WHAT HAPPENED YESTERDAY

As of New York Close 15 May 2020,

FX

U.S. Dollar Index, -0.06%, 100.40

USDJPY, -0.21%, $107.04

EURUSD, +0.10%, $1.0816

GBPUSD, -1.00%, $1.2106

USDCAD, +0.43%, $1.4110

AUDUSD, -0.73%, $0.6415

NZDUSD, -1.17%, $0.5933

STOCK INDICES

S&P500, +0.39%, 2,863.70

Dow Jones, +0.25%, 23,685.42

Nasdaq, +0.79%, 9,014.56

Nikkei Futures, +1.31%, 20,040.0

COMMODITIES

Gold Spot, +0.71%, 1,743.00

Brent Oil Spot, +4.75%, 30.88

SUMMARY:

The USD index was relatively unchanged but the USD itself made strong gains vs GBP, AUD and NZD as these currencies which have been trading weak in the last few sessions continued to sell. Gold and Silver gained 0.7% and 4.8% respectively against the USD as hard assets continue to perform well in fiat money terms. With increasingly bad economic data, the expectations for money printing grow and that would mean more depreciation of fiat currencies against hard assets.

U.S. Industrial production declined 11.2% m/m in April (consensus -12.1%), which was the largest monthly drop in the 101-year history of the index. The capacity utilization rate fell from 73.2% to 64.9% (consensus 64.0%), which is 14.9 percentage points below its long-run average and a record-low in a series that dates back to 1967. The University of Michigan’s Index of Consumer Sentiment rose to 73.7 in the preliminary reading for May (consensus 67.4) from 71.8 in April. Dollar has been largely range-bound with its safe-haven appeal keeping it well supported overall. Against a basket of currencies, it was last at 100.380, having drifted 0.7% higher last week. GBP touched a seven-week low at $1.2073 after the chief economist of the Bank of England said it was looking more urgently at options such as negative interest rates and buying riskier assets to prop up the economy.

Early in the U.S. session, economic data showed total retail sales declined a record 16.4% m/m in April (consensus -11.9%) and industrial production declined 11.2% m/m in April (consensus -12.1%). The market wasn’t visibly upset by the data, though, likely due to the prevailing view that it can’t get any worse. Instead, there was a negative reaction to the news that the Trump administration moved to block semiconductor shipments to China’s Huawei Technologies. With relations already strained because of the Covid-19 outbreak, the move renewed worries about potential Chinese retaliation against U.S. companies.

S&P 500 (+0.39%), Dow Jones Industrial Average (+0.25%), and Nasdaq Composite (+0.79%) ended Friday’s session modestly higher, recovering from early declines that followed more weak economic data and increased U.S.-China tensions. The Russell 2000 outperformed with a 1.6% gain after a rough week for the small-cap index. U.S. 2yr rates remained unchanged at 0.16% and U.S. 10yr rates rose 1bp to 0.64%.

Today, Japan’s economy slipped into recession for the first time in 4-1/2 years, GDP data showed this morning, putting the nation on course for its deepest postwar slump as the coronavirus crisis takes a heavy toll on businesses and consumers. GDP contracted an annualised 3.4% (vs expected -4.6%) in the first quarter as private consumption, capital expenditure and exports fell, preliminary official data showed. Analysts expect Japan’s economy to shrink an annualised 22.0% in the current quarter, which would be the biggest decline on record and underscores the collapse in activity that is expected to see the worst global slump since the Great Depression of the 1930s.

HOUSE PASSES $3 TRILLION COVID-19 AID BILL

The U.S. House of Representatives on Friday narrowly approved a $3 trillion bill crafted by Democrats to provide more aid for battling the Covid-19 and stimulating a faltering economy rocked by the pandemic.

By a vote of 208-199 Democrats won passage of a bill that Republican leaders, who control the Senate, have vowed to block despite some Republican support for provisions aimed at helping state and local governments.

IMPACT: It directs nearly $1 trillion to state, local and tribal governments, including $500 billion in direct, flexible aid for state governments and an additional $357 billion for local governments and counties. And it adds $200 billion in pandemic hazard pay for essential workers and $75 billion for coronavirus testing, contact tracing, and treatment efforts.

The incessant money printing might create a lot of excesses in the economy and cause inflation as too much capital is chasing lagging productivity in times ahead. Businesses are not light switches that can be turned on and off, some will be taken off the market permanently and fear might keep new entrants away. This inflationary environment is beneficial to hard assets like Gold and Silver (as we have pointed out in last week’s Trade Insights on Silver’s strong technical outlook, it has exploded +7.7% since then till current time of writing ).

FED WARNS OF ‘SIGNIFICANT’ FINANCIAL VULNERABILITIES FROM PANDEMIC

In its latest report on financial stability, the Fed said the global pandemic imposed sweeping risks. While policy actions from the Fed and others have helped bolster the economy, and the banking system has withstood the initial downturn, the report warned of major risks if the pandemic proves lengthy or more severe than anticipated.

“The COVID-19 outbreak poses severe risks to businesses of all sizes and millions of households,” the central bank said as it ran down a list of trouble spots that could arise depending on how long the virus persists and keeps the economy on its heels.

IMPACT: Governments are starting to warn about the lingering effects of the virus while a good number of market participants are calling for a “v-shaped” recovery. There is a good chance that we are near the end of the bear-market rally and a second wave of infection in the U.S. will dampen risk sentiment. Safe-Haven currencies like Japanese Yen should trade at a premium in the months ahead.

BOE LOOKING MORE URGENTLY AT NEGATIVE RATES

The Bank of England is looking more urgently at options such as negative interest rates and buying riskier assets to prop up the country’s economy to fight the coronavirus crisis, the BoE’s chief economist was quoted as saying.

The Telegraph newspaper said Andy Haldane refused to rule out the possibility of taking interest rates below zero and buying riskier assets under its bond-buying programme.

IMPACT: Top BoE officials have previously expressed objections to taking rates below zero – as the central banks of the eurozone and Japan have done – because it might hinder the ability of banks in Britain to lend and hurt rather than help the economy. But with the BoE’s benchmark at an all-time low of 0.1% and Britain facing potentially its sharpest economic downturn in decades, talk of cutting rates to below zero has resurfaced. BoE will be the latest developed world central bank to officially discuss the prospects other than the RBNZ. This will be bearish for Sterling, and given the heightened volatility in global markets and geopolitics, GBP/JPY might head much lower.

DAY AHEAD

The coming week seems relatively quiet. The preliminary PMIs for April in the UK, US, and Eurozone will give us an update on how much businesses have suffered, while the minutes of the latest Fed meeting might reaffirm the central bank’s willingness to do even more, even as Powell hints that Congress should take the lead. Overall though, the most important variables for investors may be how quickly new virus cases increase now that economies are partially re-opening, and whether US-China tensions flare up any further.

SENTIMENT

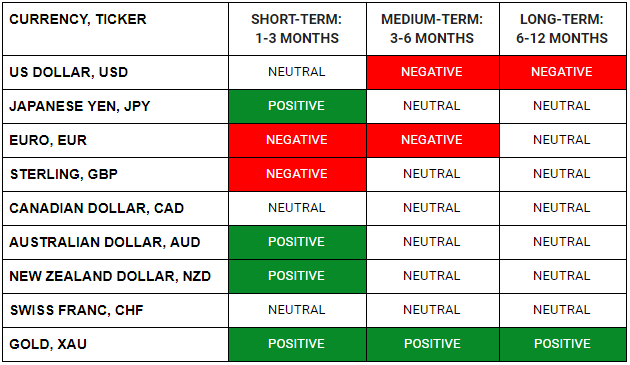

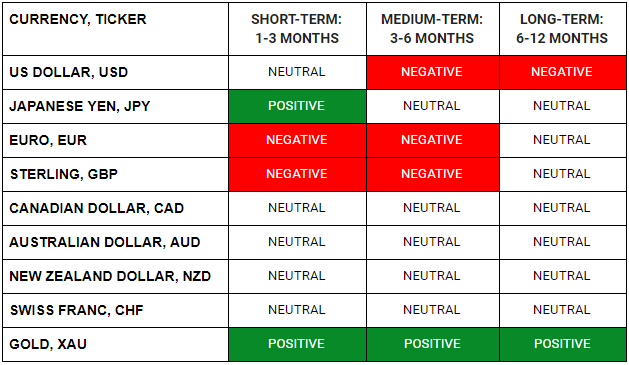

OVERALL SENTIMENT:

Stocks continue to trade well, but strangely risk currencies such as AUD and NZD could not rally. AUD is struggling due to the current trade tension between China and Australia and NZD is still suffering from RBNZ’s latest policy statement that it has asked banks to prepare for negative interest rates in time to come. GBP also trades extremely weak as Brexit negotiations are not making any headway and having no trade deal in the time of economic devastation is not a great place to be. Gold and Silver started to make the move against fiat currencies finally. Expect this move to be long-lasting.

Concentrate on trades that work. Sell that which is weak and buy that which is strong.

FX

STOCK INDICES

TRADING TIP

Rise and Shine!

Gold and Silver finally woke up and are truly shining bright. Just like a broken record, we will be singing this tune for some time to come. In a world where the money presses are working overtime all around the world, fiat money will be devalued against hard assets. We spoke of the imminent Silver move late last week just before it exploded. The reasons then remain valid and will continue to drive it higher over time.