WHAT HAPPENED YESTERDAY

As of Thu 27 Feb, Singapore Time zone UTC+8

FX

U.S. Dollar Index, +0.18%, 99.14

USDJPY, +0.16%, $110.38

EURUSD, +0.05%, $1.0886

GBPUSD, -0.77%, $1.2906

USDCAD, +0.49%, $1.3345

AUDUSD, -0.85%, $0.6547

NZDUSD, -0.51%, $0.6288

STOCK INDICES

S&P500, -0.38%, 3,116.39

Dow Jones, -0.46%, 26,957.59

Nasdaq, +0.17%, 8,980.77

Nikkei Futures, -0.74%, 22,090.00

COMMODITIES

Gold Futures, -0.12%, 1,645.00

Brent Oil Futures, -3.86%, 52.83

SUMMARY:

The wild swings in the equity markets did not really spill over to the FX markets. Most currencies remained within recent ranges. EUR crept higher throughout the day and triggered stops to reach a high of 1.0908 before quickly pulling back to 1.0850s. It has since regained the bid tone and is starting the Asian session at the highs. AUD, however, traded heavy all day despite the strength of EUR, broke to new lows since 2009 and lingers at the lows still. The heaviness of AUD is likely to continue given the market is waking up to the fact that the economic consequences of Covid-19 will be significant.

S&P 500 advanced as much as 1.7% on Wednesday, as investors tried to buy an oversold market, but pestering worries about the coronavirus left the benchmark index down 0.38% for the session. The Nasdaq Composite (+0.17%) eked out a slim gain, while the Dow Jones Industrial Average (-0.46%) and Russell 2000 (-1.2%) joined the S&P 500 in negative territory.

Early on, it looked like sellers were taking an off-day after the S&P 500 dropped 7.6% over the prior four sessions, but the market continued to be inundated with negative updates on the Covid-19. For instance, Germany’s health minister said Germany is at the beginning of an epidemic, and it was reported that 83 people in New York were being monitored for exposure to the virus.

U.S. Treasuries were less in focus today, but the continued gains in the bond market weren’t conducive for risk sentiment. The 2-yr yield declined five basis points to 1.15%, and the 10-yr yield declined two basis points to 1.31%. The U.S. Dollar Index increased 0.18% to 99.14.

COVID-19 SPREADS FASTER OUTSIDE CHINA

The number of new Covid-19 infections inside China – the source of the outbreak – was for the first time overtaken by fresh cases elsewhere on Wednesday, with Italy and Iran emerging as epicenters of the rapidly spreading illness. Asia reported hundreds of new cases, Brazil confirmed Latin America’s first infection and the new infections were also detected for the first time in Pakistan, Sweden, Norway, Greece, Romania, and Algeria.

Trump, seeking to calm markets and an increasingly worried public said in a live broadcast that the United States was “very, very ready” to face the virus threat and that Vice President Mike Pence would be in charge of the national response. It was one of just a handful of times that the president has appeared in the White House briefing room.

IMPACT: Wall Street reversed earlier gains on Wednesday and oil prices dropped to their lowest level in over a year, spooked in part by health officials saying dozens of people who had been in China were being monitored in suburbs of populous New York city – although no confirmed cases have been found. Risk assets are sensitive to the velocity of the spread outside of China, and will be driven by the narrative as such. Trump’s presser did not ease market fears as stock indices continue to drift lower in Asian hours.

IMF, WORLD BANK CONSIDER ‘VIRTUAL’’ SPRING MEETINGS AS VIRUS SPREADS

The institutions’ April 17-19 Spring Meetings are scheduled to bring some 10,000 government officials, journalists, business people and civil society representatives from across the globe to a tightly packed, two-block area of downtown Washington, DC, that houses their headquarters.

Options include scaling back the number of meetings, canceling external events and limiting the size of the country delegations that would travel to Washington. Another alternative is to hold “virtual” meetings by teleconference, and the institutions could still proceed with full-fledged meetings. One person familiar with the IMF’s planning discussions said: “Plenty of people here see wider merit in testing whether holding key meetings virtually could be made to work.”

IMPACT: The virus will ultimately speed up adoption of technology such as web conferencing, and drive organizations to have off-site work contingency plans in the future as part of their SOP. Companies like Zoom Video Communications (ZM) will benefit as they are purely a tech company with almost no supply chain drag, it is interesting to note that Zoom prices have remained bid in the face of the market selloff.

SOUTH KOREA HOLDS INTEREST RATE DESPITE VIRUS FEARS

South Korea’s central bank kept its key interest rate unchanged (1.25%) on Thursday, defying expectations for a cut amid growing pressure to ease policy as the Covid-19 hits demand in the export-reliant economy.

IMPACT: South Korean Won strengthened on the back of surprise no policy move, but gave it all back on bad news of the virus. (1. The US urges reconsidering travel to South Korea 2. South Korea confirms 334 more Covid-19 cases, a total of 1595 cases 3. The U.S. decided to indefinitely postpone upcoming combined military exercises over Covid-19 concerns)

DAY AHEAD

Canada will report GDP numbers for the fourth quarter on Friday when trade tensions and industrial strikes are expected to have ground growth to a near halt. With economic conditions not likely to have improved in the first quarter, the data will be watched carefully by policymakers at the Bank of Canada, who meet next week. In the meantime, the Canadian dollar has stumbled near 4-month lows versus its US counterpart, weighed by weaker oil prices.

SENTIMENT

OVERALL SENTIMENT: Sentiment was clearly still fragile when the rally of more than 2% off the lows in US equity indices lost steam as the day progressed. Trump’s press conference seems measured, advising caution and reiterating that the US is prepared for even the worst-case scenario while being nowhere close to sounding panicky and that should soothe the market a little. However, the central issue remains i.e. the spread of Covid-19 will continue.

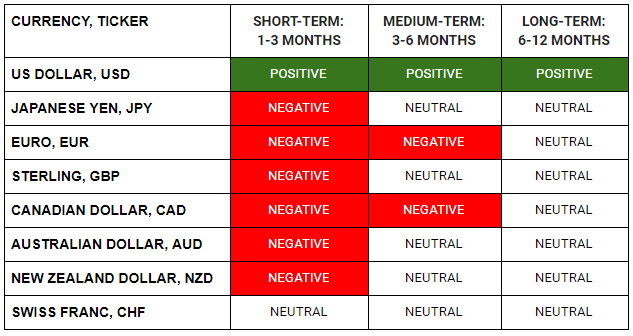

FX

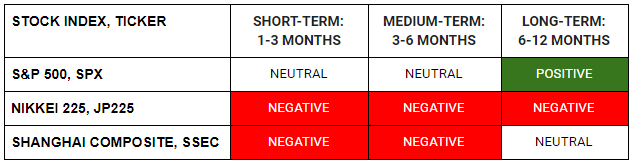

MARKETS

TRADING TIP

Bet on the horse you don’t believe in…

Imagine you’re at the horse-racing course, and a race is about to start. Your friend who is an expert at punting on horses (if there is ever such a thing), tells you that the number 8 horse is the one least likely to win, is young and has never won a race before. Chances of it winning is maybe only once if it ran a hundred races. You look up at the board and you see the pay-out for it winning is 500 to 1. What would you do?

Seems like good odds? Much like the scenario above, there are instances when you should bet on low probability outcomes if the pay-out for such outcomes are skewed in your favour. Trading is not about buying the best stock in the market regardless of price. Price, how much higher it can go and how low it might go if you are wrong are key considerations. The reward is relative to the risk you are taking matters!

Sometimes, the best trades are betting on the favourites, but only if the pay-out makes sense. If you are risking too much just to make a little, no matter how certain you are of the outcome, it may not be worth making the bet. If that is the case, then it’s okay to just let it go. You don’t need to be trading all the time. Trade only when the price is right!

Sometimes, the best trades are on the outcomes that you think have very little chance of happening. Markets tend to underestimate the probability of such outcomes and as a result, the price of getting into such trades is typically low.

Look out for trades like that as the key to being extremely profitable is having asymmetric reward vs risk profiles in your portfolio. When you lose, you suffer minimal losses, but when you win, you win big. Rinse and repeat!