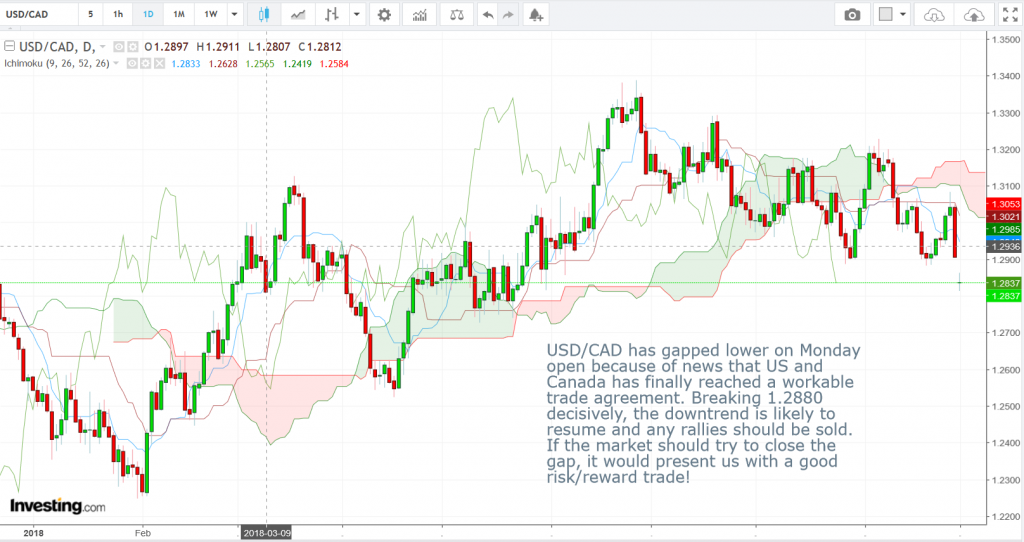

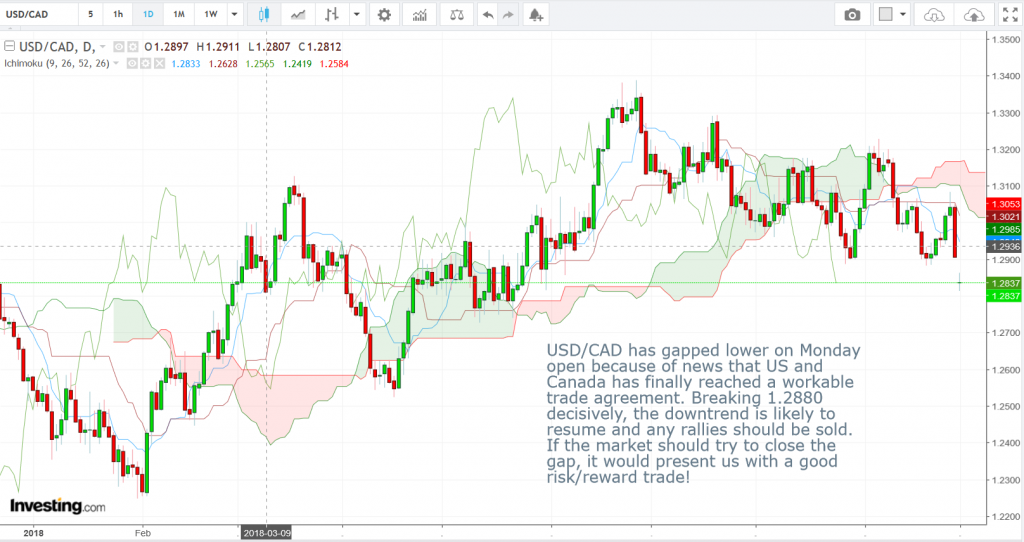

USD/CAD Daily Candlesticks & Ichimoku Chart

USD/CAD has gapped lower on Monday open because of news that US and Canada has finally reached a workable trade agreement. Breaking 1.2880 decisively, the downward trend is likely to resume and any rallies should be sold. If the market should try to close the gap, it would present us with a good risk/reward trade!

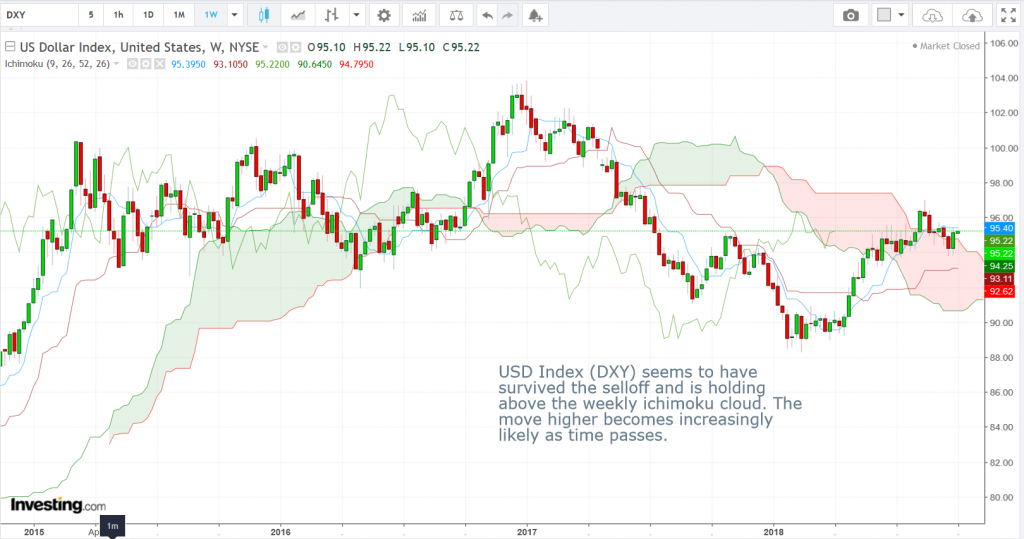

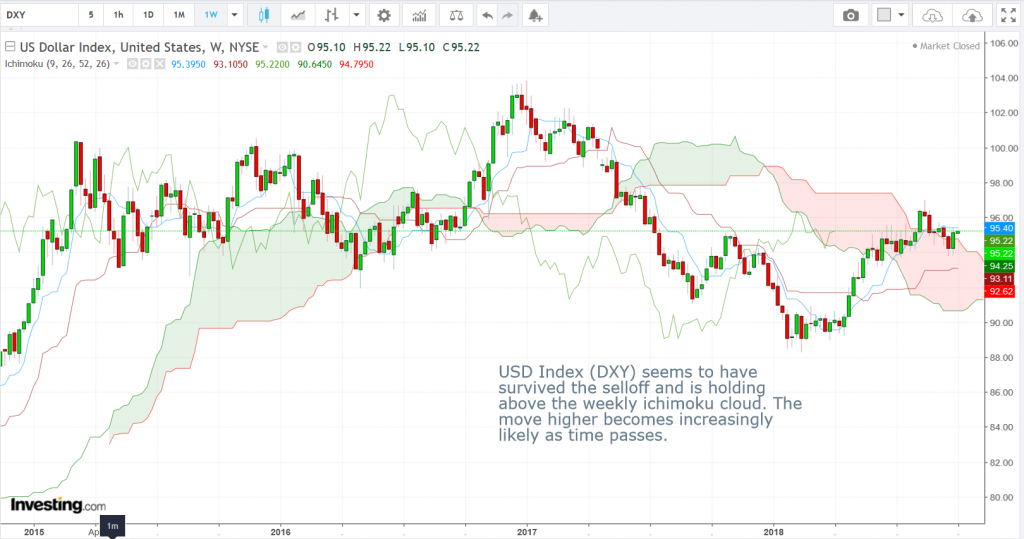

USD Index (DXY) Weekly Candlesticks & Ichimoku Chart

USD Index (DXY) seems to have survived the selloff and is holding above the weekly ichimoku cloud. The move higher becomes increasingly likely as time passes.

Vee, our Founder/CIO highlights patterns/formations on selected chart(s) every week which may have the potential to turn into trading opportunities. These charts are extracts of our weekly subscription product – “CIO’s Week Ahead Update” which provides analysis for the week ahead, first sent out on Monday of the week.

Let us know what you think in the comments below!

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte. Ltd. that any particular investment, security, transaction or investment strategy is suitable for any specific person. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte. Ltd