WHAT HAPPENED YESTERDAY

As of Tue 25 Feb, Singapore Time zone UTC+8

FX

U.S. Dollar Index, -0.13%, 99.29

USDJPY, -0.63%, $110.86

EURUSD, +0.09%, $1.0848

GBPUSD, -0.21%, $1.2924

USDCAD, +0.25%, $1.3288

AUDUSD, +0.09%, $0.6611

NZDUSD, +0.35%, $0.6343

STOCK INDICES

S&P500, -3.35%, 3,225.89

Dow Jones, -3.56%, 27,960.80

Nasdaq, -3.71%, 9,221.28

Nikkei Futures, -1.96%, 22,355.0

COMMODITIES

Gold Futures, +0.69%, 1,656.10

Brent Oil Futures, -1.29%, 55.66

SUMMARY:

FX was relatively calm given the fierce sell-off in equity markets. USD started off strong due to safe-haven bids with a gap when the market opened in Australia. Gold went on a rampage to reach a high of 1689.4 before easing off to 1656.1 as profit-taking sales came in. USD/JPY started the session at 11.20s and steadily climbed higher throughout Asian hours (up to 111.60s) before finally trading like the safe-haven currency that JPY used to be, and falling back during NY hours. The FX moves continue to baffle traders as correlations that used to hold seems to be changing from day to day (Example: when stocks fall by 3-4% in a day, AUD would have fallen much more than 0.3% in the past).

The stock market sold off more than 3% on Monday following a surge in Covid-19 cases outside China, including South Korea, Italy, and Iran. The Dow Jones Industrial Average (-3.56%), S&P 500 (-3.35%), and Russell 2000 (-3.0%) each turned negative for the year, while the Nasdaq Composite (-3.71%) gave up most of its monthly gains.

Governments took swift action to help contain the outbreak, such as closing public spaces, but weakness in foreign equity markets reflected concerns about the possibility of a global pandemic. South Korea’s Kospi fell 3.9%, and Italy’s MIB fell 5.4%. China’s Shanghai Composite declined just 0.3% amid reports that the rate of new Covid-19 cases may have peaked in the region.

The World Health Organization (WHO) said that the drop in infections in China is “real” due to Beijing’s aggressive approach. It remained unclear, however, if the virus would continue to worsen in a way that further impedes economic activity that consequently hurts earnings prospects.

Technology and travel stocks, such as Advanced Micro Devices (AMD 49.12, -4.16, -7.8%) and American Airlines (AAL 25.45, -2.37, -8.5%), sold off on concerns that their businesses would be hurt by the Covid-19 situation. Many healthcare names like United Health (UNH 277.79, -23.64, -7.8%) were additionally pressured by Senator Bernie Sanders (I-VT) decisively winning the Nevada caucuses.

BATTLE AGAINST CORONAVIRUS TURNS TO ITALY

While health experts have expected limited outbreaks beyond China, the rapid acceleration of cases in Italy going from 3 on Friday to 220 on Monday is concerning, the World Health Organization (WHO) said in a statement. Just as China put cities on lockdown, Italian authorities sealed off the worst-affected towns, closed schools and halted the carnival in Venice, where there were two cases. Shops are shut, bars are closed and people speak to each other from a safe distance in Northern Italy. Italian health authorities were struggling to find out how the virus started. “If we cannot find ‘patient zero’ then it means the virus is even more ubiquitous than we thought,” said Luca Zaia, the regional governor of the wealthy Veneto region.

IMPACT: The surge of cases outside mainland China triggered sharp falls in global markets as investors fled to safe havens. European equities markets suffered their biggest slump since mid-2016, gold soared to a seven-year high and oil tumbled 4%.

GERMAN BUSINESS MORALE RISES, UNFAZED BY CORONAVIRUS FOR NOW

German business morale rose unexpectedly in February, a survey showed on Monday, easing recession fears in Europe’s largest economy and reflecting a slight improvement in its manufacturing sector, which has been struggling with falling exports. The Ifo institute said its business climate index rose to 96.1 from an upwardly revised 96.0 in January. The February reading was compared with a consensus forecast for a fall to 95.3. Ifo warned however that the survey did not fully reflect the possible economic fallout from the Covid-19, which could hurt growth if it becomes a pandemic.

IMPACT: The full economic impact of the virus is not being accurately priced, especially for economies in the western hemisphere as the complacency is higher due to distance from the epicenter. However, this bubble is gradually being deflated with Italy taking center stage for a sudden surge in Covid-19 cases, given the extreme contagion effect of the virus, it should not be long before entire Europe will be battling this and business morale will have to be revised much lower. The knock-on effects from a freeze in global supply chains and transportation do not warrant business optimism in trade-sensitive Europe unless it’s based on blind optimism.

COVID-19 UPDATE: HUBEI SEES RISE IN NEW COVID-19 CASES AS INFECTIONS SLOW IN OTHER PROVINCES

China reported a rise in new Covid-19 cases in Hubei province, the epicentre of the outbreak, on Tuesday while the rest of the country saw a fourth straight day of declines.

Hubei had 499 new confirmed cases on Feb. 24, the National Health Commission said, up from 398 a day earlier and driven mainly by new infections in the provincial capital of Wuhan. Mainland China in total had 508 new confirmed cases, up from 409 on Feb. 23, bringing the total number of confirmed cases in mainland China so far to 77,658.

Excluding the latest cases in Hubei, the rest of China had just nine new infections on Feb. 24, the lowest number of cases since Jan. 20 when the national health authority began publishing nationwide data on the Covid-19 infections.

IMPACT: More positive developments out of China will encourage other nations that the virus can be contained and boost morale, eventually affecting risk appetite.

DAY AHEAD

The upcoming economic prints are unlikely to change this Dollar-friendly narrative. The last few weeks have seen market expectations for Fed rate cuts grow, with more than one and a half cuts now priced in by year-end, but the Dollar has only moved higher in the meantime. And the more concerns about the virus impact on foreign economies intensify, the more the Dollar is likely to shine since the US economy is better protected from a slowdown in China and US authorities have policy room to react to any shock, unlike Europe or Japan.

SENTIMENT

OVERALL SENTIMENT: Fear took hold of equity markets as the worsening of the Covid-19 situation in various countries over the weekend hit the newswires. Welcome to the new normal of trading Covid-19 headlines. Expect sentiment to remain fragile for some time.

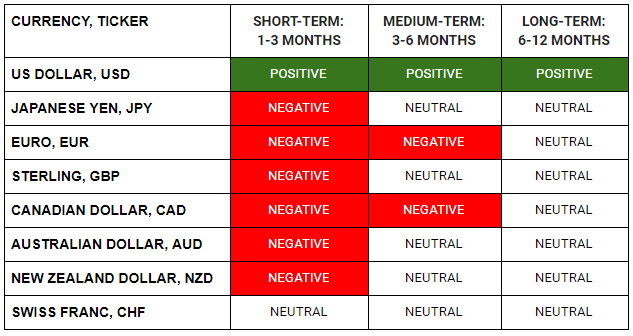

FX

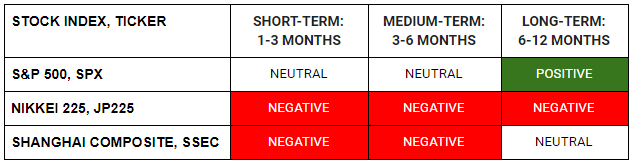

MARKETS

TRADING TIP

Adapt or Die…

This is essentially what Charles Darwin was trying to say but with more words in his famous quote: “It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.”

For traders to succeed in the long-term, we must always be open to the possibility that what we used to know to be true may not be so anymore. Correlations between different asset classes are never constant and sometimes change when we least expect it.

For example, if volatility increases dramatically, the sizes of trades will need to be reduced so that we can have wider stops to protect the trades from being taken out by random moves caused by unexpected headlines.

Adapting to changes in market conditions is imperative if we want to survive and be around to take advantage of the opportunities that will inevitably appear once the dust settles.