WHAT HAPPENED YESTERDAY

As of Wed 19 Feb, Singapore Time zone UTC+8

FX MOVES

U.S. Dollar Index, +0.45%%, 99.45

USDJPY, +0.02%, $109.92

EURUSD, -0.38%, $1.0795

GBPUSD, -0.08%, $1.2999

USDCAD, +0.15%, $1.3254

AUDUSD, -0.03%, $0.6694

NZDUSD, -0.67%, $0.6393

MARKET MOVES

S&P500, -0.29%, 3,370.29

Dow Jones, -0.56%, 29,232.19

Nasdaq, +0.02%, 9,732.74

Nikkei Futures, -0.99%, 23,308.0

COMMODITIES

Gold (XAU/USD), +1.05%, 1,600.91

SUMMARY:

USD gained on the day as EUR continued its dribble lower. Though a weaker than expected ZEW did not have much of an immediate impact, the weak sentiment did not do any favours for the already heavy EUR. Gold gained more than 1% without any significant headlines on a day when USD was performing well is yet another sign that the risk sentiment is weakening.

The S&P 500 declined as much as 0.7% on Tuesday after Apple (AAPL 319.00, -5.95, -1.8%) issued a revenue warning due to the coronavirus. The market resiliently cut its losses during the afternoon, though, leaving the S&P 500 down 0.29% for the session.

The 2-yr yield declined 2 basis points to 1.40%, and the 10-yr yield declined 3 basis points to 1.56%. The U.S. Dollar Index rose 0.45% to 99.45. WTI crude inched up 0.1% (+$0.05) to $52.10/bbl, recouping its intraday losses.

DEMOCRATIC PRESIDENTIAL HOPEFUL BLOOMBERG UNVEILS PLAN TO REIN IN WALL STREET

Bloomberg on Tuesday outlined a sweeping financial services policy proposal to rein in Wall Street trading, boost consumer protections, increase Americans’ access to banking services, and a crackdown on financial crime.

Among the most eye-catching proposals is a tax of 0.1% on transactions in stocks, bonds and payments on derivative contracts, bolstering the “Volcker Rule” ban on proprietary trading, and setting a trading speed limit – all of which take aim at Wall Street clients of Bloomberg Inc’s trading terminal.

Bloomberg, a latecomer to the race who has so far spent $188 million of his own money on the campaign, will step onto the Democratic debate stage for the first time later today after meeting the 10% polling threshold set by the Democratic Party, by coming in second behind Bernie Sanders with 19%. Sanders was well ahead of the field with 31%.

IMPACT: Bloomberg’s foray into the presidential race adds a new dynamic that may induce more volatility as we approach the November elections. Political polarization in the US is at an all time high.

CANADIAN MANUFACTURING SALES

New numbers from Statistics Canada show Canadian manufacturing sales fell for 4 months in a row to close out 2019, as the industry’s sales slipped to $56.4 billion in December. That was down 0.7% from November’s level (consensus +0.8%), which was itself down a full percentage point from the previous month’s level. The motor vehicle assembly and aerospace industries were especially hard hit during the month, Statistics Canada noted. While the impact of the November rail strike may have only been temporary, it exacerbated weaknesses that were already there.

IMPACT: Rail blockades have brought Canada’s manufacturing industry to a virtual standstill, and the industry will start seeing plant closures and temporary layoffs soon if it continues, the group that represents the industry says. In British Columbia, some Indigenous protestors and sympathizers have shut down a key rail line in Northern B.C. because they oppose the construction of the Coastal GasLink pipeline on the grounds that it would run through the hereditary land of the Wet’suwet’en people.

Those actions have broken the supply chains for manufacturers, who rely on rail service to bring in parts and components but also to ship out finished products to customers. The group says that every day the rail stoppages continue, $425 million worth of manufactured goods are sitting idle.

RBA MINUTES FLAG CORONAVIRUS UNCERTAINTY

The minutes said that the COVID-19 presented a ‘material risk’ to China’s economy and therefore to Australia’s, but that it was too early to judge its impact. The RBA said it was prepared to ease policy further if needed but that the impact of such a move needed to be balanced against the effect of still-lower returns on savers. Consumption remained a key uncertainty for the central bank, with labour market developments flagged again as a key metric. The catastrophic bushfires which have plagued Australia were expected to be an economic drag through the current quarter, with recovery expected in full by year-end.

IMPACT: Aussie drifted lower after the minutes’ release, but there was really nothing new here for investors who will now await more hard data. Market focus will now turn to official Australian labor market data for January due for release on Thursday. This series has held up extremely well in terms of headline job creation, but December’s impressive rise masked the uncomfortable fact that full-time positions fell. The market is looking for a headline gain of 10,000 jobs, on average, but expect close attention to be paid to the full-time/part-time split this time around.

DAY AHEAD

UK January inflation numbers will be the focus today before attention moves to the latest retail sales data tomorrow. Retail sales in the UK have not grown since July of last year as households turned more cautious amidst the political turmoil generated by Brexit. A bounce in retail sales in January would suggest the decisive election outcome in December went some way in restoring confidence among consumers.

In the US, we are not as likely to see much of a market response to the Federal Reserve’s minutes of their January meeting due later today. Following Chairman Powell’s testimony in Congress last week, the minutes will be seen as somewhat out-of-date and will probably be ignored by traders.

SENTIMENT

OVERALL SENTIMENT:

Apple’s revenue warning triggered worries that the economic impact, as we have been repeatedly saying, could be significant. The strength of Gold on a day when USD is gaining could be a sign that the canary is singing its last song for risk sentiment.

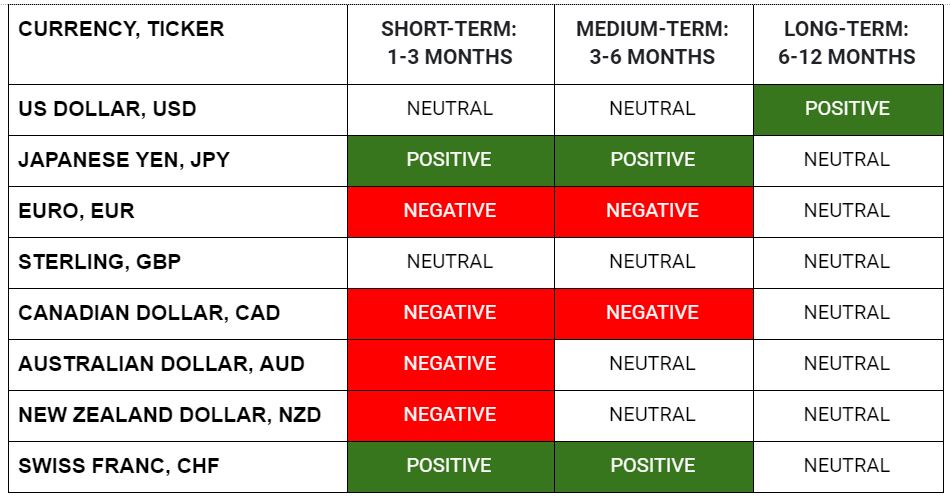

FX

MARKETS

TRADING TIP

Given that the break below the 33-month EUR/USD low of 1.0880 last week was a strangely low momentum move, not many speculators were in a rush to get involved. However, since then, the EUR has continued to trade like a soggy blanket.

Often, the temptation is to fight the trend – especially one that you cannot make sense of (another example is the case of speculators who insist on shorting Tesla all the way up), but the right thing to do is to stay out of the way if you cannot find it in you to get involved!

Then, again, we all know what they say about trends! They are supposedly our friends.