WHAT HAPPENED YESTERDAY

As of New York Close 22 Apr 2020,

FX

U.S. Dollar Index, +0.28%, 100.48

USDJPY, +0.05%, $107.82

EURUSD, -0.47%, $1.0806

GBPUSD, +0.22%, $1.2322

USDCAD, -0.18%, $1.4186

AUDUSD, +0.25%, $0.6297

NZDUSD, -0.60%, $0.5922

STOCK INDICES

S&P500, +2.29%, 2,799.31

Dow Jones, +1.99%, 23,475.82

Nasdaq, +2.81%, 8,495.38

Nikkei Futures, +0.98%, 19,260.0

COMMODITIES

Gold Spot, +1.65%, 1,714.82

Brent Oil Spot, +7.60%, 20.11

SUMMARY:

Dollar edged higher on Wednesday, adding to the previous session’s gains, as safe-haven currencies remained largely well supported even as markets began to stabilize and oil prices recovered from another slump. The U.S. House of Representatives will pass Congress’ latest Covid-19 aid bill on Thursday, House Speaker Nancy Pelosi said, paving the way for nearly $500 billion more in economic relief amid the pandemic.S&P 500 advanced 2.29% on Wednesday, recouping some of its decline this week,, as sentiment benefited from a reprieve in the oil futures market and expectation of more stimulus from the government. The Nasdaq Composite outperformed with a 2.81% gain, followed by the Dow Jones Industrial Average (+1.99%) and Russell 2000 (+1.3%). U.S. 2yr yield rose 2bp to 0.22% and U.S. 10yr yield rose 5bp to 0.63%.WTI crude futures gained 19.3%, or $2.23, to $13.80/bbl after a two-day collapse. Facebook (FB 182.28, +11.48, +6.7%) and Alphabet (GOOG 1263.21, +46.87, +3.9%) also did some heavy lifting, partially due to the overwhelmingly positive response to Snap’s (SNAP 16.95, +4.51, +36.3%) revenue results. Daily active users (DAU) on Snapchat rose 20% to 229 million in the first quarter ended March 31, compared with a year earlier. The figure stood at 218 million in the fourth quarter. The average revenue per user in the first quarter was $2.02, up from $1.68 in the prior year.

MORE U.S. STATES MAKE PLANS TO REOPEN; CALIFORNIA HOLDS FIRM

More states in the U.S. South and Midwest signaled readiness on Wednesday to reopen their economies in hopes the worst of the Covid-19 pandemic had passed, but California’s governor held firm to sweeping stay-at-home orders and business closures. Nationwide, U.S. deaths totaled 47,050 on Wednesday, up about 1,800, with some states yet to report. The United States has the world’s largest number of cases at over 830,000.

IMPACT: The patchwork of still-evolving orders across the 50 states meant some Americans were still confined indefinitely to their homes, unable to work, while others began to venture out for the first time in weeks. Reopening prematurely before it is safe to do so will have tragic consequences in the longer run.

TRUMP: IF IRANIAN SHIPS GET TOO CLOSE ‘WE’LL SHOOT THEM OUT OF THE WATER’

Trump said on Wednesday he had instructed the U.S. Navy to fire on any Iranian ships that harass it at sea, a week after 11 vessels from Iran’s Islamic Revolutionary Guard Corps Navy (IRGCN) came dangerously close to American ships in the Gulf. “I have instructed the United States Navy to shoot down and destroy any and all Iranian gunboats if they harass our ships at sea,” Trump wrote in a tweet, hours after Iran’s Revolutionary Guards Corps said it had launched the country’s first military satellite into orbit.

IMPACT: Senior Pentagon officials said that Trump’s comments on Iran were meant as a warning to Tehran, but suggested that the U.S. military would continue to abide by their existing right to self-defense instead of any changes to their rules. Tensions between Iran and the United States increased earlier this year after the United States killed Qassem Soleimani, the head of Iran’s elite Quds Force, in a drone strike in Iraq.

TRUMP SIGNS IMMIGRATION ORDER CURBING GREEN CARDSTrump on Wednesday signed an order to temporarily block some foreigners from permanent residence in the United States, saying he was doing so in order to protect American workers during the Covid-19 pandemic. White House lawyers worked all day to craft the language for the order, prompting some officials to say the signing might have to wait for Thursday. But aides described Trump as eager to sign the document.One U.S. Department of Homeland Security official who requested anonymity said the order would only apply to people applying for permanent residence from outside the United States, not those already in the country seeking to adjust their status.

IMPACT: The order is to last for 60 days and then will be reviewed and possibly extended. Some critics saw Republican Trump’s announcement as a move to take advantage of the Covid-19 crisis to implement a long-sought policy goal of barring more immigrants ahead of the Nov. 3 election.

DAY AHEAD

Another slowdown in U.S. Initial Jobless Claims data, which upset investors three weeks ago after revealing a 6.8 million increase in demand for unemployment benefits amid the global lockdown, could help strengthen the Dollar. If forecasts are true, the gauge will have retreated for the second consecutive week to 4.35 million in the week ending April 18, hinting that measures by the Trump administration may have brought some stabilization in the labour market.

SENTIMENT

OVERALL SENTIMENT:

Another day of wild swings in the oil market but this time, prices went higher. That soothed the market and both stocks and Gold rallied on the day. Expect swings in sentiment to be the norm for now. Focus on the inevitable, i.e. the unlimited amount of fiat money in the system will drive prices of hard assets ever higher!

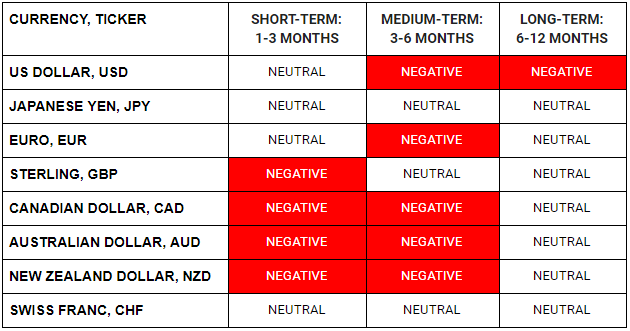

FX

STOCK INDICES

TRADING TIP

Rolling in the Dip

Unlike stocks or spot markets where the instrument can trade in perpetuity, futures contracts have a set rollover or expiration date. “Rollover” refers to the process of closing out all positions in soon-to-expire futures contracts and opening contracts in newly formed contracts. Understanding products like the USO Exchange Traded Fund (Oil ETF) whose underlying is made up of Oil futures is crucial to profitability.

Futures have various expiration months out the curve and each month’s futures are priced differently, relative to the cost of funding and the cost of storing the commodity in this case, oil. For example, the June Oil contract may be at $20, while the July contract may be at $24. Each time the fund rolls, you get fewer contracts of Futures as you are selling at the cheaper price ($20) to buy at the higher price ($24), this is a drag on your portfolio if this phenomenon persists as the number of fund holdings erodes over time. Even if the market prices do not fluctuate, as long as the futures curve remains upward sloping and time passes, the investor long these contracts will be losing money as time passes.

ETFs that deal in the futures market is a double-edged sword, understanding when the macro environment works for you or against you and understanding the products that you trade are crucial to successful investing. To illustrate the point, as WTI Oil June Futures rose 19.3% yesterday, the USO ETF was down by -10.68%.