CURRENCY MARKET WRAP

As of Fri, Apr 12, Singapore Time zone UTC +8

Dollar Index +0.20%, $97.15

USDJPY, +0.56%, $111.64

EURUSD, -0.12%, $1.1260

GBPUSD, -0.28%, $1.3055

USDCAD, +0.41%, $1.3376

AUDUSD, -0.71%, $0.7122

NZDUSD, -0.61%, $0.6725

U.S. Treasuries finished on a lower note, pushing yields higher across the curve. The 2-yr yield increased four basis points to 2.35%, and the 10-yr yield increased three basis points to 2.50%. The U.S. Dollar Index increased 0.2% to 97.16. WTI crude fell 1.4% to $63.65/bbl.

U.S. Producer Price Index for final demand increased 0.6% in March (consensus +0.3%), bolstered predominately by a pickup in energy prices. There won’t be any alarming read through at this juncture for market participants who are cognizant that the Consumer Price Index for March showed a moderation in the year-over-year increase for core CPI (2.0% from 2.1% in February. This moderation helped strengthen the Fed’s stance to keep a patient mindset, which further increase the appeal for risk assets).

Central bankers aren’t as optimistic as contradictory views dominate yesterday’s Fed speak. Fed Vice Chair Clarida says the labor market is healthy and the economy is in a good place – a view shared by Fed President Williams. Fed President Bullard on the other hand thinks the March hike marked the end of policy normalization and favors removing the word “patient” from the policy statement because it suggests a tightening bias.

STOCK MARKET WRAP

S&P500, +0.00%, 2,888.32

Nasdaq, -0.22%, 7,594.89

Nikkei Futures, +0.47%, 21,803.0

The stock market finished little changed on Thursday in a tight-ranged trading session. The S&P 500 (unch) finished fractionally higher, as relative strength from financial and industrial stocks helped mitigate losses from shares of healthcare companies in front of earnings season.

There was no specific driver for the noticeable decline in the S&P 500 health care sector (-1.2%). The broad-based selling in the group could have been a move to reduce exposure from the year’s worst-performing sector. Heavyweight UnitedHealth (UNH 235.42, -10.61, -4.3%) and many of the components within the iShares NASDAQ Biotechnology ETF (IBB 111.90, -1.94, -1.7%) led the space lower.

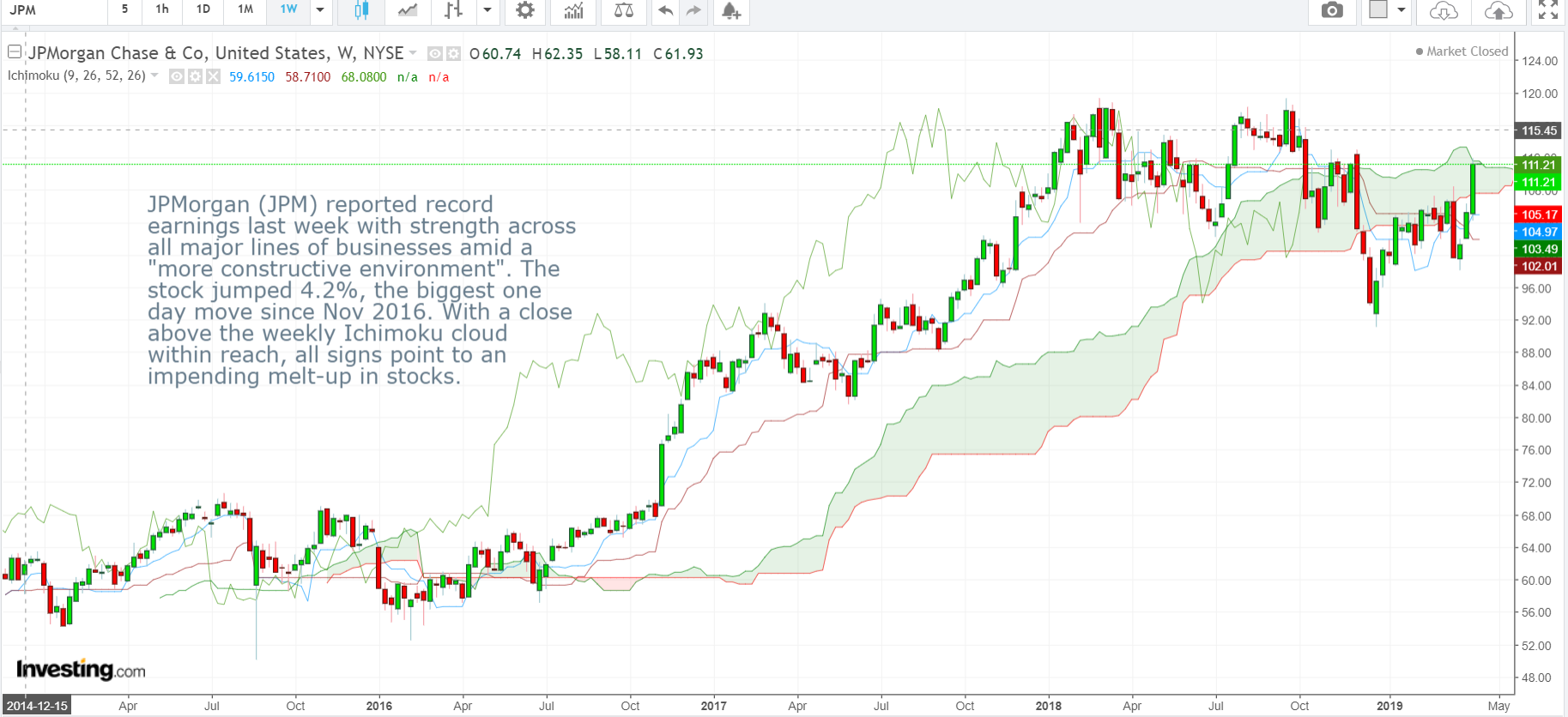

The financial sector (+0.6%), meanwhile, exhibited strength in front of earnings reports from JPMorgan Chase (JPM 106.23, +0.89, +0.8%) and Wells Fargo (WFC 47.74, -0.05, -0.1%) tomorrow.

In other corporate news, Tesla (TSLA 268.42, -7.64, -2.8%) and Panasonic suspended plans to expand Tesla’s Gigafactory in Nevada; Bed Bath & Beyond (BBBY 17.71, -1.70, -8.8%) disappointed investors with its earnings report; and Caesar Entertainment (CZR 9.40, +0.35, +3.9%) is reportedly interested in selling itself.