdaq Composite, powered by its mega-cap components, rose 0.78% while the Dow Jones Industrial Average (-0.45%) and Russell 2000 (-0.6%) closed lower. U.S. 2yr yield rose 1bp to 0.17% and U.S. 10yr yield rose 4bp to 0.73%.

Monday’s lower start was seemingly rooted in pestering worries that reopening the economy too soon could cause additional outbreaks of Covid-19, especially after reports pointed to an uptick in cases in Germany and South Korea. Positive news included New York Governor Cuomo saying he will end state-wide restrictions this Friday, allowing for the re-opening of some low-risk businesses, and Quidel (QDEL 208.95, +50.35, +31.8%) receiving FDA approval for its antigen test for Covid-19. The resilience of the market likely pulled in under-allocated investors fearful of missing out on further gains.

In early trading today, China escalated trade tensions this time with Australia, imposing an import ban on four Australian abattoirs just days after flagging plans to introduce an 80 percent tariff on Australian barley. The move was speculated to be in retaliation to Australian PM Scott Morrison’s request for an independent investigation into the Covid-19 outbreak. AUD is down -0.65% since this morning as a result. If China continues to put pressure on trade with Australia (likely as a punishment for Australia’s call for investigation into the Covid-19 virus), AUDNZD could start to trend lower.

COVID-19 SPREAD ACCELERATES AGAIN IN GERMANY

New Covid-19 infections are accelerating again in Germany just days after its leaders loosened social restrictions. The Robert Koch Institute for disease control said in a daily bulletin the number of people each sick person now infects – known as the reproduction rate, or R0 – had risen to 1.1. When it goes above 1, it means the number of infections is growing.

IMPACT: Chancellor Angela Merkel, bowing to pressure from leaders of Germany’s 16 federal states to restart social life and revive the economy, announced measures that included more shop openings and a gradual return to school. As we have been warning, a second wave of infection is a highly probable scenario and this will eventually dampen recent optimism that slowing infection numbers mean that life can return quickly back to normal.

WUHAN REPORTS FIRST COVID-19 CLUSTER SINCE LOCKDOWN LIFTED

Wuhan reported its first cluster of COVID-19 infections since a lockdown on the city, the epicentre of the outbreak in China, was lifted a month ago, stoking concerns of a wider resurgence. The five new confirmed cases, all from the same residential compound, come amid efforts to ease restrictions across China as businesses restart and individuals get back to work.

IMPACT: Wuhan plans to conduct nucleic acid testing over a period of 10 days, sources familiar with the situation said, with every district told to submit a detailed testing plan by Tuesday. China implemented the strictest measures to control the virus and the testing in Wuhan should be followed, if infected cases spike in the city after the lockdown, we can be sure other countries like the U.S. and Europe whose measures are relaxed will see a second wave of infection. The USD is strengthening on the back of this scenario as markets are starting to price it in.

SHALE PIONEER CHESAPEAKE CONSIDERS BANKRUPTCY

Chesapeake Energy Corp said on Monday it is no longer able to access financing and is considering a bankruptcy court restructuring of its over $9 billion debt if oil prices don’t recover from their sharp fall caused by the Covid-19 pandemic. A bankruptcy filing would cap a long reversal of fortunes for Chesapeake, a company that helped revolutionize the energy industry through the relentless extraction of untapped oil and natural gas from shale rock formations, an environmentally controversial method that became known as fracking.

IMPACT: The company was trying to pivot from natural gas to a greater emphasis on oil when a Saudi-Russian energy price war earlier this year upended its plans and the wider crude market. It was dealt another blow by the Covid-19 outbreak, which caused energy demand to dwindle by shutting down large swaths of the global economy. More shut-ins like Chesapeake will cause the market to organically correct itself and solve the supply glut over time. Keep an eye on the rate of bankruptcies and shut-ins because the fact is that the more it happens, the faster Oil will find a bottom in price, and this is supportive to Oil-linked currencies like the Canadian Dollar.

FED OFFICIALS PUSH BACK ON NEGATIVE RATES

Two FED presidents pushed back on the possibility of negative rates on Monday after the Fed Funds futures markets last week priced in the possibility that the central bank will cut its policy rate below zero in 2021.

“At best, we’d have to study it more, but I don’t anticipate that being a tool we would be using in the U.S.,” Federal Reserve Bank of Chicago President Charles Evans said from Chicago.

“I am not a big fan of going into the negative rate territory,” Atlanta Fed President Raphael Bostic said in Atlanta.

IMPACT: The commentary gave the USD some support after it traded weakly last week as Fed Funds futures were implying negative rates. In a world where developed world central banks like the BoJ, ECB and SNB are already in negative and RBNZ keeping the possibility on the table, Fed’s reassurance will keep the implied rates from sinking in negative territory and provide support to the USD.

DAY AHEAD

The Reserve Bank of New Zealand will wrap up its policy meeting tomorrow morning, and recent developments suggest that more stimulus is needed. A rate cut is probably off the cards, for now, so the central bank is more likely to expand its QE program instead. As for the NZD, its reaction may depend mainly on how open policymakers appear about easing again in the future. In this sense, the risks surrounding the currency seem asymmetric and tilted to the upside, as a lot of gloom has been priced in already.

SENTIMENT

OVERALL SENTIMENT:

Just when it seemed like it’s always a good bet to buy risk assets during Asian hours, US equity futures started the day weak and remained weak till US hours started. Just when it looked like it was going to be a down day for US stocks, the big tech companies surged and turned the NASDAQ index positive and up more than a percent intraday. Just when USD looked like it was doomed to test lower, pushback from Fed speakers on negative interest rates triggered weak stops and gave it new life. Trading sure does seem difficult these days! With markets changing on a dime on random headlines, it is imperative to keep one’s emotions in check to preserve sanity while waiting for easier times.

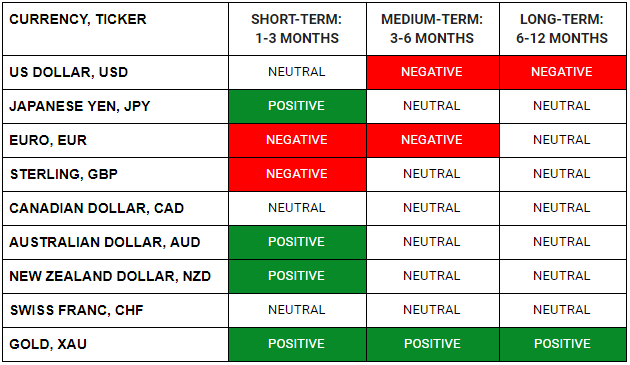

FX

STOCK INDICES

TRADING TIP

Trading In The Trenches

Trading is indeed, not an easy vocation. Most people have the misconception that all it takes is a few clicks and money will miraculously pile up in your trading account. Even the most obvious of views will sometimes not show up in market prices. This can be extremely energy sapping and demoralising.

However, there will always be periods like this in a career of trading. It is important to get through rough patches like this in one piece, because eventually, market trends will become easier to identify again.

The trick is to keep your head down, keep your risk light and size your trades appropriately till “easier times” are back! Save your risk capital till you get into the right trading rhythm again. Be true to your process and keep calm!