NOTABLE MOVES

As of Tues, Dec 05, 08:00 GMT (UTC +08:00)

USDJPY, -0.86%, 112.69

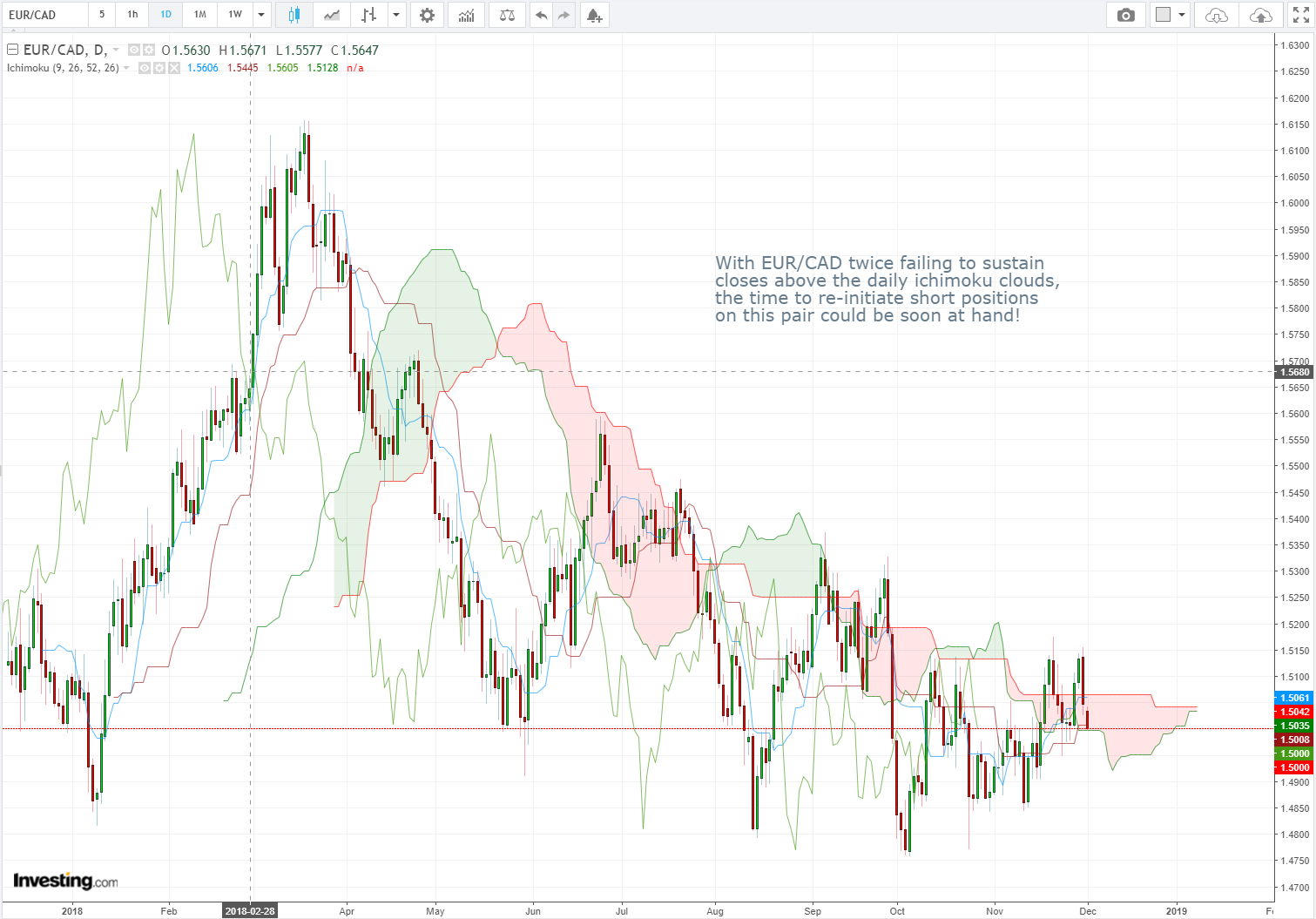

EURUSD, -0.11%, 1.1342

GBPUSD, -0.04%, 1.2719

USDCAD, +0.45% 1.3257

NZDUSD, +0.14%, 0.6938

S&P500 , -3.24%, 2,700.06

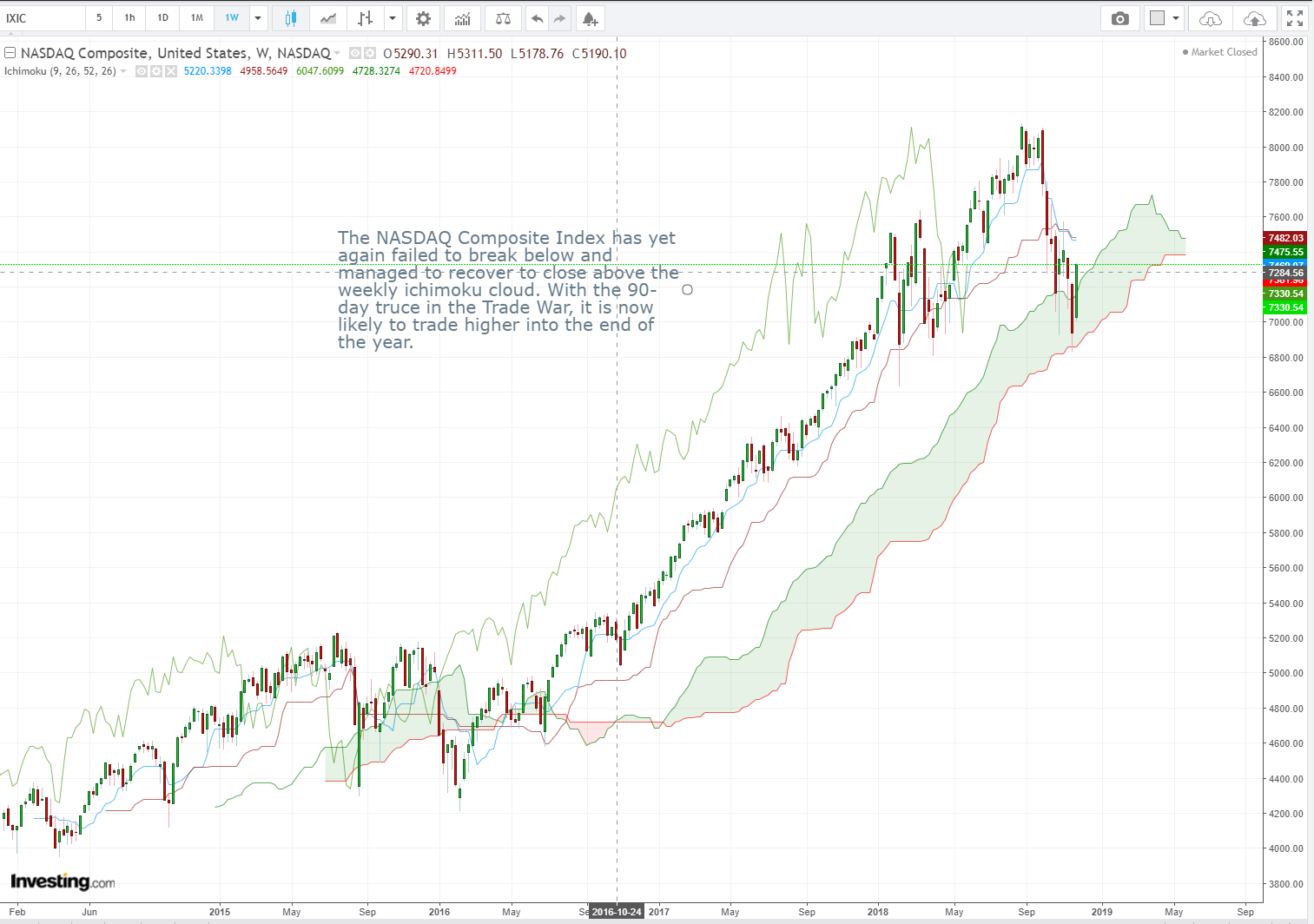

Nasdaq, -3.80%, 7,158.43

Nikkei Futures, -2.39%, 22,036.05

CURRENCY MARKET WRAP

- US 10Y yields dropped below the strong support level at 3% overnight, as equity markets reversed some of the gains from the previous day as trade optimism faded. The move lower in yields came when US breakevens were already under renewed pressure, and as the market had to absorb comments from Fed’s Clarida who said he was more concerned about falling short of the 2% target than running above it. The dollar index hit a 10-day low as the slide in US yields continued to weigh on the buck in Asian and early European session.

- U.K. Prime Minister Theresa May’s push to avoid a so-called “hard Brexit” may be at risk. The pound fell at one point to its lowest level against the dollar this year as MPs voted 311 to 293 in favour of finding the government in contempt. The defeat means the government will now have to publish the legal advice given to Cabinet ministers on the Brexit deal – despite insisting it would not be in the national interest to do so. While the contempt vote was the most surprising of the day, it was the later vote on Tory MP Dominic Grieve’s amendment that could prove the most significant. It ensures MPs can amend any motion the government brings to the House of Commons relating to its divorce deal with the European Union. If the deal is voted down at the first time of asking on December 11, May has 21 days to set out her plan of action in a statement to MPs – though it can now be amended by parliament.

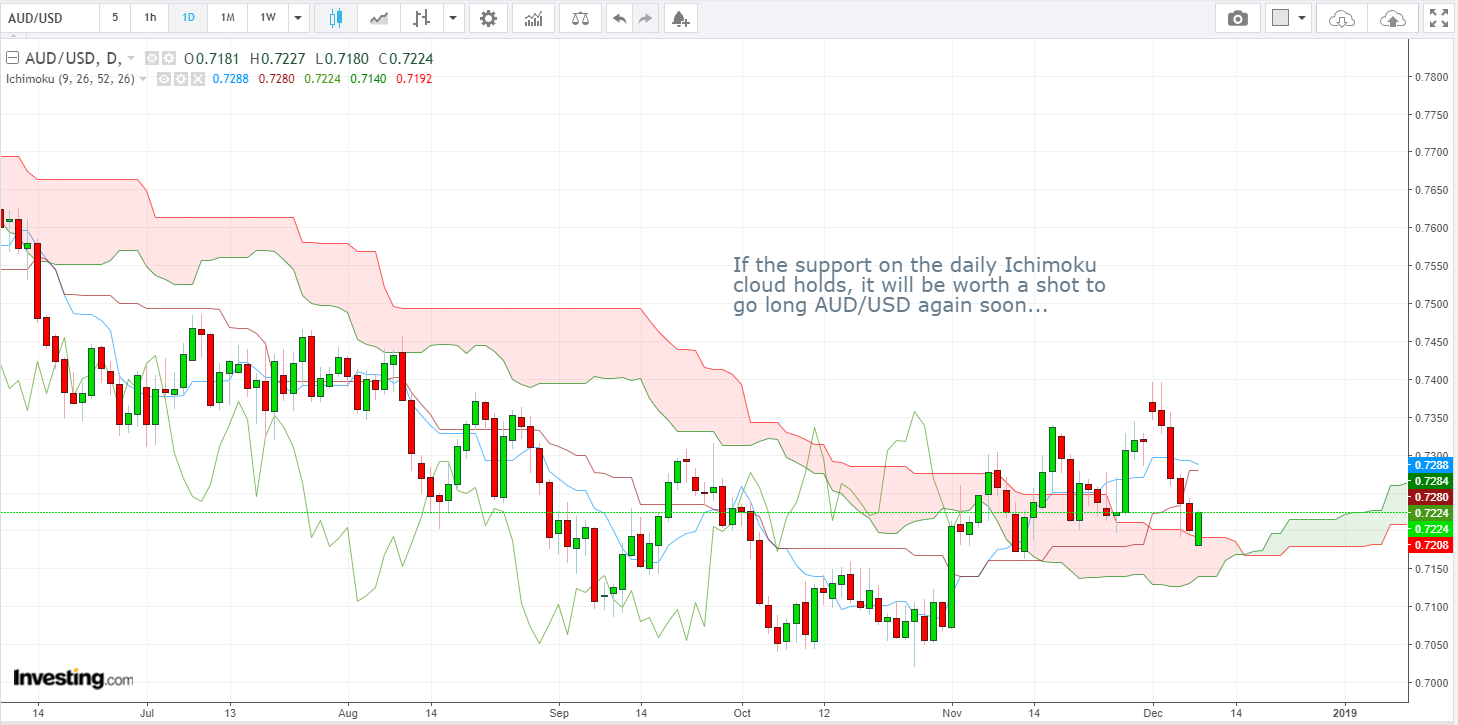

- RBA has left official interest rates on hold at a record low of 1.5% for the 26th consecutive RBA board meeting, with many analysts expect no rise until 2020. “The global economic expansion is continuing and unemployment rates in most advanced economies are low. There are, however, some signs of a slowdown in global trade, partly stemming from ongoing trade tensions. Growth in China has slowed a little, with the authorities easing policy while continuing to pay close attention to the risks in the financial sector.” RBA governor Philip Lowe said in his statement.

- Oil price is steady after the sharp increase yesterday, despite Qatar’s surprise announcement that it will leave the OPEC group on 1 January to concentrate on boosting its gas production. The move comes as the cartel struggles in response to falling prices, as well as possible strained relations with Saudi Arabia and pressure from US president Trump.

STOCK MARKET WRAP

- U.S. stocks plunged, as a litany of concerns wiped out Monday’s rally in risk assets. Trade-sensitive shares sank as US officials scrambled to explain exactly what had been agreed in the meeting between the US and Chinese presidents, with Larry Kudlow saying that the agreement was ‘stuff that they’re (Chinese officials) going to look at and presumably implement’. Financial shares got hammered as the yield curve continued to flatten, spurred by hawkish comments from New York Fed President Williams who said the strong outlook in 2019 warrants “continued” hikes. Losses accelerated and trading volumes in S&P 500 futures spiked after contracts broke below their 200-day moving average. Traders are even starting to bet that the Fed will cut interest rates as soon as 2020.

- In other corporate news, Hewlett Packard Enterprise Co. (HPE) shares ticked slightly higher Tuesday afternoon following an earnings report that was hit by charges from the new tax law but beat analysts’ expectations on an adjusted basis. Shares gained about 1% in after-hours action following the report, after closing with a 2.8% decline in a rough day for tech stocks. Major suppliers to Apple Inc.’s iPhone fell Tuesday, after Cirrus Logic (CRUS), a maker of audio chips, reduced its financial guidance for its third quarter, citing “recent weaknesses in the smartphone market.” In its most recent annual filing, Cirrus Logic said Apple accounted for 81% of its sales in its fiscal 2018. Cirrus Logic joined the ranks of companies that have recently cut their outlook, a trend that has underlined concerns about demand prospects for one of the most important product lines in the technology sector. Lumentum Holdings Inc. (LITE), which cut its outlook last month, fell as much as 5.8%. Qorvo Inc. (QRVO), another supplier that recently slashed its forecast, shed as much as 4.1%.

BLOCKCHAIN & CRYPTOCURRENCY NEWS

Singapore: State Agency Backs Blockchain Accelerator Launched by Venture Capital Firm

Singaporean governmental body Enterprise Singapore, along with other partners, has supported a new blockchain accelerator launched by a local venture capital firm. The initiative, dubbed Tribe Accelerator was launched to support later-stage startups. The accelerator is designed for a six-month period and will focus on the mass adoption of blockchain, decentralized applications (DApps), and back-end digital solutions that deal with blockchain. The managers for Tribe Accelerator will initially pick eight start-ups to participate, and the launch of the program is scheduled for Q1 2019. PwC, whose venture branch has backed the blockchain accelerator in Singapore, is also actively exploring blockchain solutions. In August, the “big four” audit giant announced the launch of its own accelerator set to train 1,000 staff in blockchain over two years.

Binance to Launch Its Own Blockchain ‘Binance Chain’ in ‘Coming Months’

Binance, the world’s largest crypto exchange by trading volumes, will launch its own blockchain “Binance Chain” in the “coming months”. The new Binance-backed blockchain aims to provide a basis for creating new cryptocurrencies and Initial Coin Offering (ICO) tokens, as the company announced: “Binance is pushing for blockchain adoption and doing many things to help advancement of the industry. E.g. we will have the Binance chain ready in the coming months, on which millions of projects can easily issue tokens.” Speaking at the “Decrypting Blockchain for Business” event in Singapore, Binance CEO Changpeng Zhao (CZ) stated that the new plans actually indicate an old vision of crypto, which will expectedly lead to increasing its adoption on a global scale. The Binance CEO stated that while Binance possessed just 10 percent of the trading volumes they had in January 2018, the volumes are still higher than those of “two or three years ago,” and the business is “still profitable.”

Russian Intellectual Property Court Trials Blockchain to Store Copyright Data

A Russian court dedicated to intellectual property cases has successfully tested a blockchain network for storing copyright data. The technology was reportedly used for the first time in the judicial area in Russia. The court recorded a change in a group of right holders, using a blockchain solution provided by Russian intellectual property startup IPChain. According to IPChain’s president Andrey Krichevsky, this is a precedent for the Russian judicial system. He believes that blockchain could help increase interoperability in the copyright market, as it allows all information stored to be kept up-to-date, which is particularly important for the area of property rights. The court’s representative, Ludmila Novoselova, hinted that the courts’ tech support will further evolve, noting that in five years all the legal disputes will probably be settled online.