NOTABLE MOVES

As of Wed, Mar 20, Singapore Time zone UTC+8

USDJPY, -0.10%, $111.42

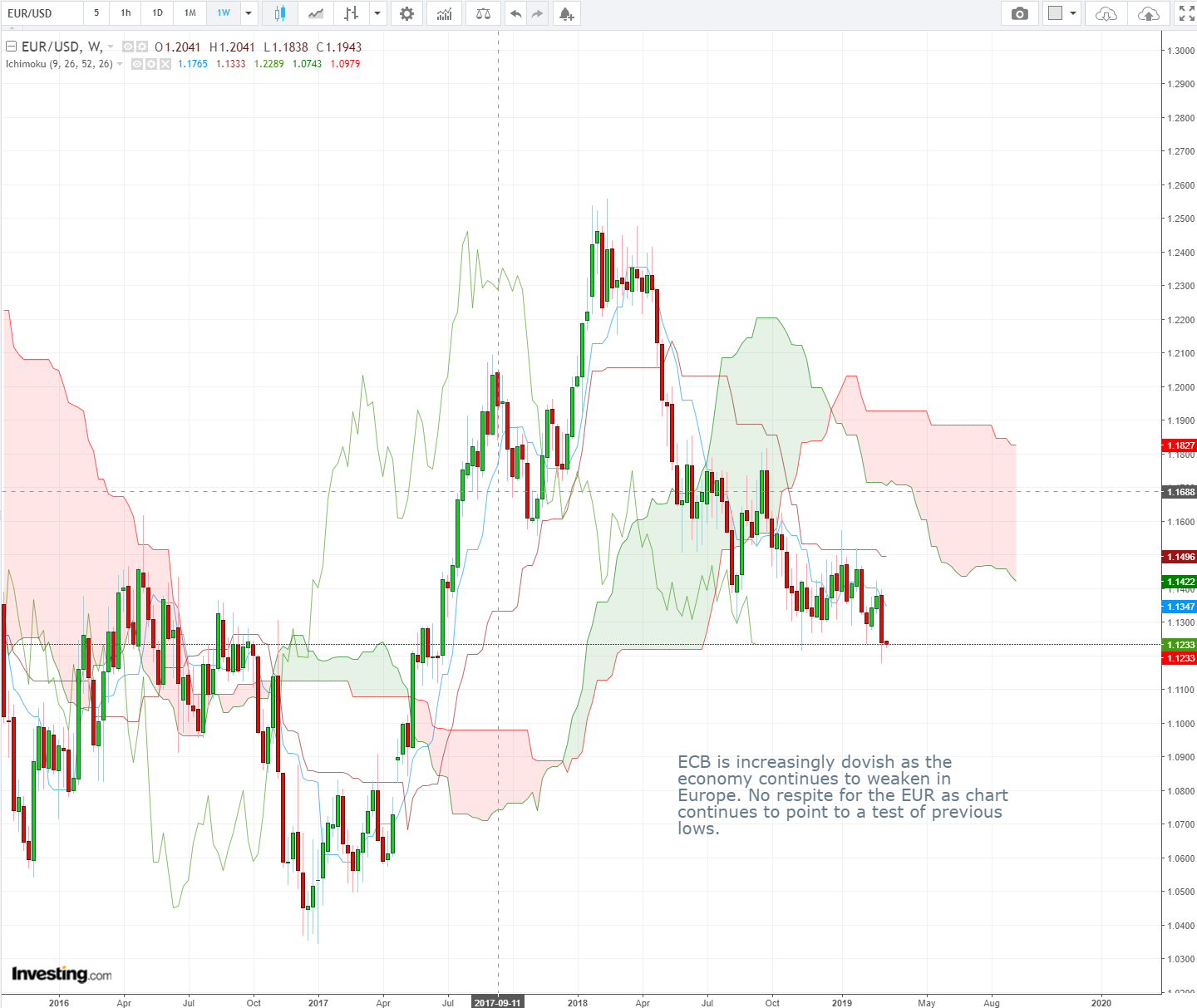

EURUSD, +0.17%, $1.1355

GBPUSD, +0.07%, $1.3269

USDCAD, -0.11%, $1.3322

AUDUSD, -0.15%, $0.7088

NZDUSD, +0.13%, $0.6853

S&P500, -0.01%, 2,832.57

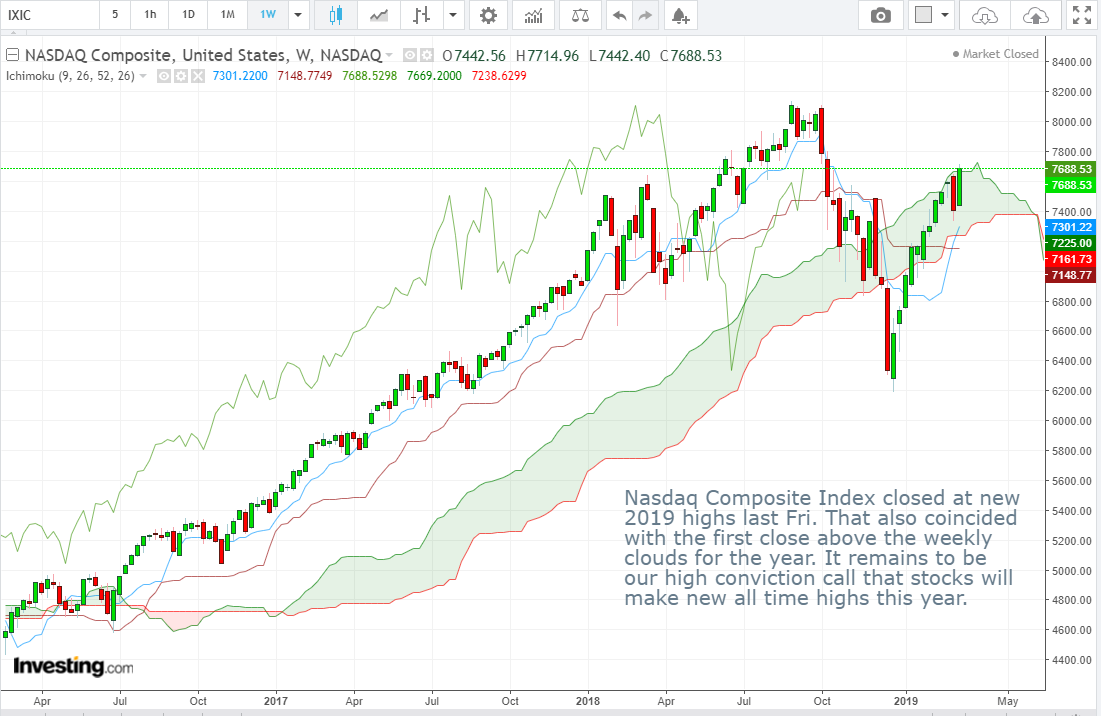

Nasdaq, +0.31%, 7,349.28

Nikkei Futures, -0.22%, 21,362.5

CURRENCY MARKET WRAP

The U.S. Dollar Index declined 0.2% to 96.37. WTI crude increased 0.1% to $59.34/bbl. U.S. Treasuries closed on a lower note, pushing yields slightly higher. The 2-yr yield and the 10-yr yield increased one basis point each to 2.46% and 2.61%, respectively.

Bloomberg reports that U.S. officials are concerned China will walk back its trade offers. A follow-up report from The Wall Street Journal offered a more positive perspective: the two sides are expected to hold meetings in Beijing and Washington over the next two weeks in hopes for a deal by the end of April.

The main event this week will be the Fed’s policy meeting, which concludes on Thurs morning. No action is anticipated, so market attention will fall on the new economic forecasts, Powell’s press conference, and the updated ‘dot plot’. Fed officials adopted a much more cautious tone in early 2019, indicating they’ll put their rate-hike plans on hold for the time being while they monitor the risks surrounding the economy. In the context of markets now seeing greater odds for rate cuts moving forward, a dot plot pointing to even one hike in 2019 could come as a ‘hawkish surprise’.

The S&P 500 advanced as much as 0.7% on Tuesday, bolstered by dovish expectations ahead of the Federal Reserve’s policy decision on Wednesday. Conflicting U.S-China trade headlines, however, induced some profit-taking interest after a recent stretch of gains, as did a late-day slide in oil prices, which hit their highs for the year earlier in the session. The S&P 500 was down as much as 0.3% but managed to close near its flat line.

S&P 500 utilities (-1.2%), financials (-0.8%), and industrial (-0.4%) sectors underperformed the broader market. Conversely, the health care (+0.8%), consumer discretionary (+0.5%), and information technology (+0.2%) sectors were the lone groups to finish with gains.

Notable chipmaker Advanced Micro Devices (AMD 26.00, +2.75) rose 11.8% as Google confirmed a partnership with the company for its new gaming streaming service. On the other hand, transport heavyweight Union Pacific (UNP 160.75, -5.49, -3.3%) dragged on the transportation average after it was downgraded to ‘Hold’ from ‘Buy’ at Loop Capital. Trucking stocks were also weak following a first quarter earnings warning from Covenant Transportation (CVTI 19.61, -1.79, -8.4%).