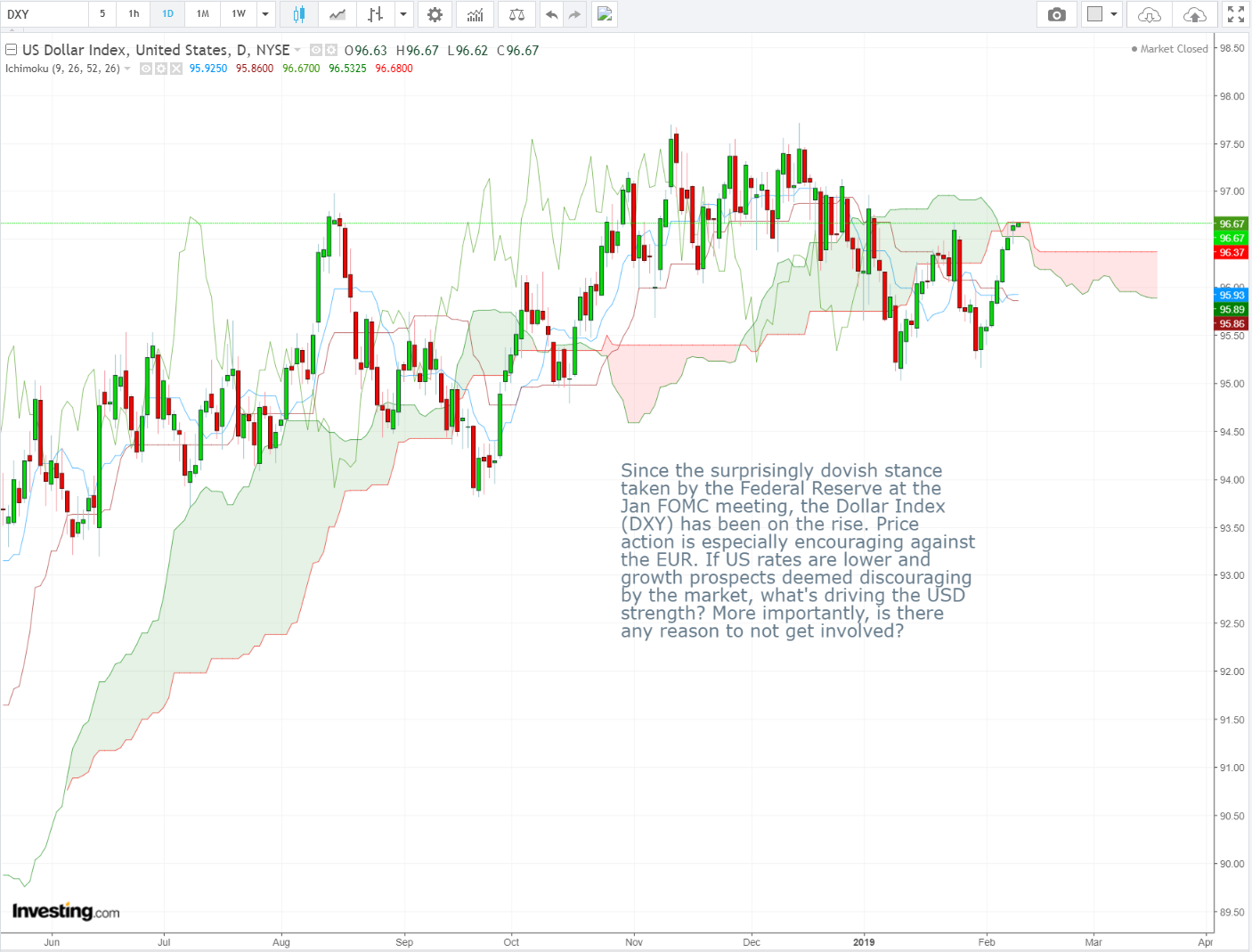

US Dollar Index (DXY) Daily Candlesticks & Ichimoku Chart: LONG

Since the surprisingly dovish stance taken by the Federal Reserve at the Jan FOMC meeting, the Dollar Index (DXY) has been on the rise. Price action is especially encouraging against the EUR. If US rates are lower and growth prospects deemed discouraging by the market, what’s driving the USD strength? More importantly, is there any reason to not get involved?

Vee, our Founder/CIO highlights patterns/formations on selected chart(s) every week which may have the potential to turn into trading opportunities. These charts are first sent out on Monday of the week to members subscribed to THE LONG & SHORT OF IT, which helps you to filter out the noise and condense only what’s important in the markets for the week ahead.

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte. Ltd. that any particular investment, security, transaction or investment strategy is suitable for any specific person. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte. Ltd