WHAT HAPPENED YESTERDAY

As of New York Close 24 Apr 2020,

FX

U.S. Dollar Index, -0.23%, 100.29

USDJPY, -0.07%, $107.51

EURUSD, +0.40%, $1.0821

GBPUSD, +0.20%, $1.2369

USDCAD, +0.22%, $1.4104

AUDUSD, +0.27%, $0.6387

NZDUSD, +0.20%, $0.6020

STOCK INDICES

S&P500, +1.39%, 2,836.74

Dow Jones, +1.11%, 23,775.27

Nasdaq, +1.65%, 8,634.52

Nikkei Futures, -1.29%, 19,190.0

COMMODITIES

Gold Spot, -0.12%, 1,729.43

Brent Oil Spot, +1.87%, 21.30

SUMMARY:

Dollar eased against the Euro on Friday, snapping a four-day winning streak as investors covered some bearish bets against the common currency. Despite an agreement by EU leaders to fund a recovery from the Covid-19 pandemic, delays to an agreement on divisive details of the European Union’s stimulus package has kept a lid on the Euro. French President Emmanuel Macron said differences continued among EU governments over whether the fund should be transferring grant money, or simply making loans.

U.S. Durable goods orders declined 14.4% m/m in March (consensus -10.0%). Excluding transportation, durable goods orders declined 0.2% (consensus -4.0%). Given the unprecedented set of circumstances, the projection being way off ironically isn’t that unexpected. Market sentiment continues to be driven by Covid-19 developments, oil production, and brewing geopolitical tension between China and U.S. For now, bad numbers will be the norm. Real economic data will start to matter at a later point in the cycle. The final reading for the University of Michigan Index of Consumer Sentiment for March was revised up to 71.8 (consensus 66.5) from the preliminary reading of 71.0. The final reading for March was 89.1.

S&P 500 increased 1.39% on Friday, wrapping up a negative week on a positive note amid a resurgence in buyers during the afternoon. The Dow Jones Industrial Average rose 1.11%, the Nasdaq Composite rose 1.65%, and the Russell 2000 rose 1.6%. U.S. 2yr yield remained unchanged at 0.22% and U.S. 10yr yield decreased 1bp to 0.60%.

Investors started the day parsing a mixed batch of earnings reports, including those from a trio of Dow components. Intel (INTC 59.26, +0.22, +0.4%), Verizon (VZ 57.93, +0.34, +0.6%), and American Express (AXP 83.17, +0.71, +0.9%) reported mixed earnings results, but shares were able to close higher despite early losses. Price action was muted from an index level, though, as the market appeared disinterested, even as oil prices ($17.03, +0.23, +1.4%) continued to rebound and the $484 billion Covid-19 relief bill was signed by Trump.

STATES MOVE TOWARD REOPENING

With the U.S. Covid-19 death toll topping 51,000 and nearly one in six workers out of a job, Georgia, Oklahoma, and several other states took tentative steps at reopening businesses on Friday, despite disapproval from Trump and medical experts. Georgia, one of several states in the Deep South that waited until early April to mandate restrictions imposed weeks before across much of the rest of the country to curb the outbreak, has become a flashpoint in the debate over how and when the nation should return to work.

Georgia was not alone in reopening. Oklahoma was permitting some retailers to resume business on Friday, Florida began reopening its beaches a week ago, South Carolina started easing restrictions on Monday, and other states will follow suit next week.

Trump, who had staked his November re-election on the nation’s booming economy before the pandemic, has given mixed signals about when and how the country should begin to get back to work.

IMPACT: In the latest protest against the shutdowns, hundreds of people gathered on Friday outside the Wisconsin State Capitol building in Madison calling for Democratic Governor Tony Evers to reopen the state, even as it reported its largest single-day jump of new Covid-19 cases. Based on the asian infection curve, the risk of a second wave of infection seems inevitable for the U.S. and any spike in Covid-19 related deaths will be bad for global risk assets as the U.S. remains a barometer for economic recovery. A resurgence of new infection will cause a bout of risk aversion which perversely will lead to USD strength.

TRIAL OF GILEAD’S POTENTIAL COVID-19 TREATMENT RUNNING AHEAD OF SCHEDULE

A key U.S. government trial of Gilead Sciences Inc’s experimental Covid-19 treatment may yield results as early as mid-May, according to the study’s lead investigator, after doctors clamored to enroll their patients in the study.

Those hopes were dampened somewhat on Thursday when details from a Chinese remdesivir trial involving patients with severe Covid-19 inadvertently released by the World Health Organization suggested it provided no benefit. Gilead pushed back on that interpretation saying the study, which was stopped early due to low patient enrollment, cannot provide meaningful conclusions.

IMPACT: Gilead on Thursday said it expected results from the NIAID trial in late May. The company’s shares, up more than 20% so far this year due largely to remdesivir prospects, were 1.7% higher at $79.10 on Friday. The Infectious Disease Society of America (IDSA), which represents more than 12,000 U.S. specialists, said it will make a formal recommendation once the entire body of evidence for remdesivir is available. Gilead has the potential to produce a positive wing outcome in this virus situation, any conclusive drug effectiveness on the virus will send optimism across the globe. If that should happen, growth currencies such as AUD and NZD will benefit from the positive risk sentiment.

ITALY TO REOPEN FACTORIES IN STAGED END TO COVID-19 LOCKDOWN

Italy will allow factories and building sites to reopen from May 4 and permit limited family visits as it prepares a staged end to Europe’s longest Covdi-19 lockdown, Prime Minister Giuseppe Conte said on Sunday. “We expect a very complex challenge,” Conte said as he outlined the road map to restarting activities put into hibernation since early March. “We will live with the virus and we will have to adopt every precaution possible.”

IMPACT: Manufacturers, construction companies and some wholesalers will be allowed to reopen from May 4, followed by retailers two weeks later. Restaurants and bars will be allowed to reopen fully from the beginning of June, although takeaway business will be possible earlier. Italy has been hardest hit by the virus pandemic, the lockdown has put a strain on the euro zone’s third-largest economy, which is headed for its worst recession since World War Two. Italian business leaders have called for the restrictions to be eased to head off economic catastrophe.

DAY AHEAD

Bank of Japan’s policy meeting will kick off on Monday, but it will not be a usual two-day gathering this time as policymakers are expected to reach their decision the same day. While under other circumstances, such an adjustment would signal an eventful meeting, the current virus situation may pressure the central bank for additional corporate aid and likely some flexibility on government bond purchases, whereas there is no doubt that interest rates will remain steady.

SENTIMENT

OVERALL SENTIMENT:

Risk assets rallied into the close without any clear reason but that seems to be the case these days. The relentless money printing has pretty much taken away the fear of the economic damage that is about to come. Economic damage, though inevitable, will slowly manifest itself in various ways. For now, focus on the trades that do not go against the tide of money.

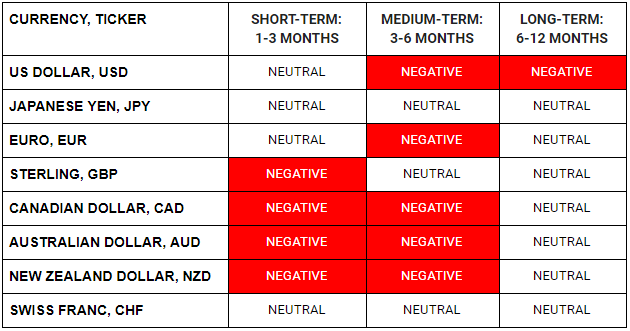

FX

STOCK INDICES

TRADING TIP

Time to Shine

Though the economic prospects of the world seem extremely bleak, risk assets such as stocks have relentlessly crept higher due primarily to the incessant money printing from various policymakers around the world. Until the folly of such policies manifests itself in the form of inflation, the printing presses will continue to work overtime.

To sell risk assets will be to fight against this tide of money. It could work, but it sure takes a lot of struggling. The easier thing to do would be find trades that go along with the tide. Gold is one such beneficiary. With infinite amounts of fiat money being printed, hard assets in finite supply will be repriced. Gold, although volatile, will inevitably and inexorably creep higher as time passes.