NOTABLE MOVES

As of Fri, Jan 18, 08:00 Singapore Time zone UTC+8

USDJPY, +0.05%, $109.14

EURUSD, -0.07%, $1.1393

GBPUSD, +0.78%, $1.2983

USDCAD, +0.20%, $1.3282

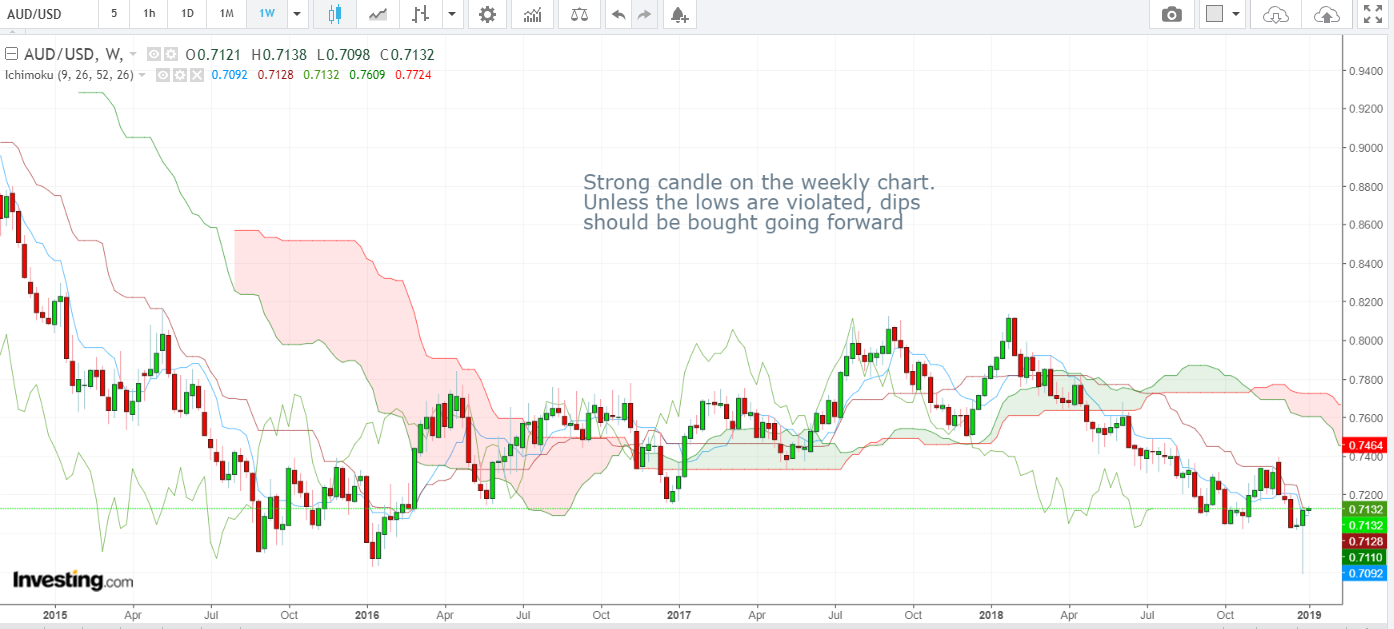

AUDUSD, +0.30%, $0.7189

NZDUSD, -0.19%, $0.6763

S&P500, +0.76%, 2,635.96.

Nasdaq, +0.71%, 7,084.46.

Nikkei Futures, +0.15%, 20,460.0

CURRENCY MARKET WRAP

- Initial claims for the week ending January 12 decreased by 3,000 to 213,000 (consensus 219,000) while continuing claims for the week ending January 5 increased by 18,000 to 1.737 million. The key takeaway from the report is that the low level of initial claims continues to reflect a solid labor market.

- The Philadelphia Fed Index for January jumped to 17.0 (consensus 9.7) from 9.4, paced by an eight-point pop in the new orders index to 21.3 that was the highest reading in six months.

- U.S. Treasuries edged lower, pushing the 2-yr yield and 10-yr yield higher by two basis points each to 2.56% and 2.75%, respectively. The U.S. Dollar Index was flat at 96.06. WTI crude lost -0.6% to $51.99/bbl.

STOCK MARKET WRAP

- The S&P 500 gained 0.76% on Thursday, boosted by a Wall Street Journal report indicating the U.S. is considering lifting some, or all, of the tariffs on Chinese imports while trade negotiations continue. It was a relatively muted session prior to the release of the report, which was published around 2:40 p.m. ET. According to the article, Treasury Secretary Steven Mnuchin suggested lifting tariffs with the aim of advancing talks and winning China’s support for longer-term reforms. The report, however, also mentioned that U.S. Trade Representative Robert Lighthizer had pushed back, arguing that any concession could be seen as a sign of weakness.

- The market retraced a good portion of the knee-jerk gains on a follow-up report that said a Treasury spokesperson informed CNBC by email that no recommendations have been made on the tariffs. Despite the contradictory reports, this was viewed as an interesting development because it gave market participants (and Trump) a quick glimpse at the type of reaction that would presumably ensue on news of an actual trade deal. To that end, the S&P 500 jumped nearly 0.76% in a span of about ten minutes on just a suggestion that a proposal was made to lift tariffs temporarily.

- In earnings news, Morgan Stanley (MS 42.53, -1.96) reported top and bottom line results that were below consensus estimates for the fourth quarter. The stock fell -4.4% on the disappointing results, but it was not enough to bring down the red-hot financial sector (+0.5%), which is now up 7.2% this month. Netflix beats on subscriber growth, but misses slightly on revenue, stock fell after hours (-3.74%). The company is guiding toward lower-than-expected results for the first quarter of 2019. Netflix expects earnings per share of 56 cents on revenue of $4.49 billion, compared with Wall Street consensus estimates of 82 cents and $4.61 billion. Netflix previously warned content costs are more heavily weighted in the second half of the year. Newly appointed Chief Financial Officer Spence Neumann said during the company’s earnings interview that a move towards owned content has “put pressure on the cash flows of the business and the cash needs of the business over the past few years,” but that the company is confident in its investment.

World Wildlife Fund-Australia (WWF-Australia) has announced the launch of a supply chain tool that uses blockchain to allow businesses and consumers to track food items. The platform, dubbed OpenSC, is the product of a partnership between WWF-Australia and BCG Digital Ventures (BCGDV) — the global corporate venture, investment and incubation arm of United States-based Boston Consulting Group. The system allows both businesses to track products they produce, and consumers to view the origins of said products via a “unique blockchain code at the product’s point of origin.” The platform distributes QR codes to products made by client corporations signing up to the scheme. The codes are then linked to a blockchain platform to allow consumers to check the origin and life cycle of the specific product. The aim is to empower consumers with the knowledge of exactly what they are buying so they can purposely make an ethical choice.

Crypto exchanges and wallet providers would have to register with regulators under rules proposed by South Africa’s central bank. The South African Reserve Bank (SARB) said that regulatory action on crypto assets needs to be prioritized to protect consumers and investors, stating that consumers “are left vulnerable as sellers of crypto assets are not regulated.” The bank suggests that a “useful starting point” for regulating the space would be the introduction of a registration scheme for crypto asset service providers such as exchanges and wallet providers. It would follow that with a review of existing rules and how they can be applied to crypto assets, with possible amendments or new rules to follow, and finally a review of the regulatory actions implemented at that point. The central bank also recommended that crypto assets should remain without legal tender status and should not be recognized as electronic money in its proposal. A detailed process for registration is expected to be issued and implemented by the first quarter of 2019.

Cryptocurrency exchange Huobi — currently the world’s 7th largest by daily traded volume — has relaunched as a fully licensed platform in Japan after merging with BitTrade. Huobi Global’s wholly owned subsidiary, Huobi Japan Holding Ltd, acquired a majority stake in BitTrade last September. Leon Li, Huobi Group Founder and CEO, has said that securing the license represents a significant milestone for Huobi, given the importance of the Japanese market. Huobi Japan supports trading of Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Ripple (XRP), and Monacoin (MONA). While a license has been mandatory for all crypto exchanges operating within Japan since the amendment of the country’s Payment Services Act back in April 2017, the FSA has continued to ratchet up requirements for applicants throughout 2018, in the wake of last January’s industry-record-breaking $532 million theft of NEM tokens from Coincheck. Huobi Group has been headquartered in Singapore since Beijing’s crackdown on domestic crypto-fiat exchanges in September 2017. As part of its ongoing overseas expansion efforts, the platform has recently rebranded its United States-based strategic partner trading platform HBUS to the better known Huobi name.