WHAT HAPPENED YESTERDAY

As of New York Close 7 May 2020,

FX

U.S. Dollar Index, -0.38%, 99.82

USDJPY, +0.20%, $106.36

EURUSD, +0.38%, $1.0836

GBPUSD, +0.25%, $1.2374

USDCAD, -1.21%, $1.3974

AUDUSD, +1.56%, $0.6501

NZDUSD, +1.40%, $0.6094

STOCK INDICES

S&P500, +1.15%, 2,881.19

Dow Jones, +0.89%, 23,875.89

Nasdaq, +1.41%, 8,979.66

Nikkei Futures, +2.68%, 19,928.0

COMMODITIES

Gold Spot, +1.69%, 1,714.42

Brent Oil Spot, -1.15%, 26.70

SUMMARY:

Dollar fell from two-week highs on Thursday, as investors booked profits on the currency’s gains this week before today’s U.S. nonfarm payrolls report for April, which could show massive job losses amid a Covid-19 pandemic that has ravaged the global economy. The USD weakness was triggered when Fed Funds futures started to price for negative interest rates in 2021 during the NY trading session. Hard commodity currencies such as AUD and NZD and Gold ripped higher as the implied interest rates slipped below 0% in the US.

Non-farm business sector labor productivity decreased 2.5% in the first quarter (consensus -6.0%) following a 1.2% increase in the fourth quarter. Unit labor costs increased by 4.8% ( consensus +2.9%) after increasing 0.9% in the fourth quarter. The key takeaway from the report is that productivity was weak, which is a headwind to an increased standard of living. That headwind should be even stronger in the second quarter. Continuing claims, or the total number of Americans receiving unemployment benefits, rose to a fresh record of 22.6 million in the week ended April 25. The weekly pace of filings is decelerating, suggesting the worst of the layoffs may be over as several states embark on limited reopenings of restaurants, retail shops, and other businesses.

Cyclical sectors led the S&P 500 to a 1.15% gain on Thursday, while mega-cap technology stocks carried the Nasdaq Composite to a 1.41% gain and into positive territory for the year. The Dow Jones Industrial Average rose 0.89%, and the Russell 2000 rose 1.6%. U.S. 2yr yield fell 4bp to 0.13% and U.S. 10yr yield fell 9bp to 0.63%.

The day started with investors receiving economic data that the market construed as relatively good: weekly initial jobless claims totaled 3.169 million (consensus 2.900 million), but it was encouraging that it reflected another 677,000 decline from the prior week. Likewise, China’s imports fell more than expected in April, but an increase in exports was a nice surprise.

FRANCE TO RE-OPEN ON MONDAY

France is ready to start unwinding its Covid-19 lockdown from next Monday as planned, the prime minister said on Thursday, although some regions including the Paris area where the virus is still circulating would keep some restrictions.

The country has made enough progress in slowing down the spread of the virus and reducing strain in hospitals to gradually return to normal, Prime Minister Edouard Philippe said. Schools, cafes and most shops have been shut for nearly two months.

IMPACT: Next week, about 1 million children and 130,000 teachers will return to school, the education minister said. Some 25,809 people have died of Covid-19 in France, according to official data. The Eurozone is already in a fractured state and a second wave of infections will weigh on the Euro as the policy response and government coordination within the EU has been abysmal and ineffective in addressing the virus and its economic impact.

BLAME CHINA. REMAKE ECONOMY

Several Trump aides say their 2020 campaign will now be chiefly defined by two themes: Trump is the only candidate who can resurrect the economy and that Biden will not be as tough on China, a country Trump is blaming for the pandemic.

It is a message resonating with Trump’s base, according to interviews with more than 50 voters in three swing counties in the battleground states of Pennsylvania, Michigan, and Wisconsin – states Trump won in 2016 by less than a percentage point and that will decide whether he can win a second term.

Trump officials say the new messaging, being sent to Republican state leaders across the country and pushed in new anti-Biden ads across swing states, reflects internal and external polling data that shows voters trust Trump more on the economy, and that Americans across party lines distrust China.

IMPACT: The recalibrated strategy comes as Trump faces a more difficult re-election campaign amid an outbreak that has now infected more than 1.2 million in the United States and killed over 70,000 – the world’s highest number of cases and deaths – and led to over 30 million filings for unemployment in the past six weeks. A Pew Research Center survey in late April showed two-thirds of Americans viewed China unfavorably now, up 20 points since the start of the Trump administration in January 2017. Expect more geopolitical headwinds as we head into Nov U.S. elections and for Safe-Haven currencies like the Japanese Yen and U.S. Dollar to trade at a premium relative to risk-assets.

STERLING’S POST-BOE RALLY FADES; POOR OUTLOOK WEIGHS ON POUND-TRADERS

The Bank of England held rates steady and announced no further stimulus, as was broadly expected, and said it was ready to take fresh action to counter the economic fallout from the Covid-19 pandemic.

The bank will consider what it needs to do with its 645 billion Pounds ($796 billion) bond-buying programme in June when it will have more clarity on how the government intends to lift its Covid-19 lockdown, Governor Andrew Bailey said. It was appropriate that the BoE continues with its “aggressive” pace of bond-buying for now, Bailey said.

IMPACT: As mentioned yesterday in our update, Sterling staged a knee-jerk relief rally, as there had been some expectations that the BoE could extend quantitative easing, but it soon faded into the close. Weighing on Sterling are the ongoing Brexit negotiations. Britain insists that it will not seek an extension to the transition period, which is due to end in December 2020, whether or not a trade deal has been struck. GBP spiked to a high of 1.2418 on the decision but dribbled down to a low of 1.2267 as investors are reminded of the bleak outlook ahead for the UK. However, it managed to recover and spike higher as USD weakened broadly when short term US interest rates for 2021 slipped below 0%.

DAY AHEAD

The American economy is forecast to have lost a breath-taking 20 million jobs, which would push the unemployment rate up to 14%, far above the 10% peak of the previous recession. Average hourly earnings are expected to have lost steam too, but admittedly, the focus will be on job losses, not wage growth.

Also, employment numbers for April are due out of Canada later today, but as far as jobs reports go, this will be one that nobody will be looking forward to. Canada has been no exception in the global pandemic of the Covid-19 and after losing one million jobs in March, the employment picture is about to get much worse. The number of people out of work is projected to have shot up by a record 4 million in April, pushing unemployment to an astonishingly high rate of 18.0% – another record – from 7.8% in March.

Like many other countries, Canada has begun to loosen some of its restrictions, with several provinces allowing some retailers and businesses to reopen. Assuming that all goes to plan and a second wave of infections can be avoided, the April jobs figures may be as bad as they get.

The question now is how quickly economic activity returns to normal and how many businesses will the stimulus packages from the government and central bank manage to save from going bust. The Canadian government has responded with a sizable fiscal aid package amounting to C$260 billion (11% of GDP). The Bank of Canada’s emergency asset purchases are also in that range, totalling C$200 billion, and at its last meeting, it expanded its program to include provincial and high-grade corporate bonds.

Market is getting used to massive numbers in terms of job losses, and is unlikely to react to much. The driver, especially for the currency market, will continue to be US interest rates. Should it slip further into negative territory, USD weakness will accelerate.

SENTIMENT

OVERALL SENTIMENT:

US Fed Funds futures started to price for negative interest rates for the US policy rate in 2021. This is despite repeated statements from various Fed speakers expressing very little enthusiasm for negative interest rates thus far. USD weakened against most developed currencies and especially so against Gold. It was a perplexing move as no one could really pin down a reason for this, so most experts settled on hedging or stop-outs by banks and other investors.

Whatever the reason might be, it is a significant development, and the best trade, in our opinion, to profit from this is to be long Gold over the long run. In a world of negative nominal and real rates, Gold will shine.

If the world was so bleak that negative rates were being priced in the US, it is perplexing that stock markets would be rising but that seems to be the case. Again, it seems to be the wave of free money driving asset markets higher. Stay out of the way for now and get involved with the easier trades.

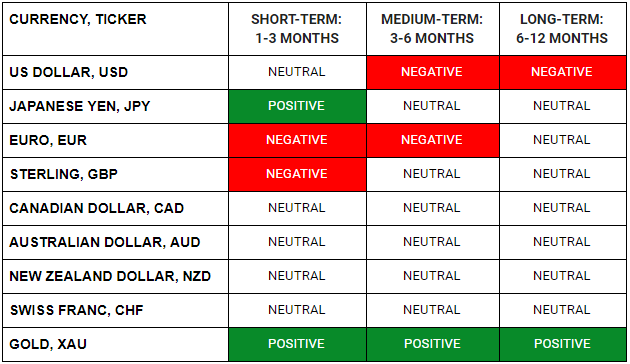

FX

STOCK INDICES

TRADING TIP

Bitcoin’s Coming of Age

Bitcoin has been around for more than a decade and has survived numerous attacks from policymakers and hackers alike, proving itself to be the antifragile asset it claims to be when Satoshi Nakamoto first invented it. Yesterday, Bitcoin as an asset was given a credibility boost when Hedge Fund legend Paul Tudor Jones announced that he had allocated a percentage of his fund to it as a hedge against the inflation he sees coming from the incessant and indiscriminate central bank money-printing around the world, telling clients that bitcoin reminds him of the role gold played in the 1970s.

In his own words, “We are witnessing the Great Monetary Inflation — an unprecedented expansion of every form of money, unlike anything the developed world has ever seen.” Indeed, the purpose Satoshi Nakamoto had for Bitcoin was for a time like this, to protect savers from the hubris of government monetary experiments.

Bitcoin is transitioning from being a collectible that appeals to the millennials to a store of value taken seriously by the great investors of our time. As a non-sovereign monetary good, it is possible that at some stage in the future Bitcoin will become a trusted store of value much like Gold did during the classical gold standard of the 19th century.