WHAT HAPPENED YESTERDAY

As of New York Close 27 Apr 2020,

FX

U.S. Dollar Index, -0.20%, 100.09

USDJPY, -0.20%, $107.29

EURUSD, +0.04%, $1.0825

GBPUSD, +0.42%, $1.2421

USDCAD, -0.48%, $1.4037

AUDUSD, +0.97%, $0.6449

NZDUSD, +0.07%, $0.6024

STOCK INDICES

S&P500, +1.47%, 2,878.48

Dow Jones, +1.51%, 24,133.78

Nasdaq, +1.11%, 8,730.16

Nikkei Futures, +3.01%, 19,768.0

COMMODITIES

Gold Spot, -1.13%, 1,709.84

Brent Oil Spot, -7.37%, 19.73

SUMMARY:

Dollar fell across the board on Monday as several countries laid out plans to ease restrictions on businesses that have been closed due to the Covid-19 outbreak, boosting risk appetite and reducing demand for the safe-haven U.S. currency. Italy, which has the world’s second-highest Covid-19 mortality rate due to a large elderly population, is among the countries that have laid out plans to allow businesses to reopen.

The Yen gained after the Bank of Japan expanded its stimulus to help companies hit by the Covid-19 crisis, pledging to buy an unlimited amount of bonds to keep borrowing costs low as the government tries to spend its way out of the deepening economic pain. Typically, the currency should weaken if the Central Bank embarks on an unlimited Quantitative Easing program but Japan has essentially been on such a program for years. As such, it was more of a sell the fact as word that this was on the table was already leaked last week.

S&P 500 gained 1.47% on Monday, as investors showed optimism in reopening efforts indicated by more states and countries. The Dow Jones Industrial Average (+1.51%) and Nasdaq Composite (+1.11%) also advanced more than 1.0%, while the Russell 2000 outperformed with a 4.0% gain. U.S. 2yr yield rose 2bp to 0.24% and U.S. 10yr yield rose 7bp to 0.67%.

At least nine U.S. states had their economies partially reopened as of Monday, according to The New York Times, while other states like New York, Texas, and Ohio announced plans to gradually reopen in the coming weeks. The prospective increase in economic activity, even without a confirmed Covid-19 treatment, had investors piling into previously-neglected cyclical sectors.

Italy, France and Spain initiated steps to reopen their economies as well. Some attribute the risk-on sentiment partially to the Bank of Japan lifting the cap on its JGB bond purchases, and announcing plans to increase its purchases of corporate bonds and commercial paper.

GEORGIA EATERIES REOPEN AS MORE U.S. STATES EASE PANDEMIC SHUTDOWNS

Georgia, at the vanguard of states testing the safety of reopening the U.S. economy in the midst of the Covic-19 outbreak, permitted restaurant dining for the first time in a month on Monday while governors in regions with fewer cases also eased restrictions.

Eager to revive battered commerce despite warnings from public health experts about the lack of testing, a handful of states from Montana to Mississippi were also set to reopen some workplaces deemed to be non-essential.

Alaska, Oklahoma, and South Carolina, along with Georgia, previously took such steps, after weeks of mandatory lockdowns that have thrown millions of Americans out of work and led to forecasts that an economic shock of historic proportions is at hand.

IMPACT: Trump and some local officials have criticized Georgia Governor Brian Kemp for forging ahead to add restaurants and movie theaters to the list of businesses – hair and nail salons, barbershops, and tattoo parlors – that he allowed reopening last week, albeit with social-distancing restrictions still in force. As states start to reopen, keep an eye out for the rise in a second wave of infection within 14-28 days later, any spike will cause the Dollar to strengthen as risk-aversion due to policy error will take hold. This might be a case of taking one step forward and two steps back.

BANK OF JAPAN EXPANDS STIMULUS AS PANDEMIC PAIN WORSENS

At the meeting on Monday, cut short by a day as a precaution against the spread of the pandemic, the BOJ kept its interest rate targets unchanged, as had been widely expected. Kuroda said the central bank was ready to act further to fight the impact of the novel coronavirus, which he said could do more harm to the global economy than the 2008 collapse of Lehman Brothers.

Under a policy dubbed yield curve control, the BOJ targets short-term interest rates at -0.1% and 10-year bond yields around 0%. It also buys government bonds and risky assets to pump money aggressively into the economy.

To ease corporate funding strains, the BOJ said, it will boost three-fold the maximum amount of corporate bonds and commercial paper it buys to 20 trillion yen ($186 billion). The central bank also clarified its commitment to buy unlimited amounts of government bonds by scraping loose guidance to buy them at an annual pace of 80 trillion yen.

IMPACT: The BOJ also sharply cut its economic forecast and projected inflation would fall well short of its 2% target for three more years, suggesting its near-term focus will be to battle the crisis. Their determination to do what they have done for years for no results remains strong. JPY was unimpressed and in fact, strengthened mildly as a result. Part of the BoJ plan is to weaken the JPY to boost inflation but it has not been the case thus far. Further strengthening in the JPY will likely be met with more comments on their resolve to ease more aggressively.

AUSTRALIA TO OUTLINE COVID-19 HIT TO ECONOMY NEXT MONTH

The Australian government will give an update next month on the economic impact of the coronavirus before providing further outlook in June, it said on Tuesday, bowing to calls for more fiscal transparency in relation to the crisis.

Treasurer Josh Frydenberg will outline the impact of the outbreak and the federal government’s response in a statement to parliament on May 12, the day the government was originally scheduled to deliver its full annual budget.

IMPACT: A prelude into the impact on the Australian economy will be Westpac Banking Corp earnings. The bank on Tuesday said it expects to record pre-tax impairment provisions of A$2.24 billion ($1.4 billion) for the first half, largely due to the economic deterioration expected from the Covid-19 outbreak. Westpac is set to announce results for the six months ending March 31 and its decision on interim dividend payment on May 4. A huge miss in earnings and revision lower in revenues might cause Aussie to lose some steam.

DAY AHEAD

The Fed has thrown everything including the kitchen sink at the US economy in a desperate bid to avoid total catastrophe as the deadly Covid-19 has forced most businesses to go into hibernation. That has left the Fed with very few new options and policymakers are expected to sit tight when they meet on Wednesday for their first regular meeting since January.

SENTIMENT

OVERALL SENTIMENT:

WTI June futures fell more than 25% but did not cause much of a panic as the market seems to have become used to the wild moves. Gold weakened more than 1% against the USD but the USD was weak against most of the other currencies, especially the AUD (+0.97%). Stocks started weak in early Asia with S&P down 0.5% but steadily recovered throughout the day to close more than 1% higher. Everything seems mixed and confused but eventually the fundamentals will reassert themselves.

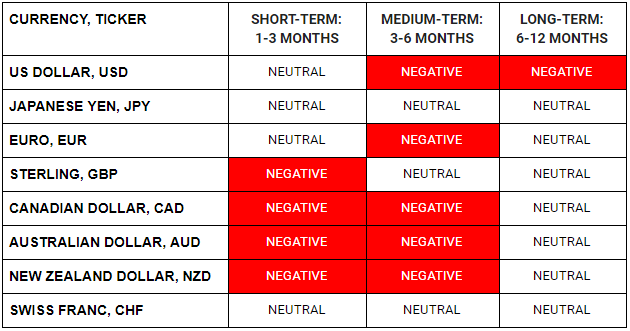

FX

STOCK INDICES

TRADING TIP

Watch Out For The Second Wave

Countries and States that are re-opening their economies do not seem to realise that bulldozing your way into economic recovery whether be it via monetary policy or reopening commerce without proper measures set in place may be a fool’s errand in the long run. Singapore and many other established governments are good reference cases for how things can go awry in a short span of time if they rest on their laurels. The city-state was the poster boy for the containment of Covid-19 earlier on in the pandemic, but that proved to be an illusion. Mistaking a victory in an early battle means that the war is won, imported cases started to infect the community and with uncurtailed community spread, it quickly became one of the countries with the highest % rate of infections (adjusted for population size) and eventually had to implement draconian social distancing measures.

Watch out for the increase in rate of infections for the re-opened countries and states and that will be a good barometer for how much more protracted this crisis will be. The next 3-4 weeks will be a crucial period.