WHAT HAPPENED YESTERDAY

As of Tue 18 Feb, Singapore Time zone UTC+8

FX MOVES

U.S. Dollar Index, +0.05%, 99.15

USDJPY, +0.04%, $109.83

EURUSD, -0.05%, $1.0836

GBPUSD, -0.35%, $1.3005

USDCAD, -0.06%, $1.3238

AUDUSD, -0.24%, $0.6709

NZDUSD, -0.12%, $0.6438

MARKET MOVES

S&P500, MARKET CLOSED

Dow Jones, MARKET CLOSED

Nasdaq, MARKET CLOSED

Nikkei Futures, -0.46%, 23,390.0

SUMMARY:

U.S. markets were closed on the 17th Feb for Presidents’ Day. There were no notable economic data releases on Monday.

The FX market was quiet given that lack of drivers.

Tuesday started off on the wrong foot with Risk Assets selling off (S&P futures down 0.4%, and AUDJPY down almost 0.5%) after Apple said it will not meet its revenue guidance for the March quarter as the coronavirus outbreak slowed production and weakened demand in China. Also hurting market sentiment was news that the Trump administration is considering changing U.S. regulations to allow it to block shipments of chips to Huawei Technologies from companies such as Taiwan’s TSMC, the world’s largest contract chipmaker.

In China, the number of new COVID-19 cases fell to 1,886 on Monday from 2,048 the day before. The World Health Organization cautioned on Monday, however, that “every scenario is still on the table” in terms of the epidemic’s evolution.

APPLE UNLIKELY TO MEET REVENUE GUIDANCE DUE TO CORONAVIRUS

Apple’s manufacturing facilities in China have begun to reopen, but they are ramping up more slowly than expected, the technology company said in a statement to its investors. Global supplies of Apple’s iPhones will be limited as the sites work toward operating at full capacity, the company said. “These iPhone supply shortages will temporarily affect revenues worldwide,” the company said.

IMPACT: Apple’s stock is expected to face a knee-jerk reaction on Tuesday, when Wall Street reopens after the Presidents’ Day holiday. The importance of Apple cannot be understated as it is seen as a barometer for the health of the US economy and global supply chain/trade and consumer health. Apple’s warning caused a risk off sentiment in the FX and Commodity market as it is a stark reminder of the real economic impact of the virus. Many companies will have to slash guidance and the drag on the economy will be significant.

HUNDREDS OF AMERICANS FLOWN HOME ON CRUISE SHIP, 14 WITH VIRUS

More than 300 American cruise liner passengers, including 14 who tested positive for coronavirus, were flown home to military bases in the United States after two weeks under quarantine off Japan. The cruise ship Diamond Princess, which has more than 400 cases, has by far the largest cluster outside China.

Although U.S. officials had said passengers with coronavirus symptoms would not be repatriated, 14 passengers found at the last minute to have tested positive were permitted to board the planes. The U.S. State Department said the infected passengers were exposed to other passengers for about 40 minutes before they were isolated.

IMPACT: The virus is making landfall on North American soil, if the spread is not well contained, US Risk Assets will be repriced on contagion fears.

US MULLS CUTTING HUAWEI OFF FROM GLOBAL CHIP SUPPLIERS

The Trump administration is considering changing U.S. regulations to allow it to block shipments of chips to Huawei Technologies from companies such as Taiwan’s TSMC, the world’s largest contract chipmaker, two sources familiar with the matter said. New restrictions on commerce with China’s Huawei are among several options to be considered at high-level U.S. meetings this week and next. The chip proposal has been drafted but its approval is far from certain, one of the sources said.

IMPACT: To target global chip sales to Huawei, U.S. authorities would alter the Foreign Direct Product Rule, which subjects some foreign-made goods based on U.S. technology or software to U.S. regulations. Under the draft proposal, the U.S. government would force foreign companies that use U.S. chip-making equipment to seek a U.S. license before supplying Huawei – a major expansion of export control authority that could anger U.S. allies worldwide. This is an escalation of the tensions between US & China and will be negative for risk sentiment.

The Commerce Department declined to comment on the proposal.

DAY AHEAD

UK Jobs figures are up first later today and after last month’s surprise jump in employment growth, investors will be looking to see if a similar momentum was maintained in the three months to December. Wage growth will be closely monitored too given the recent weakness in consumer spending.

ZEW Economic Sentiment index for Eurozone and Germany will likely reaffirm the gloomy outlook for the region. EUR continues to trade heavy as it has been in recent days.

Australia’s labor market will be eyed tomorrow as quarterly wage growth figures are due and the latest employment report is out on Thursday. With the Reserve Bank of Australia looking increasingly reluctant to make deeper cuts to interest rates, the labor market indicators will test policymakers’ economic optimism.

Apart from the devastating bushfires that so far do not appear to have notably dented growth, Australian businesses have also had to grapple with the coronavirus epidemic, which is bound to disrupt trade with China – Australia’s biggest trading partner. The Australian dollar has bounced off 11-year lows on hopes that the outbreak may be slowing.

SENTIMENT

OVERALL SENTIMENT:

Risk sentiment is starting to weaken as the economic impact of the COVID-19 is starting to show. Expect this to continue.

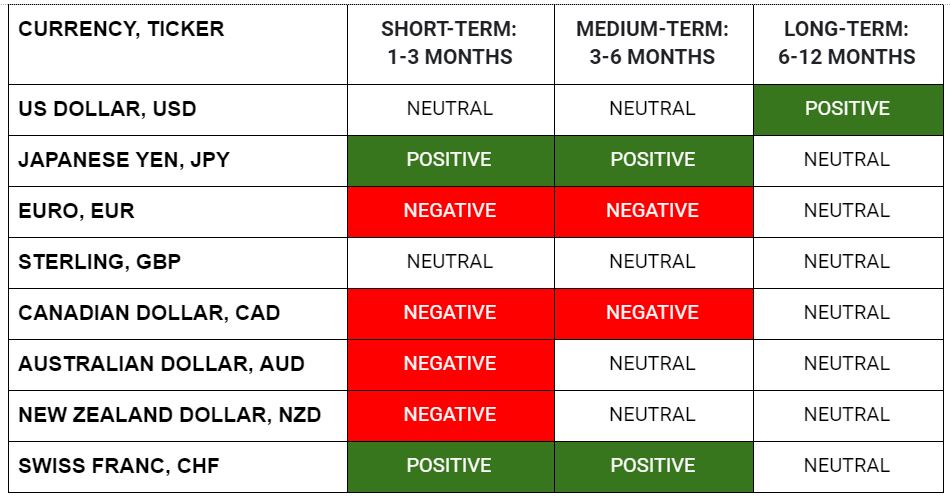

FX

MARKETS

TRADING TIP

Conviction is a dangerous thing…

Many size their trades according to the strength of their conviction. The stronger the conviction they have in a trade, the bigger risk they will take. This is also why macro traders who lose everything they have typically lose it all on one trade which they are willing to bet everything on.

Their conviction that this is the best trade that must have on is likely just before it all goes to zero for them! For that reason, it is imperative for every trader to have a risk framework which protects them from risking it all on one trade, no matter how strong their conviction may be.

Always remember, no matter how good you are, it is a certainty you will be wrong about the markets some day!