WHAT HAPPENED YESTERDAY

As of New York Close 29 Apr 2020,

FX

U.S. Dollar Index, -0.37%, 99.49

USDJPY, -0.24%, $106.61

EURUSD, +0.53%, $1.0877

GBPUSD, +0.37%, $1.2471

USDCAD, -0.85%, $1.3875

AUDUSD, +0.97%, $0.6554

NZDUSD, +1.39%, $0.6140

STOCK INDICES

S&P500, +2.66%, 2,939.51

Dow Jones, +2.21%, 24,633.86

Nasdaq, +3.57%, 8,914.71

Nikkei Futures, +2.46%, 20,297.5

COMMODITIES

Gold Spot, +0.32%, 1,714.12

Brent Oil Spot, +5.98%, 21.45

SUMMARY:

Dollar fell on Wednesday after the Fed left interest rates unchanged and repeated a vow to do whatever it takes to shore up the economy that has been battered by business shutdowns due to Covid-19. The dollar index against a basket of currencies fell 0.37% to 99.49, but held above a two-week low of 99.44 reached on Tuesday.

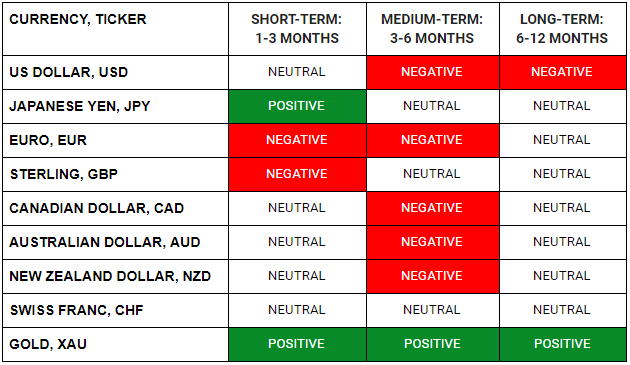

USD weakness, especially against AUD and NZD, continues unabated and seems unlikely to stop. For now, Gold is taking a back seat as short term speculative positions seem to be long but once that is unwound, the wave of money that is driving risk assets higher will lift Gold prices as well. In the midst of a risk rally, the JPY remains strangely strong. The JPY tends to weaken when risk appetite is strong. This could be a sign that USDJPY and EURJPY will likely probe lower levels in time to come.

S&P 500 climbed 2.66% on Wednesday, primarily driven by positive remdesivir news and aided by better-than-feared earnings reports and a market-friendly reminder from the Fed. The Nasdaq Composite rose 3.57%, the Dow Jones Industrial Average rose 2.21%, and the Russell 2000 rose 4.8%. U.S. 2yr yield remained unchanged at 0.20% and U.S. 10yr yield rose 1bp to 0.63%.

The US day started with Gilead Sciences (GILD 83.14, +4.47, +5.7%) affirming that remdesivir, an antiviral treatment for COVID-19, met its primary endpoint in an NIAID placebo-controlled study. The news helped the market open noticeably higher, as it fueled reopening hopes and overshadowed data depicting Q1 GDP contracting at a 4.8% annualized rate (consensus -4.3%).

Alphabet (GOOG 1341.48, +107.81, +8.7%), MasterCard (MA 283.69, +19.09, +7.2%), and Boeing (BA 139.00, +7.70, +5.9%) contributed to the bullish price action following their earnings reports. Energy stocks received an added boost from the 22% spike in oil prices ($15.13/bbl, +2.76, +22.3%).

While most stocks finished the day higher, notable holdouts included Starbucks (SBUX 76.86, -1.83, -2.3%), Advanced Micro Devices (AMD 53.66, -1.85, -3.3%), and General Electric (GE 6.58, -0.22, -3.2%) following their earnings reports.

Later in the day, the Fed unanimously voted to maintain the target range for the fed funds rate at 0.00-0.25%, as was expected and said rates will remain there until the economy is on track to achieve the Fed’s goals of full employment and price stability. The inference is that rates will stay there for much longer, as the record unemployment isn’t expected to return to normal anytime soon.

Fed Chair Powell acknowledged that low rates alone won’t revive economic activity and reiterated the Fed’s commitment to using its full range of policy tools. Powell also said legislators should embrace policies that protect against avoidable insolvencies. Market reaction was relatively muted to the policy directive and the Fed Chair’s comments.

Microsoft shares rose as much as 5% in extended trading on Wednesday after the company reported fiscal third-quarter sales growth of 15%, fueled by its cloud business. The company said in a statement that Covid-19 “had a minimal net impact on the total company revenue” in the quarter and that “effects of Covid-19 may not be fully reflected in the financial results until future periods.”

Facebook which gleans nearly all of its revenue through advertising, reported better-than-expected quarterly revenue but missed on earnings. The social-networking giant still managed to double its profit from a year ago, though, and its shares shot up 10% in after-hours trading. “Rather than slamming on the brakes now… it is important to keep on investing and building where other companies turn back,” Zuckerberg said.

DATA ON GILEAD DRUG RAISES HOPES IN PANDEMIC FIGHT, FAUCI CALLS IT ‘HIGHLY SIGNIFICANT’

Preliminary results from a U.S. government trial showing that patients given remdesivir recovered 31% faster than those given a placebo, were hailed by Dr. Anthony Fauci as “highly significant.”

The U.S. Food and Drug Administration said it has been in discussions with Gilead about making remdesivir available to patients as quickly as possible, but the agency declined to comment on any plans to grant the drug regulatory approval.

“I want them to go as quickly as they can,” President Donald Trump said, when asked if he wanted the FDA to grant emergency use authorization for remdesivir. “We want everything to be safe, but we would like to see very quick approvals, especially with things that work.”

IMPACT: Gilead’s shares rose more than 5% on Wednesday to close at $83.14 and are up 27% so far this year. Despite the excitement, Dr. Lawrence K. Altman, a global fellow at The Wilson Center in Washington, DC, was not ready to celebrate the preliminary findings. The new data “offers a glimmer of hope” that remdesivir has an effect against Covid-19, but the more scientific analysis is needed “comparing them to other studies of the drug that have shown mixed results,” he said in a statement. Any positive developments in relation to Gilead’s drug will see risk assets and growth currencies, such as the AUD, get a boost and if the cure is actually found, we may see an unwind in safe-haven assets like the U.S. Dollar.

PRESIDENT TRUMP SAYS CHINA WANTS HIM TO LOSE RE-ELECTION RACE

Trump said on Wednesday he believes China’s handling of the Covid-19 is proof that Beijing “will do anything they can” to make him lose his re-election bid.

In an interview with Reuters in the Oval Office, Trump said he was looking at different options in terms of consequences for China for the virus. “I can do a lot,” he said.

IMPACT: Desperate to win reelection and avoid blame for the U.S.’s Covid-19 disaster, Trump is going all-in on China-bashing. The effects of attacks on China are broad. More China criticism could increase volatility in bond, stock, and affect growth sensitive currencies (AUD, SGD, NZD, etc). Asian governments’ and businesses’ biggest fear is Trump doubling down on import taxes just when China is growing the slowest in 30 years. Following the Covid-19-driven 6.8% contraction in China’s gross domestic product in the first quarter, trade disputes would hardly be welcome.

JAPAN PM SAYS TO CONSULT EXPERTS ON WHETHER TO EXTEND STATE OF EMERGENCY

Japanese Prime Minister Shinzo Abe said on Thursday that the government would consult experts to decide whether to extend the state of emergency beyond May 6.

Abe, speaking in parliament, also said the situation surrounding the Covid-19 epidemic continued to be “severe”. The Nikkei business daily reported on Wednesday that the government was planning to extend the nationwide state of emergency by about one month.

IMPACT: The global economy could this year see the steepest downturn since the Great Depression of the 1930s due to a virus-driven collapse of activity, with Japan’s economy facing stagnation due to its export dependence and soft domestic consumption. Official data on Thursday showed factory output slipped 3.7% in March from the previous month, a smaller decline than the 5.2% drop forecast. We are not out of the woods as major economies are still grappling with the virus and demand destruction is not a light switch that can be turned on and off, the pickup in economic activity will be a protracted grind, hence higher Oil prices might not be entirely sustainable at this point. This in turn affects Oil-linked commodity currencies like the Canadian Dollar and Mexican Peso.

DAY AHEAD

With Europe’s biggest economies shutting down in March as the Covid-19 wreaked havoc across the continent, no one is expecting the Eurozone’s first-quarter GDP estimate later today to be anything but abysmal. But just as in previous crises, it is the European Central Bank that has been first to come to the rescue and with European Union leaders still bickering over the details of a virus recovery fund, it will be up to Lagarde and her team to calm investor’s nerves when they announce their latest policy decision later today.

SENTIMENT

OVERALL SENTIMENT:

US GDP was worse than expected, proving that the economy is bad, but it did not faze the market. At the same time as the data release, news that Gilead’s drug, remdesivir, was showing “positive results’ ‘ in a trial hit the wires, and it was off to the races for risk assets, with US stocks up almost 2% on that.

The Federal Reserve kept policy unchanged, and the Fed Chair, Powell, says the economy is bad and the employment numbers are going to be horrible next. That did not put a dent in the market, and it rallied almost another percent. It seems that good news is good for the market, and bad news is expected and ignored for now.

FX

STOCK INDICES

TRADING TIP

A Fractious Europe

With the virus crisis not looking like it will end anytime soon and the EU dragging its feet on meaningful measures to support the hardest-hit member states, expectations are growing that the ECB will boost the Pandemic Emergency Purchase Programme at today’s meeting. If the expectation is met, the Euro could advance. If, though, the ECB keeps the size of its stimulus unchanged and just fine-tunes existing measures, the Euro would be in danger of revisiting the $1.0775 support as doubts would resurface about the Eurozone’s recovery plan.

In the more medium-term, the ECB’s forward guidance and any hints on the future policy will be more significant for the Euro’s outlook. In particular, should Lagarde suggest that unlimited bond purchases were discussed in the meeting, this could limit future rebounds against currencies where their central banks have also pledged unlimited QE (like the Federal Reserve and Bank of Japan).