WHAT HAPPENED YESTERDAY

As of New York Close 5 May 2020,

FX

U.S. Dollar Index, +0.30%, 99.79

USDJPY, -0.27%, $106.46

EURUSD, -0.63%, $1.0839

GBPUSD, 0.00%, $1.2444

USDCAD, -0.32%, $1.4040

AUDUSD, +0.11%, $0.6434

NZDUSD, +0.08%, $0.6053

STOCK INDICES

S&P500, +0.90%, 2,868.44

Dow Jones, +0.56%, 23,883.09

Nasdaq, +1.13%, 8,809.12

Nikkei Futures, +0.96%, 19,595.0

COMMODITIES

Gold Spot, +0.14%, 1,704.08

Brent Oil Spot, +14.83%, 28.81

SUMMARY:

U.S. ISM Non-Manufacturing Index for April dropped to 41.8% (consensus 38.5%) from 52.5% in March. A number below 50.0% is indicative of contraction. The April reading was the lowest reading for the index since March 2009. The Dollar Index rose for a third session, primarily because of EUR weakness. The greenback’s gains came at the expense of the Euro, which weakened broadly after a German constitutional court ruled that the Bundesbank must stop buying government bonds if the European Central Bank cannot prove those purchases are needed. The decision did not apply to the ECB’s latest pandemic-fighting program, a 750 billion-euro scheme to prop up the economy, but the ruling unsettled financial markets. The ruling was confusing and unexpected, and the first thing to do when investors do when uncertain is to sell and get to safety. That led to EURJPY breaking the support at 115.50. Expect EURJPY to go even lower in time to come.

U.S. stocks, bolstered by the prospect of reopenings in some American states and countries around the world, as well as U.S. ISM data that was stronger than market expectations had a good day. S&P 500 rallied as much as 2.0% on Tuesday, as investors continued to buy into the reopening narrative, but stocks pared gains late in the day to leave the benchmark index up 0.9% for the session. The Nasdaq Composite increased 1.13%, the Dow Jones Industrial Average increased 0.56%, and the Russell 2000 increased 0.8%. U.S. 2yr yield remained unchanged at 0.19% and U.S. 10yr yield rose 2bp to 0.66%.

Positive reopening news included California announcing plans to reopen parts of its economy as early as Friday, joining a growing list of U.S. states to have already opened or outlined plans. Starbucks (SBUX 72.90, +1.01, +1.4%) said it expects to have 85% of its U.S. stores open again by the end of the week, excluding dine-in service.

The health care space received a sentiment boost by news that Pfizer (PFE 38.51, +0.89, +2.4%) and BioNTech SE (BNTX 50.00, +4.22, +9.2%) conducted a clinical trial of a potential COVID-19 vaccine with their first U.S. patients. Expect more news of such trials from various companies going forward.

Notably, the ISM Non-Manufacturing Index for April fell into contraction territory with a 41.8% reading (consensus 38.5%), United Airlines (UAL 24.12, -1.14, -4.5%) warned it will likely cut 30% of its management and administrative staff in October, and Norwegian Cruise Line Holdings (NCLH 11.18, -3.26, -22.6%) expressed “substantial doubt” about its future.

WHITE HOUSE TO WIND DOWN CORONAVIRUS TASK FORCE AS FOCUS SHIFTS TO AFTERMATH

The White House coronavirus task force will wind down as the U.S. moves into a second phase that focuses on the aftermath of the outbreak, Trump said on Tuesday. Trump said Anthony Fauci and Deborah Birx, doctors who assumed a high profile during weeks of nationally televised news briefings, would remain advisers after the group is dismantled. Fauci leads the National Institute of Allergy and Infectious Diseases and Birx was response coordinator for the force.

IMPACT: The focus is now on therapeutics, vaccines, and addressing infection hot spots, the task force members said. Most experts have suggested clinical trials to guarantee a vaccine is safe and effective could take a minimum of 12 to 18 months. The “road to recovery” in America will be a key barometer for market sentiment in the weeks ahead, winding down of the task force at this point in time is not a prudent measure especially given case studies in Asia of a second wave. When that happens and a dedicated body is not in place to tackle the issue, blind optimism will turn to doom and gloom really fast and cause safe haven currencies like the Japanese Yen and Dollar to trade strongly against risk assets.

RESERVE BANK OF AUSTRALIA

After keeping rates on hold at a record 0.25 percent at its monthly board meeting on Tuesday, Governor Lowe said several scenarios for the economy had been considered and would be detailed in the Statement on Monetary Policy to be released on Friday.

However, he said: “A stronger economic recovery is possible if there is further substantial progress in containing the Covid-19 in the near term and there is a faster return to normal economic activity.” The Prime Minister and national cabinet are expected to make significant revisions to restrictions this Friday, bolstering early signs of a recovery in the economy.

IMPACT: The Australian government has handled the Covid-19 crisis well and this is reflected in the rebound in the Aussie. Hopes of the Australian economy reopening and China starting up the economic engine provided optimism and tailwind that things may resume to normal faster for Australia, as compared to the rest of the world. A caveat to note is that the Aussie is still considered a risk asset and a commodity currency, should risk appetite take turn for the worst, a highly plausible scenario at this point, Aussie will inadvertently be dragged down as well.

BIDEN’S EDGE EVAPORATES AS TRUMP SEEN AS BETTER SUITED FOR ECONOMY

Joe Biden’s advantage over Trump in popular support has eroded in recent weeks as the presumptive Democratic presidential nominee struggles for visibility with voters during the Covid-19 pandemic, according to a poll released on Tuesday.

According to the poll, 45% of Americans said Trump was better suited to create jobs, while 32% said Biden was the better candidate for that. That pushed Trump’s advantage over Biden in terms of job creation to 13 points, compared with the Republican president’s 6-point edge in a similar poll that ran in mid-April.

IMPACT: Trump plays the media like a fiddle and is a master of narratives. He has used this Covid-19 situation well to shore up support and bash rivals. Expect elevated volatility as we head into the November elections and safe-haven currencies like the Japanese Yen should trade stronger against most counterparts this year.

DAY AHEAD

The Bank of England (BoE) meets tomorrow. Having already slashed rates to almost zero and restarted QE, BoE is unlikely to do any more for now. But it will still have a tough job on its hands, as its new economic forecasts will try to estimate the depth and length of this unique recession.

Sterling’s reaction though may depend mainly on the comments of the new Governor, Andrew Bailey. From a risk-management perspective, Bailey probably has more incentive to maintain a dovish tone and hint that his central bank is prepared to do much more if need be. Anything short of that could trigger a sizable rebound in sterling and a tightening of financial conditions, which the BoE likely wants to avoid.

Overall, the outlook for Sterling seems challenging. In the near term, Britain is one of the few major economies that haven’t announced an opening-up plan so far, and the longer things stay shut, the bleaker the outlook for the economy. Longer-term, Brexit worries could come back to haunt the currency, as PM Johnson insists that he won’t request an extension to the December deadline for the transition period, setting the stage for more eleventh-hour negotiations, brinkmanship, and drama ahead.

SENTIMENT

OVERALL SENTIMENT:

Trump tones down his anti-China rhetoric, and asset markets regained the positive tone. However, while risk assets were enjoying a good day, the German courts finally delivered a ruling, in a lawsuit that started 5 years ago, that ECB’s indiscriminate bond buying is beyond its mandate. So, the German Central Bank now has to stop participating in the program unless ECB can prove in the next 3 months that the policy is delivering the monetary effects it is supposed to and not just monetising the debts of governments.

This caused weakness in the EUR but small sell-off in risk did not last. However, it is a theme that needs to be watched going forward.

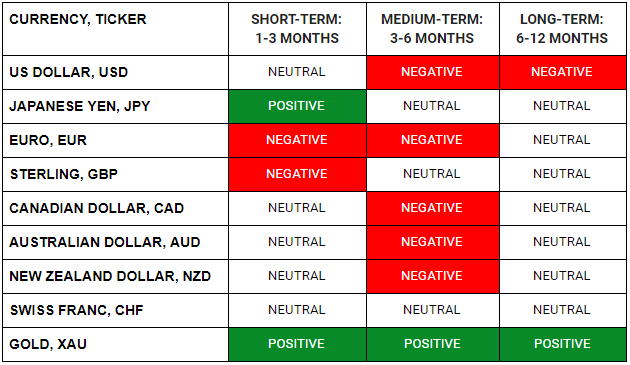

FX

STOCK INDICES

TRADING TIP

European Fractured Union

The German constitutional court ruled that the German Central Bank, the Bundesbank, must stop buying government bonds if the European Central Bank (ECB) cannot prove those purchases are needed to effectively conduct its monetary policy. The judges believe that it is possible that the ECB has gone beyond its mandate and is now encroaching on the territory of fiscal policies by indiscriminately monetising the debt of governments. The Euro reacted negatively given that such a ruling was not expected, hence the disappointment effect and the confusion that ensued led to investors heading for the exits. In the current times of stress, the ECB easing measures have helped calmed the markets and if that is in doubt, investors will shy away from investing in the currency till clarity is restored.

This is one of the many instances the EU has failed in coming together to solve a crisis. The EU may have survived Brexit, the refugee crisis, and the financial meltdown of 2008, but do not assume the COVID-19 crisis can’t destroy it. The countries hit the worst by the pandemic — Italy, Spain, and France — are the ones that have the least amount of fiscal breathing space, irrespective of the European Commission’s relaxation of fiscal and state aid rules.

The EU’s leaders and the European Central Bank’s president, in particular, face a similar choice. Either they move boldly to help the periphery, or the periphery is going to help itself in whatever way it can — even if it means the unravelling of the eurozone and the EU. Previous calls for exits have always come from the periphery, but with German Chancellor Merkel nearing the end of her term, the new Chancellor may face questions from the masses as to the point of the Monetary Union if the ECB is deemed to be conducting the policies that are unconstitutional and monetising debt has been something that the Bundesbank has historically been averse to.

With the obvious beneficiaries of such initiatives being periphery countries as well as the financial sector, and no obvious benefit to the everyday person who is losing his job, the backlash that is to come could be game-changing.