WHAT HAPPENED YESTERDAY

As of New York Close 8 May 2020,

FX

U.S. Dollar Index, -0.08%, 99.73

USDJPY, +0.36%, $106.67

EURUSD, +0.06%, $1.0841

GBPUSD, +0.37%, $1.2409

USDCAD, -0.32%, $1.3927

AUDUSD, +0.54%, $0.6530

NZDUSD, +0.82%, $0.6135

STOCK INDICES

S&P500, +1.69%, 2,929.80

Dow Jones, +1.91%, 24,331.32

Nasdaq, +1.58%, 9,121.32

Nikkei Futures, +2.23%, 20,140.0

COMMODITIES

Gold Spot, -0.89%, 1,702.65

Brent Oil Spot, +5.58%, 28.19

SUMMARY:

US key jobs number, the Non-farm payrolls for April declined by 20.5 million (consensus -21.00 million), and the unemployment rate increased to 14.7% (consensus 16.2%). Those were the worst readings in the post-World War II era, but the number of unemployed persons said to be on “temporary layoff” increased about ten-fold to 18.1 million in April. This is noteworthy because it shows that most workers who were recently laid off are optimistic about being reemployed. That sentiment would be consistent with 1) the market’s view that the jobs data can’t get any worse and 2) news that more companies are restarting operations as states move along with their reopening plans. If those assumptions turn out to be wrong, then the jobs market will be even more dire in the weeks ahead.

Dollar posted its largest weekly gain versus the Euro in more than a month, although that was more related to the European single currency’s issues concerning the German Court’s decision against the European Central Bank’s asset purchases. Separately, U.S.-China tensions appeared to drop a notch today after the two sides reportedly pledged to make progress on their Phase One trade deal.

U.S. stocks extended weekly gains on Friday, as the market saw reasons to stay positive on the economic outlook despite the dismal employment report for April. The S&P 500 (+1.69%), Dow Jones Industrial Average (+1.91%), and Nasdaq Composite (+1.58%) advanced more than 1.5%, while the Russell 2000 rose 3.6%.

Apple (AAPL 310.13, +7.21, +2.4%) plans to reopen stores in several U.S. states next week. Boeing (BA 133.44, +4.79, +3.7%) plans to reopen its 737 MAX factory later this month. Uber (UBER 32.79, +1.86, +6.0%) observed ride-sharing growth over the past three weeks, and tickets to Walt Disney’s (DIS 109.16, +3.59, +3.4%) Shanghai theme park sold out within minutes.

EU PLANS TO RESTART TRAVEL AND TOURISM DESPITE COVID-19

EU states should guarantee vouchers for travel cancelled during the Covid-19 pandemic and start lifting internal border restrictions in a bid to salvage some of the summer tourism season, the bloc’s executive will say this week.

“To provide incentives for passengers and travellers to accept vouchers instead of reimbursement, vouchers should be protected against insolvency of the issuer and remain refundable by the end of their validity if not redeemed,” the draft document said. The EU executive will also tell the bloc’s 27 member countries to gradually lift internal border restrictions and restart some travel to help the ailing tourism sector.

IMPACT: Tourism normally brings in 150 billion euros every season from June through August with some 360 million international arrivals, according to the Commission. Titled “Europe needs a break” the Commission’s tourism strategy will call for targeted restrictions to replace a general ban on travel and seek a gradual lifting of internal border checks where the health situation has improved. “Don’t count the chickens before they hatch” as the old adage says, a second wave of infection is a probable scenario as we’ve witnessed in South Korea over the weekend, such a scenario will be bearish for the Euro. In addition, given how divided the EU is politically, any spikes in the Euro should be sold.

U.S. TO WITHDRAW PATRIOT MISSILES FROM SAUDI ARABIA OVER OIL DISPUTE

The U.S. is pulling two Patriot missile batteries and some fighter aircraft out of Saudi Arabia, an American official said, amid tensions between the kingdom and the Trump administration over oil production. The decision scales back the American presence in Saudi Arabia just months after the Pentagon began a military buildup there to counter threats from Iran. About 300 troops that staff the two batteries would also leave Saudi Arabia, according to the official, who spoke on condition of anonymity to discuss sensitive military operations.

IMPACT: When Saudi Arabia ramped up oil production and slashed prices this year, Republicans accused the kingdom of exacerbating instability in the oil market, which was already suffering because of the Covid-19 pandemic. The volatility and price crash in oil hurt U.S. shale producers, leading to layoffs in the industry, particularly in Republican-run states. Some Republican senators warned in late March that if Saudi Arabia did not change course, it risked losing American defense support and facing a range of potential “levers of statecraft” such as tariffs and other trade restrictions, investigations and sanctions.

This gives Saudi Arabia less reasons to play nice with U.S. Shale, Saudi Arabia is known to have tried to bankrupt U.S. Shale before by flooding the world with Oil, and now they have good reasons to do so. Watch out below for Oil prices and Oil-Linked currencies like the Canadian Dollar and Mexican Peso.

HALF OF SPANIARDS WILL SEE LOCKDOWN EASED FROM TODAY AS DEATH TOLL FALLS

Spain’s daily death toll from the Covid-19 fell to its second-lowest since mid-March on Saturday, as half the country prepared to move to the next phase of an exit from one of Europe’s strictest lockdowns.

Spain began to loosen its lockdown last week, but Phase 1 will include a considerable easing of measures that will allow people to move around their province as well as attend concerts and go to the theatre. Gatherings of up to 10 people will be allowed.

Spain’s daily death toll from the Covid-19 fell to 179 on Saturday, down from 229 the previous day and a fraction of highs above 900 seen in early April. The cumulative death total rose to 26,478 while the number of diagnosed cases rose to 223,578 from 222,857 the day before, the health ministry said.

IMPACT: Some 51% of the population will progress to Phase 1 of a four-step easing plan today after the government decided the regions in which they lived met the necessary criteria. The country’s two biggest cities – Madrid and Barcelona – do not currently meet the criteria for easing and will remain in Phase 0.

In a positive step for Spain’s tourism industry, which contributes around 12% of economic output, hotels will be allowed to open all rooms and nature tourism will be allowed for groups of up to 10. With reference to similar reasons above for the EU, a second wave of infection is a highly probable outcome.

DAY AHEAD

There can be no hiding from the awful economic data that is now pouring in from all angles as we move well into the second quarter. Australian jobs, UK Q1 GDP, and US retail sales and inflation numbers will be the next key releases to showcase the virus-inflicted damage. But amid growing optimism about the pandemic easing, the Reserve Bank of New Zealand will likely err on the side of caution at its policy meeting, posing a downside risk for the Kiwi and other commodity dollars.

SENTIMENT

OVERALL SENTIMENT:

US stocks continued to grind higher, while Fed Futures edged away from negative interest rates territory to hover around 0%. With interest rates edging higher, Gold lost some momentum and backed off more than 1% from the highs. USD, however, remained weak against most developed currencies except the JPY. With stock sentiment diverging from the economic reality, it has become a market that requires patience as fundamentals will eventually matter again.

With Australia and New Zealand seemingly doing all the right things to keep the outbreak under control, their currencies are leading the way in this bout of USD weakness. This is likely to continue as food security and optimism on re-opening of economies become key themes going forward.

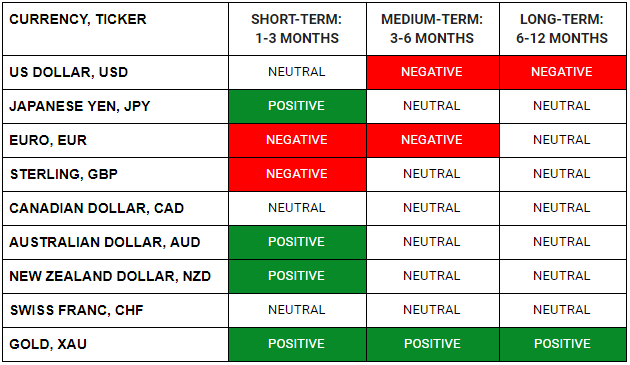

FX

STOCK INDICES

TRADING TIP

Threat Of Inflation

The Fed’s balance sheet is expected by many estimates to expand from $4 trillion to $10 trillion this year and is already up to $6.7 trillion within two months of the crisis and is still growing at a swift rate. We’re already seeing the largest year-over-year percentage growth in broad money supply in modern history. But outside of essentials like groceries and healthcare, that money isn’t moving around yet, with velocity extremely low.

In the years ahead, the possibility of broad inflation is back on the table. As pandemic lockdowns ease and ongoing government stimulus tries to get the economy back up off the floor, consumer demand can increase while the new money supply remains in the system. The timeline on which this happens depends on how much stimulus and consumer/business support both the Treasury and Federal Reserve print and hand out to Main Street, and how fast the virus goes away enough such that restaurants, hotels, airlines, and other businesses can partially and then completely re-open.

Over the multi-year longer-run, if we see a trend towards diversification of supply chains by bringing production facilities back to the United States or other higher cost locations, that could further raise inflationary pressures because it would start to undo one of the major deflationary outlets (offshoring) that has been in place for decades.