WHAT HAPPENED YESTERDAY

As of New York Close 8 May 2020,

FX

U.S. Dollar Index, -0.08%, 99.73

USDJPY, +0.36%, $106.67

EURUSD, +0.06%, $1.0841

GBPUSD, +0.37%, $1.2409

USDCAD, -0.32%, $1.3927

AUDUSD, +0.54%, $0.6530

NZDUSD, +0.82%, $0.6135

STOCK INDICES

S&P500, +1.69%, 2,929.80

Dow Jones, +1.91%, 24,331.32

Nasdaq, +1.58%, 9,121.32

Nikkei Futures, +2.23%, 20,140.0

COMMODITIES

Gold Spot, -0.89%, 1,702.65

Brent Oil Spot, +5.58%, 28.19

SUMMARY:

US key jobs number, the Non-farm payrolls for April declined by 20.5 million (consensus -21.00 million), and the unemployment rate increased to 14.7% (consensus 16.2%). Those were the worst readings in the post-World War II era, but the number of unemployed persons said to be on “temporary layoff” increased about ten-fold to 18.1 million in April. This is noteworthy because it shows that most workers who were recently laid off are optimistic about being reemployed. That sentiment would be consistent with 1) the market’s view that the jobs data can’t get any worse and 2) news that more companies are restarting operations as states move along with their reopening plans. If those assumptions turn out to be wrong, then the jobs market will be even more dire in the weeks ahead.

Dollar posted its largest weekly gain versus the Euro in more than a month, although that was more related to the European single currency’s issues concerning the German Court’s decision against the European Central Bank’s asset purchases. Separately, U.S.-China tensions appeared to drop a notch today after the two sides reportedly pledged to make progress on their Phase One trade deal.

U.S. stocks extended weekly gains on Friday, as the market saw reasons to stay positive on the economic outlook despite the dismal employment report for April. The S&P 500 (+1.69%), Dow Jones Industrial Average (+1.91%), and Nasdaq Composite (+1.58%) advanced more than 1.5%, while the Russell 2000 rose 3.6%.

Apple (AAPL 310.13, +7.21, +2.4%) plans to reopen stores in several U.S. states next week. Boeing (BA 133.44, +4.79, +3.7%) plans to reopen its 737 MAX factory later this month. Uber (UBER 32.79, +1.86, +6.0%) observed ride-sharing growth over the past three weeks, and tickets to Walt Disney’s (DIS 109.16, +3.59, +3.4%) Shanghai theme park sold out within minutes.

EU PLANS TO RESTART TRAVEL AND TOURISM DESPITE COVID-19

EU states should guarantee vouchers for travel cancelled during the Covid-19 pandemic and start lifting internal border restrictions in a bid to salvage some of the summer tourism season, the bloc’s executive will say this week.

“To provide incentives for passengers and travellers to accept vouchers instead of reimbursement, vouchers should be protected against insolvency of the issuer and remain refundable by the end of their validity if not redeemed,” the draft document said. The EU executive will also tell the bloc’s 27 member countries to gradually lift internal border restrictions and restart some travel to help the ailing tourism sector.

IMPACT: Tourism normally brings in 150 billion euros every season from June through August with some 360 million international arrivals, according to the Commission. Titled “Europe needs a break” the Commission’s tourism strategy will call for targeted restrictions to replace a general ban on travel and seek a gradual lifting of internal border checks where the health situation has improved. “Don’t count the chickens before they hatch” as the old adage says, a second wave of infection is a probable scenario as we’ve witnessed in South Korea over the weekend, such a scenario will be bearish for the Euro. In addition, given how divided the EU is politically, any spikes in the Euro should be sold.

U.S. TO WITHDRAW PATRIOT MISSILES FROM SAUDI ARABIA OVER OIL DISPUTE

The U.S. is pulling two Patriot missile batteries and some fighter aircraft out of Saudi Arabia, an American official said, amid tensions between the kingdom and the Trump administration over oil production. The decision scales back the American presence in Saudi Arabia just months after the Pentagon began a military buildup there to counter threats from Iran. About 300 troops that staff the two batteries would also leave Saudi Arabia, according to the official, who spoke on condition of anonymity to discuss sensitive military operations.

IMPACT: When Saudi Arabia ramped up oil production and slashed prices this year, Republicans accused the kingdom of exacerbating instability in the oil market, which was already suffering because of the Covid-19 pandemic. The volatility and price crash in oil hurt U.S. shale producers, leading to layoffs in the industry, particularly in Republican-run states. Some Republican senators warned in late March that if Saudi Arabia did not change course, it risked losing American defense support and facing a range of potential “levers of statecraft” such as tariffs and other trade restrictions, investigations and sanctions.

This gives Saudi Arabia less reasons to play nice with U.S. Shale, Saudi Arabia is known to have tried to bankrupt U.S. Shale before by flooding the world with Oil, and now they have good reasons to do so. Watch out below for Oil prices and Oil-Linked currencies like the Canadian Dollar and Mexican Peso.

HALF OF SPANIARDS WILL SEE LOCKDOWN EASED FROM TODAY AS DEATH TOLL FALLS

Spain’s daily death toll from the Covid-19 fell to its second-lowest since mid-March on Saturday, as half the country prepared to move to the next phase of an exit from one of Europe’s strictest lockdowns.

Spain began to loosen its lockdown last week, but Phase 1 will include a considerable easing of measures that will allow people to move around their province as well as attend concerts and go to the theatre. Gatherings of up to 10 people will be allowed.

Spain’s daily death toll from the Covid-19 fell to 179 on Saturday, down from 229 the previous day and a fraction of highs above 900 seen in early April. The cumulative death total rose to 26,478 while the number of diagnosed cases rose to 223,578 from 222,857 the day before, the health ministry said.

IMPACT: Some 51% of the population will progress to Phase 1 of a four-step easing plan today after the government decided the regions in which they lived met the necessary criteria. The country’s two biggest cities – Madrid and Barcelona – do not currently meet the criteria for easing and will remain in Phase 0.

In a positive step for Spain’s tourism industry, which contributes around 12% of economic output, hotels will be allowed to open all rooms and nature tourism will be allowed for groups of up to 10. With reference to similar reasons above for the EU, a second wave of infection is a highly probable outcome.

DAY AHEAD

There can be no hiding from the awful economic data that is now pouring in from all angles as we move well into the second quarter. Australian jobs, UK Q1 GDP, and US retail sales and inflation numbers will be the next key releases to showcase the virus-inflicted damage. But amid growing optimism about the pandemic easing, the Reserve Bank of New Zealand will likely err on the side of caution at its policy meeting, posing a downside risk for the Kiwi and other commodity dollars.

SENTIMENT

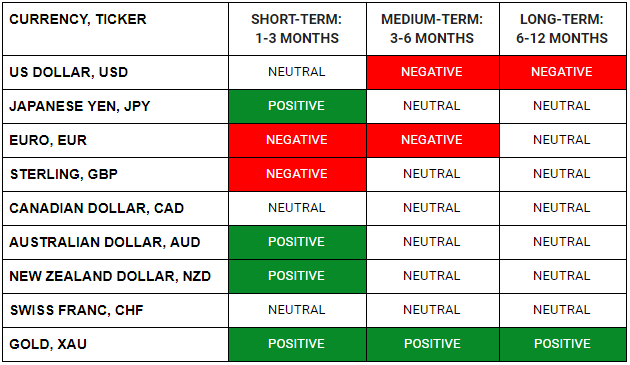

OVERALL SENTIMENT:

US stocks continued to grind higher, while Fed Futures edged away from negative interest rates territory to hover around 0%. With interest rates edging higher, Gold lost some momentum and backed off more than 1% from the highs. USD, however, remained weak against most developed currencies except the JPY. With stock sentiment diverging from the economic reality, it has become a market that requires patience as fundamentals will eventually matter again.

With Australia and New Zealand seemingly doing all the right things to keep the outbreak under control, their currencies are leading the way in this bout of USD weakness. This is likely to continue as food security and optimism on re-opening of economies become key themes going forward.

FX

STOCK INDICES

TRADING TIP

Threat Of Inflation

The Fed’s balance sheet is expected by many estimates to expand from $4 trillion to $10 trillion this year and is already up to $6.7 trillion within two months of the crisis and is still growing at a swift rate. We’re already seeing the largest year-over-year percentage growth in broad money supply in modern history. But outside of essentials like groceries and healthcare, that money isn’t moving around yet, with velocity extremely low.

In the years ahead, the possibility of broad inflation is back on the table. As pandemic lockdowns ease and ongoing government stimulus tries to get the economy back up off the floor, consumer demand can increase while the new money supply remains in the system. The timeline on which this happens depends on how much stimulus and consumer/business support both the Treasury and Federal Reserve print and hand out to Main Street, and how fast the virus goes away enough such that restaurants, hotels, airlines, and other businesses can partially and then completely re-open.

Over the multi-year longer-run, if we see a trend towards diversification of supply chains by bringing production facilities back to the United States or other higher cost locations, that could further raise inflationary pressures because it would start to undo one of the major deflationary outlets (offshoring) that has been in place for decades.

WHAT HAPPENED YESTERDAY

As of New York Close 7 May 2020,

FX

U.S. Dollar Index, -0.38%, 99.82

USDJPY, +0.20%, $106.36

EURUSD, +0.38%, $1.0836

GBPUSD, +0.25%, $1.2374

USDCAD, -1.21%, $1.3974

AUDUSD, +1.56%, $0.6501

NZDUSD, +1.40%, $0.6094

STOCK INDICES

S&P500, +1.15%, 2,881.19

Dow Jones, +0.89%, 23,875.89

Nasdaq, +1.41%, 8,979.66

Nikkei Futures, +2.68%, 19,928.0

COMMODITIES

Gold Spot, +1.69%, 1,714.42

Brent Oil Spot, -1.15%, 26.70

SUMMARY:

Dollar fell from two-week highs on Thursday, as investors booked profits on the currency’s gains this week before today’s U.S. nonfarm payrolls report for April, which could show massive job losses amid a Covid-19 pandemic that has ravaged the global economy. The USD weakness was triggered when Fed Funds futures started to price for negative interest rates in 2021 during the NY trading session. Hard commodity currencies such as AUD and NZD and Gold ripped higher as the implied interest rates slipped below 0% in the US.

Non-farm business sector labor productivity decreased 2.5% in the first quarter (consensus -6.0%) following a 1.2% increase in the fourth quarter. Unit labor costs increased by 4.8% ( consensus +2.9%) after increasing 0.9% in the fourth quarter. The key takeaway from the report is that productivity was weak, which is a headwind to an increased standard of living. That headwind should be even stronger in the second quarter. Continuing claims, or the total number of Americans receiving unemployment benefits, rose to a fresh record of 22.6 million in the week ended April 25. The weekly pace of filings is decelerating, suggesting the worst of the layoffs may be over as several states embark on limited reopenings of restaurants, retail shops, and other businesses.

Cyclical sectors led the S&P 500 to a 1.15% gain on Thursday, while mega-cap technology stocks carried the Nasdaq Composite to a 1.41% gain and into positive territory for the year. The Dow Jones Industrial Average rose 0.89%, and the Russell 2000 rose 1.6%. U.S. 2yr yield fell 4bp to 0.13% and U.S. 10yr yield fell 9bp to 0.63%.

The day started with investors receiving economic data that the market construed as relatively good: weekly initial jobless claims totaled 3.169 million (consensus 2.900 million), but it was encouraging that it reflected another 677,000 decline from the prior week. Likewise, China’s imports fell more than expected in April, but an increase in exports was a nice surprise.

FRANCE TO RE-OPEN ON MONDAY

France is ready to start unwinding its Covid-19 lockdown from next Monday as planned, the prime minister said on Thursday, although some regions including the Paris area where the virus is still circulating would keep some restrictions.

The country has made enough progress in slowing down the spread of the virus and reducing strain in hospitals to gradually return to normal, Prime Minister Edouard Philippe said. Schools, cafes and most shops have been shut for nearly two months.

IMPACT: Next week, about 1 million children and 130,000 teachers will return to school, the education minister said. Some 25,809 people have died of Covid-19 in France, according to official data. The Eurozone is already in a fractured state and a second wave of infections will weigh on the Euro as the policy response and government coordination within the EU has been abysmal and ineffective in addressing the virus and its economic impact.

BLAME CHINA. REMAKE ECONOMY

Several Trump aides say their 2020 campaign will now be chiefly defined by two themes: Trump is the only candidate who can resurrect the economy and that Biden will not be as tough on China, a country Trump is blaming for the pandemic.

It is a message resonating with Trump’s base, according to interviews with more than 50 voters in three swing counties in the battleground states of Pennsylvania, Michigan, and Wisconsin – states Trump won in 2016 by less than a percentage point and that will decide whether he can win a second term.

Trump officials say the new messaging, being sent to Republican state leaders across the country and pushed in new anti-Biden ads across swing states, reflects internal and external polling data that shows voters trust Trump more on the economy, and that Americans across party lines distrust China.

IMPACT: The recalibrated strategy comes as Trump faces a more difficult re-election campaign amid an outbreak that has now infected more than 1.2 million in the United States and killed over 70,000 – the world’s highest number of cases and deaths – and led to over 30 million filings for unemployment in the past six weeks. A Pew Research Center survey in late April showed two-thirds of Americans viewed China unfavorably now, up 20 points since the start of the Trump administration in January 2017. Expect more geopolitical headwinds as we head into Nov U.S. elections and for Safe-Haven currencies like the Japanese Yen and U.S. Dollar to trade at a premium relative to risk-assets.

STERLING’S POST-BOE RALLY FADES; POOR OUTLOOK WEIGHS ON POUND-TRADERS

The Bank of England held rates steady and announced no further stimulus, as was broadly expected, and said it was ready to take fresh action to counter the economic fallout from the Covid-19 pandemic.

The bank will consider what it needs to do with its 645 billion Pounds ($796 billion) bond-buying programme in June when it will have more clarity on how the government intends to lift its Covid-19 lockdown, Governor Andrew Bailey said. It was appropriate that the BoE continues with its “aggressive” pace of bond-buying for now, Bailey said.

IMPACT: As mentioned yesterday in our update, Sterling staged a knee-jerk relief rally, as there had been some expectations that the BoE could extend quantitative easing, but it soon faded into the close. Weighing on Sterling are the ongoing Brexit negotiations. Britain insists that it will not seek an extension to the transition period, which is due to end in December 2020, whether or not a trade deal has been struck. GBP spiked to a high of 1.2418 on the decision but dribbled down to a low of 1.2267 as investors are reminded of the bleak outlook ahead for the UK. However, it managed to recover and spike higher as USD weakened broadly when short term US interest rates for 2021 slipped below 0%.

DAY AHEAD

The American economy is forecast to have lost a breath-taking 20 million jobs, which would push the unemployment rate up to 14%, far above the 10% peak of the previous recession. Average hourly earnings are expected to have lost steam too, but admittedly, the focus will be on job losses, not wage growth.

Also, employment numbers for April are due out of Canada later today, but as far as jobs reports go, this will be one that nobody will be looking forward to. Canada has been no exception in the global pandemic of the Covid-19 and after losing one million jobs in March, the employment picture is about to get much worse. The number of people out of work is projected to have shot up by a record 4 million in April, pushing unemployment to an astonishingly high rate of 18.0% – another record – from 7.8% in March.

Like many other countries, Canada has begun to loosen some of its restrictions, with several provinces allowing some retailers and businesses to reopen. Assuming that all goes to plan and a second wave of infections can be avoided, the April jobs figures may be as bad as they get.

The question now is how quickly economic activity returns to normal and how many businesses will the stimulus packages from the government and central bank manage to save from going bust. The Canadian government has responded with a sizable fiscal aid package amounting to C$260 billion (11% of GDP). The Bank of Canada’s emergency asset purchases are also in that range, totalling C$200 billion, and at its last meeting, it expanded its program to include provincial and high-grade corporate bonds.

Market is getting used to massive numbers in terms of job losses, and is unlikely to react to much. The driver, especially for the currency market, will continue to be US interest rates. Should it slip further into negative territory, USD weakness will accelerate.

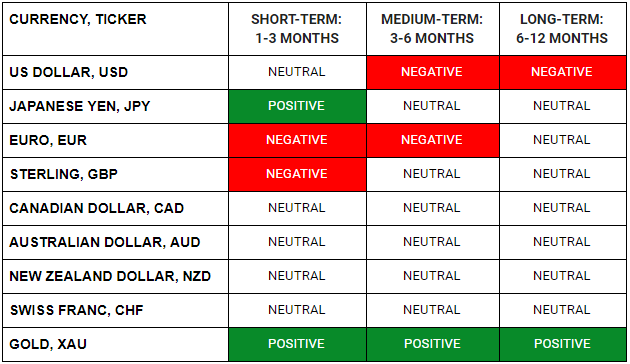

SENTIMENT

OVERALL SENTIMENT:

US Fed Funds futures started to price for negative interest rates for the US policy rate in 2021. This is despite repeated statements from various Fed speakers expressing very little enthusiasm for negative interest rates thus far. USD weakened against most developed currencies and especially so against Gold. It was a perplexing move as no one could really pin down a reason for this, so most experts settled on hedging or stop-outs by banks and other investors.

Whatever the reason might be, it is a significant development, and the best trade, in our opinion, to profit from this is to be long Gold over the long run. In a world of negative nominal and real rates, Gold will shine.

If the world was so bleak that negative rates were being priced in the US, it is perplexing that stock markets would be rising but that seems to be the case. Again, it seems to be the wave of free money driving asset markets higher. Stay out of the way for now and get involved with the easier trades.

FX

STOCK INDICES

TRADING TIP

Bitcoin’s Coming of Age

Bitcoin has been around for more than a decade and has survived numerous attacks from policymakers and hackers alike, proving itself to be the antifragile asset it claims to be when Satoshi Nakamoto first invented it. Yesterday, Bitcoin as an asset was given a credibility boost when Hedge Fund legend Paul Tudor Jones announced that he had allocated a percentage of his fund to it as a hedge against the inflation he sees coming from the incessant and indiscriminate central bank money-printing around the world, telling clients that bitcoin reminds him of the role gold played in the 1970s.

In his own words, “We are witnessing the Great Monetary Inflation — an unprecedented expansion of every form of money, unlike anything the developed world has ever seen.” Indeed, the purpose Satoshi Nakamoto had for Bitcoin was for a time like this, to protect savers from the hubris of government monetary experiments.

Bitcoin is transitioning from being a collectible that appeals to the millennials to a store of value taken seriously by the great investors of our time. As a non-sovereign monetary good, it is possible that at some stage in the future Bitcoin will become a trusted store of value much like Gold did during the classical gold standard of the 19th century.

WHAT HAPPENED YESTERDAY

As of New York Close 6 May 2020,

FX

U.S. Dollar Index, +0.40%, 100.20

USDJPY, -0.36%, $106.21

EURUSD, -0.38%, $1.0799

GBPUSD, -0.90%, $1.2325

USDCAD, +0.83%, $1.4164

AUDUSD, -0.63%, $0.6392

NZDUSD, -0.75%, $0.6007

STOCK INDICES

S&P500, -0.70%, 2,848.42

Dow Jones, -0.91%, 23,664.64

Nasdaq, +0.51%, 8,854.39

Nikkei Futures, -0.96%, 19,407.5

COMMODITIES

Gold Spot, -1.01%, 1,690.00

Brent Oil Spot, -6.25%, 27.01

SUMMARY:

Safe-haven Yen and Dollar rose on Wednesday, as investors sought refuge in these currencies in the wake of dire global economic numbers, manufacturing data in the Eurozone and the bleak picture painted by the UK – the country that was “the most reluctant in Europe to impose a lockdown has become the most cautious to start reopening”, with public opinion frightened of the consequences and Boris Johnson eager to avoid breaking Italy’s “sad record” , undermining the Euro and Sterling. U.S. private payroll data also showed a record of more than 20 million jobs lost in April based on the ADP National Employment Report, but the Dollar held gains.

Mega-cap technology stocks carried the Nasdaq Composite to a 0.5% gain on Wednesday, but another late fade in the market left the S&P 500 (-0.7%), Dow Jones Industrial Average (-0.9%), and Russell 2000 (-0.8%) in negative territory. U.S. 2yr yield fell 2bp to 0.17% and U.S. 10yr yield rose 6bp to 0.72%. The fade was attributable to Trump’s comments on China near the close, he cited – “This is really the worst attack we’ve ever had. This is worse than Pearl Harbor. This is worse than the World Trade Center. There’s never been an attack like this,” Trump said at the White House on Wednesday. “And it should’ve never happened. It could’ve been stopped at the source. It could’ve been stopped in China. It should’ve been stopped right at the source, and it wasn’t.” Describing it as an attack worse than Pearl Harbour and 9/11 is not going to help with US-China relations.

For most of the day, money continued to flow into Apple (AAPL 300.63, +3.07, +1.0%), Microsoft (MSFT 182.54, +1.78, +1.0%), Amazon (AMZN 2351.26, +33.46, +1.4%), Facebook (FB 208.47, +1.40, +0.7%), and Alphabet (GOOG 1347.30, -3.81, -0.3%). Typically, wherever these stocks move, the broader market follows.

TRUMP TO REFOCUS COVID-19 TASK FORCE ON ECONOMIC REVIVAL, CONCEDES RISKS

Trump said on Wednesday his coronavirus task force would shift its primary focus to reviving U.S. business and social life while acknowledging that reopening the economy could put more lives at risk.

In a series of tweets, Trump said the White House task force he formed in March would not wind down, as he suggested on Tuesday, but would instead add some advisers and center its attention on “SAFETY & OPENING UP OUR COUNTRY AGAIN.”

Asked later if Americans will have to accept that reopening will lead to more deaths, Trump told reporters: “You have to be warriors. We can’t keep our country closed down for years and we have to do something. Hopefully, that won’t be the case, but it could very well be the case.”

IMPACT: While New York state, New Jersey and other early U.S. hotspots have lowered their infection curves since mid-April, a number of states, mainly in the Midwest, have posted sharp spikes in new cases and deaths. Minnesota has set a record for new cases nine out of the last 14 days, including 728 cases on Wednesday. Safe-haven Dollar and Yen are already trading strongly in the face of geopolitical and economic headwinds, any spike in infections due to reopening should provide continued strength to those two currencies against most counterparts.

CANADA’S BRITISH COLUMBIA THE LATEST PROVINCE TO UNVEIL RESTART PLAN

British Columbia will begin reopening its economy as early as mid-May, the premier said on Wednesday, as new Covid-19 cases dwindle and other parts of the country, including Quebec and Manitoba, begin to loosen their restrictions. British Columbia has a population of about 5 million people and shares a border with Washington state, where the first major U.S. outbreak occurred.

IMPACT: As of Wednesday, there were 62,458 reported Covid-19 cases in Canada and 4,111 deaths, Chief Public Health Officer Theresa Tam said, adding Canada’s epidemic continued to slow. North American states are eager to reopen, Canada should be prudent about this as well, a global spike in reinfection will prolong the demand destruction in oil, and coupled with a protracted economic crisis, will weigh heavily on the oil-linked commodity currency.

NEW ZEALAND TO RUN DEFICITS FOR EXTENDED PERIOD, DEBT TO EXCEED TARGETS

New Zealand’s Finance Minister said on Thursday the government will be running deficits for an extended period and its debt level would increase to levels well beyond previous targets.

He said the budget, to be released next Thursday, will carry on supporting industries hit by Covid-19 and despite the additional borrowing, New Zealand will remain among the least indebted countries.

IMPACT: The RBNZ has been more liberal with its monetary policy since the start of the crisis, even suggesting that they are considering negative interest rates. The trajectory for the Kiwi should be lower in the long run as the economic impact of the virus unfolds.

DAY AHEAD

The Bank of England’s new governor Andrew Bailey will brief markets about the central bank’s policy decision and announce his first quarterly economic projections later today, earlier than the usual timing in order to comment on the interim Financial Stability report as well. Having deployed big stimulus firepower in previous meetings, the bank is likely to stand pat this week, with markets turning attention to growth forecasts after warnings of a painful contraction in Q2. A speech by the UK Prime Minister later in the day could be another driver of volatility for the pound as the market is eager to hear about Boris Johnson’s reopening plans.

Any rebound could prove short-lived if policymakers cast doubts about a rapid economic recovery, leading to a continuation this month’s sell-off in the GBP. A cautious speech by Boris Johnson accompanied by a more gradual removal of restrictions than markets expect could add to the bearish sentiment.

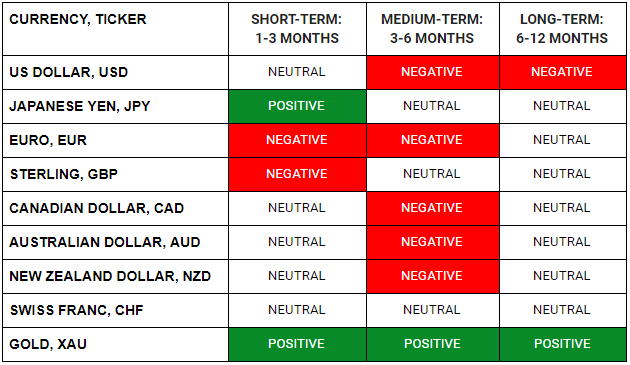

SENTIMENT

OVERALL SENTIMENT:

Stocks tried hard to rally but ended pretty much in the same place. Fixed income tried to sell off, but also ended up pretty much in the same place. Gold futures sold off nearly 2% but managed to recoup about a third of its losses from the low. The EUR continued to trade weak with EURJPY breaking below the 2017 low of around 114.80-85. USD and JPY traded strong for the day, as sentiment seems to be trading on the weaker side. The anti-China rhetoric from Trump and other US

FX

STOCK INDICES

TRADING TIP

Take time to Reflect

There will be times in your trading journey that prices will move in a fashion that is counter to everything you believe to be true. For now, the prices of risk assets seem to be defying the gravity pull of a global economy that is getting devastated by the Covid-19 outbreak.

It is essential at junctures like this to step away from trades that are not working and look instead for trades which are. For instance, a developing theme is the inability of the European governments to agree on a cohesive fiscal policy to save the deteriorating economy. The German court ruling that the ECB’s bond buying programme initiated 5 years ago, for the previous crisis, is unconstitutional is yet another nail in the coffin of European Monetary Union project.

There will always be trade opportunities that do not require you to fight against the market trend. Concentrate on those while you bide your time and wait for what you believe to be true to play out. The object of trading, as always, is not to be right but to make money.

When the markets are going against you, take a step back, reflect and find better opportunities!

WHAT HAPPENED YESTERDAY

As of New York Close 5 May 2020,

FX

U.S. Dollar Index, +0.30%, 99.79

USDJPY, -0.27%, $106.46

EURUSD, -0.63%, $1.0839

GBPUSD, 0.00%, $1.2444

USDCAD, -0.32%, $1.4040

AUDUSD, +0.11%, $0.6434

NZDUSD, +0.08%, $0.6053

STOCK INDICES

S&P500, +0.90%, 2,868.44

Dow Jones, +0.56%, 23,883.09

Nasdaq, +1.13%, 8,809.12

Nikkei Futures, +0.96%, 19,595.0

COMMODITIES

Gold Spot, +0.14%, 1,704.08

Brent Oil Spot, +14.83%, 28.81

SUMMARY:

U.S. ISM Non-Manufacturing Index for April dropped to 41.8% (consensus 38.5%) from 52.5% in March. A number below 50.0% is indicative of contraction. The April reading was the lowest reading for the index since March 2009. The Dollar Index rose for a third session, primarily because of EUR weakness. The greenback’s gains came at the expense of the Euro, which weakened broadly after a German constitutional court ruled that the Bundesbank must stop buying government bonds if the European Central Bank cannot prove those purchases are needed. The decision did not apply to the ECB’s latest pandemic-fighting program, a 750 billion-euro scheme to prop up the economy, but the ruling unsettled financial markets. The ruling was confusing and unexpected, and the first thing to do when investors do when uncertain is to sell and get to safety. That led to EURJPY breaking the support at 115.50. Expect EURJPY to go even lower in time to come.

U.S. stocks, bolstered by the prospect of reopenings in some American states and countries around the world, as well as U.S. ISM data that was stronger than market expectations had a good day. S&P 500 rallied as much as 2.0% on Tuesday, as investors continued to buy into the reopening narrative, but stocks pared gains late in the day to leave the benchmark index up 0.9% for the session. The Nasdaq Composite increased 1.13%, the Dow Jones Industrial Average increased 0.56%, and the Russell 2000 increased 0.8%. U.S. 2yr yield remained unchanged at 0.19% and U.S. 10yr yield rose 2bp to 0.66%.

Positive reopening news included California announcing plans to reopen parts of its economy as early as Friday, joining a growing list of U.S. states to have already opened or outlined plans. Starbucks (SBUX 72.90, +1.01, +1.4%) said it expects to have 85% of its U.S. stores open again by the end of the week, excluding dine-in service.

The health care space received a sentiment boost by news that Pfizer (PFE 38.51, +0.89, +2.4%) and BioNTech SE (BNTX 50.00, +4.22, +9.2%) conducted a clinical trial of a potential COVID-19 vaccine with their first U.S. patients. Expect more news of such trials from various companies going forward.

Notably, the ISM Non-Manufacturing Index for April fell into contraction territory with a 41.8% reading (consensus 38.5%), United Airlines (UAL 24.12, -1.14, -4.5%) warned it will likely cut 30% of its management and administrative staff in October, and Norwegian Cruise Line Holdings (NCLH 11.18, -3.26, -22.6%) expressed “substantial doubt” about its future.

WHITE HOUSE TO WIND DOWN CORONAVIRUS TASK FORCE AS FOCUS SHIFTS TO AFTERMATH

The White House coronavirus task force will wind down as the U.S. moves into a second phase that focuses on the aftermath of the outbreak, Trump said on Tuesday. Trump said Anthony Fauci and Deborah Birx, doctors who assumed a high profile during weeks of nationally televised news briefings, would remain advisers after the group is dismantled. Fauci leads the National Institute of Allergy and Infectious Diseases and Birx was response coordinator for the force.

IMPACT: The focus is now on therapeutics, vaccines, and addressing infection hot spots, the task force members said. Most experts have suggested clinical trials to guarantee a vaccine is safe and effective could take a minimum of 12 to 18 months. The “road to recovery” in America will be a key barometer for market sentiment in the weeks ahead, winding down of the task force at this point in time is not a prudent measure especially given case studies in Asia of a second wave. When that happens and a dedicated body is not in place to tackle the issue, blind optimism will turn to doom and gloom really fast and cause safe haven currencies like the Japanese Yen and Dollar to trade strongly against risk assets.

RESERVE BANK OF AUSTRALIA

After keeping rates on hold at a record 0.25 percent at its monthly board meeting on Tuesday, Governor Lowe said several scenarios for the economy had been considered and would be detailed in the Statement on Monetary Policy to be released on Friday.

However, he said: “A stronger economic recovery is possible if there is further substantial progress in containing the Covid-19 in the near term and there is a faster return to normal economic activity.” The Prime Minister and national cabinet are expected to make significant revisions to restrictions this Friday, bolstering early signs of a recovery in the economy.

IMPACT: The Australian government has handled the Covid-19 crisis well and this is reflected in the rebound in the Aussie. Hopes of the Australian economy reopening and China starting up the economic engine provided optimism and tailwind that things may resume to normal faster for Australia, as compared to the rest of the world. A caveat to note is that the Aussie is still considered a risk asset and a commodity currency, should risk appetite take turn for the worst, a highly plausible scenario at this point, Aussie will inadvertently be dragged down as well.

BIDEN’S EDGE EVAPORATES AS TRUMP SEEN AS BETTER SUITED FOR ECONOMY

Joe Biden’s advantage over Trump in popular support has eroded in recent weeks as the presumptive Democratic presidential nominee struggles for visibility with voters during the Covid-19 pandemic, according to a poll released on Tuesday.

According to the poll, 45% of Americans said Trump was better suited to create jobs, while 32% said Biden was the better candidate for that. That pushed Trump’s advantage over Biden in terms of job creation to 13 points, compared with the Republican president’s 6-point edge in a similar poll that ran in mid-April.

IMPACT: Trump plays the media like a fiddle and is a master of narratives. He has used this Covid-19 situation well to shore up support and bash rivals. Expect elevated volatility as we head into the November elections and safe-haven currencies like the Japanese Yen should trade stronger against most counterparts this year.

DAY AHEAD

The Bank of England (BoE) meets tomorrow. Having already slashed rates to almost zero and restarted QE, BoE is unlikely to do any more for now. But it will still have a tough job on its hands, as its new economic forecasts will try to estimate the depth and length of this unique recession.

Sterling’s reaction though may depend mainly on the comments of the new Governor, Andrew Bailey. From a risk-management perspective, Bailey probably has more incentive to maintain a dovish tone and hint that his central bank is prepared to do much more if need be. Anything short of that could trigger a sizable rebound in sterling and a tightening of financial conditions, which the BoE likely wants to avoid.

Overall, the outlook for Sterling seems challenging. In the near term, Britain is one of the few major economies that haven’t announced an opening-up plan so far, and the longer things stay shut, the bleaker the outlook for the economy. Longer-term, Brexit worries could come back to haunt the currency, as PM Johnson insists that he won’t request an extension to the December deadline for the transition period, setting the stage for more eleventh-hour negotiations, brinkmanship, and drama ahead.

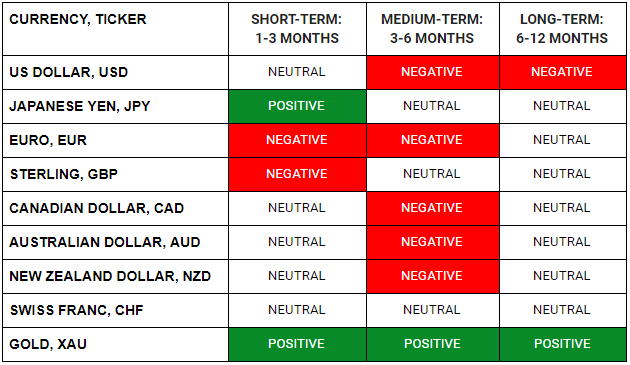

SENTIMENT

OVERALL SENTIMENT:

Trump tones down his anti-China rhetoric, and asset markets regained the positive tone. However, while risk assets were enjoying a good day, the German courts finally delivered a ruling, in a lawsuit that started 5 years ago, that ECB’s indiscriminate bond buying is beyond its mandate. So, the German Central Bank now has to stop participating in the program unless ECB can prove in the next 3 months that the policy is delivering the monetary effects it is supposed to and not just monetising the debts of governments.

This caused weakness in the EUR but small sell-off in risk did not last. However, it is a theme that needs to be watched going forward.

FX

STOCK INDICES

TRADING TIP

European Fractured Union

The German constitutional court ruled that the German Central Bank, the Bundesbank, must stop buying government bonds if the European Central Bank (ECB) cannot prove those purchases are needed to effectively conduct its monetary policy. The judges believe that it is possible that the ECB has gone beyond its mandate and is now encroaching on the territory of fiscal policies by indiscriminately monetising the debt of governments. The Euro reacted negatively given that such a ruling was not expected, hence the disappointment effect and the confusion that ensued led to investors heading for the exits. In the current times of stress, the ECB easing measures have helped calmed the markets and if that is in doubt, investors will shy away from investing in the currency till clarity is restored.

This is one of the many instances the EU has failed in coming together to solve a crisis. The EU may have survived Brexit, the refugee crisis, and the financial meltdown of 2008, but do not assume the COVID-19 crisis can’t destroy it. The countries hit the worst by the pandemic — Italy, Spain, and France — are the ones that have the least amount of fiscal breathing space, irrespective of the European Commission’s relaxation of fiscal and state aid rules.

The EU’s leaders and the European Central Bank’s president, in particular, face a similar choice. Either they move boldly to help the periphery, or the periphery is going to help itself in whatever way it can — even if it means the unravelling of the eurozone and the EU. Previous calls for exits have always come from the periphery, but with German Chancellor Merkel nearing the end of her term, the new Chancellor may face questions from the masses as to the point of the Monetary Union if the ECB is deemed to be conducting the policies that are unconstitutional and monetising debt has been something that the Bundesbank has historically been averse to.

With the obvious beneficiaries of such initiatives being periphery countries as well as the financial sector, and no obvious benefit to the everyday person who is losing his job, the backlash that is to come could be game-changing.

EUR/JPY Weekly Candlesticks & Ichimoku Chart

EUR/JPY has been relentlessly trending downwards since the start of 2018. Rallies need to be sold, and a break to new lows seem inevitable.

Source: tradingview.com

Vee, our Founder/CIO highlights patterns/formations on selected chart(s) every week which may have the potential to turn into trading opportunities. These charts are first sent out on Monday of the week to the TRACKRECORD COMMUNITY which helps them to filter out the noise and condense only what’s important in the markets for the week ahead.

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte. Ltd. that any particular investment, security, transaction or investment strategy is suitable for any specific person. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte. Ltd

WHAT HAPPENED YESTERDAY

As of New York Close 4 May 2020,

FX

U.S. Dollar Index, +0.42%, 99.50

USDJPY, -0.23%, $106.69

EURUSD, -0.75%, $1.0903

GBPUSD, -0.48%, $1.2444

USDCAD, -0.01%, $1.4085

AUDUSD, +0.11%, $0.6426

NZDUSD, -0.31%, $0.6050

STOCK INDICES

S&P500, +0.42%, 2,842.74

Dow Jones, +0.11%, 23,749.76

Nasdaq, +1.23%, 8,710.71

Nikkei Futures, -1.13%, 19,408.0

COMMODITIES

Gold Spot, +0.20%, 1,703.88

Brent Oil Spot, +6.54%, 25.09

SUMMARY:

Dollar gained on Monday, bolstered by safe-haven flows as risk appetite waned amid fears that last year’s U.S.-China dispute will be reignited, this time over the Covid-19. Trump and Secretary of State Mike Pompeo have pinned the blame for the pandemic on China, where the Covid-19 outbreak is believed to have originated. The latest salvo came on Sunday from Pompeo, who said there was “a significant amount of evidence” that the virus emerged from a laboratory in the central Chinese city of Wuhan.

S&P 500 advanced 0.42% on Monday, closing near session highs, as strength in the mega-cap technology stocks helped the market overcome an increase in U.S.-China tensions and cautious commentary from Warren Buffett. Dow Jones, +0.11% and Nasdaq, +1.23%. U.S. 2yr yield fell 1bp to 0.19% and U.S. 10yr yield remained unchanged at 0.64%.

Over the weekend, the Trump administration stepped up its accusations against China for covering up the Covid-19 outbreak, and Warren Buffett said he has yet to find any attractive opportunities in the market. Buffett, instead, used the uncertainty and volatility in the market to dump Berkshire Hathaway’s (BRK.B 177.95, -4.72, -2.6%) holdings of airline companies.

These events helped send the S&P 500 down 1.2% shortly after the open, but the market gradually regained its familiar resilience, guided by leadership from Microsoft (MSFT 178.84, +4.27, +2.5%), Amazon (AMZN 2315.99, +29.94, +1.3%), Apple (AAPL 293.16, +4.09, +1.4%), and Facebook (FB 205.26, +2.99, +1.5%).

The major U.S. airlines Berkshire sold — Delta (DAL 22.57, -1.55, -6.4%), United (UAL 25.26, -1.36, -5.1%), American (AAL 9.82, -0.82, -7.7%), and Southwest (LUV 27.56, -1.67, -5.7%) — took noticeable hits (again) and weighed on the Dow Jones Transportation Average (-2.0%).

INTERNAL CHINESE REPORT WARNS BEIJING FACES TIANANMEN-LIKE GLOBAL BACKLASH OVER VIRUS

The report, presented early last month by the Ministry of State Security to top Beijing leaders including President Xi Jinping, concluded that global anti-China sentiment is at its highest since the 1989 Tiananmen Square crackdown, the sources said. As a result, Beijing faces a wave of anti-China sentiment led by the United States in the aftermath of the pandemic and needs to be prepared in a worst-case scenario for an armed confrontation between the two global powers, according to people familiar with the report’s content, who declined to be identified given the sensitivity of the matter.

IMPACT: No one could determine to what extent the stark assessment described in the paper (classified) reflects positions held by China’s state leaders, and to what extent, if at all, it would influence policy. But the presentation of the report shows how seriously Beijing takes the threat of a building backlash that could threaten what China sees as its strategic investments overseas and its view of its security standing.

The rhetoric led by Washington will only intensify in the months ahead and this will place more pressure on Chinese dependent trade partners like Australia, New Zealand and the Emerging Market Economies. The push for de-globalization by the U.S. seems uncannily rushed with the world still fighting Covid-19. As Trump’s re-election looms, expect more volatility and risk-assets to finally get the memo that this is indeed a paradigm shift. Expect U.S. Dollar and Safe-Haven currencies (JPY) to trade at a premium in the months ahead.

TRUMP ADMINISTRATION PUSHING TO RIP GLOBAL SUPPLY CHAINS FROM CHINA

Trump administration is “turbocharging” an initiative to remove global industrial supply chains from China as it weighs new tariffs to punish Beijing for its handling of the Covid-19 outbreak, according to officials familiar with U.S. planning.

The U.S. Commerce Department, State, and other agencies are looking for ways to push companies to move both sourcing and manufacturing out of China. Tax incentives and potential re-shoring subsidies are among measures being considered to spur changes, the current and former officials said.

IMPACT: The United States is pushing to create an alliance of “trusted partners” dubbed the “Economic Prosperity Network,” one official said. It would include companies and civil society groups operating under the same set of standards on everything from digital business, energy, and infrastructure to research, trade, education, and commerce.

The U.S. government is working with Australia, India, Japan, New Zealand, South Korea, and Vietnam to “move the global economy forward,” Secretary of State Mike Pompeo said April 29. The re-shoring of global supply chains will be economically bad for China, but beneficial for South-East Asian economies like Vietnam in the future. USD/CNH appears to be trending higher and might test the key 7.20 level soon, a break above that level might warrant a stronger USD/CNH amidst rising geopolitical tensions, trade war and supply chain issues.

RESEARCHERS NEARLY DOUBLE U.S. COVID-19 DEATH PROJECTION DUE TO EASING

The Institute for Health Metrics and Evaluation at the University of Washington’s School of Medicine is now projecting 134,000 Covid-19-related fatalities, up from a previous prediction of 72,000. Factoring in the scientists’ margin of error, the new prediction ranges from 95,000 to 243,000.

The CDC document found some reason for optimism, noting that nationwide, the trajectory of new illnesses in “multiple counties, including hard-hit areas in Louisiana and in the New York City region” has continued to decrease, and that incidence rates have recently plateaued around Chicago.

IMPACT: The alarming modeling comes as some states are already beginning to put parts of the White House’s phased reopening plan into motion despite concerns that the administration’s guidelines for doing so have not yet been met. It also underscores fears that moving too fast to relax strict social-distancing restrictions could fuel a dangerous second wave of infections. Consistent with our theme, if projections come true, expect the US Dollar to trade much higher from here as optimism turns to doom and gloom.

DAY AHEAD

The Reserve Bank of Australia will announce its latest policy decision later today and is not anticipated to make any changes to the cash rate or its quantitative easing (QE) program. But as one of the newest members to the QE club, the RBA may also be the first to exit its emergency programs as the virus is brought under control in Australia and the Bank has had to make fewer purchases lately to keep the target on 3-year government bond yields at 0.25%.

But the Aussie may not be out of the woods just yet. A worrying resurgence of Trump’s anti-China rhetoric in recent days has reawakened trade war fears and this poses a real threat to the global economy’s recovery from the Covid-19 crisis. That prospect has knocked the Aussie’s uptrend off course, and combined with an overly cautious outlook by the RBA, could bring fresh pain for the currency.

SENTIMENT

OVERALL SENTIMENT:

The battered bears got to enjoy just one and half trading days in the sun before yet being sent back into the cave again. On a day with no significant news, a market which started on the backfoot spent the rest of the day grinding back to close at the highs of the session.

If even Warren Buffet is divesting all his airlines stocks rather than holding or adding to his position, it is a clear sign that many industries are impaired for protracted periods of time. The going forth remains tough for the battered bears, but rising trade tensions and the deteriorating relationship between the US and China will eventually temper the relentless optimism of markets.

FX

STOCK INDICES

TRADING TIP

The Widening Rift

As the printing presses of governments continue to work overtime, asset markets relentlessly march higher. Stabilising asset markets which were panicking may well be a necessary policy objective, but there is a cost to these policies of indiscriminate money printing.

While asset prices creep ever higher, and hedge funds and banks profit from positioning for and facilitating the policies, the fate of the everyday Joe could not be more different. Jobs will continue to be lost, and earnings will remain depressed. The stark contrast of the fortunes of Wall Street and Main Street will become clearer as time passes.

The discontent that is inevitable among the masses will eventually boil over if not arrested in time. The masses will soon be looking for someone to blame, and if politicians do not find a convenient bogeyman to pin it on, they will have to bear the brunt of the anger.