WHAT HAPPENED YESTERDAY

As of Thu 20 Feb, Singapore Time zone UTC+8

FX

U.S. Dollar Index, +0.15%, 99.59

USDJPY, +1.20%, $111.19

EURUSD, +0.16%, $1.0810

GBPUSD, -0.56%, $1.2926

USDCAD, -0.29%, $1.3219

AUDUSD, -0.07%, $0.6681

NZDUSD, -0.03%, $0.6389

STOCK INDICES

S&P500, +0.47%, 3,386.15

Dow Jones, +0.59%, 29,348.03

Nasdaq, +0.87%, 9,817.18

Nikkei Futures, +1.98%, 23,660.0

COMMODITIES

Gold (XAU/USD), +0.60%, 1,610.44

Brent Oil, +2.77%, 59.35

SUMMARY:

Volatility returned in a big way in USD/JPY. Complacent longs of JPY (ie short USD/JPY, EUR/JPY) all got a rude shock when USD/JPY exploded breaking through key resistance at 110.30-35 level and did not look back. It marched relentlessly to touch a high of 111.58 before easing off to around 111.20. No one could quite explain the explosive move, with some reasons given ranging from good US data (housing and PPI) to the alarming increase in the infection cases on the Diamond Princess moored off the coast of Yokohama. However, whatever the reason, the price action cannot be ignored. USD is strong.

The S&P 500 (+0.47%) and Nasdaq Composite (+0.9%) closed at fresh record highs on Wednesday, as investors remained optimistic about the global economic outlook despite the coronavirus. In the U.S., building permits climbed to a near 13-year high in January, while China signaled further support for businesses affected by the coronavirus. In addition, the FOMC minutes from the January meeting didn’t alter the market’s favourable outlook for monetary policy, which is to say that policy could be adjusted if the coronavirus situation doesn’t improve.

U.S. Treasuries traded within a narrow range and closed slightly lower. The 2-yr yield increased two basis points to 1.42%, and the 10-yr yield increased one basis point to 1.57%. The U.S. Dollar Index advanced 0.15% to 99.59.

WEAK AUSSIE WAGE GROWTH

Australia’s annual wage price index rose a tepid 2.2% in the final quarter of last year with pay rewards in the public sector slowing to the weakest pace on record, according to data released on Wednesday. The Reserve Bank of Australia (RBA) is predicting this pedestrian pace of wage growth to extend through mid-2022 as the jobless rate is not seen dipping materially during that time.

Minutes of the RBA’s February policy meeting out this week showed its committee thought that easing policy further might accelerate the process, but judged the risks of ever-lower low rates outweighed the benefits. The RBA has estimated the unemployment rate needs to fall below 4.5% from 5.1% currently for wages to grow at 3% or more.

IMPACT: Tepid Wage Growth coupled with bushfire damages and unaccounted for coronavirus impact, it is likely that the Reserve Bank will need to cut rates again by mid-year, with a second cut not out of the question, the Australian Dollar finished lower as a result.

UK INFLATION HITS HIGHS

UK inflation in January rose to a six-month high as petrol and house prices rose, official figures show. The Consumer Prices Index (CPI) stood at 1.8% last month, up from 1.3% in December, the Office for National Statistics said. However, some analysts said that the new figures were unlikely to “move the dial” on the central bank’s next decision on interest rates in March.

Fuel prices were up 4.7% compared with a year earlier, marking the biggest rise since November 2018. Energy regulator Ofgem’s cap on energy bills meant that the average household could not be charged more than £1,137 annually for their gas and electricity.

IMPACT: For the MPC, the fact that inflation is in line with its projections provides another reason not to cut interest rates in the near-term.” The rate currently stands at 0.75%. The MPC is next due to meet on 26 March. The inflation print initially pushed Sterling above key $1.30 level, but the pair finished -0.56% lower at $1.2926 to end the day.

CANADIAN INFLATION RISES ON BACK OF HIGHER GASOLINE

Canada’s annual inflation rate rose to 2.4% in January on higher gasoline prices, Statistics Canada said on Wednesday, with some analysts suggesting the data may pose a challenge for the Bank of Canada should it wish to ease rates. Analysts in a poll had forecast a rate of 2.3%, up from 2.2% in December. Excluding gasoline prices, the annual inflation rate rose 2.0% in January.

IMPACT: The Bank of Canada aims to keep inflation at 2%. Money markets see about a 10% chance of a rate cut in March, down from about 16% seen before the data release. It gives the bank a bit of a challenge if they want to cut rates. It’s not a straightforward case like in the U.S. when their measure of core inflation was stuck well below 2%.

DAY AHEAD

Later today, the US Philly Fed manufacturing index will provide another glimpse into the state of the manufacturing sector in February, and tomorrow the flash PMIs and existing home sales will wrap up the week. Although the IHS Markit PMIs do not carry the same weight as the ISM PMIs, they could nevertheless move the Dollar, especially if there is a global trend in the PMIs of worsening economic activity in February as a result of the coronavirus.

SENTIMENT

OVERALL SENTIMENT:

Stocks continue to march relentlessly higher, but Gold remains strong. Speculators are all confused about what the drivers of the markets are. Expectations of more liquidity from central banks should the negative economic impact of Covid-19 start to take hold supports the market but price action in currency markets are giving mixed signals.

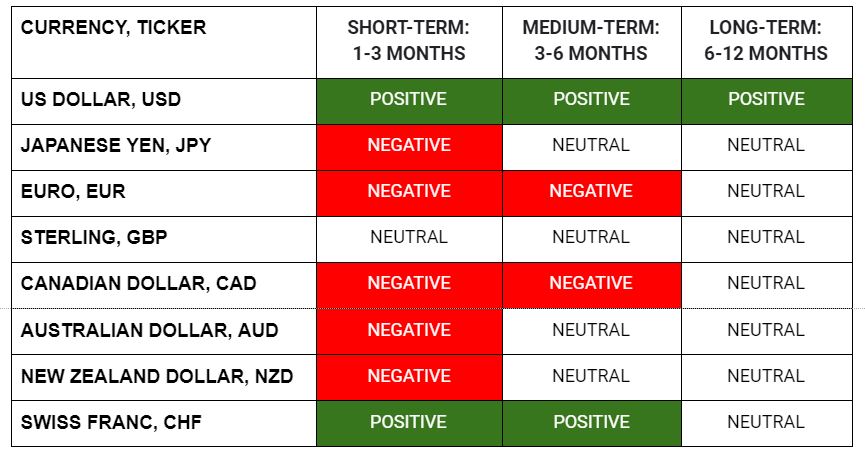

FX

MARKETS

TRADING TIP

Don’t forget to watch your canary!

In the past, coal miners will bring with them caged canaries while they work the mines. If toxic gases such as carbon monoxide were present, the bird’s small size, high metabolism rate and rapid breathing rate will cause it to die before the effects are felt by the miners.

This simple warning system is a great way for the miners to know when it’s time to get the heck out of there before it’s too late. To be successful in trading, you too, need to have some canaries which you can keep your eye on.

When things move contrary to what you expect given what the rest of the market is doing, it’s time to pay attention.

For example, when USD is strong, generally, Gold will be weak.

When Gold is strong, this usually means risk sentiment is weak, hence JPY will also be strong and stock indices should be quite weak.

So, if there should be a time when USD is strong, Gold is strong, Stock Indices are strong, and JPY is weak – you can be sure it sounds like a few canaries are flapping about and chirping very loudly. When that happens, it’s time to pay attention, and get ready for what comes next.

If you have no clue what’s likely to come next, the best thing to do is to reduce your risk and RESPECT the PRICE ACTION!