WHAT HAPPENED YESTERDAY

As of New York Close 21 May 2020,

FX

U.S. Dollar Index, +0.30%, 99.42

USDJPY, +0.11%, $107.64

EURUSD, -0.25%, $1.0951

GBPUSD, -0.15%, $1.2222

USDCAD, +0.31%, $1.3945

AUDUSD, -0.47%, $0.6567

NZDUSD, -0.37%, $0.6122

STOCK INDICES

S&P500, -0.78%, 2,948.51

Dow Jones, -0.41%, 24,474.12

Nasdaq, -0.97%, 9,284.88

Nikkei 225, -0.21%, 20,552.31

COMMODITIES

Gold Spot, -1.34%, 1,726.12

Brent Oil Spot, +0.87%, 34.75

SUMMARY:

FX and stock markets essentially traded listly within the range. Only moves of note were the retracement in Gold and Silver after the recent run up. With all central banks continuing to talk of easier monetary policy, retracements in hard assets should be opportunities to get involved.

U.S. Initial claims for the week ending May 16 decreased by 249,000 to 2.438 million (consensus 2.400 million), bringing the 9-week total to 38.636 million. Continuing claims for the week ending May 9 surged by 2,525,000 to 25.073 million, which is an all-time high. The key takeaway from the report in the market’s mind is that the pace of increase in initial claims is decelerating; however, the real-world takeaway is that the economic damage runs deep as initial claims and continuing claims keep piling up. Chinese Premier Li Keqiang will be unveiling stimulus measures when the National People’s Congress starts to spur its economy, which has been battered by the Covid-19. The measures are expected to move FX markets, especially chinese trade sensitive currencies like the AUD and NZD.

In an emergency policy meeting early this morning, the Bank of Japan decided to launch a new lending facility that aims to channel more funds to small and midsize businesses suffering from the economic blow of the coronavirus pandemic. The central bank also extended the deadline for a series of measures it has deployed to combat the virus fallout, including accelerated corporate debt buying, by six months to March 2021. As widely expected, the BOJ kept monetary settings unchanged including its short-term interest rate target of -0.1% and a pledge to guide the 10-year government bond yield around 0%.

S&P 500 declined 0.8% on Thursday, failing to overcome weak economic data and a fresh increase in U.S.-China tensions. The Dow Jones Industrial Average lost 0.4%, and the Nasdaq Composite lost 1.0%. The small-cap Russell 2000, however, eked out a 0.1% gain. Moderna (MRNA), the pharmaceutical company which announced the ‘positive” results of 1st stage vaccine trials for Covid-19 that sparked a rally earlier this week, continues to see its share price fall further from the highs.

On the U.S.-China front, the White House issued a report criticizing China’s economic and military policies, Trump accused China of a “disinformation and propaganda attack” on the U.S. and Europe, and a bipartisan group of Senators planned to introduce legislation to sanction China over new national security laws in Hong Kong.

U.S. SECURES 300 MILLION DOSES OF POTENTIAL ASTRAZENECA COVID-19 VACCINE

The United States has secured almost a third of the first one billion doses planned for AstraZeneca’s experimental Covid-19 vaccine by pledging up to $1.2 billion, as world powers scramble for medicines to get their economies back to work.

The vaccine, previously known as ChAdOx1 nCoV-19 and now as AZD1222, was developed by the University of Oxford and licensed to AstraZeneca. Immunity to an evolving Covid-19 strain is uncertain and so the use of vaccines unclear. The U.S. deal allows a late-stage – Phase III – clinical trial of the vaccine with 30,000 people in the United States.

Cambridge, England-based AstraZeneca said it had concluded agreements for at least 400 million doses of the vaccine and secured manufacturing capacity for 1 billion doses, with first deliveries due to begin in September.

IMPACT: There are currently no approved treatments or vaccines for Covid-19. Governments, drugmakers, and researchers are working on around 100 programmes, and experts are predicting a safe, effective means of preventing the disease could take 12 to 18 months to develop. Vaccines are seen by world leaders as the only real way to restart their stalled economies, and even to get an edge over global competitors.

Any news of a successful clinical trial will boost global risk sentiment, however as seen with Moderna and Gilead, such news of “potential cures” have become prevalent between pharmaceutical companies without much concrete evidence to show for. Given the economic reality and geopolitical backdrop, any dips in Safe Havens like Gold on the back of risk rallies should be bought into.

CHINA SET TO IMPOSE NEW HONG KONG SECURITY LAW, TRUMP WARNS OF STRONG U.S. REACTION

China’s action could spark fresh protests in Hong Kong, which enjoys many freedoms not allowed on the mainland after often violent demonstrations of 2019 plunged the city into its deepest turmoil since it returned to Beijing’s rule in 1997.

Trump, who has ratcheted up his anti-China rhetoric as he seeks re-election in November, told reporters at the White House that “nobody knows yet” the details of China’s plan. “If it happens we’ll address that issue very strongly,” Trump said, without elaborating.

IMPACT: Hong Kong media outlets reported that the legislation would ban secession, foreign interference, terrorism and all seditious activities aimed at toppling the central government and any external interference in the financial hub. The legislation, which will face NPC deliberations, could be a turning point for its freest and most international city, potentially triggering a revision of its special status in Washington and likely to spark more unrest.

Given the strong anti-Chinese rhetoric the U.S. is propagating, the Trump administration will be sure to use this as a lever to ratchet tensions and growth sensitive currencies, especially the AUD and NZD, will be affected by any geopolitical strains between western ideals and chinese interests.

TRUMP LAUNCHES DIRECT ATTACK ON XI JINPING

Trump escalated his rhetoric against China, suggesting that the country’s leader, Xi Jinping, is behind a “disinformation and propaganda attack on the United States and Europe.” While Trump has often blamed China for failing to prevent the pandemic now ravaging the global economy, he was careful in maintaining that his relationship with Xi is strong. Until now.

“It all comes from the top,” Trump said in a series of tweets on Wednesday night. He added that China was “desperate” to have former Vice President Joe Biden, the presumptive Democratic nominee, win the presidential race.

IMPACT: Trump and other Republicans have been ratcheting up efforts to paint China as the villain, as the U.S. economy plunges into recession and the president’s handling of the crisis jeopardizes the party’s grip on the executive branch. China has denied Trump’s claims that it was trying to damage his chances at re-election in November.

The relentless attacks will definitely be paid back in kind by the Chinese government. We speculate that China will start to counter these threats after the National People’s Congress (NPC) meeting ends (in about 7 days). Expect a flurry of measures against countries that threaten their interest going forward. Given the potential for escalation, adjust risk accordingly as things can turn south on a whim.

CHINESE NATIONAL PEOPLE’S CONGRESS 2020

With about 3,000 delegates to the annual gathering of China’s parliament, the National People’s Congress (an expected 7-day event this year) congregates in Beijing today to discuss political and economic policy. On opening day, Premier Li Keqiang typically announces key annual economic targets in a state-of-the-nation style address.

As of this morning, China announced that they are setting a 2020 GDP growth target and pledged to step up spending and financing to support its economy. The defence budget is expected to be unveiled on opening day too, seen as a gauge of the extent China may ratchet up its military capabilities this year.

IMPACT: The NPC normally meets every March to pass major bills, approve the budget, and endorse personnel nominations. Its Standing Committee meets regularly to approve other legislation. Being the second largest economy in the world, the legislation passed by the NPC will understandably have a material impact on the global economy. Given the heightened geopolitical tension and rhetoric against China in recent weeks, the policies will be scrutinized for any retaliatory measures against the US and other nations engaged in China-bashing of late.

DAY AHEAD

The ECB minutes from the April’s policy meeting are due today, with traders waiting more details on why the central bank decided to keep its main tools unchanged in April even as it pledged to inject more liquidity through its newly-introduced pandemic emergency bond purchase program and adjust its composition as much as it is needed. Hence, any strong comment that reflects a muddy outlook on the EU economy and flags more QE increases in the future could pressure the Euro, whereas a softer language may reduce the risk of additional stimulus actions, raising demand for the currency.

SENTIMENT

OVERALL SENTIMENT:

Yet another “quiet day” with most things trading within recent ranges. With headlines coming out of the China’s National People’s Congress meetings, watch out for reaction to the recent China-bashing that is led by the US and its allies. For now, enjoy the lull before the storm.

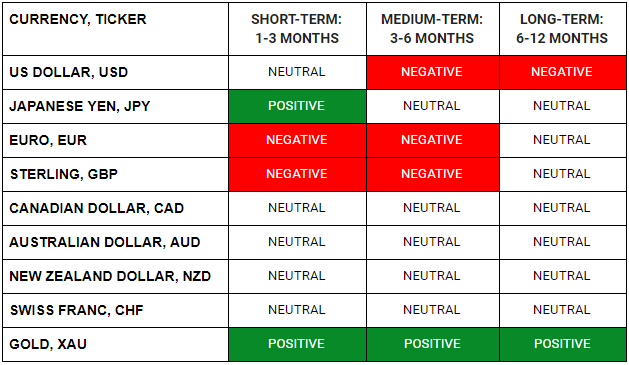

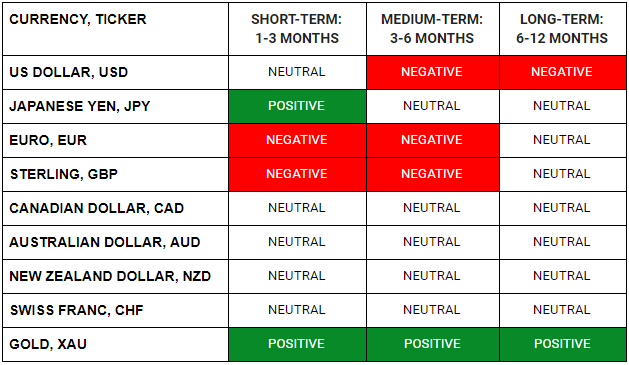

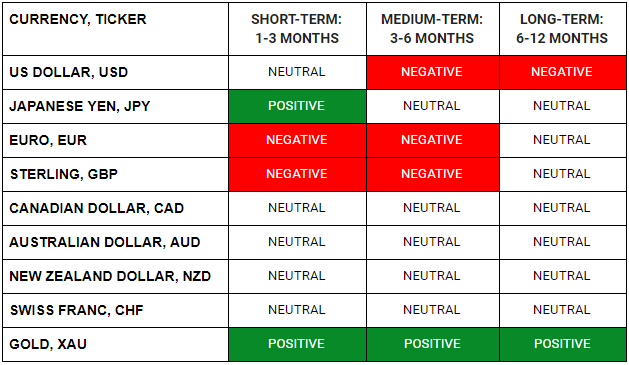

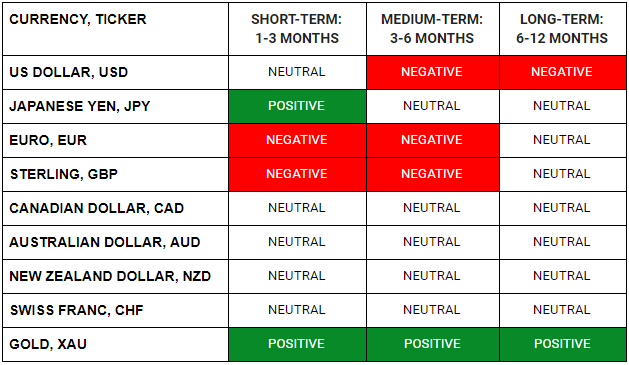

FX

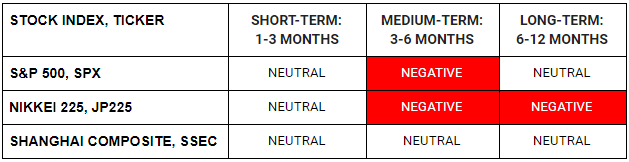

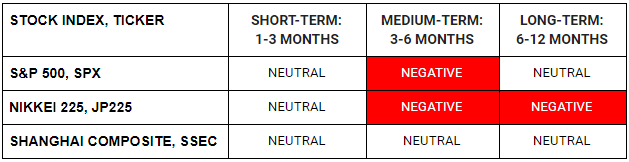

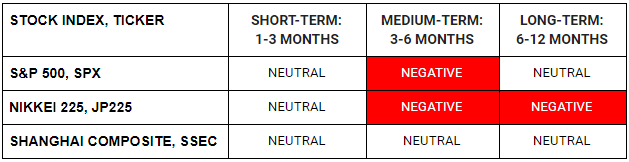

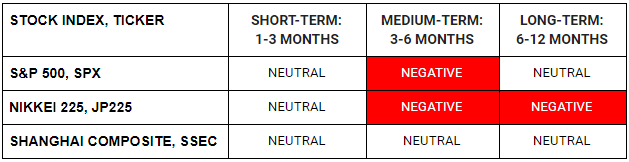

STOCK INDICES

TRADING TIP

Respect the Price

If you are trading with leverage, price action should be a critical input to your investment process. There will be times when fundamental factors may all point overwhelmingly in one direction, but prices just do not seem to follow. It is times like this that a disciplined approach to using technical analysis and a rigorous risk management framework will stop you from being crushed by the conviction of your view.

Currently, many prominent market legends and respected policymakers are all surprised by the strength of the stock markets in an environment of atrociously deteriorating economic conditions. Yet, risk assets continue to trade strongly. This reminds me of the period leading up to the burst of the dotcom bubble in the late 90s, and the credit bubble that led to the 2008 GFC. Eventually, asset prices will have to catch up with economic realities. When momentum starts to weaken, and price starts to go in the right direction, it is not too late to start getting heavily involved.

For now, price action is everything.

WHAT HAPPENED YESTERDAY

As of New York Close 20 May 2020,

FX

U.S. Dollar Index, -0.19%, 99.18

USDJPY, -0.10%, $107.60

EURUSD, +0.52%, $1.0980

GBPUSD, -0.13%, $1.2236

USDCAD, -0.29%, $1.3903

AUDUSD, +0.84%, $0.6592

NZDUSD, +1.17%, $0.6147

STOCK INDICES

S&P500, +1.67%, 2,971.61

Dow Jones, +1.52%, 24,575.90

Nasdaq, +2.08%, 9,375.78

Nikkei 225, +0.79%, 20,595.15

COMMODITIES

Gold Spot, +0.15%, 1,747.74

Brent Oil Spot, +4.08%, 34.45

SUMMARY:

Dollar fell to a more than two-week low against the Euro as the common currency enjoyed a boost from the recently announced proposal for a common fund that could move Europe closer to a fiscal union as it tries to counter the economic hit from the Covid-19 pandemic. The Euro also found strength from survey data on Tuesday that showed German investor sentiment improved much more than expected in May. Pain was the order of the day as AUD and NZD continued to charge higher despite obvious problems for the currencies. China’s unhappiness with Australia and RBNZ’s intent to be extremely dovish are not going away anytime soon. Eventually those factors will take a toll on AUD and NZD respectively.

The Dollar found little support from the release of the minutes of the U.S. Federal Reserve’s most recent policy-setting meeting, which showed that policymakers agreed to use their tools “as appropriate” to support the economy and re-upped a pledge to keep interest rates near zero.

S&P 500 gained 1.7% on Wednesday in a broad-based advance to close at its highest level since March 6. The Nasdaq Composite (+2.1%) and Russell 2000 (+3.0%) increased more than the benchmark index, while the Dow Jones Industrial Average rose 1.5%. U.S. 2yr yield fell 1bp to 0.16% and U.S. 10yr yield fell 2bp to 0.68%.

In Washington, the Senate passed the Holding Foreign Companies Accountable Act, which requires certain foreign companies listed in the U.S. to certify that they are not owned or controlled by a foreign government. Failure to provide appropriate certification could result in de-listing.

The increased scrutiny on Chinese companies pressured shares of Alibaba (BABA 216.79, -0.41, -0.2%) and Baidu (BIDU 108.52, -1.23, -1.1%), while the broader U.S. market was barely bothered by the bill’s potential to worsen U.S.-China tensions. Facebook surged more than 6% Wednesday to a record high of about $230 per share on its announcement a day earlier that it would roll out Facebook and Instagram shops starting Wednesday.

U.S. TO SELL TAIWAN $180 MILLION WORTH OF TORPEDOES

U.S government has notified Congress of a possible sale of advanced torpedoes to Taiwan worth around $180 million, a move likely to further sour already tense ties between Washington and Beijing, which claims Taiwan as Chinese territory.

The proposed sale serves U.S. national, economic, and security interests by supporting Taiwan’s “continuing efforts to modernise its armed forces and to maintain a credible defensive capability”, the agency said.

The announcement came on the same day Taiwan President Tsai Ing-wen was sworn in for her second term in office, saying she strongly rejected China’s sovereignty claims. China responded that “reunification” was inevitable and that it would never tolerate Taiwan’s independence. US Secretary of State Pompeo, being the first US Secretary of State to call the Taiwanese President to congratulate her for her re-election, did not help matters.

IMPACT: The United States, like most countries, has no official diplomatic ties with Taiwan, but is bound by law to provide the democratic island with the means to defend itself. China routinely denounces U.S. arms sales to Taiwan. The U.S. seems to be taking every opportunity to aggravate China, from disrupting Economic Incentives via Trade War and stock listing restrictions, to the WHO fiasco and now selling Taiwan weapons during a sensitive period. Expect retaliation from China and risk assets like the AUD and NZD to turn on a whim as volatility explodes. The path of least resistance remains to be long Gold and Silver amidst an uncertain future.

MEXICO REGISTERS RECORD ONE-DAY COVID-19 DEATH TOLL WITH 424 FATALITIES

Mexico’s health ministry on Wednesday registered 2,248 new Covid-19 infections and an additional 424 fatalities, a record one-day death toll since the start of the pandemic.

The new infections brought confirmed Covid-19 cases to 56,594 and 6,090 deaths in total, according to the official tally.

IMPACT: Mexico has had a tumultuous couple of days on the virus front and this is after reopening its economy on Monday, which does not seem like such a good idea after all. With the first wave not under control, a second wave of outbreak in Mexico is inevitable and the same fate awaits many countries who are nonchalant towards this risk. This will weigh on the domestic currency in the case of emerging markets, and on global risk sentiment should developed markets see a second outbreak. Safe Havens such as the JPY, CHF, and Gold should be considered on pullbacks.

BRAZIL READY TO INCREASE FX INTERVENTION

Brazil stands ready to dip into its large pool of foreign exchange reserves and continue intervening in the currency market if needed, but any bond market intervention is likely to be far smaller in size, central bank President Roberto Campos Neto said on Wednesday.

Brazil’s real has lost around 30% of its value and is one of the worst-performing currencies against the dollar this year. A combination of record-low interest rates, a sharply deteriorating economy because of the Covid-19 pandemic and political uncertainty have pulled capital out of the country.

IMPACT: Global coronavirus cases surpassed 5 million on Wednesday, with Latin America overtaking the United States and Europe in the past week to report the largest portion of new daily cases globally. Latin America accounted for around a third of the 91,000 cases reported earlier this week. Europe and the United States each accounted for just over 20%. Cases in Brazil are now rising at a daily pace second only to the United States. Further weakness in the already battered BRL is expected, unless Brazil shows it can flatten the curve, any monetary intervention will be faded quickly and the BRL will resume its downward trajectory.

DAY AHEAD

The Eurozone’s flash PMI readings for the month of May will hit the markets tomorrow, likely showing a reviving business sector as most member states moved forward with their reopening plans. The data are expected to contribute to the bullish atmosphere of the German-Franco deal for a virus relief fund created for the euro this week, exposing the currency to fresh buying pressure. On the same day, the ECB meeting minutes could clarify if there is any willingness for more monetary stimulus.

SENTIMENT

OVERALL SENTIMENT:

On a generally quiet day, stocks tried again to break to new highs, but failed. USD weakened against almost all the developed currency except the JPY. Subscribed trades such as short GBP and NZD got squeezed as stops were triggered. With the weak hands out, the strong hands will likely prevail as fundamentals eventually reassert themselves.

FX

STOCK INDICES

TRADING TIP

Don’t Poke the Sleeping Giant

This should be sound advice for everyone to follow and yet, this is what Australia and Taiwan seem to be intent on doing. Just when the world is going through the biggest economic crisis of our lifetime, and for any respectable economic rebound to take place smoothly, it would seem obvious to all that you should be on good terms with your biggest trading partner. Obvious to us, but not so much to the politicians of these countries as they continually antagonise China with their words and actions.

US is leading the charge in anti-China rhetoric, but the EU is also trying to get involved by passing legislation to prevent Chinese companies from buying any European companies that have become cheaper during this Covid-19 crisis. Preventing foreign entities from gaining a controlling stake in key companies is not a novel idea but this is specifically targeted at China.

Eventually China will react and when it does, it will not be pretty for the ones who will need to bear the brunt of the pent-up fury. So far, China has only acted against Australia, and it is likely Australia will continue to be made an example of. The worst is yet to come.

WHAT HAPPENED YESTERDAY

As of New York Close 19 May 2020,

FX

U.S. Dollar Index, -0.11%, 99.56

USDJPY, +0.45%, $107.82

EURUSD, +0.11%, $1.0926

GBPUSD, +0.51%, $1.2256

USDCAD, +0.02%, $1.39439

AUDUSD, +0.25%, $0.6540

NZDUSD, +0.74%, $0.6086

STOCK INDICES

S&P500, -1.05%, 2,922.94

Dow Jones, -1.59%, 24,206.86

Nasdaq, -0.54%, 9,185.10

Nikkei 225, +1.49%, 20,433.45

COMMODITIES

Gold Spot, +0.80%, 1,746.24

Brent Oil Spot, -2.16%, 33.10

SUMMARY:

AUD, NZD and GBP continued with their retracement and JPY crosses in particular ripped higher as shorts that were initiated at bad levels continued to be taken out with stocks trading strong from early on in Asian session. Even though stocks lost some momentum during the NY trading session, the risk currencies continued to trade strongly. The moves are confusing to say the least, but fundamentals remain especially bad for GBP (stuck in Brexit limbo), AUD (rising tension with China) and NZD (extremely dovish RBNZ). The time to reinitiate shorts on this currency should come again when the momentum of the correction wanes.

In Washington, Fed Chair Powell and Treasury Secretary Mnuchin testified before the Senate Banking Committee regarding the government response to Covid-19. Powell reiterated the Fed’s commitment to using its full range of tools to support the economy, and Mnuchin said he’s prepared to increase risk and lend more money. Dollar fell against the EUR on Tuesday as the common currency added to Monday’s gains on a Franco-German proposal for a fund that would offer grants to European Union regions and sectors hit hardest by the Covid-19 pandemic. Germany and France, whose agreements usually pave the way for broader EU deals, proposed that the European Commission borrow 500 billion euros ($550 billion) on behalf of the whole EU. The Commission is expected to outline its proposal before a European summit scheduled for May 27.

S&P 500 pulled back 1.1% on Tuesday, as stocks succumbed to late-day selling following a negative-sounding vaccine headline. The Dow Jones Industrial Average (-1.6%) and Russell 2000 (-2.0%) declined more than the benchmark index, while the Nasdaq Composite (-0.5%) fared slightly better. U.S. 2yr yield fell 1bp to 0.17% and U.S. 10yr yield fell 3bp to 0.70%.

For most of the session, the S&P 500 wavered around its flat line, supported by relative strength in the technology stocks. As the S&P 500 traded at session highs (+0.4%) late in the session, Stat News published a report in which vaccine experts cautioned about Moderna’s (MRNA 71.67, -8.33, -10.4%) Covid-19 vaccine candidate due to a lack of critical data provided.

Recall, stocks rallied on Monday after the company said a Phase 1 trial yielded positive results. The negative-sounding headline, then, provided a good excuse for investors to take some profits given the uncertainty that remains.

Moderna was caught in a web of suspicion in a “bait and switch” pump where insiders built up a position in the stock with insider knowledge of “positive development” and dumping it on spikes, as reports about insider share sales emerged. Moderna’s billionaire founder and CEO Stephane Bancel along with the White House’s new vaccine czar, Moncef Slaoui stands to profit from the action. CNBC reported that the CEO has been selling his stock in the past weeks during the course of the stock price rise. Moncef Slaoui holds more than 150,000 options contracts, worth more than $12 million and resisted pressure to divest them despite the conflict of interest. Sen. Elizabeth Warren, D-Mass., decried Slaoui’s continued holdings in Moderna, calling it a “huge conflict of interest.”

Separately, Facebook (FB 216.88, +3.69, +1.7%) introduced “Facebook Shops” and “Instagram Shop” to help more businesses go online. Spotify (SPOT 175.03, +13.60, +8.4%) shares climbed 8% after the company reached a deal to exclusively host the Joe Rogan Experience podcast.

TRUMP THREATENS TO HALT WHO FUNDING, REVIEW U.S. MEMBERSHIP

Trump threatened on Monday to permanently halt funding for the World Health Organization (WHO) if it did not commit to improvements within 30 days, and to reconsider his country’s membership of the agency.

Trump suspended U.S. contributions to the WHO last month, accusing it of promoting Chinese “disinformation” about the Covid-19 outbreak, although WHO officials denied the accusation and China said it was transparent and open.

“They have to clean up their act. They have to do a better job. They have to be much more fair to other countries, including the United States, or we’re not going to be involved with them anymore,” Trump told reporters at the White House.

IMPACT: The United States contributed more than $400 million to the WHO in 2019, or about 15% of its budget. The United States traditionally provides several hundred million dollars annually in voluntary funding tied to specific WHO programmes like polio eradication, vaccine-preventable disease, HIV and hepatitis, tuberculosis, and maternal and child and health. The United States withdrawing from the WHO is an indirect spite towards China. Geopolitical volatility is being ratcheted in every possible angle and Safe Havens like Gold and Silver will continue to outperform.

RUSSIA AWAITS U.S. VENTILATOR AID AS COVID-19 CASES NEAR 300,000

The United States said on Tuesday it would this week start delivering 200 medical ventilators to Russia, which has the world’s second-highest number of confirmed Covid-19 cases. Russia reported 9,263 new infections on Tuesday, pushing its nationwide total to 299,941, and 115 more deaths, taking the total death toll to 2,837. Only the United States has reported more Covid-19 cases.

IMPACT: Foreign Minister Sergei Lavrov said the United States planned to deliver the machines in two planes and that Washington would cover all the costs. This is the U.S. chance to build goodwill relations with Russia especially in a time when the relationship between Russia and China is under strain.The pandemic had cast a shadow over relations between China and Russia, partly because of Moscow’s early move to shut border crossings in late January despite Beijing’s opposition.

MEXICO COVID-19 CASES HIT NEW DAILY RECORD OF 2,713

Mexico registered 2,713 new cases of the Covid-19 on Tuesday, the health ministry said, its biggest daily increase yet in infections, bringing its overall tally to 54,346 cases. Authorities also registered 334 more fatalities, only the second time that the daily death toll has exceeded 300. The country has now tallied 5,666 overall deaths from the virus.

IMPACT: This came a day after Mexico issued guidelines for restarting operations in the automotive, mining, and construction sectors, pushing ahead with reopening the economy despite a growing national toll from the Covid-19 pandemic and concerns about unsafe work sites. Mexico is a microcosm of the potential effect if countries do not have proper measures in place. Should case counts pick up, the Mexican Peso (MXN) will weaken against Safe Havens like the Dollar and Japanese Yen (JPY).

DAY AHEAD

In Britain, the preliminary PMIs for May will hit the markets on Thursday, ahead of retail sales for April on Friday. The PMIs are expected to rise, but to remain deep within contractionary waters, while retail sales are primed for a record collapse. As for GBP, it is being battered from all sides. The UK economy will reopen very slowly, investors are worried that deficits will result in austerity, the BoE is considering negative rates, and to top everything off, the risk of a no-deal Brexit is back on the radar.

First, markets weren’t impressed by the government’s handling of the health crisis, as the early hesitation to shut down the economy now means a longer period of things staying shut. Second, there are growing fears the exploding government deficit will result in ‘belt-tightening’ austerity once the crisis ends, either via tax increases or by spending cuts or both, sapping demand as the recovery begins.

SENTIMENT

OVERALL SENTIMENT:

The rallies continue to be stronger than the sell-offs but S&P500 is trading close to previous recent highs. Caution should be the order of the day as Fed speakers continue to speak of the economy in a much more sombre tone than the politicians. Horrible economic data is pretty much expected and ignored these days, but bankruptcies and layoffs will eventually take a toll on confidence.

FX

STOCK INDICES

TRADING TIP

Filter out the Noise

You will often be inundated with random noise in a market that seems directionless. Sentiment changes on a dime based on headlines that can hardly be anticipated at times. However, in the midst of all the noise, there will be occasions when a clear trend seems to be emerging. This seems to be the case with Gold and especially, Silver now.

When the market speaks, take heed, and take action!

XAG/USD (Silver) Weekly Candlesticks & Ichimoku Chart

Silver broke above recent highs last week and is now trying to break above the weekly Ichimoku Cloud. If successful, and it is likely to be, the move could be explosive. Check out the move on the last massive QE after GFC.

Source: tradingview.com

Vee, our Founder/CIO highlights patterns/formations on selected chart(s) every week which may have the potential to turn into trading opportunities. These charts are first sent out on Monday of the week to the TRACKRECORD COMMUNITY which helps them to filter out the noise and condense only what’s important in the markets for the week ahead.

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte. Ltd. that any particular investment, security, transaction or investment strategy is suitable for any specific person. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte. Ltd

WHAT HAPPENED YESTERDAY

As of New York Close 18 May 2020,

FX

U.S. Dollar Index, -0.77%, 99.63

USDJPY, +0.33%, $107.39

EURUSD, +0.91%, $1.0914

GBPUSD, +0.77%, $1.2199

USDCAD, -1.20%, $1.3940

AUDUSD, +1.70%, $0.6524

NZDUSD, +1.79%, $0.6039

STOCK INDICES

S&P500, +3.15%, 2,953.91

Dow Jones, +3.85%, 24,597.37

Nasdaq, +2.44%, 9,234.83

Nikkei Futures, +2.99%, 20,640.0

COMMODITIES

Gold Spot, -0.46%, 1,734.93

Brent Oil Spot, +9.55%, 33.83

SUMMARY:

A jump in oil prices lifted commodity currencies such as the NOK and the CAD against the U.S. Dollar on Monday as optimism about a reopening of economies stifled by the Covid-19 pandemic boosted risk appetite. USD started out strong in Asia with Gold and Silver breaking higher aggressively. However, that soon turned around when stocks started to power higher just prior to NY start. Fundamentals remain intact, and patience is a requirement in this market. On the UK front, GBP made new lows, but managed a reversal (+0.97%) due to USD weakness when markets turned risk on. The problems that plague the GBP remain, this temporary reprieve is likely to be just that.

Italian government bond yields fell to their lowest level in over a month after France and Germany on Monday proposed a 500 billion euro ($543 billion) recovery fund offering grants to regions hit hardest by the Covid-19 crisis. The proposal moves the EU more in the direction of a transfer union and is likely to please countries like Italy or Spain which have long called for more joint action in response to the crisis. But offering grants rather than loans could be hard to swallow for some of the frugal northern countries of the 27-nation bloc, like the Netherlands, Finland, and Austria.

S&P 500 rallied 3.15% on Monday, as reopening hopes were fueled by a positive vaccine update from Moderna (MRNA 80.00, +13.31, +20.0%). The small-cap Russell 2000 outperformed with a 6.1% gain, followed by the Dow Jones Industrial Average (+3.85%) and Nasdaq Composite (+2.44%). U.S. 2yr yield rose 2bp and U.S. 10yr yield rose 9bp to 0.73%.

Prior to the open, Moderna announced that a Phase 1 study for its COVID-19 vaccine candidate yielded positive interim clinical results. The company was hopeful that a Phase 3 trial could begin earlier than expected in July, and it started scaling up its manufacturing capacity so it can produce as much vaccine as possible if approved.

The news provided an added boost to the market, which was already trading higher following Powell’s “60 Minutes” interview with CBS. Powell assured the market that the Fed is still not out of ammunition and suggested Congress should do more. Powell also said that a full economic recovery could take more than a year and will likely require a vaccine.

The timely vaccine update, then, coupled with the Fed’s support and an increase in nationwide reopening efforts, helped ignite a rally in risk assets, this inadvertently caused safe havens like Gold and Silver to be sold.

NEW ZEALAND CENTRAL BANK COULD EXPAND, EXTEND QE

New Zealand’s central bank could expand its government bond-buying programme further though it hopes to have more certainty in about three months’ time on whether to go harder or ease back stimulus, a top official said on Tuesday.

On Tuesday, RBNZ Deputy Governor said negative rates were one of many monetary policy options available to the RBNZ. “We will evaluate negative rates alongside other options,” he said. “For now, we think the best thing we should be doing is large scale asset purchases and we’ve expanded that. We could expand it further if needed.”

IMPACT: The RBNZ has been the clearest among developed world central banks, which have yet to implement negative rates, about its intent to use negative rates and accommodative policies to boost its economy should things turn south. This makes the RBNZ (NZD) along with BoE (GBP) the most dovish developed central banks and their currencies a good underlying to sell into any spikes should their stance remain and the effect of the virus remain protracted as we have suggested.

MEXICO BEGINS REOPENING DESPITE COVID-19 FEARS

Mexico issued guidelines for restarting operations in the automotive, mining, and construction sectors on Monday, pushing ahead with reopening the economy despite a growing national toll from the Covid-19 pandemic and concerns about unsafe work sites.

With Mexico’s coronavirus death toll having surged past 5,000, and known cases set to surpass 50,000, officials are wrestling with how to restart key industries without triggering greater spread of the virus. The moves to loosen restrictions follow growing pressure from the United States to reopen factories that are vital to supply chains of U.S.-based businesses, especially in the vast automotive sector.

IMPACT: On May 12, Mexico reported a record number of deaths in a single day with 353 fatalities. That grim news was followed on Friday by a reported 2,437 new coronavirus infections, a one-day record rise in cases since the start of the pandemic. Critics, including some within Lopez Obrador’s own ruling MORENA party, worry that restarting factories too soon could exacerbate the spread of the virus before it has been brought under control. A second-wave of infection (highly likely) will put pressure on the Mexican Peso (MXN).

NASDAQ TO TIGHTEN LISTING RULES, RESTRICTING CHINESE IPOs

Nasdaq Inc is set to unveil new restrictions on initial public offerings (IPOs), a move that will make it more difficult for some Chinese companies to debut on its stock exchange, people familiar with the matter said on Monday.

While Nasdaq will not cite Chinese companies specifically in the changes, the move is being driven largely by concerns about some of the Chinese IPO hopefuls’ lack of accounting transparency and close ties to powerful insiders, the sources said.

The new rules will require companies from some countries, including China, to raise $25 million in their IPO or, alternatively, at least a quarter of their post-listing market capitalization, the sources said.

IMPACT: At a time of escalating tensions between the United States and China over trade, technology, and the spread of the Covid-19, Nasdaq’s curbs on small Chinese IPOs represent the latest flashpoint in the financial relationship between the world’s two largest economies. Expect more trade and geopolitical volatility going forward, which will keep Safe Haven currencies like the Japanese Yen (JPY) at a premium relative to its counterparts, especially trade sensitive currencies like the Aussie (AUD) and Singapore Dollar (SGD).

DAY AHEAD

A raft of economic data is due out of the United Kingdom this week, starting with the labour market report on later today and the consumer price index on Wednesday. Following last week’s dire GDP figures, traders should be braced for more depressing readings on the economy, with the March jobs numbers stealing the limelight early in the week. But as if things weren’t critical enough with the Covid-19 pandemic spreading mayhem on the global economy, the UK also has to contend with Brexit, adding to GBP woes.

SENTIMENT

OVERALL SENTIMENT:

Stocks powered ahead after pharmaceutical firm Moderna reported “positive” data on early-stage covid-19 vaccine trial. If you run any pharma firm, it makes sense to be chasing a vaccine or treatment, do trials and report any “positive” data you see as it causes massive spikes in your stock price!

Gold started the day shining bright but tumbled for no good reason except to frustrate gold bugs as the market went full risk on. This is a trade for the long haul and not for the faint-hearted!

FX

STOCK INDICES

TRADING TIP

Higher Volatility Lurks

As geopolitical tensions rise and governments warn about the protracted effect the virus has on the economy, there seems to be a mismatch between expectations of market participants (“v-shaped recovery”) and the real world. The exuberance of incessant money printing is being front-loaded in recent times, but the motivations between both parties (Central Planners and Market Participants) in this can’t be more different. Central Planners are acting out of fear and overcompensating for it with actions, while market participants are buying in “hope”. The stark contrast in intent is troubling, and we suspect central planners have the upper hand in terms of understanding economic reality.

With the fate of Wall Street diverging further away from the dire reality of Main Street, expect volatility in time to come.