Listen to TrackRecord’s CIO Phan Vee Leung as he speaks with Ryan Huang from MoneyFM 89.3 this morning.

Vee gave his views about the Tech stock rally, the recent FOMC meeting, his take on the US Economy and the British Pound. Find out his thoughts on which is the “cleanest dirty shirt” in terms of currency pairs.

Receive regular updates and in-depth trading insights covering Vee’s thoughts, analyses and executions here.

AUD/USD Weekly Candlesticks & Ichimoku Chart – SHORT

AUD/USD has broken to new lows below 0.6660. With the world economy likely to be significantly impacted by the Covid-19 situation, a test of 0.6000 seems likely from both the fundamental and technical perspective.

Vee, our Founder/CIO highlights patterns/formations on selected chart(s) every week which may have the potential to turn into trading opportunities. These charts are first sent out on Monday of the week to the TRACKRECORD COMMUNITY which helps them to filter out the noise and condense only what’s important in the markets for the week ahead.

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte. Ltd. that any particular investment, security, transaction or investment strategy is suitable for any specific person. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte. Ltd

WHAT HAPPENED YESTERDAY

As of Fri 21 Feb, Singapore Time zone UTC+8

FX

U.S. Dollar Index, +0.18%, 99.88

USDJPY, +0.55%, $111.97

EURUSD, -0.17%, $1.0788

GBPUSD, -0.31%, $1.2881

USDCAD, +0.31%, $1.3261

AUDUSD, -0.96%, $0.6612

NZDUSD, -0.85%, $0.6333

STOCK INDICES

S&P500, -0.38%, 3,373.23

Dow Jones, -0.44%, 29,219.98

Nasdaq, -0.67%, 9,750.97

Nikkei Futures, +0.09%, 23,390.0

COMMODITIES

Gold (XAU/USD), +0.79%, 1,622.30

Brent Oil, +0.00%, 59.12

SUMMARY:

Asian markets started off with a wild ride when USD/SGD exploded after it broke 1.3950 to reach a high of 1.4080 in a matter of minutes before quickly retracing just as fast to 1.4020 ish. Although USD/SGD closed just about 0.5% on the day, the wild swings experienced were not typical of the usually sedated currency pair.

The rampage led to USD strength vs most of the currencies that matter. AUD and NZD bore the brunt of relentless USD buying, with both falling nearly 1% against the USD. Even when the GBP rallied almost 0.2% to 1.2920 on the better than expected Retail Sales data (+0.8% YoY vs exp 0.7%), the spike was quickly met with sellers that pushed it to a low of 1.2849. As the old saying goes, that which will not rally on good news, is weak. Amidst all the USD buying, Gold remained strangely bid.

The S&P 500 took a precipitous 1.3% decline in a span of a short time during Thursday’s NY late morning session as stocks pulled back from record highs, but opportunistic investors stepped in to buy the intraday dip. The brief sell-off set off fears and commentary of a “freak sell-off” among the speculative community. The benchmark index closed lower by just 0.4%, as some dip-buying soothed the market. The Dow Jones Industrial Average (-0.5%) and Nasdaq Composite (-0.7%) also closed off the lows.

The 2-yr yield declined three basis points to 1.39%, and the 10-yr yield declined five basis points to 1.53%. The U.S. Dollar Index increased 0.2% to 99.87. WTI crude rose 0.8%, or $0.45, to $53.77/bbl.

YEN’S SAFE HAVEN STATUS BEING QUESTIONED

The Yen’s status as a safe haven is coming under pressure as uneasiness grows about the rising number of coronavirus cases in Japan, against the backdrop of a stuttering domestic economy. Analysts were quick to pin the move to large portfolio shifts out of yen-denominated assets – most likely by Japan’s giant government pension funds – amid worries about its economy and the spread of the coronavirus.

There are already fears it will cast a shadow over the Olympic Games in Tokyo, due to begin late in July and bring a hoped-for boost to the national economy and morale. However, should it start to spread through Japan’s population, the fallout would almost certainly be enough to tip the world’s third largest economy, which shrank unexpectedly hard last quarter, into recession. Some 3 trillion yen ($27 billion) in net foreign bond purchases by Japanese investors in the first two weeks of February seems to underscore the lack of confidence in domestic investments.

IMPACT: The Yen’s slide is unusual because the exchange rate with the dollar has been unraveling from its close correlation to the price of Gold and U.S. Treasury yields – a development that should be watched. The move lower in global interest rates may have undermined the Yen’s attractiveness as a “funding currency,” or one cheap to borrow for use in buying riskier investments.

BLOOMBERG FLOPS ON DEBATE STAGE

After spending more than $300 million of his fortune on a massive ad campaign that boosted his poll numbers and landed him on the debate stage, he was torched from every angle.

Bloomberg was forced to defend, among other things, his massive wealth, New York’s “stop-and-frisk” policing programme and the treatment of women at his media company. He was even boo-ed at one point by the Democrat-friendly crowd in Las Vegas. At times he seemed distant and disinterested, speaking in bland technocratic assertions. His best moments came when he was talking about building his company and positioning himself as an ardent defender of capitalism. But those moments were few.

IMPACT: Bloomberg was woefully unprepared to defend or explain his record, which includes the ineffective and racist stop-and-frisk policy that terrorised New York’s communities of color, and decades of complaints of a sexist and hostile work environment for women at his company. With his money unable to bail him out, Bloomberg offered little more than the haughty, eye-rolling outrage of a man unaccustomed to answering to anybody about anything.

CHINA CUTS RATES

The PBoC cut the 1Y Loan Prime Rate by 10 basis points to 4.05% as expected, following cuts of 10 basis points in the 7D reverse repo and 1Y MLF rates. What is unexpected is that the central bank cut the 5Y Loan Prime Rate by only 5 basis points to 4.75%, not by 10 basis points.

IMPACT: USDCNY rose on the back of today’s rate decision. The objective of interest-rate cuts at this time is to help corporates and individuals with their interest service costs during the Covid-19 epidemic. There is also a rough consensus that this epidemic will end sometime in 2020. So cutting the 5Y loan rate to a lesser extent is logical as the rate-cut needs for longer-term loans should not be mixed with critical short-term cash-flow needs. Moreover, there is history in China that when money is too cheap, it increasingly flows into speculative assets, e.g. during 2009 and 2010. This also explains why the central bank is cautious when cutting the 5Y Loan Prime Rate.

DAY AHEAD

The flash PMI readings by IHS Markit (UK, Germany, EU, US) later today will be the highlight, amid doubts about the green shoots of recovery in the euro area. Eurozone manufacturing PMI has been steadily recovering since October and picked up some speed in January. However, the rebound could be cut short by the virus outbreak and so PMIs for both the manufacturing and services sectors will be very important for detecting any shift in the outlook for the Eurozone economy.

How the market trade into the weekend will also be telling. Given that many of the recent swings in the market have confused market participants, a reduction of risk positions into the weekend may not be surprising.

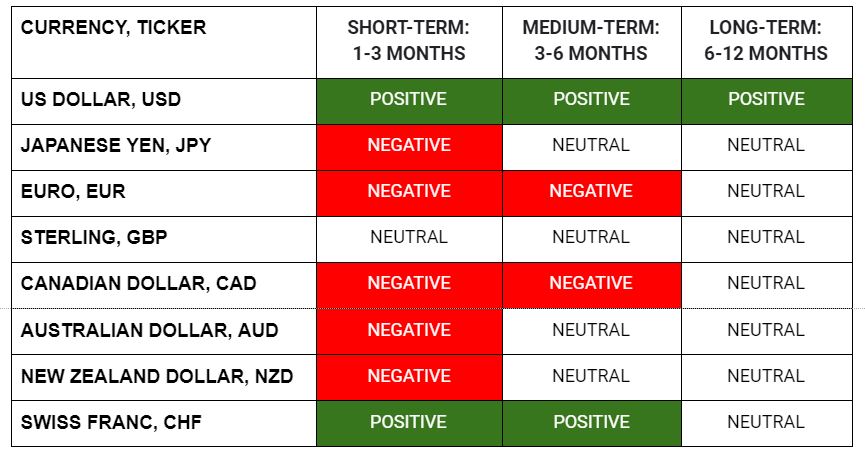

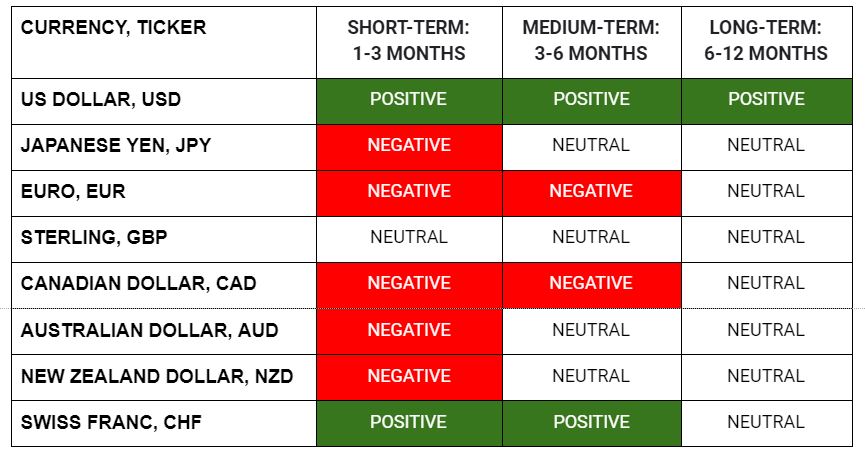

SENTIMENT

OVERALL SENTIMENT:

As expected, risk sentiment weakened a little as markets do not like uncertainty and confusion. With many of the recent moves in the FX markets remaining unexplained, and the sharp (though brief) selloff in the US equity indices last night adding to the jitters, expect many to be in the mood to reduce risk as we head into the weekend.

FX

STOCK INDICES

TRADING TIP

Price Action is King!

It is human nature to resist changes and this is especially true for changes that defy our understanding and expectations. This is also the case with many traders when faced with market moves which are “inexplicable” to them.

However, the job of traders is not to explain market moves but to take advantage of these moves and make money. To be successful at this, it is imperative to know when to pay attention to the wisdom of crowds, and pay due respect to Price Action, especially when no one can explain the unexpected moves.

To paraphrase a good friend of mine who is a successful trader of many years, “If the move can be explained, it won’t move in such a fashion! Most of the bigger moves can’t be immediately explained, but the researchers and market commentators will be able to soon enough!”

With the USD Index breaking above the highs last seen since May 2017 (almost 3 years ago), and volatility returning to the FX market, it is time to sit up and pay attention!

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte Ltd or Gregg Tan and does not have regards to specific investment objectives, financial situation and/or the particular needs of any specific person. The main objective of this material is for educational and discussion purposes only. The technical views and commentaries are to facilitate the finer application of various technical tools. These technical views may be subject to further revision without notice. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte Ltd or Gregg Tan.

The reports below are compiled by Gregg. Gregg has over 38 years of experience in the finance industry. His responsibilities in the initial 20 years was mainly with major Financial institutions, spanning across roles as a Trader, Dealer and as Head of Fundamental/ Technical Research of a team in Indonesia. He then spent the next 18 years at Bloomberg as an Application Specialist for Charting and Technical Analysis. Many of Bloomberg’s Institutional clients have acknowledged that they found true value at Gregg’s sessions. Gregg was a key contributor to Bloomberg’s charting ecosystem, as evident when the development team even rescheduled a planned global summit just to accommodate his busy schedule. Gregg has recently joined TrackRecord’s team of professional analysts to value-add to our existing offerings.

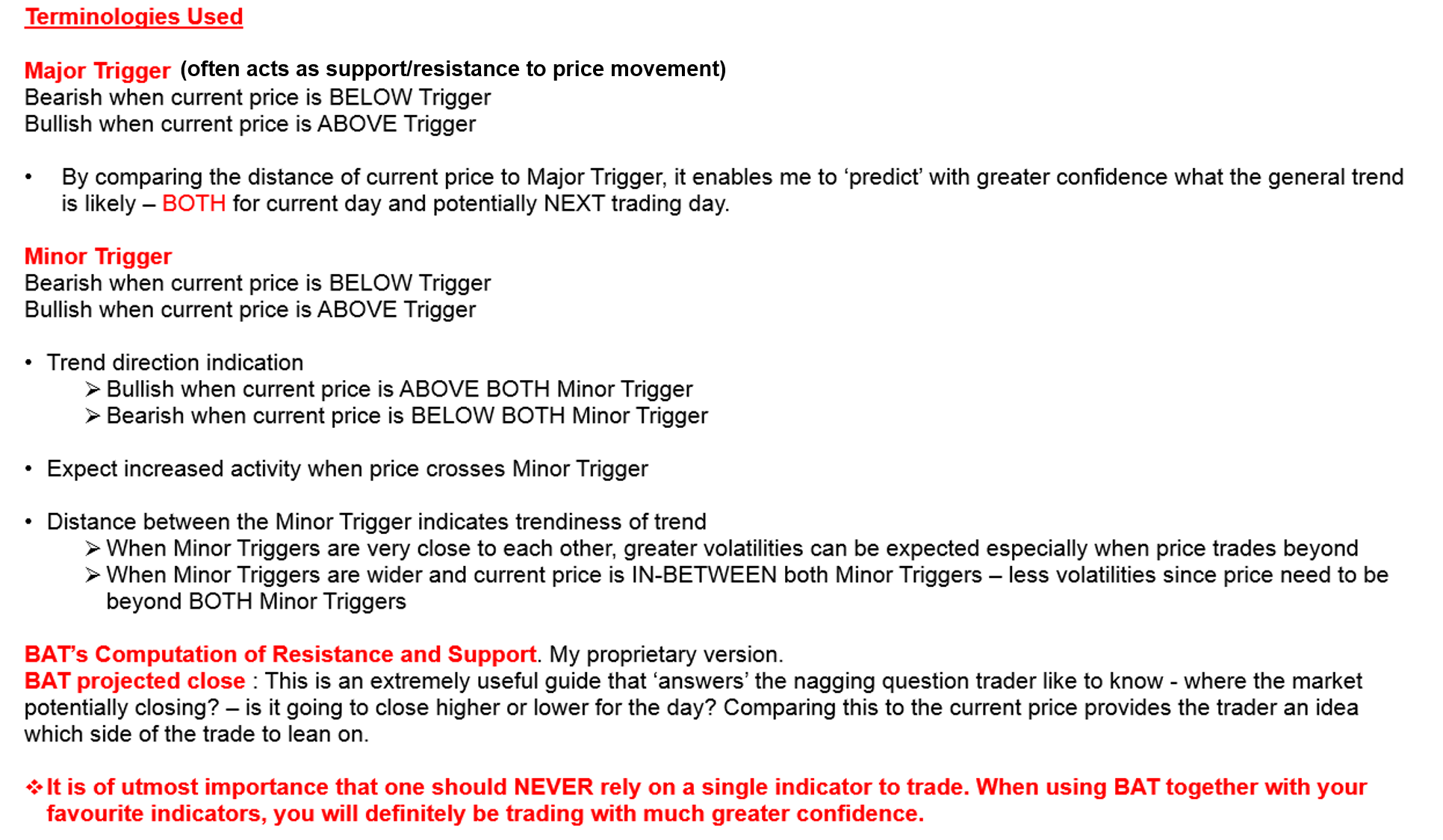

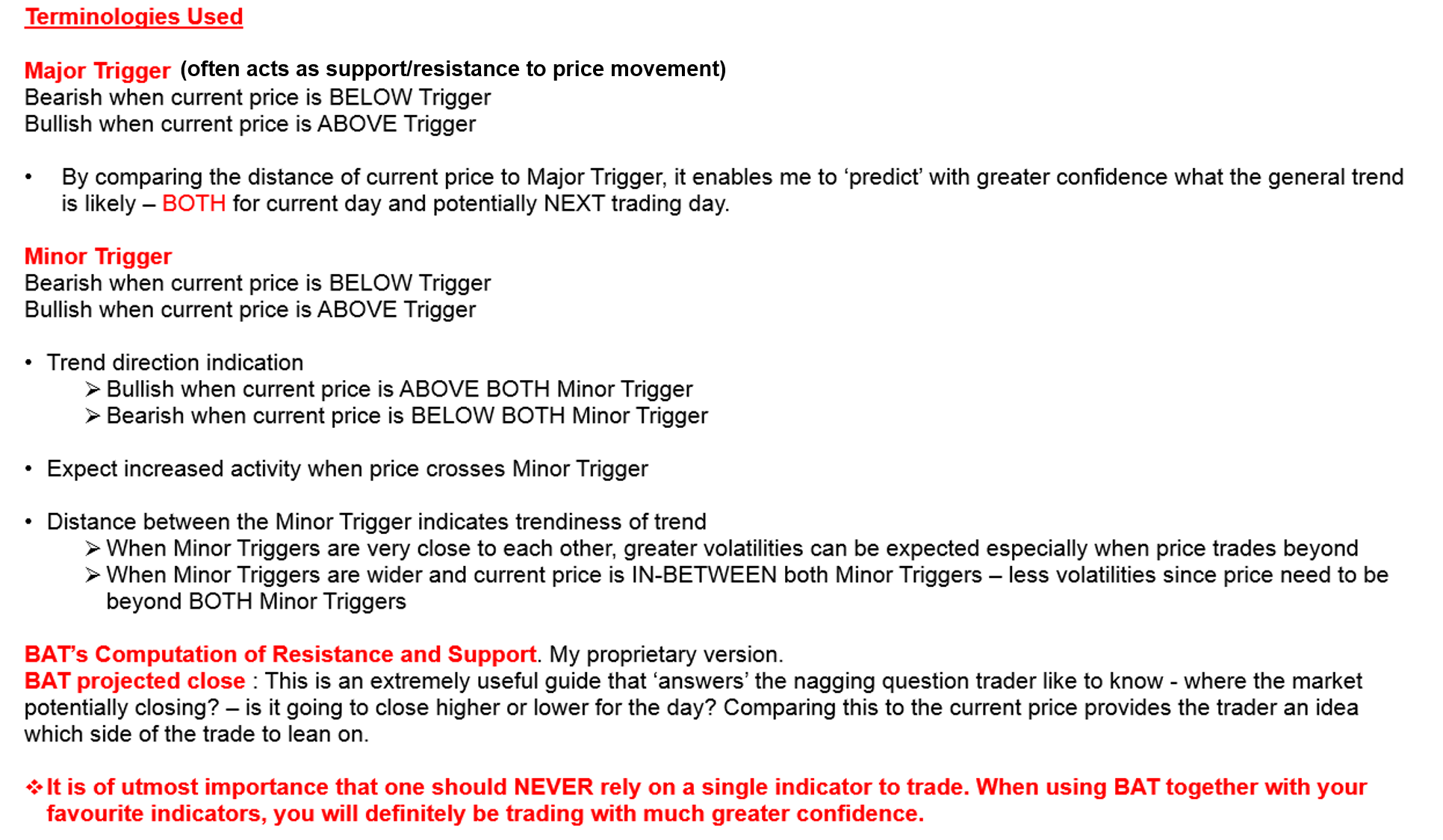

Boundaries & Triggers (BAT) – Key technical levels for Short-Term Trading based on Hourly/Intraday Charts

Boundaries & Triggers (BAT): 21 Feb 2020

Boundaries And Trigger (BAT) is a complex formula requiring the identification of unique price behaviour, price projections and BAT Triggers. The Triggers are levels that will likely attract immediate follow-through activities when price crosses it.

AUD/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

EUR/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

EUR/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

GBP/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/CHF – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/JPY – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/CAD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

XAU/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte Ltd or Gregg Tan and does not have regards to specific investment objectives, financial situation and/or the particular needs of any specific person. The main objective of this material is for educational and discussion purposes only. The technical views and commentaries are to facilitate the finer application of various technical tools. These technical views may be subject to further revision without notice. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte Ltd or Gregg Tan.

The reports below are compiled by Gregg. Gregg has over 38 years of experience in the finance industry. His responsibilities in the initial 20 years was mainly with major Financial institutions, spanning across roles as a Trader, Dealer and as Head of Fundamental/ Technical Research of a team in Indonesia. He then spent the next 18 years at Bloomberg as an Application Specialist for Charting and Technical Analysis. Many of Bloomberg’s Institutional clients have acknowledged that they found true value at Gregg’s sessions. Gregg was a key contributor to Bloomberg’s charting ecosystem, as evident when the development team even rescheduled a planned global summit just to accommodate his busy schedule. Gregg has recently joined TrackRecord’s team of professional analysts to value-add to our existing offerings.

Boundaries & Triggers (BAT) – Key technical levels for Short-Term Trading based on Hourly/Intraday Charts

Boundaries & Triggers (BAT): 20 Feb 2020

Boundaries And Trigger (BAT) is a complex formula requiring the identification of unique price behaviour, price projections and BAT Triggers. The Triggers are levels that will likely attract immediate follow-through activities when price crosses it.

AUD/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

EUR/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

GBP/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/CHF – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/JPY – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

USD/CAD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

XAU/USD – 60 Mins (Click to view explanation on usage of BAT and Pivot Points)

WHAT HAPPENED YESTERDAY

As of Thu 20 Feb, Singapore Time zone UTC+8

FX

U.S. Dollar Index, +0.15%, 99.59

USDJPY, +1.20%, $111.19

EURUSD, +0.16%, $1.0810

GBPUSD, -0.56%, $1.2926

USDCAD, -0.29%, $1.3219

AUDUSD, -0.07%, $0.6681

NZDUSD, -0.03%, $0.6389

STOCK INDICES

S&P500, +0.47%, 3,386.15

Dow Jones, +0.59%, 29,348.03

Nasdaq, +0.87%, 9,817.18

Nikkei Futures, +1.98%, 23,660.0

COMMODITIES

Gold (XAU/USD), +0.60%, 1,610.44

Brent Oil, +2.77%, 59.35

SUMMARY:

Volatility returned in a big way in USD/JPY. Complacent longs of JPY (ie short USD/JPY, EUR/JPY) all got a rude shock when USD/JPY exploded breaking through key resistance at 110.30-35 level and did not look back. It marched relentlessly to touch a high of 111.58 before easing off to around 111.20. No one could quite explain the explosive move, with some reasons given ranging from good US data (housing and PPI) to the alarming increase in the infection cases on the Diamond Princess moored off the coast of Yokohama. However, whatever the reason, the price action cannot be ignored. USD is strong.

The S&P 500 (+0.47%) and Nasdaq Composite (+0.9%) closed at fresh record highs on Wednesday, as investors remained optimistic about the global economic outlook despite the coronavirus. In the U.S., building permits climbed to a near 13-year high in January, while China signaled further support for businesses affected by the coronavirus. In addition, the FOMC minutes from the January meeting didn’t alter the market’s favourable outlook for monetary policy, which is to say that policy could be adjusted if the coronavirus situation doesn’t improve.

U.S. Treasuries traded within a narrow range and closed slightly lower. The 2-yr yield increased two basis points to 1.42%, and the 10-yr yield increased one basis point to 1.57%. The U.S. Dollar Index advanced 0.15% to 99.59.

WEAK AUSSIE WAGE GROWTH

Australia’s annual wage price index rose a tepid 2.2% in the final quarter of last year with pay rewards in the public sector slowing to the weakest pace on record, according to data released on Wednesday. The Reserve Bank of Australia (RBA) is predicting this pedestrian pace of wage growth to extend through mid-2022 as the jobless rate is not seen dipping materially during that time.

Minutes of the RBA’s February policy meeting out this week showed its committee thought that easing policy further might accelerate the process, but judged the risks of ever-lower low rates outweighed the benefits. The RBA has estimated the unemployment rate needs to fall below 4.5% from 5.1% currently for wages to grow at 3% or more.

IMPACT: Tepid Wage Growth coupled with bushfire damages and unaccounted for coronavirus impact, it is likely that the Reserve Bank will need to cut rates again by mid-year, with a second cut not out of the question, the Australian Dollar finished lower as a result.

UK INFLATION HITS HIGHS

UK inflation in January rose to a six-month high as petrol and house prices rose, official figures show. The Consumer Prices Index (CPI) stood at 1.8% last month, up from 1.3% in December, the Office for National Statistics said. However, some analysts said that the new figures were unlikely to “move the dial” on the central bank’s next decision on interest rates in March.

Fuel prices were up 4.7% compared with a year earlier, marking the biggest rise since November 2018. Energy regulator Ofgem’s cap on energy bills meant that the average household could not be charged more than £1,137 annually for their gas and electricity.

IMPACT: For the MPC, the fact that inflation is in line with its projections provides another reason not to cut interest rates in the near-term.” The rate currently stands at 0.75%. The MPC is next due to meet on 26 March. The inflation print initially pushed Sterling above key $1.30 level, but the pair finished -0.56% lower at $1.2926 to end the day.

CANADIAN INFLATION RISES ON BACK OF HIGHER GASOLINE

Canada’s annual inflation rate rose to 2.4% in January on higher gasoline prices, Statistics Canada said on Wednesday, with some analysts suggesting the data may pose a challenge for the Bank of Canada should it wish to ease rates. Analysts in a poll had forecast a rate of 2.3%, up from 2.2% in December. Excluding gasoline prices, the annual inflation rate rose 2.0% in January.

IMPACT: The Bank of Canada aims to keep inflation at 2%. Money markets see about a 10% chance of a rate cut in March, down from about 16% seen before the data release. It gives the bank a bit of a challenge if they want to cut rates. It’s not a straightforward case like in the U.S. when their measure of core inflation was stuck well below 2%.

DAY AHEAD

Later today, the US Philly Fed manufacturing index will provide another glimpse into the state of the manufacturing sector in February, and tomorrow the flash PMIs and existing home sales will wrap up the week. Although the IHS Markit PMIs do not carry the same weight as the ISM PMIs, they could nevertheless move the Dollar, especially if there is a global trend in the PMIs of worsening economic activity in February as a result of the coronavirus.

SENTIMENT

OVERALL SENTIMENT:

Stocks continue to march relentlessly higher, but Gold remains strong. Speculators are all confused about what the drivers of the markets are. Expectations of more liquidity from central banks should the negative economic impact of Covid-19 start to take hold supports the market but price action in currency markets are giving mixed signals.

FX

MARKETS

TRADING TIP

Don’t forget to watch your canary!

In the past, coal miners will bring with them caged canaries while they work the mines. If toxic gases such as carbon monoxide were present, the bird’s small size, high metabolism rate and rapid breathing rate will cause it to die before the effects are felt by the miners.

This simple warning system is a great way for the miners to know when it’s time to get the heck out of there before it’s too late. To be successful in trading, you too, need to have some canaries which you can keep your eye on.

When things move contrary to what you expect given what the rest of the market is doing, it’s time to pay attention.

For example, when USD is strong, generally, Gold will be weak.

When Gold is strong, this usually means risk sentiment is weak, hence JPY will also be strong and stock indices should be quite weak.

So, if there should be a time when USD is strong, Gold is strong, Stock Indices are strong, and JPY is weak – you can be sure it sounds like a few canaries are flapping about and chirping very loudly. When that happens, it’s time to pay attention, and get ready for what comes next.

If you have no clue what’s likely to come next, the best thing to do is to reduce your risk and RESPECT the PRICE ACTION!

WHAT HAPPENED YESTERDAY

As of Wed 19 Feb, Singapore Time zone UTC+8

FX MOVES

U.S. Dollar Index, +0.45%%, 99.45

USDJPY, +0.02%, $109.92

EURUSD, -0.38%, $1.0795

GBPUSD, -0.08%, $1.2999

USDCAD, +0.15%, $1.3254

AUDUSD, -0.03%, $0.6694

NZDUSD, -0.67%, $0.6393

MARKET MOVES

S&P500, -0.29%, 3,370.29

Dow Jones, -0.56%, 29,232.19

Nasdaq, +0.02%, 9,732.74

Nikkei Futures, -0.99%, 23,308.0

COMMODITIES

Gold (XAU/USD), +1.05%, 1,600.91

SUMMARY:

USD gained on the day as EUR continued its dribble lower. Though a weaker than expected ZEW did not have much of an immediate impact, the weak sentiment did not do any favours for the already heavy EUR. Gold gained more than 1% without any significant headlines on a day when USD was performing well is yet another sign that the risk sentiment is weakening.

The S&P 500 declined as much as 0.7% on Tuesday after Apple (AAPL 319.00, -5.95, -1.8%) issued a revenue warning due to the coronavirus. The market resiliently cut its losses during the afternoon, though, leaving the S&P 500 down 0.29% for the session.

The 2-yr yield declined 2 basis points to 1.40%, and the 10-yr yield declined 3 basis points to 1.56%. The U.S. Dollar Index rose 0.45% to 99.45. WTI crude inched up 0.1% (+$0.05) to $52.10/bbl, recouping its intraday losses.

DEMOCRATIC PRESIDENTIAL HOPEFUL BLOOMBERG UNVEILS PLAN TO REIN IN WALL STREET

Bloomberg on Tuesday outlined a sweeping financial services policy proposal to rein in Wall Street trading, boost consumer protections, increase Americans’ access to banking services, and a crackdown on financial crime.

Among the most eye-catching proposals is a tax of 0.1% on transactions in stocks, bonds and payments on derivative contracts, bolstering the “Volcker Rule” ban on proprietary trading, and setting a trading speed limit – all of which take aim at Wall Street clients of Bloomberg Inc’s trading terminal.

Bloomberg, a latecomer to the race who has so far spent $188 million of his own money on the campaign, will step onto the Democratic debate stage for the first time later today after meeting the 10% polling threshold set by the Democratic Party, by coming in second behind Bernie Sanders with 19%. Sanders was well ahead of the field with 31%.

IMPACT: Bloomberg’s foray into the presidential race adds a new dynamic that may induce more volatility as we approach the November elections. Political polarization in the US is at an all time high.

CANADIAN MANUFACTURING SALES

New numbers from Statistics Canada show Canadian manufacturing sales fell for 4 months in a row to close out 2019, as the industry’s sales slipped to $56.4 billion in December. That was down 0.7% from November’s level (consensus +0.8%), which was itself down a full percentage point from the previous month’s level. The motor vehicle assembly and aerospace industries were especially hard hit during the month, Statistics Canada noted. While the impact of the November rail strike may have only been temporary, it exacerbated weaknesses that were already there.

IMPACT: Rail blockades have brought Canada’s manufacturing industry to a virtual standstill, and the industry will start seeing plant closures and temporary layoffs soon if it continues, the group that represents the industry says. In British Columbia, some Indigenous protestors and sympathizers have shut down a key rail line in Northern B.C. because they oppose the construction of the Coastal GasLink pipeline on the grounds that it would run through the hereditary land of the Wet’suwet’en people.

Those actions have broken the supply chains for manufacturers, who rely on rail service to bring in parts and components but also to ship out finished products to customers. The group says that every day the rail stoppages continue, $425 million worth of manufactured goods are sitting idle.

RBA MINUTES FLAG CORONAVIRUS UNCERTAINTY

The minutes said that the COVID-19 presented a ‘material risk’ to China’s economy and therefore to Australia’s, but that it was too early to judge its impact. The RBA said it was prepared to ease policy further if needed but that the impact of such a move needed to be balanced against the effect of still-lower returns on savers. Consumption remained a key uncertainty for the central bank, with labour market developments flagged again as a key metric. The catastrophic bushfires which have plagued Australia were expected to be an economic drag through the current quarter, with recovery expected in full by year-end.

IMPACT: Aussie drifted lower after the minutes’ release, but there was really nothing new here for investors who will now await more hard data. Market focus will now turn to official Australian labor market data for January due for release on Thursday. This series has held up extremely well in terms of headline job creation, but December’s impressive rise masked the uncomfortable fact that full-time positions fell. The market is looking for a headline gain of 10,000 jobs, on average, but expect close attention to be paid to the full-time/part-time split this time around.

DAY AHEAD

UK January inflation numbers will be the focus today before attention moves to the latest retail sales data tomorrow. Retail sales in the UK have not grown since July of last year as households turned more cautious amidst the political turmoil generated by Brexit. A bounce in retail sales in January would suggest the decisive election outcome in December went some way in restoring confidence among consumers.

In the US, we are not as likely to see much of a market response to the Federal Reserve’s minutes of their January meeting due later today. Following Chairman Powell’s testimony in Congress last week, the minutes will be seen as somewhat out-of-date and will probably be ignored by traders.

SENTIMENT

OVERALL SENTIMENT:

Apple’s revenue warning triggered worries that the economic impact, as we have been repeatedly saying, could be significant. The strength of Gold on a day when USD is gaining could be a sign that the canary is singing its last song for risk sentiment.

FX

MARKETS

TRADING TIP

Given that the break below the 33-month EUR/USD low of 1.0880 last week was a strangely low momentum move, not many speculators were in a rush to get involved. However, since then, the EUR has continued to trade like a soggy blanket.

Often, the temptation is to fight the trend – especially one that you cannot make sense of (another example is the case of speculators who insist on shorting Tesla all the way up), but the right thing to do is to stay out of the way if you cannot find it in you to get involved!

Then, again, we all know what they say about trends! They are supposedly our friends.