WHAT HAPPENED YESTERDAY

As of New York Close 1 May 2020,

FX

U.S. Dollar Index, -0.03%, 99.08

USDJPY, -0.22%, $106.94

EURUSD, +0.26%, $1.0985

GBPUSD, -0.71%, $1.2504

USDCAD, +1.01%, $1.4086

AUDUSD, -1.41%, $0.6419

NZDUSD, -0.93%, $0.6069

STOCK INDICES

S&P500, -2.81%, 2,830.71

Dow Jones, -2.55%, 23,723.69

Nasdaq, -3.20%, 8,604.95

Nikkei Futures, -2.14%, 19,630.0

COMMODITIES

Gold Spot, +0.91%, 1,700.41

Brent Oil Spot, +0.04%, 23.55

SUMMARY:

Safe-haven Japanese Yen gained on Friday and riskier currencies, including the Australian Dollar, dropped as risk sentiment soured after Trump threatened to impose new tariffs on China over the Covid-19 crisis. Trump said on Thursday his hard-fought trade deal with China was now of secondary importance to the Covid-19 pandemic and he threatened new tariffs on Beijing, as his administration crafted retaliatory measures over the outbreak.

Expect AUD and NZD, which have rallied off the lows of late, to give back some gains as risk aversion continues to take hold. US-China trade tensions rising will be most keenly felt by these growth dependent currencies

S&P 500 declined 2.81% on Friday, as investors increased profit-taking efforts after Amazon (AMZN 2286.04, -187.96, -7.6%) underwhelmed investors with its earnings report and U.S.-China tensions appeared to escalate. The Dow Jones Industrial Average lost 2.55%, the Nasdaq Composite lost 3.2%, and the Russell 2000 lost 3.8%. U.S. 2yr yield remained unchanged at 0.20% and U.S. 10yr yield remained unchanged at 0.64%.

Amazon warned that Covid-19-related expenses would likely wipe out its expected $4 billion operating income in Q2, providing investors a good excuse to take some profits after a 50% rally off its March low. The notion that stocks have come too far too fast was bluntly put by Tesla (TSLA 701.32, -80.56, -10.3%) CEO Elon Musk tweeting that Tesla’s stock price is too high.

As for the broader market, investors had to contend with Trump threatening new tariffs on China for its handling of the Covid-19 outbreak, as well as the ISM Manufacturing Index for April declining to its lowest level since 2009 with a 41.5% reading (consensus 39.0%). The latter wasn’t too shocking for investors.

Aside from Amazon, Apple (AAPL 289.07, -4.73, -1.6%), Exxon Mobil (XOM 43.14, -33.33, -7.2%), Chevron (CVX 89.44, -2.56, -2.8%), and Visa (V 175.57, -3.15, -1.8%) also succumbed to losses after reporting earnings. Note, Apple shares still rose 2.1% for the week. Separately, the FDA approved Gilead Sciences’ (GILD 79.95, -4.05, -4.8%) remdesivir for emergency use in treating COVID-19, Gilead shares recouped some losses after the news (+2.25% After Hours) but did not aid the overall market sentiment.

AMERICANS BEGIN TO SURFACE FROM ISOLATION AS STATES EASE CLAMP-DOWNS

Americans in about half of U.S. states, led by Texas and Georgia, began emerging on Friday from home confinement while California and New York held fast to business closures and other restrictions. Texas began a phased-in reopening of businesses shuttered more than a month ago, with restaurants, retail stores, and malls allowed to open at 25% capacity. A second phase is planned for May 18 if infection rates continue to decline.

IMPACT: As of Friday, the number of known infections nationwide had climbed to more than 1 million, including nearly 64,000 deaths. As had happened in other nations, keep an eye out for the second spike in Covid-19 infection the weeks ahead. Any resurgence will cause safe-haven currencies like the Japanese Yen and U.S Dollar to trade stronger against risk assets like the AUD.

U.S. EMERGENCY APPROVAL BROADENS USE OF GILEAD’S COVID-19 DRUG REMDISIVIR

Gilead Science Inc’s antiviral drug remdesivir was granted emergency use authorization by the U.S. Food and Drug Administration for Covid-19 on Friday, clearing the way for broader use of the drug in more hospitals around the United States. U.S. Vice President Mike Pence said the 1.5 million vials would start being distributed to hospitals on Monday.

Gilead said the federal government will coordinate the donation and distribution of remdesivir to hospitals in cities hardest hit by Covid-19. Citing the drug’s limited supply, the company said hospitals with intensive care units and other hospitals that the government deems most in need will receive priority.

IMPACT: Gilead did not immediately respond to a request for the price it plans to charge for the drug after its pledged donations are used up. The Institute for Clinical and Economic Review, which assesses the effectiveness of drugs to determine appropriate prices, but the cost of producing a 10-day course of remdesivir at $10, but suggested that the price would rise to $4,500 based on patient benefits shown in clinical trials. Near term risk appetite will be driven by the effectiveness and availability of cure, watch out for any remdesivir headlines as it should cause knee jerk reactions in risk assets.

TRUMP VS CHINA

Some top Trump administration officials are moving to take a more aggressive stand against China on economic, diplomatic, and scientific issues at the heart of the relationship between the world’s two superpowers, further fraying ties that have reached their lowest point in decades.

White House aides last week have prodded Trump to issue an executive order that would block a government pension fund from investing in Chinese companies, officials said — a move that could upend capital flows across the Pacific. Trump announced on Friday that he was restricting the use of electrical equipment in the domestic grid system with links to “a foreign adversary” — an unspoken reference to China.

IMPACT: Trump’s announcement on electrical equipment on Friday appeared to be another attempt to constrain China. He declared a national emergency and ordered the energy secretary to ban the import of foreign equipment for power plants and transmission systems, arenas where China is becoming increasingly active around the world.

Some White House advisers, including Mnuchin, have cautioned against the steps, saying they could disrupt American financial markets or the trade deal that the United States signed with China in January. Banking executives have also warned of adverse consequences.

In addition, Secretary of State Mike Pompeo said on Sunday there was “a significant amount of evidence” that the Covid-19 emerged from a Chinese laboratory, but did not dispute U.S. intelligence agencies’ conclusion that it was not man-made. “There is a significant amount of evidence that this came from that laboratory in Wuhan,” Pompeo told ABC’s “This Week,” referring to Covid-19.

As the theme of U.S. ratcheting tensions with China develops, any escalation should see Chinese trade dependent currencies like the Aussie, Kiwi and Singapore Dollar weaken against the greenback.

DAY AHEAD

In Australia, the Reserve Bank is unlikely to act on Tuesday, but that doesn’t mean the meeting will be boring. The Aussie has rallied quite sharply in recent weeks, partly as market participants rewarded the government’s impressive response to the pandemic and partly because the RBA itself has been slightly less aggressive than other central banks, for instance by ruling out negative rates.

Yet, a stronger currency is probably the last thing the RBA wants, as that could depress the nation’s exports even more. That implies policymakers may try to implicitly talk down the Aussie, for example by highlighting that they can still do much more, like buying corporate bonds.

SENTIMENT

OVERALL SENTIMENT:

Trump’s bashing of China and efforts to pin the blame on China to distract from his abysmal response to the Covid-19 crisis finally took its toll on market sentiment. The stock market weakness was also attributed to underwhelming earnings reports from tech giants, Amazon and Apple. Even Elon Musk’s tweet that Tesla shares was too high was partly to blame.

Whatever the reasons are, it has been a while since the market reacted negatively to negative news. With share markets in the Middle East down on Sunday (Saudi’s Tadawul All Share Index down 7.4%) as the Saudi Finance Minister warns of “painful measures” ahead due to the Covid-19 crisis and the oil price crash, the Asian trading session is set to start of the week on the backfoot.

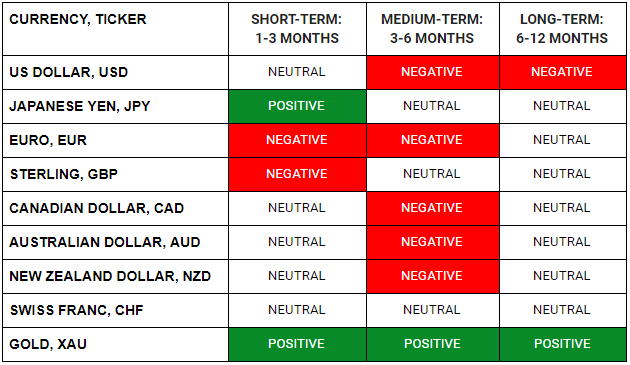

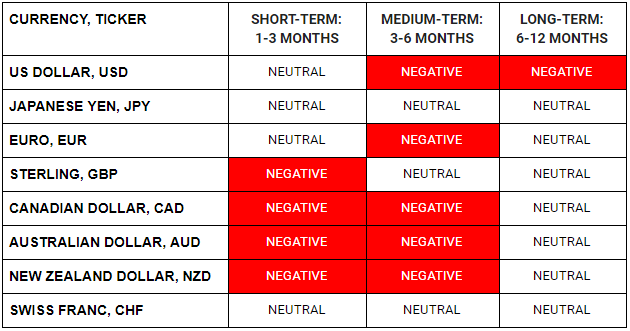

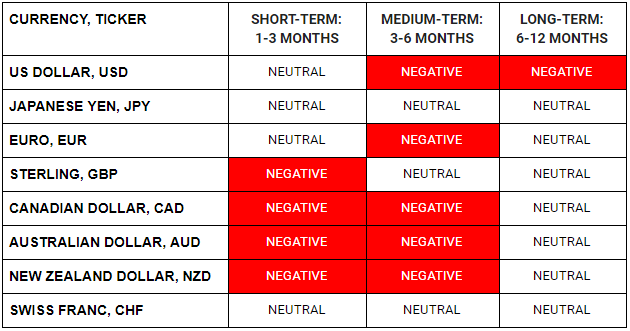

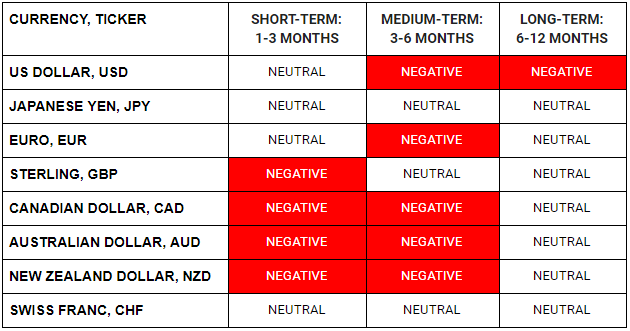

FX

STOCK INDICES

TRADING TIP

The Battered Bear Reawakens

Bears have been sent back running into their caves to lick their wounds in recent weeks as the aggressive rally in global stock markets from the low have defied the overwhelmingly bad data on the economic front. For weeks, good news was celebrated, no matter how trivial they are, and bad news was ignored and brushed over. That was a clear sign of a market that was looking for reasons to rally.

Finally, bad news is being priced as bad and the bears are regaining some signs of life. This is the cue for us to dip our toes once again on risk averse positions. The old adage of “Sell in May and go away” may yet again prove to be good advice.

WHAT HAPPENED YESTERDAY

As of New York Close 30 Apr 2020,

FX

U.S. Dollar Index, -0.38%, 99.11

USDJPY, +0.54%, $107.29

EURUSD, +0.65%, $1.0946

GBPUSD, +0.91%, $1.2581

USDCAD, +0.53%, $1.3953

AUDUSD, -0.69%, $0.6511

NZDUSD, -0.11%, $0.6126

STOCK INDICES

S&P500, -0.92%, 2,912.43

Dow Jones, -1.17%, 24,345.72

Nasdaq, -0.28%, 8,889.55

Nikkei Futures, -1.17%, 20,060

COMMODITIES

Gold Spot, -1.60%, 1,685.05

Brent Oil Spot, +9.74%, 23.54

SUMMARY:

Central banks remained committed to supporting the financial system. The Fed expanded the scope and eligibility for its Main Street Lending Program, and the ECB said it will conduct net asset purchases under its EUR750 billion pandemic emergency purchase program through at least the end of the year. Yesterday was month-end and around the London fixing, the EUR, CHF and GBP surged versus the US dollar on flow demand, while the JPY, AUD, NZD and CAD fell vs the greenback. Overall the dollar was marginally lower on the day but mixed overall. Dollar Index fell -0.38%, 99.11.

S&P 500 declined 0.92% on Thursday to end a strong April with some light profit-taking activity. Mega-cap technology stocks outperformed and limited the Nasdaq Composite’s decline to 0.28%, while the Dow Jones Industrial Average declined 1.17% and the Russell 2000 declined 3.7%. U.S. 2yr yield remained unchanged at 0.20% and U.S. 10yr yield rose 1bp to 0.64%.

Economic data continued to reveal the damage caused by the Covid-19, specifically a 7.5% plunge in personal spending for March (consensus -3.6%) and 3.839 million initial jobless claims (consensus 3.050 million) filed for the week ending April 25. The positive spin regarding the jobs data was that it marked a 603,000 decline from the prior week.

Notably, mega-cap technology stocks remained in favor, with Amazon (AMZN 2474.00, +101.29, +4.3%) and Apple (AAPL 293.95, +6.22, +2.2%) rallying in front of their earnings reports after the close. Facebook (FB 204.35, +10.16, +5.2%) and Microsoft (MSFT 179.13, +1.70, +1.0%) also finished higher following their earnings.

Apple shares were down more than 2% in the after hours market on Thursday after the company reported a slight increase in second-quarter revenue to $58.3 billion, during a period in which supply and demand for Apple’s products were negatively affected by the Covid-19 pandemic. Apple will also continue to buy back its stock amid the pandemic, the company said. It has authorized an increase of $50 billion in the company’s share repurchase program, in addition to a dividend of $0.82 per share. In Apple’s fiscal 2019, it spent $67.1 billion repurchasing shares and $14.1 billion on dividends.

Amazon reported its first-quarter earnings after the bell on Thursday, revealing the pandemic’s impact on the business that has been a rare bright spot on the stock market. The stock fell about 5% after hours after missing estimates on earnings while beating revenue expectations.

TRUMP THREATENS NEW TARIFFS ON CHINAS AS U.S. MULLS RETALIATORY ACTION OVER VIRUS

Trump said on Thursday his hard-fought trade deal with China was now of secondary importance to the Covid-19 pandemic and he threatened new tariffs on Beijing, as his administration crafted retaliatory measures over the outbreak.

Trump’s sharpened rhetoric against China reflected his growing frustration with Beijing over the pandemic, which has cost tens of thousands of lives in the United States alone, sparked an economic contraction, and threatened his chances of re-election in November.

IMPACT: Two U.S. officials, speaking on condition of anonymity, said a range of options against China were under discussion, but cautioned that efforts were in the early stages. Recommendations have not yet reached the level of Trump’s top national security team or the president. Trump made clear, however, that his concerns about China’s role in the origin and spread of the Covid-19 were taking priority for now over his efforts to build on an initial trade agreement with Beijing that long dominated his dealings with the world’s second-largest economy. Now the word used is tariffs, but who knows when it could be sanctions that are floated. If and when that happens, risk assets will come under heavy pressure and currencies such as AUD and NZD will be in trouble.

Consistent with the narrative we have been advocating that the U.S’ rhetoric against China will ramp up into the Nov elections, expect increasing geopolitical tensions and risk assets like the Aussie Dollar and Emerging Market currencies to be more volatile for the remainder of the year.

GILEAD TO WORK WITH PARTNERS TO RAMP UP PRODUCTION OF POTENTIAL COVID-19 TREATMENT

The company said it still expects to have more than one million remdesivir treatment courses manufactured by December, “with plans to be able to produce several million treatment courses in 2021.” By the end of next month, Gilead said it expects to have manufactured enough of the drug to treat more than 140,000 patients, and it plans to donate that supply to hospitals.

The company said it has been in constant dialogue with the U.S. Food and Drug Administration about making remdesivir, which is given to hospitalized patients by intravenous infusion, available to patients as quickly as possible.

IMPACT: This is positive development from Gilead and any concrete rollout of the drugs will be positive for risk sentiment as it’s a boost for morale globally. Risk currencies like the Aussie Dollar will do well from near term exuberance.

HALF OF U.S. STATES EASING COVID-19 RESTRICTIONS AS JOBLESS NUMBERS GROW

As White House economic reopening guidance expired on Thursday after two weeks in place, half of all U.S. states forged ahead with easing restrictions on restaurants, retail, and other businesses in hopes of reviving Covid-19-stricken commerce.

The enormous pressure on states to reopen, despite a lack of wide-scale virus testing and other precautions urged by health experts, was highlighted in new Labor Department data showing some 30 million Americans seeking unemployment benefits since March 21.

The jobless toll amounts to more than 18.4% of the U.S. working-age population, a level not seen since the Great Depression of the 1930s.

IMPACT: In recurring fashion, we reiterate that there is a good possibility of a second wave of infection as the U.S. relaxes its measures prematurely. Any spike in Covid-19 deaths will dampen risk sentiment and strengthen the U.S. Dollar when risk aversion hits. One caveat is that markets may view remdesivir as a hedge against Covid-19 deaths, hence if the drug is available and reinfections pick up, the impact on risk assets may not be as severe as before, but deaths is a key barometer to watch.

DAY AHEAD

Financial markets closed April in a cheerful mood. US stocks had their best month in decades, beaten-down commodity currencies are on the mend, and the defensive dollar is losing some of its shine. It seems that the incredible stimulus measures by governments and central banks, alongside the announcement of plans to re-open many economies and positive signals on the medical front about a treatment, have all done their part to calm investors.

At present, stock market valuations imply a quick, V-shaped rebound for the world economy. Alas, that assumption is probably overly optimistic. First, many small businesses will shut down permanently due to lockdowns. Secondly, the impact on consumption from soaring unemployment is likely to be underestimated. The US just lost all the jobs it created in the last decade, how long will it take to recover those, and what does that imply for consumption? Third, consider the lasting behavioural shock to some consumers, who might be much more defensive with their spending even after things open up, as we’ve seen in China.

Markets are starting the first day of May negatively on the back of Trump’s anti-China rhetoric and poor earnings reports from tech giants, Apple and Amazon. Is the old adage “Sell in May and go away” going to be that name of the game again? With all but the most ardent of bears having capitulated, and bad news finally getting a bearish reaction, this may indeed be time for the massive rally from the lows to end.

SENTIMENT

OVERALL SENTIMENT:

Finally, the market reacts to the incessant anti-China rhetoric from the US policymakers and bad news elicit the appropriately bearish response. Trump now talks of imposing tariffs to punish China for their lack of transparency or “letting it spread”. Now tariffs, the next word could be sanctions as the same rhetoric could be coming from other US allies soon.

Apple’s disappointing earnings report should not be that big of a surprise to the market given that Apple stores have been closed in various countries due to the virus situation. Yet, the market is not brushing it off as it has tended to do so with most bad news of late. When bad news causes bearish reactions once again, it is time for the wounded bear to awaken once again.

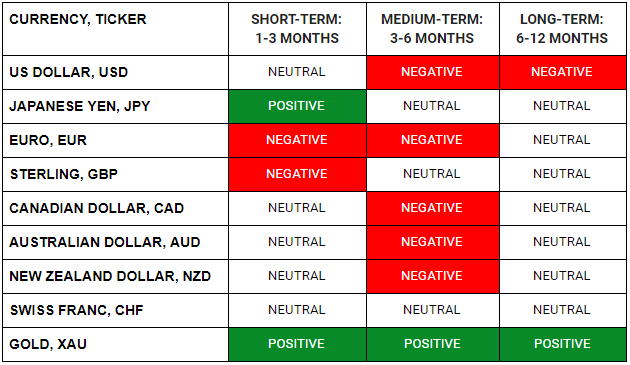

FX

STOCK INDICES

TRADING TIP

Chickens Will Eventually Come Home To Roost

The serenity that has encompassed global markets lately will be put to the test next week when America’s nonfarm payroll data reveal how much destruction the pandemic has left in its wake. The Bank of England and the Reserve Bank of Australia are unlikely to deliver anything new at their meetings, though both will likely maintain a very dovish tone. Overall, the recent flood of liquidity and stimulus has helped stabilize markets, but ultimately, the V-shaped recovery that is now baked into stocks seems unrealistic.

To be clear, all this doesn’t mean the world will end. Rather, that markets may be underplaying the real magnitude of this crisis, how long it will take to get out of it, and its longer-term damage. All told a lot of optimism has been priced back into stocks, suggesting that there’s a lot of room for disappointment if anything goes wrong and that the risk of another move lower from here seems dangerously high.

WHAT HAPPENED YESTERDAY

As of New York Close 29 Apr 2020,

FX

U.S. Dollar Index, -0.37%, 99.49

USDJPY, -0.24%, $106.61

EURUSD, +0.53%, $1.0877

GBPUSD, +0.37%, $1.2471

USDCAD, -0.85%, $1.3875

AUDUSD, +0.97%, $0.6554

NZDUSD, +1.39%, $0.6140

STOCK INDICES

S&P500, +2.66%, 2,939.51

Dow Jones, +2.21%, 24,633.86

Nasdaq, +3.57%, 8,914.71

Nikkei Futures, +2.46%, 20,297.5

COMMODITIES

Gold Spot, +0.32%, 1,714.12

Brent Oil Spot, +5.98%, 21.45

SUMMARY:

Dollar fell on Wednesday after the Fed left interest rates unchanged and repeated a vow to do whatever it takes to shore up the economy that has been battered by business shutdowns due to Covid-19. The dollar index against a basket of currencies fell 0.37% to 99.49, but held above a two-week low of 99.44 reached on Tuesday.

USD weakness, especially against AUD and NZD, continues unabated and seems unlikely to stop. For now, Gold is taking a back seat as short term speculative positions seem to be long but once that is unwound, the wave of money that is driving risk assets higher will lift Gold prices as well. In the midst of a risk rally, the JPY remains strangely strong. The JPY tends to weaken when risk appetite is strong. This could be a sign that USDJPY and EURJPY will likely probe lower levels in time to come.

S&P 500 climbed 2.66% on Wednesday, primarily driven by positive remdesivir news and aided by better-than-feared earnings reports and a market-friendly reminder from the Fed. The Nasdaq Composite rose 3.57%, the Dow Jones Industrial Average rose 2.21%, and the Russell 2000 rose 4.8%. U.S. 2yr yield remained unchanged at 0.20% and U.S. 10yr yield rose 1bp to 0.63%.

The US day started with Gilead Sciences (GILD 83.14, +4.47, +5.7%) affirming that remdesivir, an antiviral treatment for COVID-19, met its primary endpoint in an NIAID placebo-controlled study. The news helped the market open noticeably higher, as it fueled reopening hopes and overshadowed data depicting Q1 GDP contracting at a 4.8% annualized rate (consensus -4.3%).

Alphabet (GOOG 1341.48, +107.81, +8.7%), MasterCard (MA 283.69, +19.09, +7.2%), and Boeing (BA 139.00, +7.70, +5.9%) contributed to the bullish price action following their earnings reports. Energy stocks received an added boost from the 22% spike in oil prices ($15.13/bbl, +2.76, +22.3%).

While most stocks finished the day higher, notable holdouts included Starbucks (SBUX 76.86, -1.83, -2.3%), Advanced Micro Devices (AMD 53.66, -1.85, -3.3%), and General Electric (GE 6.58, -0.22, -3.2%) following their earnings reports.

Later in the day, the Fed unanimously voted to maintain the target range for the fed funds rate at 0.00-0.25%, as was expected and said rates will remain there until the economy is on track to achieve the Fed’s goals of full employment and price stability. The inference is that rates will stay there for much longer, as the record unemployment isn’t expected to return to normal anytime soon.

Fed Chair Powell acknowledged that low rates alone won’t revive economic activity and reiterated the Fed’s commitment to using its full range of policy tools. Powell also said legislators should embrace policies that protect against avoidable insolvencies. Market reaction was relatively muted to the policy directive and the Fed Chair’s comments.

Microsoft shares rose as much as 5% in extended trading on Wednesday after the company reported fiscal third-quarter sales growth of 15%, fueled by its cloud business. The company said in a statement that Covid-19 “had a minimal net impact on the total company revenue” in the quarter and that “effects of Covid-19 may not be fully reflected in the financial results until future periods.”

Facebook which gleans nearly all of its revenue through advertising, reported better-than-expected quarterly revenue but missed on earnings. The social-networking giant still managed to double its profit from a year ago, though, and its shares shot up 10% in after-hours trading. “Rather than slamming on the brakes now… it is important to keep on investing and building where other companies turn back,” Zuckerberg said.

DATA ON GILEAD DRUG RAISES HOPES IN PANDEMIC FIGHT, FAUCI CALLS IT ‘HIGHLY SIGNIFICANT’

Preliminary results from a U.S. government trial showing that patients given remdesivir recovered 31% faster than those given a placebo, were hailed by Dr. Anthony Fauci as “highly significant.”

The U.S. Food and Drug Administration said it has been in discussions with Gilead about making remdesivir available to patients as quickly as possible, but the agency declined to comment on any plans to grant the drug regulatory approval.

“I want them to go as quickly as they can,” President Donald Trump said, when asked if he wanted the FDA to grant emergency use authorization for remdesivir. “We want everything to be safe, but we would like to see very quick approvals, especially with things that work.”

IMPACT: Gilead’s shares rose more than 5% on Wednesday to close at $83.14 and are up 27% so far this year. Despite the excitement, Dr. Lawrence K. Altman, a global fellow at The Wilson Center in Washington, DC, was not ready to celebrate the preliminary findings. The new data “offers a glimmer of hope” that remdesivir has an effect against Covid-19, but the more scientific analysis is needed “comparing them to other studies of the drug that have shown mixed results,” he said in a statement. Any positive developments in relation to Gilead’s drug will see risk assets and growth currencies, such as the AUD, get a boost and if the cure is actually found, we may see an unwind in safe-haven assets like the U.S. Dollar.

PRESIDENT TRUMP SAYS CHINA WANTS HIM TO LOSE RE-ELECTION RACE

Trump said on Wednesday he believes China’s handling of the Covid-19 is proof that Beijing “will do anything they can” to make him lose his re-election bid.

In an interview with Reuters in the Oval Office, Trump said he was looking at different options in terms of consequences for China for the virus. “I can do a lot,” he said.

IMPACT: Desperate to win reelection and avoid blame for the U.S.’s Covid-19 disaster, Trump is going all-in on China-bashing. The effects of attacks on China are broad. More China criticism could increase volatility in bond, stock, and affect growth sensitive currencies (AUD, SGD, NZD, etc). Asian governments’ and businesses’ biggest fear is Trump doubling down on import taxes just when China is growing the slowest in 30 years. Following the Covid-19-driven 6.8% contraction in China’s gross domestic product in the first quarter, trade disputes would hardly be welcome.

JAPAN PM SAYS TO CONSULT EXPERTS ON WHETHER TO EXTEND STATE OF EMERGENCY

Japanese Prime Minister Shinzo Abe said on Thursday that the government would consult experts to decide whether to extend the state of emergency beyond May 6.

Abe, speaking in parliament, also said the situation surrounding the Covid-19 epidemic continued to be “severe”. The Nikkei business daily reported on Wednesday that the government was planning to extend the nationwide state of emergency by about one month.

IMPACT: The global economy could this year see the steepest downturn since the Great Depression of the 1930s due to a virus-driven collapse of activity, with Japan’s economy facing stagnation due to its export dependence and soft domestic consumption. Official data on Thursday showed factory output slipped 3.7% in March from the previous month, a smaller decline than the 5.2% drop forecast. We are not out of the woods as major economies are still grappling with the virus and demand destruction is not a light switch that can be turned on and off, the pickup in economic activity will be a protracted grind, hence higher Oil prices might not be entirely sustainable at this point. This in turn affects Oil-linked commodity currencies like the Canadian Dollar and Mexican Peso.

DAY AHEAD

With Europe’s biggest economies shutting down in March as the Covid-19 wreaked havoc across the continent, no one is expecting the Eurozone’s first-quarter GDP estimate later today to be anything but abysmal. But just as in previous crises, it is the European Central Bank that has been first to come to the rescue and with European Union leaders still bickering over the details of a virus recovery fund, it will be up to Lagarde and her team to calm investor’s nerves when they announce their latest policy decision later today.

SENTIMENT

OVERALL SENTIMENT:

US GDP was worse than expected, proving that the economy is bad, but it did not faze the market. At the same time as the data release, news that Gilead’s drug, remdesivir, was showing “positive results’ ‘ in a trial hit the wires, and it was off to the races for risk assets, with US stocks up almost 2% on that.

The Federal Reserve kept policy unchanged, and the Fed Chair, Powell, says the economy is bad and the employment numbers are going to be horrible next. That did not put a dent in the market, and it rallied almost another percent. It seems that good news is good for the market, and bad news is expected and ignored for now.

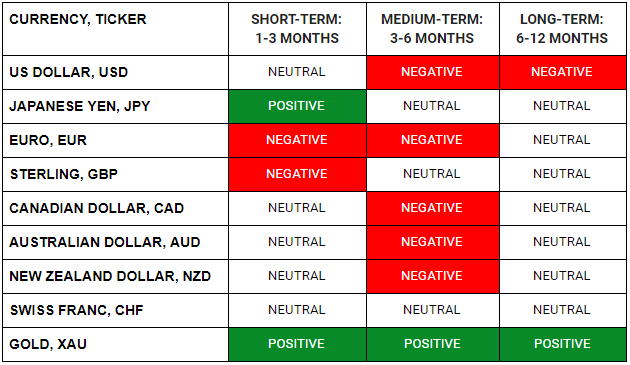

FX

STOCK INDICES

TRADING TIP

A Fractious Europe

With the virus crisis not looking like it will end anytime soon and the EU dragging its feet on meaningful measures to support the hardest-hit member states, expectations are growing that the ECB will boost the Pandemic Emergency Purchase Programme at today’s meeting. If the expectation is met, the Euro could advance. If, though, the ECB keeps the size of its stimulus unchanged and just fine-tunes existing measures, the Euro would be in danger of revisiting the $1.0775 support as doubts would resurface about the Eurozone’s recovery plan.

In the more medium-term, the ECB’s forward guidance and any hints on the future policy will be more significant for the Euro’s outlook. In particular, should Lagarde suggest that unlimited bond purchases were discussed in the meeting, this could limit future rebounds against currencies where their central banks have also pledged unlimited QE (like the Federal Reserve and Bank of Japan).

WHAT HAPPENED YESTERDAY

As of New York Close 28 Apr 2020,

FX

U.S. Dollar Index, -0.22%, 99.87

USDJPY, -0.45%, $106.75

EURUSD, +0.02%, $1.0833

GBPUSD, +0.04%, $1.2435

USDCAD, -0.36%, $1.3980

AUDUSD, +0.57%, $0.6502

NZDUSD, +0.48%, $0.6076

STOCK INDICES

S&P500, -0.52%, 2,863.39

Dow Jones, -0.13%, 24,101.55

Nasdaq, -1.40%, 8,607.73

Nikkei Futures, +1.08%, 19,933.0

COMMODITIES

Gold Spot, -0.61%, 1,705.03

Brent Oil Spot, +2.58%, 20.24

SUMMARY:

Dollar was on the back foot as the slowing spread of the Covid-19 and moves to re-open economies supported the investor mood, ahead of major central bank meetings. AUD and NZD continued to creep relentlessly higher as trade data from both countries show that exports continue to remain robust. With food security being a key issue in the months ahead, both these currencies could continue to trade strong on that back of that.

Investors will be watching to see if the Fed gives any clues on its future policy path after it responded to the economic devastation of the Covid-19 pandemic by slashing rates, buying bonds and backstopping credit markets. The US Conference Board’s Consumer Confidence Index for April plunged to 86.9 (consensus 86.5) from a downwardly revised 118.8 (from 120.0) for March. The April reading is the lowest since June 2014. The key takeaway from the report is that consumers while thinking positively about things reopening again, are still less optimistic about their financial prospects, which could be a headwind for spending activity during the recovery phase.

S&P 500 declined 0.52% on Tuesday in a mixed session. Large-cap technology and health care stocks lagged while reopening enthusiasm continued to flow into the small-cap Russell 2000 (+1.3%). The Dow Jones Industrial Average shed 0.13%, while the Nasdaq Composite fell 1.40%. U.S. 2yr yield fell 4bp to 0.20% and U.S. 10yr yield fell 5bp to 0.62%.

In other earnings news, shares of Caterpillar (CAT 115.46, +0.26, +0.2%), 3M (MMM 157.61, +3.96, +2.6%), and PepsiCo (PEP 136.32, +1.4%) finished higher, even after the companies withdrew full-year guidance, while shares of UPS (UPS 96.43, -6.12, -6.0%) faltered after the company missed profit estimates.

Alphabet rose more than 7% on earnings after hours, as ad revenue slowdown turns out to be less than feared. Though $33.8 billion of Google’s total quarterly revenue of $41.16 billion came from advertising, a reflection of its continued reliance on a battered market, there is a silver lining. Sales from Google Cloud and YouTube continued to surge, underscoring versatility in the company’s overall product line — YouTube ad revenue increased 33.4%, to $4.04 billion from $3.03 billion a year ago, while Google Cloud sales grew 52%, to $2.78 billion from $1.83 billion.

TRUMP TO ORDER U.S. MEAT PROCESSING PLANTS TO STAY OPEN DESPITE COVID-19 FEARS

With concerns about food shortages and supply chain disruptions, Trump is expected to sign an executive order using the Defense Production Act to mandate that the plants continue to function, a senior administration official said.

U.S. meat companies slaughtered an estimated 283,000 hogs on Tuesday, down about 43% from before plants began shutting because of the pandemic, according to U.S. Department of Agriculture data. Processors slaughtered about 76,000 cattle, down about 38%.

IMPACT: The world’s biggest meat companies, including Smithfield Foods Inc, Cargill Inc, JBS USA and Tyson Foods, have halted operations at about 20 slaughterhouses and processing plants in North America as workers fall ill, stoking global fears of a meat shortage. UFCW, the largest U.S. meatpacking union, demanded that the administration compel meat companies to provide “the highest level of protective equipment” to slaughterhouse workers and ensure daily Covid-19 testing.

Any shortage in poultry due to supply chain destruction will put pressure on prices when demand returns. Meat exporting countries like New Zealand might get some positive tailwind for its currency.

BIDEN, SEEKING SUPPORT OF WOMEN, WINS HILLARY CLINTON’S ENDORSEMENT

The endorsement, at an online town hall on the effects of the Covid-19 crisis on women, came at a critical moment as Biden aims to raise his profile with female voters and other key demographic groups even as the pandemic ravages the U.S. economy.

Women favored Clinton over Trump in 2016, exit polls showed, and are expected to play a critical role in swaying the most competitive swing states in the Nov. 3 election between Biden and Trump.

IMPACT: The battle lines for the U.S. presidential election are not Dollar friendly. Biden’s main proposal is likely to be Nationalizing Healthcare and using wealth tax to fund the deficit. This is a Dollar bearish scenario as the U.S. will be running a much larger budget deficit due to the Covid-19 crisis.

U.S. COVID-19 DEATHS SURPASS VIETNAM WAR TOLL

U.S. Covid-19 death toll reached (56,567 Covid Deaths, 58,220 Vietnam War Deaths) a grim milestone on Tuesday, surpassing the number of American lives lost in the Vietnam War, as Florida’s governor met with Trump to discuss easing shutdowns aimed at curbing the pandemic.

About a dozen states were forging ahead to restart shuttered commerce without being ready to put in place the large-scale virus testing or means to trace close contacts of newly infected individuals, as outlined in White House guidelines on April 16.

IMPACT: The number of known U.S. Covid-19 infections has doubled over the past 18 days to more than 1 million. The actual count is believed to be higher, with state public health officials cautioning that shortages of trained workers and materials have limited testing capacity, leaving many infections unrecorded. Any spike in Covid-19 mortality in the U.S. will morbidly cause the Dollar to strengthen on risk-aversion.

DAY AHEAD

The Fed meets later today and, having thrown everything including the kitchen sink to protect the US economy in the battle against the economic damage of this crisis, no action is expected this time. As such, the market reaction may depend mainly on Powell’s remarks. From a risk-management perspective, Powell has more incentive to soothe investors’ nerves and hint that more stimulus is possible, which could briefly hurt the Dollar.

Investors will be hanging from Powell’s every word, eager to find out whether the central bank is willing to do even more if the crisis worsens, or whether policymakers feel they have done enough. For example, would the Fed consider going down the Bank of Japan’s path and introduce yield-curve control? How about buying stocks (though Treasury Secretary Mnuchin was quoted yesterday that this was an unlikely option for the Fed)?

Overall, he is likely to maintain a very cautious tone, and probably keep even these extreme options on the table. Ruling out more stimulus now would risk increasing market volatility, which is the last thing the Fed wants as that could reduce the effectiveness of all its previous actions. Better be safe than sorry, especially in the middle of a recession.

SENTIMENT

OVERALL SENTIMENT:

Yet another day of wild swings in the WTI crude oil June future falling almost 30% at one stage before retracing the losses to close slightly positive on the day. The volatility was likely exacerbated by the USO ETF announcing that they would be selling the June future to switch their long positions to contracts further out the calendar. S&P500 slowly crept to test the highs of the day before the open of the US session, and promptly sold off when the US trading hours got fully underway. There seems to be a puzzling trend of risk assets being bought during Asian hours before retracing during NY hours. Seems inexplicable why that is the case, but it’s something to keep an eye on.

FX

STOCK INDICES

TRADING TIP

Get out of the way!

The relentless rally in the stock markets in recent days is a good reminder that to succeed in trading, we need a healthy dose of humility along with a generous helping of prudence. Regardless of what you believe the fundamentals to be, when the price action is constantly going against your trade, it is imperative to have risk management measures which will ensure that your risk gets smaller as your performance deteriorates.

If the bear market should resume, there will be ample opportunities to get short in a meaningful way again. There is no need to be fighting the market on a trade that is not working when there are many other trade opportunities that can be exploited every day! Constantly be on the look out for trades that work, rather than stick to the ones that are a constant torture. That will help preserve your sanity and help grow your capital in the long run.

S&P500 Stock index Daily Candlesticks & Ichimoku Chart

S&P500 Index is now trying to break above the daily Ichimoku Cloud. If successful, then the bears will have to go back to sleep for a while…

Source: tradingview.com

Vee, our Founder/CIO highlights patterns/formations on selected chart(s) every week which may have the potential to turn into trading opportunities. These charts are first sent out on Monday of the week to the TRACKRECORD COMMUNITY which helps them to filter out the noise and condense only what’s important in the markets for the week ahead.

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte. Ltd. that any particular investment, security, transaction or investment strategy is suitable for any specific person. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte. Ltd

WHAT HAPPENED YESTERDAY

As of New York Close 27 Apr 2020,

FX

U.S. Dollar Index, -0.20%, 100.09

USDJPY, -0.20%, $107.29

EURUSD, +0.04%, $1.0825

GBPUSD, +0.42%, $1.2421

USDCAD, -0.48%, $1.4037

AUDUSD, +0.97%, $0.6449

NZDUSD, +0.07%, $0.6024

STOCK INDICES

S&P500, +1.47%, 2,878.48

Dow Jones, +1.51%, 24,133.78

Nasdaq, +1.11%, 8,730.16

Nikkei Futures, +3.01%, 19,768.0

COMMODITIES

Gold Spot, -1.13%, 1,709.84

Brent Oil Spot, -7.37%, 19.73

SUMMARY:

Dollar fell across the board on Monday as several countries laid out plans to ease restrictions on businesses that have been closed due to the Covid-19 outbreak, boosting risk appetite and reducing demand for the safe-haven U.S. currency. Italy, which has the world’s second-highest Covid-19 mortality rate due to a large elderly population, is among the countries that have laid out plans to allow businesses to reopen.

The Yen gained after the Bank of Japan expanded its stimulus to help companies hit by the Covid-19 crisis, pledging to buy an unlimited amount of bonds to keep borrowing costs low as the government tries to spend its way out of the deepening economic pain. Typically, the currency should weaken if the Central Bank embarks on an unlimited Quantitative Easing program but Japan has essentially been on such a program for years. As such, it was more of a sell the fact as word that this was on the table was already leaked last week.

S&P 500 gained 1.47% on Monday, as investors showed optimism in reopening efforts indicated by more states and countries. The Dow Jones Industrial Average (+1.51%) and Nasdaq Composite (+1.11%) also advanced more than 1.0%, while the Russell 2000 outperformed with a 4.0% gain. U.S. 2yr yield rose 2bp to 0.24% and U.S. 10yr yield rose 7bp to 0.67%.

At least nine U.S. states had their economies partially reopened as of Monday, according to The New York Times, while other states like New York, Texas, and Ohio announced plans to gradually reopen in the coming weeks. The prospective increase in economic activity, even without a confirmed Covid-19 treatment, had investors piling into previously-neglected cyclical sectors.

Italy, France and Spain initiated steps to reopen their economies as well. Some attribute the risk-on sentiment partially to the Bank of Japan lifting the cap on its JGB bond purchases, and announcing plans to increase its purchases of corporate bonds and commercial paper.

GEORGIA EATERIES REOPEN AS MORE U.S. STATES EASE PANDEMIC SHUTDOWNS

Georgia, at the vanguard of states testing the safety of reopening the U.S. economy in the midst of the Covic-19 outbreak, permitted restaurant dining for the first time in a month on Monday while governors in regions with fewer cases also eased restrictions.

Eager to revive battered commerce despite warnings from public health experts about the lack of testing, a handful of states from Montana to Mississippi were also set to reopen some workplaces deemed to be non-essential.

Alaska, Oklahoma, and South Carolina, along with Georgia, previously took such steps, after weeks of mandatory lockdowns that have thrown millions of Americans out of work and led to forecasts that an economic shock of historic proportions is at hand.

IMPACT: Trump and some local officials have criticized Georgia Governor Brian Kemp for forging ahead to add restaurants and movie theaters to the list of businesses – hair and nail salons, barbershops, and tattoo parlors – that he allowed reopening last week, albeit with social-distancing restrictions still in force. As states start to reopen, keep an eye out for the rise in a second wave of infection within 14-28 days later, any spike will cause the Dollar to strengthen as risk-aversion due to policy error will take hold. This might be a case of taking one step forward and two steps back.

BANK OF JAPAN EXPANDS STIMULUS AS PANDEMIC PAIN WORSENS

At the meeting on Monday, cut short by a day as a precaution against the spread of the pandemic, the BOJ kept its interest rate targets unchanged, as had been widely expected. Kuroda said the central bank was ready to act further to fight the impact of the novel coronavirus, which he said could do more harm to the global economy than the 2008 collapse of Lehman Brothers.

Under a policy dubbed yield curve control, the BOJ targets short-term interest rates at -0.1% and 10-year bond yields around 0%. It also buys government bonds and risky assets to pump money aggressively into the economy.

To ease corporate funding strains, the BOJ said, it will boost three-fold the maximum amount of corporate bonds and commercial paper it buys to 20 trillion yen ($186 billion). The central bank also clarified its commitment to buy unlimited amounts of government bonds by scraping loose guidance to buy them at an annual pace of 80 trillion yen.

IMPACT: The BOJ also sharply cut its economic forecast and projected inflation would fall well short of its 2% target for three more years, suggesting its near-term focus will be to battle the crisis. Their determination to do what they have done for years for no results remains strong. JPY was unimpressed and in fact, strengthened mildly as a result. Part of the BoJ plan is to weaken the JPY to boost inflation but it has not been the case thus far. Further strengthening in the JPY will likely be met with more comments on their resolve to ease more aggressively.

AUSTRALIA TO OUTLINE COVID-19 HIT TO ECONOMY NEXT MONTH

The Australian government will give an update next month on the economic impact of the coronavirus before providing further outlook in June, it said on Tuesday, bowing to calls for more fiscal transparency in relation to the crisis.

Treasurer Josh Frydenberg will outline the impact of the outbreak and the federal government’s response in a statement to parliament on May 12, the day the government was originally scheduled to deliver its full annual budget.

IMPACT: A prelude into the impact on the Australian economy will be Westpac Banking Corp earnings. The bank on Tuesday said it expects to record pre-tax impairment provisions of A$2.24 billion ($1.4 billion) for the first half, largely due to the economic deterioration expected from the Covid-19 outbreak. Westpac is set to announce results for the six months ending March 31 and its decision on interim dividend payment on May 4. A huge miss in earnings and revision lower in revenues might cause Aussie to lose some steam.

DAY AHEAD

The Fed has thrown everything including the kitchen sink at the US economy in a desperate bid to avoid total catastrophe as the deadly Covid-19 has forced most businesses to go into hibernation. That has left the Fed with very few new options and policymakers are expected to sit tight when they meet on Wednesday for their first regular meeting since January.

SENTIMENT

OVERALL SENTIMENT:

WTI June futures fell more than 25% but did not cause much of a panic as the market seems to have become used to the wild moves. Gold weakened more than 1% against the USD but the USD was weak against most of the other currencies, especially the AUD (+0.97%). Stocks started weak in early Asia with S&P down 0.5% but steadily recovered throughout the day to close more than 1% higher. Everything seems mixed and confused but eventually the fundamentals will reassert themselves.

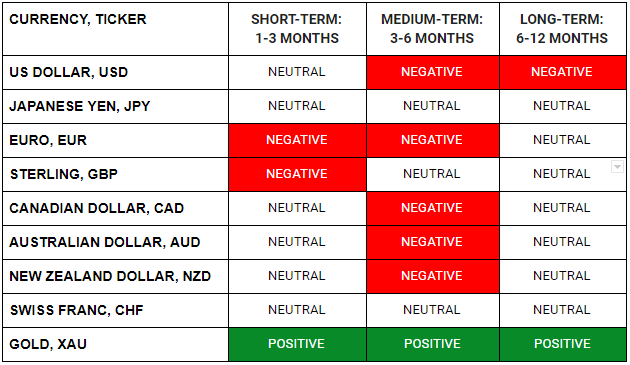

FX

STOCK INDICES

TRADING TIP

Watch Out For The Second Wave

Countries and States that are re-opening their economies do not seem to realise that bulldozing your way into economic recovery whether be it via monetary policy or reopening commerce without proper measures set in place may be a fool’s errand in the long run. Singapore and many other established governments are good reference cases for how things can go awry in a short span of time if they rest on their laurels. The city-state was the poster boy for the containment of Covid-19 earlier on in the pandemic, but that proved to be an illusion. Mistaking a victory in an early battle means that the war is won, imported cases started to infect the community and with uncurtailed community spread, it quickly became one of the countries with the highest % rate of infections (adjusted for population size) and eventually had to implement draconian social distancing measures.

Watch out for the increase in rate of infections for the re-opened countries and states and that will be a good barometer for how much more protracted this crisis will be. The next 3-4 weeks will be a crucial period.

WHAT HAPPENED YESTERDAY

As of New York Close 24 Apr 2020,

FX

U.S. Dollar Index, -0.23%, 100.29

USDJPY, -0.07%, $107.51

EURUSD, +0.40%, $1.0821

GBPUSD, +0.20%, $1.2369

USDCAD, +0.22%, $1.4104

AUDUSD, +0.27%, $0.6387

NZDUSD, +0.20%, $0.6020

STOCK INDICES

S&P500, +1.39%, 2,836.74

Dow Jones, +1.11%, 23,775.27

Nasdaq, +1.65%, 8,634.52

Nikkei Futures, -1.29%, 19,190.0

COMMODITIES

Gold Spot, -0.12%, 1,729.43

Brent Oil Spot, +1.87%, 21.30

SUMMARY:

Dollar eased against the Euro on Friday, snapping a four-day winning streak as investors covered some bearish bets against the common currency. Despite an agreement by EU leaders to fund a recovery from the Covid-19 pandemic, delays to an agreement on divisive details of the European Union’s stimulus package has kept a lid on the Euro. French President Emmanuel Macron said differences continued among EU governments over whether the fund should be transferring grant money, or simply making loans.

U.S. Durable goods orders declined 14.4% m/m in March (consensus -10.0%). Excluding transportation, durable goods orders declined 0.2% (consensus -4.0%). Given the unprecedented set of circumstances, the projection being way off ironically isn’t that unexpected. Market sentiment continues to be driven by Covid-19 developments, oil production, and brewing geopolitical tension between China and U.S. For now, bad numbers will be the norm. Real economic data will start to matter at a later point in the cycle. The final reading for the University of Michigan Index of Consumer Sentiment for March was revised up to 71.8 (consensus 66.5) from the preliminary reading of 71.0. The final reading for March was 89.1.

S&P 500 increased 1.39% on Friday, wrapping up a negative week on a positive note amid a resurgence in buyers during the afternoon. The Dow Jones Industrial Average rose 1.11%, the Nasdaq Composite rose 1.65%, and the Russell 2000 rose 1.6%. U.S. 2yr yield remained unchanged at 0.22% and U.S. 10yr yield decreased 1bp to 0.60%.

Investors started the day parsing a mixed batch of earnings reports, including those from a trio of Dow components. Intel (INTC 59.26, +0.22, +0.4%), Verizon (VZ 57.93, +0.34, +0.6%), and American Express (AXP 83.17, +0.71, +0.9%) reported mixed earnings results, but shares were able to close higher despite early losses. Price action was muted from an index level, though, as the market appeared disinterested, even as oil prices ($17.03, +0.23, +1.4%) continued to rebound and the $484 billion Covid-19 relief bill was signed by Trump.

STATES MOVE TOWARD REOPENING

With the U.S. Covid-19 death toll topping 51,000 and nearly one in six workers out of a job, Georgia, Oklahoma, and several other states took tentative steps at reopening businesses on Friday, despite disapproval from Trump and medical experts. Georgia, one of several states in the Deep South that waited until early April to mandate restrictions imposed weeks before across much of the rest of the country to curb the outbreak, has become a flashpoint in the debate over how and when the nation should return to work.

Georgia was not alone in reopening. Oklahoma was permitting some retailers to resume business on Friday, Florida began reopening its beaches a week ago, South Carolina started easing restrictions on Monday, and other states will follow suit next week.

Trump, who had staked his November re-election on the nation’s booming economy before the pandemic, has given mixed signals about when and how the country should begin to get back to work.

IMPACT: In the latest protest against the shutdowns, hundreds of people gathered on Friday outside the Wisconsin State Capitol building in Madison calling for Democratic Governor Tony Evers to reopen the state, even as it reported its largest single-day jump of new Covid-19 cases. Based on the asian infection curve, the risk of a second wave of infection seems inevitable for the U.S. and any spike in Covid-19 related deaths will be bad for global risk assets as the U.S. remains a barometer for economic recovery. A resurgence of new infection will cause a bout of risk aversion which perversely will lead to USD strength.

TRIAL OF GILEAD’S POTENTIAL COVID-19 TREATMENT RUNNING AHEAD OF SCHEDULE

A key U.S. government trial of Gilead Sciences Inc’s experimental Covid-19 treatment may yield results as early as mid-May, according to the study’s lead investigator, after doctors clamored to enroll their patients in the study.

Those hopes were dampened somewhat on Thursday when details from a Chinese remdesivir trial involving patients with severe Covid-19 inadvertently released by the World Health Organization suggested it provided no benefit. Gilead pushed back on that interpretation saying the study, which was stopped early due to low patient enrollment, cannot provide meaningful conclusions.

IMPACT: Gilead on Thursday said it expected results from the NIAID trial in late May. The company’s shares, up more than 20% so far this year due largely to remdesivir prospects, were 1.7% higher at $79.10 on Friday. The Infectious Disease Society of America (IDSA), which represents more than 12,000 U.S. specialists, said it will make a formal recommendation once the entire body of evidence for remdesivir is available. Gilead has the potential to produce a positive wing outcome in this virus situation, any conclusive drug effectiveness on the virus will send optimism across the globe. If that should happen, growth currencies such as AUD and NZD will benefit from the positive risk sentiment.

ITALY TO REOPEN FACTORIES IN STAGED END TO COVID-19 LOCKDOWN

Italy will allow factories and building sites to reopen from May 4 and permit limited family visits as it prepares a staged end to Europe’s longest Covdi-19 lockdown, Prime Minister Giuseppe Conte said on Sunday. “We expect a very complex challenge,” Conte said as he outlined the road map to restarting activities put into hibernation since early March. “We will live with the virus and we will have to adopt every precaution possible.”

IMPACT: Manufacturers, construction companies and some wholesalers will be allowed to reopen from May 4, followed by retailers two weeks later. Restaurants and bars will be allowed to reopen fully from the beginning of June, although takeaway business will be possible earlier. Italy has been hardest hit by the virus pandemic, the lockdown has put a strain on the euro zone’s third-largest economy, which is headed for its worst recession since World War Two. Italian business leaders have called for the restrictions to be eased to head off economic catastrophe.

DAY AHEAD

Bank of Japan’s policy meeting will kick off on Monday, but it will not be a usual two-day gathering this time as policymakers are expected to reach their decision the same day. While under other circumstances, such an adjustment would signal an eventful meeting, the current virus situation may pressure the central bank for additional corporate aid and likely some flexibility on government bond purchases, whereas there is no doubt that interest rates will remain steady.

SENTIMENT

OVERALL SENTIMENT:

Risk assets rallied into the close without any clear reason but that seems to be the case these days. The relentless money printing has pretty much taken away the fear of the economic damage that is about to come. Economic damage, though inevitable, will slowly manifest itself in various ways. For now, focus on the trades that do not go against the tide of money.

FX

STOCK INDICES

TRADING TIP

Time to Shine

Though the economic prospects of the world seem extremely bleak, risk assets such as stocks have relentlessly crept higher due primarily to the incessant money printing from various policymakers around the world. Until the folly of such policies manifests itself in the form of inflation, the printing presses will continue to work overtime.

To sell risk assets will be to fight against this tide of money. It could work, but it sure takes a lot of struggling. The easier thing to do would be find trades that go along with the tide. Gold is one such beneficiary. With infinite amounts of fiat money being printed, hard assets in finite supply will be repriced. Gold, although volatile, will inevitably and inexorably creep higher as time passes.

WHAT HAPPENED YESTERDAY

As of New York Close 22 Apr 2020,

FX

U.S. Dollar Index, +0.28%, 100.48

USDJPY, +0.05%, $107.82

EURUSD, -0.47%, $1.0806

GBPUSD, +0.22%, $1.2322

USDCAD, -0.18%, $1.4186

AUDUSD, +0.25%, $0.6297

NZDUSD, -0.60%, $0.5922

STOCK INDICES

S&P500, +2.29%, 2,799.31

Dow Jones, +1.99%, 23,475.82

Nasdaq, +2.81%, 8,495.38

Nikkei Futures, +0.98%, 19,260.0

COMMODITIES

Gold Spot, +1.65%, 1,714.82

Brent Oil Spot, +7.60%, 20.11

SUMMARY:

Dollar edged higher on Wednesday, adding to the previous session’s gains, as safe-haven currencies remained largely well supported even as markets began to stabilize and oil prices recovered from another slump. The U.S. House of Representatives will pass Congress’ latest Covid-19 aid bill on Thursday, House Speaker Nancy Pelosi said, paving the way for nearly $500 billion more in economic relief amid the pandemic.S&P 500 advanced 2.29% on Wednesday, recouping some of its decline this week,, as sentiment benefited from a reprieve in the oil futures market and expectation of more stimulus from the government. The Nasdaq Composite outperformed with a 2.81% gain, followed by the Dow Jones Industrial Average (+1.99%) and Russell 2000 (+1.3%). U.S. 2yr yield rose 2bp to 0.22% and U.S. 10yr yield rose 5bp to 0.63%.WTI crude futures gained 19.3%, or $2.23, to $13.80/bbl after a two-day collapse. Facebook (FB 182.28, +11.48, +6.7%) and Alphabet (GOOG 1263.21, +46.87, +3.9%) also did some heavy lifting, partially due to the overwhelmingly positive response to Snap’s (SNAP 16.95, +4.51, +36.3%) revenue results. Daily active users (DAU) on Snapchat rose 20% to 229 million in the first quarter ended March 31, compared with a year earlier. The figure stood at 218 million in the fourth quarter. The average revenue per user in the first quarter was $2.02, up from $1.68 in the prior year.

MORE U.S. STATES MAKE PLANS TO REOPEN; CALIFORNIA HOLDS FIRM

More states in the U.S. South and Midwest signaled readiness on Wednesday to reopen their economies in hopes the worst of the Covid-19 pandemic had passed, but California’s governor held firm to sweeping stay-at-home orders and business closures. Nationwide, U.S. deaths totaled 47,050 on Wednesday, up about 1,800, with some states yet to report. The United States has the world’s largest number of cases at over 830,000.

IMPACT: The patchwork of still-evolving orders across the 50 states meant some Americans were still confined indefinitely to their homes, unable to work, while others began to venture out for the first time in weeks. Reopening prematurely before it is safe to do so will have tragic consequences in the longer run.

TRUMP: IF IRANIAN SHIPS GET TOO CLOSE ‘WE’LL SHOOT THEM OUT OF THE WATER’

Trump said on Wednesday he had instructed the U.S. Navy to fire on any Iranian ships that harass it at sea, a week after 11 vessels from Iran’s Islamic Revolutionary Guard Corps Navy (IRGCN) came dangerously close to American ships in the Gulf. “I have instructed the United States Navy to shoot down and destroy any and all Iranian gunboats if they harass our ships at sea,” Trump wrote in a tweet, hours after Iran’s Revolutionary Guards Corps said it had launched the country’s first military satellite into orbit.

IMPACT: Senior Pentagon officials said that Trump’s comments on Iran were meant as a warning to Tehran, but suggested that the U.S. military would continue to abide by their existing right to self-defense instead of any changes to their rules. Tensions between Iran and the United States increased earlier this year after the United States killed Qassem Soleimani, the head of Iran’s elite Quds Force, in a drone strike in Iraq.

TRUMP SIGNS IMMIGRATION ORDER CURBING GREEN CARDSTrump on Wednesday signed an order to temporarily block some foreigners from permanent residence in the United States, saying he was doing so in order to protect American workers during the Covid-19 pandemic. White House lawyers worked all day to craft the language for the order, prompting some officials to say the signing might have to wait for Thursday. But aides described Trump as eager to sign the document.One U.S. Department of Homeland Security official who requested anonymity said the order would only apply to people applying for permanent residence from outside the United States, not those already in the country seeking to adjust their status.

IMPACT: The order is to last for 60 days and then will be reviewed and possibly extended. Some critics saw Republican Trump’s announcement as a move to take advantage of the Covid-19 crisis to implement a long-sought policy goal of barring more immigrants ahead of the Nov. 3 election.

DAY AHEAD

Another slowdown in U.S. Initial Jobless Claims data, which upset investors three weeks ago after revealing a 6.8 million increase in demand for unemployment benefits amid the global lockdown, could help strengthen the Dollar. If forecasts are true, the gauge will have retreated for the second consecutive week to 4.35 million in the week ending April 18, hinting that measures by the Trump administration may have brought some stabilization in the labour market.

SENTIMENT

OVERALL SENTIMENT:

Another day of wild swings in the oil market but this time, prices went higher. That soothed the market and both stocks and Gold rallied on the day. Expect swings in sentiment to be the norm for now. Focus on the inevitable, i.e. the unlimited amount of fiat money in the system will drive prices of hard assets ever higher!

FX

STOCK INDICES

TRADING TIP

Rolling in the Dip

Unlike stocks or spot markets where the instrument can trade in perpetuity, futures contracts have a set rollover or expiration date. “Rollover” refers to the process of closing out all positions in soon-to-expire futures contracts and opening contracts in newly formed contracts. Understanding products like the USO Exchange Traded Fund (Oil ETF) whose underlying is made up of Oil futures is crucial to profitability.

Futures have various expiration months out the curve and each month’s futures are priced differently, relative to the cost of funding and the cost of storing the commodity in this case, oil. For example, the June Oil contract may be at $20, while the July contract may be at $24. Each time the fund rolls, you get fewer contracts of Futures as you are selling at the cheaper price ($20) to buy at the higher price ($24), this is a drag on your portfolio if this phenomenon persists as the number of fund holdings erodes over time. Even if the market prices do not fluctuate, as long as the futures curve remains upward sloping and time passes, the investor long these contracts will be losing money as time passes.

ETFs that deal in the futures market is a double-edged sword, understanding when the macro environment works for you or against you and understanding the products that you trade are crucial to successful investing. To illustrate the point, as WTI Oil June Futures rose 19.3% yesterday, the USO ETF was down by -10.68%.