WHAT HAPPENED YESTERDAY

As of 4 Mar, Singapore Time zone UTC+8

FX

U.S. Dollar Index, -0.46%, 97.10

USDJPY, -1.14%, $107.07

EURUSD, +0.38%, $1.1177

GBPUSD, +0.54%, $1.2821

USDCAD, +0.40%, $1.3377

AUDUSD, +0.67%, $0.6583

NZDUSD, +0.13%, $0.6270

STOCK INDICES

S&P500, -2.81%, 3,003.37

Dow Jones, -2.97%, 25,914.15

Nasdaq, -2.99%, 8,684.09

Nikkei Futures, -1.28%, 20,900.0

COMMODITIES

Gold Futures, +3.26%, 1,646.75

Brent Oil Futures, -0.39%, 51.70

SUMMARY:

USD weakened across the board on expectations of global easing led by the Fed and the Fed delivered. JPY made strong gains against the USD as fears of a sharper slowdown return to plague the market. Now that the Fed has returned to its one playbook of cutting rates to counter all sorts of economic weakness, the question on the minds of investors is, “What next?”

Rate cuts easing monetary conditions, but they won’t solve the supply chain shock and also the demand shock that the world is facing. How will confidence be restored by cheaper money if you’re worried about the virus that is spreading like wildfire throughout the world?

U.S. stocks began the session on a modestly lower note with the early weakness blamed on a joint statement from G7 finance ministers and central bankers, which did not call for immediate easing measures. Strikingly, a U.S. mid-morning announcement of an emergency fed funds rate cut invited a 2% spike in the S&P 500, which vanished in just over an hour. The S&P500 index eventually finished the session lower (2.81%), after testing more than 2% higher on the day to close below its 200-day moving average (3049), Nasdaq was down (-2.99%).

The Federal Reserve acquiesced to the bond market’s recent screams for a sharp rate cut, slashing the fed funds rate range by 50 basis points to 1.00-1.25%. U.S. 2yr Yields were down 22bps and U.S. 10yr Yields were down 17.9bps, in a curve steepening trade.

Yesterday’s broad-based rally was followed by more gains in most Asian equity markets while central banks from the region lined up to offer support. The Bank of Japan announced readiness to purchase another JPY500 bln worth of JGBs while the Reserve Bank of Australia cut its cash rate by 25bp to a record low of 0.50% and signaled a willingness to get back into the easing mode once again.

FED CUTS RATES TO BLUNT COVID-19 IMPACT, MARKETS DROP

The U.S. Federal Reserve cut interest rates on Tuesday in a bid to shield the world’s largest economy from the impact of Covid-19, but the emergency move failed to comfort U.S. financial markets roiled by worries of a deeper, lasting slowdown.

“The virus and the measures that are being taken to contain it will surely weigh on economic activity, both here and abroad, for some time,” Powell said in a news conference shortly after policymakers unanimously decided to cut rates by a half percentage point to a target range of 1.00% to 1.25%. Powell acknowledged the outlook is uncertain and the situation “fluid.” It was the first-rate cut outside of a regularly scheduled policymaker meeting since 2008 at the height of the financial crisis.

IMPACT: Markets made a brief pop and sold off soon after, as the 50bps rate cut was already 100% priced in and speculators are demanding more easing from the Fed. Markets are already pricing in a 61.1% probability that the Fed will cut another 25bps point in its April meeting to 0.75% – 1.00%. With the Fed just falling in line with current expectations, it will not give speculators incentive to take on more risk.

RBA CUTS RATES TO 0.5% AS CHINA SLOWDOWN CONTINUES

Reserve Bank chief Philip Lowe reduced the cash rate by 0.25% to 0.5% – a new record low, as expected by traders and half of the economists surveyed. The governor said he’s prepared to ease further as the virus outbreak is having “a significant effect” on Australia’s economy.

“The Australian government has also indicated that it will assist areas of the economy most affected by the coronavirus,” Lowe said. Before the RBA meeting, Prime Minister Scott Morrison said the Treasury is working closely together with the other agencies “to address the boost that we believe will be necessary.” Morrison urged major banks to pass on any RBA cut. The four top lenders have all since confirmed that mortgage rates will be reduced by the full amount.

IMPACT: Australia kicked off an expected worldwide policy response to China’s slowdown and the fallout from the coronavirus with an interest-rate cut that’s set to operate in tandem with fiscal measures to cushion the economic blow. The RBA’s rate cut was largely priced in, hence the Aussie did not weaken on the move. However, the prospect of a hybrid package that includes fiscal measures was well received by the Aussie Dollar as these measures are traditionally inflationary and it will not limit the easing to just interest rate mechanisms.

ASIA EASES (South Korea unveils $9.8 billion stimulus to fight Covid-19 / Hong Kong’s central bank cuts interest rate after Fed move)

- South Korea announced a stimulus package of 11.7 trillion won ($9.8 billion) on Wednesday to cushion the impact of the largest outbreak of Covid-19 outside China as efforts to contain the disease worsen supply disruptions and sap consumption. Finance Minister Hong Nam-ki said the supplementary budget, subject to parliamentary approval, will channel money to the health system, child care, and outdoor markets. Of the 11.7 trillion won proposed, 3.2 trillion won ($2.68 Billion) will make up for the revenue deficit while 8.5 trillion won ($7.11 Billion) will be extra fiscal injection. An additional 10.3 trillion won ($8.62 Billion) in Treasury Bonds will be issued this year to fund the extra budget. Loans will be made on relaxed terms to affected exporters while people who have lost their jobs will be re-trained.

- The Hong Kong Monetary Authority (HKMA) lowered its base rate charged through the overnight discount window by 50 basis points to 1.5% on Wednesday, hours after the U.S. Federal Reserve delivered a rate cut of the same margin.

IMPACT: Taking a cue from the Fed, policymakers this morning are opening up their coffers to stimulate their economies and this should be the beginning of a global liquidity push. The key to navigating this situation is to keep in view the Covid-19 narrative along with market demands versus central banks response in relation to the potential knock-on effects. Any mismatch in market expectation or overcompensation by central banks will drive risk appetite.

DAY AHEAD

BoC rate cut expectations have been on the rise since the Covid-19 started spreading uncontrollably and markets have now priced cuts of almost 75-basis points in the overnight rate by year-end. That may look excessive considering that Canada’s economy isn’t doing too badly and inflation is running above the 2% target midpoint.

However, under the surface, there are several trouble spots: exports are struggling, consumer spending is soft and anti-pipeline protests on a busy railway route have been causing huge disruptions to freight traffic during February. When we also consider the additional impact from the virus on the current and upcoming quarters and the fact that growth already slowed markedly in the second half of 2019, Stephen Poloz & Co may decide waiting would be riskier than slashing rates immediately and announce a surprise reduction later today.

However, if Poloz still feels that the economy is “in a pretty good place” and the BoC stands pat, the odds are very high that it would cut in April. No action on later will also put greater weight to Friday’s employment report for February.

SENTIMENT

OVERALL SENTIMENT:

How would you feel if the cavalry that you have been waiting for arrives and you rally a little but still concede ground on the day? That’s how the bulls felt on the day. Fear will spread through the ranks. Rallies will be sold unless more reinforcements (fiscal measures, tax cuts) arrive.

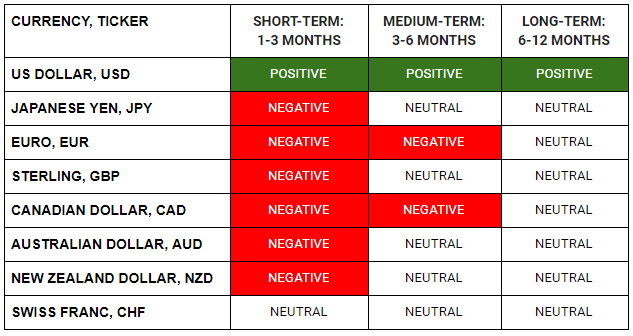

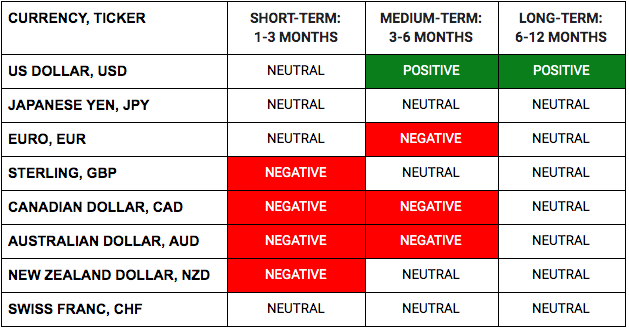

FX

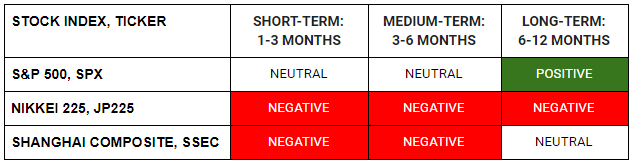

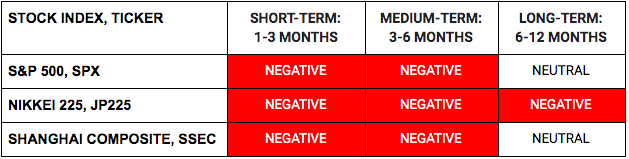

MARKETS

TRADING TIP

Buy the rumour, SELL the fact

The equity markets rallied since Friday on rumours that the G7 governments and central banks are ready to implement measures to support the economy and asset markets. The G7 had the teleconference and did nothing more than issuing a statement saying what we already know – that they’re ready to do something.

The Fed then cut 50bp in an emergency meeting, the first intermeeting cut since 2008 GFC, and the market rallied briefly before waking up to the fact that that’s what’s been promised, but where do we go from here? Markets is never just about what is, but also about what’s ahead.

Fed cuts, no matter how aggressive, is not going to change the fact that the virus will continue to spread, and the economic impact will be significant. What else is there to do but get out while you can?

With no more positive news on the horizon and every piece of positive news baked into the price, no one wants to be the last one left standing when the music stops. The governments and central banks of the world may try to stop it, but this song of growth and boom has been playing a long time.

Do you party on a little more or is it time to leave while the music is fading?