WHAT HAPPENED YESTERDAY

As of Fri 21 Feb, Singapore Time zone UTC+8

FX

U.S. Dollar Index, +0.18%, 99.88

USDJPY, +0.55%, $111.97

EURUSD, -0.17%, $1.0788

GBPUSD, -0.31%, $1.2881

USDCAD, +0.31%, $1.3261

AUDUSD, -0.96%, $0.6612

NZDUSD, -0.85%, $0.6333

STOCK INDICES

S&P500, -0.38%, 3,373.23

Dow Jones, -0.44%, 29,219.98

Nasdaq, -0.67%, 9,750.97

Nikkei Futures, +0.09%, 23,390.0

COMMODITIES

Gold (XAU/USD), +0.79%, 1,622.30

Brent Oil, +0.00%, 59.12

SUMMARY:

Asian markets started off with a wild ride when USD/SGD exploded after it broke 1.3950 to reach a high of 1.4080 in a matter of minutes before quickly retracing just as fast to 1.4020 ish. Although USD/SGD closed just about 0.5% on the day, the wild swings experienced were not typical of the usually sedated currency pair.

The rampage led to USD strength vs most of the currencies that matter. AUD and NZD bore the brunt of relentless USD buying, with both falling nearly 1% against the USD. Even when the GBP rallied almost 0.2% to 1.2920 on the better than expected Retail Sales data (+0.8% YoY vs exp 0.7%), the spike was quickly met with sellers that pushed it to a low of 1.2849. As the old saying goes, that which will not rally on good news, is weak. Amidst all the USD buying, Gold remained strangely bid.

The S&P 500 took a precipitous 1.3% decline in a span of a short time during Thursday’s NY late morning session as stocks pulled back from record highs, but opportunistic investors stepped in to buy the intraday dip. The brief sell-off set off fears and commentary of a “freak sell-off” among the speculative community. The benchmark index closed lower by just 0.4%, as some dip-buying soothed the market. The Dow Jones Industrial Average (-0.5%) and Nasdaq Composite (-0.7%) also closed off the lows.

The 2-yr yield declined three basis points to 1.39%, and the 10-yr yield declined five basis points to 1.53%. The U.S. Dollar Index increased 0.2% to 99.87. WTI crude rose 0.8%, or $0.45, to $53.77/bbl.

YEN’S SAFE HAVEN STATUS BEING QUESTIONED

The Yen’s status as a safe haven is coming under pressure as uneasiness grows about the rising number of coronavirus cases in Japan, against the backdrop of a stuttering domestic economy. Analysts were quick to pin the move to large portfolio shifts out of yen-denominated assets – most likely by Japan’s giant government pension funds – amid worries about its economy and the spread of the coronavirus.

There are already fears it will cast a shadow over the Olympic Games in Tokyo, due to begin late in July and bring a hoped-for boost to the national economy and morale. However, should it start to spread through Japan’s population, the fallout would almost certainly be enough to tip the world’s third largest economy, which shrank unexpectedly hard last quarter, into recession. Some 3 trillion yen ($27 billion) in net foreign bond purchases by Japanese investors in the first two weeks of February seems to underscore the lack of confidence in domestic investments.

IMPACT: The Yen’s slide is unusual because the exchange rate with the dollar has been unraveling from its close correlation to the price of Gold and U.S. Treasury yields – a development that should be watched. The move lower in global interest rates may have undermined the Yen’s attractiveness as a “funding currency,” or one cheap to borrow for use in buying riskier investments.

BLOOMBERG FLOPS ON DEBATE STAGE

After spending more than $300 million of his fortune on a massive ad campaign that boosted his poll numbers and landed him on the debate stage, he was torched from every angle.

Bloomberg was forced to defend, among other things, his massive wealth, New York’s “stop-and-frisk” policing programme and the treatment of women at his media company. He was even boo-ed at one point by the Democrat-friendly crowd in Las Vegas. At times he seemed distant and disinterested, speaking in bland technocratic assertions. His best moments came when he was talking about building his company and positioning himself as an ardent defender of capitalism. But those moments were few.

IMPACT: Bloomberg was woefully unprepared to defend or explain his record, which includes the ineffective and racist stop-and-frisk policy that terrorised New York’s communities of color, and decades of complaints of a sexist and hostile work environment for women at his company. With his money unable to bail him out, Bloomberg offered little more than the haughty, eye-rolling outrage of a man unaccustomed to answering to anybody about anything.

CHINA CUTS RATES

The PBoC cut the 1Y Loan Prime Rate by 10 basis points to 4.05% as expected, following cuts of 10 basis points in the 7D reverse repo and 1Y MLF rates. What is unexpected is that the central bank cut the 5Y Loan Prime Rate by only 5 basis points to 4.75%, not by 10 basis points.

IMPACT: USDCNY rose on the back of today’s rate decision. The objective of interest-rate cuts at this time is to help corporates and individuals with their interest service costs during the Covid-19 epidemic. There is also a rough consensus that this epidemic will end sometime in 2020. So cutting the 5Y loan rate to a lesser extent is logical as the rate-cut needs for longer-term loans should not be mixed with critical short-term cash-flow needs. Moreover, there is history in China that when money is too cheap, it increasingly flows into speculative assets, e.g. during 2009 and 2010. This also explains why the central bank is cautious when cutting the 5Y Loan Prime Rate.

DAY AHEAD

The flash PMI readings by IHS Markit (UK, Germany, EU, US) later today will be the highlight, amid doubts about the green shoots of recovery in the euro area. Eurozone manufacturing PMI has been steadily recovering since October and picked up some speed in January. However, the rebound could be cut short by the virus outbreak and so PMIs for both the manufacturing and services sectors will be very important for detecting any shift in the outlook for the Eurozone economy.

How the market trade into the weekend will also be telling. Given that many of the recent swings in the market have confused market participants, a reduction of risk positions into the weekend may not be surprising.

SENTIMENT

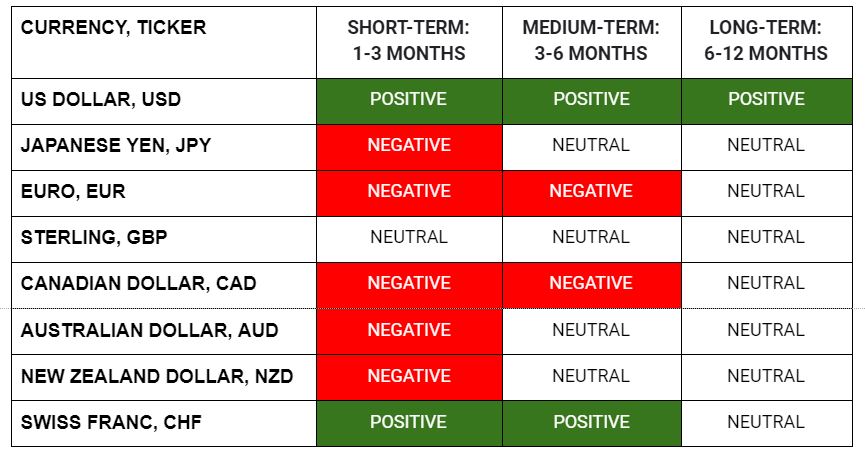

OVERALL SENTIMENT:

As expected, risk sentiment weakened a little as markets do not like uncertainty and confusion. With many of the recent moves in the FX markets remaining unexplained, and the sharp (though brief) selloff in the US equity indices last night adding to the jitters, expect many to be in the mood to reduce risk as we head into the weekend.

FX

STOCK INDICES

TRADING TIP

Price Action is King!

It is human nature to resist changes and this is especially true for changes that defy our understanding and expectations. This is also the case with many traders when faced with market moves which are “inexplicable” to them.

However, the job of traders is not to explain market moves but to take advantage of these moves and make money. To be successful at this, it is imperative to know when to pay attention to the wisdom of crowds, and pay due respect to Price Action, especially when no one can explain the unexpected moves.

To paraphrase a good friend of mine who is a successful trader of many years, “If the move can be explained, it won’t move in such a fashion! Most of the bigger moves can’t be immediately explained, but the researchers and market commentators will be able to soon enough!”

With the USD Index breaking above the highs last seen since May 2017 (almost 3 years ago), and volatility returning to the FX market, it is time to sit up and pay attention!