WHAT HAPPENED YESTERDAY

As of New York Close 28 Apr 2020,

FX

U.S. Dollar Index, -0.22%, 99.87

USDJPY, -0.45%, $106.75

EURUSD, +0.02%, $1.0833

GBPUSD, +0.04%, $1.2435

USDCAD, -0.36%, $1.3980

AUDUSD, +0.57%, $0.6502

NZDUSD, +0.48%, $0.6076

STOCK INDICES

S&P500, -0.52%, 2,863.39

Dow Jones, -0.13%, 24,101.55

Nasdaq, -1.40%, 8,607.73

Nikkei Futures, +1.08%, 19,933.0

COMMODITIES

Gold Spot, -0.61%, 1,705.03

Brent Oil Spot, +2.58%, 20.24

SUMMARY:

Dollar was on the back foot as the slowing spread of the Covid-19 and moves to re-open economies supported the investor mood, ahead of major central bank meetings. AUD and NZD continued to creep relentlessly higher as trade data from both countries show that exports continue to remain robust. With food security being a key issue in the months ahead, both these currencies could continue to trade strong on that back of that.

Investors will be watching to see if the Fed gives any clues on its future policy path after it responded to the economic devastation of the Covid-19 pandemic by slashing rates, buying bonds and backstopping credit markets. The US Conference Board’s Consumer Confidence Index for April plunged to 86.9 (consensus 86.5) from a downwardly revised 118.8 (from 120.0) for March. The April reading is the lowest since June 2014. The key takeaway from the report is that consumers while thinking positively about things reopening again, are still less optimistic about their financial prospects, which could be a headwind for spending activity during the recovery phase.

S&P 500 declined 0.52% on Tuesday in a mixed session. Large-cap technology and health care stocks lagged while reopening enthusiasm continued to flow into the small-cap Russell 2000 (+1.3%). The Dow Jones Industrial Average shed 0.13%, while the Nasdaq Composite fell 1.40%. U.S. 2yr yield fell 4bp to 0.20% and U.S. 10yr yield fell 5bp to 0.62%.

In other earnings news, shares of Caterpillar (CAT 115.46, +0.26, +0.2%), 3M (MMM 157.61, +3.96, +2.6%), and PepsiCo (PEP 136.32, +1.4%) finished higher, even after the companies withdrew full-year guidance, while shares of UPS (UPS 96.43, -6.12, -6.0%) faltered after the company missed profit estimates.

Alphabet rose more than 7% on earnings after hours, as ad revenue slowdown turns out to be less than feared. Though $33.8 billion of Google’s total quarterly revenue of $41.16 billion came from advertising, a reflection of its continued reliance on a battered market, there is a silver lining. Sales from Google Cloud and YouTube continued to surge, underscoring versatility in the company’s overall product line — YouTube ad revenue increased 33.4%, to $4.04 billion from $3.03 billion a year ago, while Google Cloud sales grew 52%, to $2.78 billion from $1.83 billion.

TRUMP TO ORDER U.S. MEAT PROCESSING PLANTS TO STAY OPEN DESPITE COVID-19 FEARS

With concerns about food shortages and supply chain disruptions, Trump is expected to sign an executive order using the Defense Production Act to mandate that the plants continue to function, a senior administration official said.

U.S. meat companies slaughtered an estimated 283,000 hogs on Tuesday, down about 43% from before plants began shutting because of the pandemic, according to U.S. Department of Agriculture data. Processors slaughtered about 76,000 cattle, down about 38%.

IMPACT: The world’s biggest meat companies, including Smithfield Foods Inc, Cargill Inc, JBS USA and Tyson Foods, have halted operations at about 20 slaughterhouses and processing plants in North America as workers fall ill, stoking global fears of a meat shortage. UFCW, the largest U.S. meatpacking union, demanded that the administration compel meat companies to provide “the highest level of protective equipment” to slaughterhouse workers and ensure daily Covid-19 testing.

Any shortage in poultry due to supply chain destruction will put pressure on prices when demand returns. Meat exporting countries like New Zealand might get some positive tailwind for its currency.

BIDEN, SEEKING SUPPORT OF WOMEN, WINS HILLARY CLINTON’S ENDORSEMENT

The endorsement, at an online town hall on the effects of the Covid-19 crisis on women, came at a critical moment as Biden aims to raise his profile with female voters and other key demographic groups even as the pandemic ravages the U.S. economy.

Women favored Clinton over Trump in 2016, exit polls showed, and are expected to play a critical role in swaying the most competitive swing states in the Nov. 3 election between Biden and Trump.

IMPACT: The battle lines for the U.S. presidential election are not Dollar friendly. Biden’s main proposal is likely to be Nationalizing Healthcare and using wealth tax to fund the deficit. This is a Dollar bearish scenario as the U.S. will be running a much larger budget deficit due to the Covid-19 crisis.

U.S. COVID-19 DEATHS SURPASS VIETNAM WAR TOLL

U.S. Covid-19 death toll reached (56,567 Covid Deaths, 58,220 Vietnam War Deaths) a grim milestone on Tuesday, surpassing the number of American lives lost in the Vietnam War, as Florida’s governor met with Trump to discuss easing shutdowns aimed at curbing the pandemic.

About a dozen states were forging ahead to restart shuttered commerce without being ready to put in place the large-scale virus testing or means to trace close contacts of newly infected individuals, as outlined in White House guidelines on April 16.

IMPACT: The number of known U.S. Covid-19 infections has doubled over the past 18 days to more than 1 million. The actual count is believed to be higher, with state public health officials cautioning that shortages of trained workers and materials have limited testing capacity, leaving many infections unrecorded. Any spike in Covid-19 mortality in the U.S. will morbidly cause the Dollar to strengthen on risk-aversion.

DAY AHEAD

The Fed meets later today and, having thrown everything including the kitchen sink to protect the US economy in the battle against the economic damage of this crisis, no action is expected this time. As such, the market reaction may depend mainly on Powell’s remarks. From a risk-management perspective, Powell has more incentive to soothe investors’ nerves and hint that more stimulus is possible, which could briefly hurt the Dollar.

Investors will be hanging from Powell’s every word, eager to find out whether the central bank is willing to do even more if the crisis worsens, or whether policymakers feel they have done enough. For example, would the Fed consider going down the Bank of Japan’s path and introduce yield-curve control? How about buying stocks (though Treasury Secretary Mnuchin was quoted yesterday that this was an unlikely option for the Fed)?

Overall, he is likely to maintain a very cautious tone, and probably keep even these extreme options on the table. Ruling out more stimulus now would risk increasing market volatility, which is the last thing the Fed wants as that could reduce the effectiveness of all its previous actions. Better be safe than sorry, especially in the middle of a recession.

SENTIMENT

OVERALL SENTIMENT:

Yet another day of wild swings in the WTI crude oil June future falling almost 30% at one stage before retracing the losses to close slightly positive on the day. The volatility was likely exacerbated by the USO ETF announcing that they would be selling the June future to switch their long positions to contracts further out the calendar. S&P500 slowly crept to test the highs of the day before the open of the US session, and promptly sold off when the US trading hours got fully underway. There seems to be a puzzling trend of risk assets being bought during Asian hours before retracing during NY hours. Seems inexplicable why that is the case, but it’s something to keep an eye on.

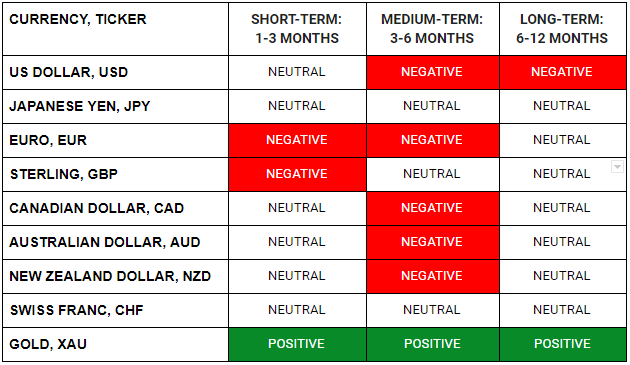

FX

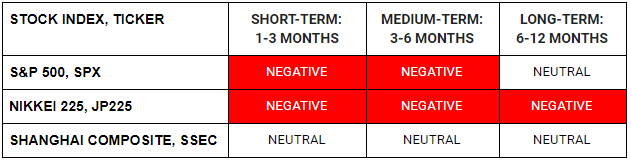

STOCK INDICES

TRADING TIP

Get out of the way!

The relentless rally in the stock markets in recent days is a good reminder that to succeed in trading, we need a healthy dose of humility along with a generous helping of prudence. Regardless of what you believe the fundamentals to be, when the price action is constantly going against your trade, it is imperative to have risk management measures which will ensure that your risk gets smaller as your performance deteriorates.

If the bear market should resume, there will be ample opportunities to get short in a meaningful way again. There is no need to be fighting the market on a trade that is not working when there are many other trade opportunities that can be exploited every day! Constantly be on the look out for trades that work, rather than stick to the ones that are a constant torture. That will help preserve your sanity and help grow your capital in the long run.