NOTABLE MOVES

As of Wed, Feb 13, 08:00 Singapore Time Zone UTC+8

USDJPY, +0.12%, $110.51

EURUSD, +0.50%, $1.1332

GBPUSD, +0.31%, $1.2890

USDCAD, -0.55%, $1.3231

AUDUSD, +0.59%, $0.7103

NZDUSD, +0.12%, $0.6740

S&P500, +1.29%, 2,744.73

Nasdaq, +1.46%, 7,414.62

Nikkei Futures, +2.89%, 21,008.0

CURRENCY MARKET WRAP

- U.S. lawmakers reached a tentative agreement to prevent another government shutdown, though Trump expressed some reservations about the deal, which included funding that was short of the $5.7 billion requested by the White House, but believed that another shutdown was not likely. As for trade, Trump said there are no plans for a meeting with President Xi at the end of March, but confirmed that the deadline could be extended if real progress is evident.

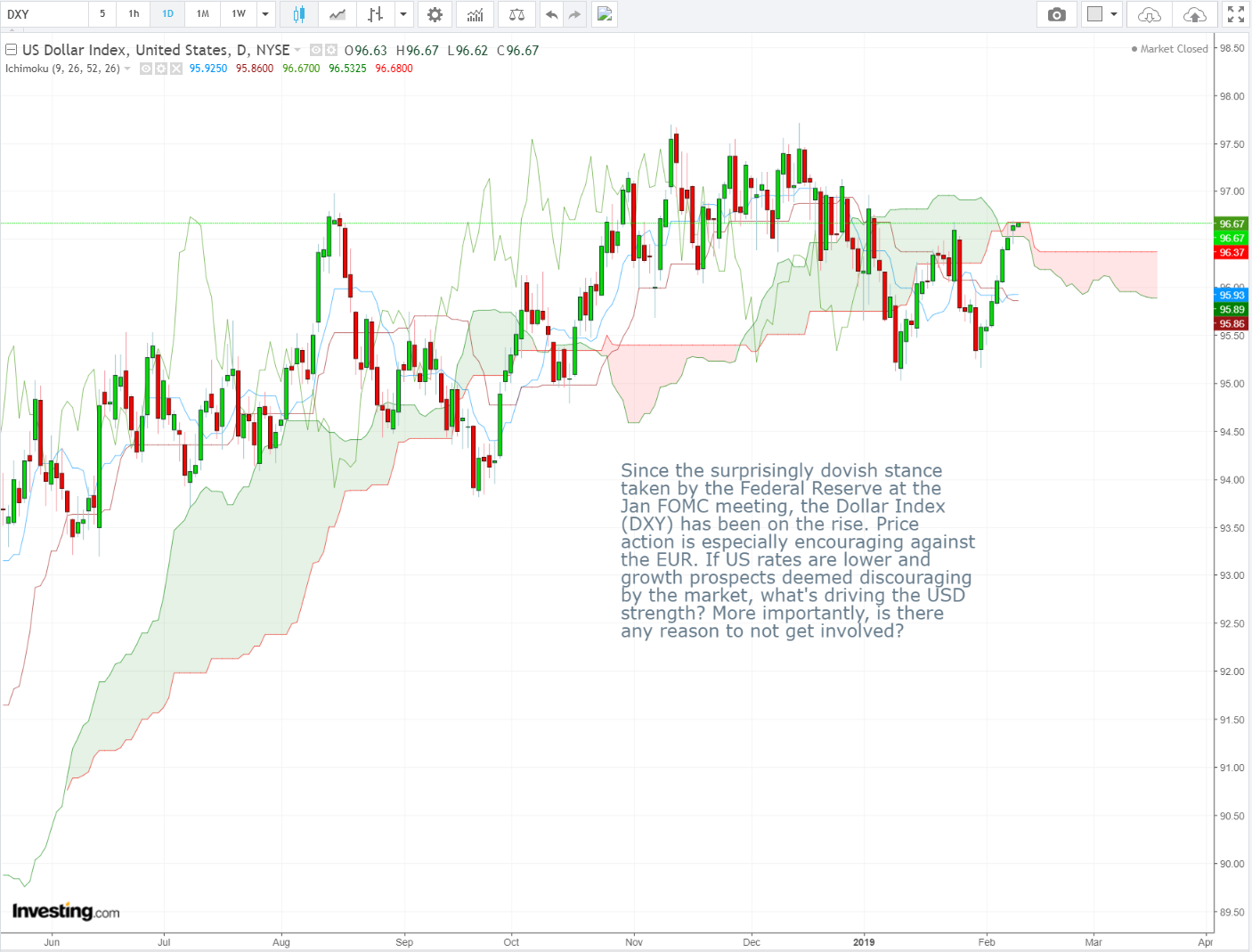

- U.S. Treasuries ended the day on a lower note, pushing yields higher across the curve. The 2-yr yield and the 10-yr yield increased two basis points each to 2.50% and 2.68%, respectively. The U.S. Dollar Index pulled back -0.4% to 96.72, recording its first loss of the month. WTI crude rose 1.4% to $53.12/bbl.

- The commodity bloc caught bids in response to positive trade developments.

STOCK MARKET WRAP

- The S&P 500 gained 1.29% on Tuesday, as optimism that U.S. lawmakers reached a tentative agreement to prevent another government shutdown helped fuel broad-based buying interest. Investors also remained hopeful for progress on the ongoing U.S-China trade talks.

- Tuesday’s gains helped the S&P 500 close above its 200-day moving average (2743) for the first time since Dec. 3. 10 of the 11 S&P 500 sectors finished with gains with materials (+2.3%), consumer discretionary (+1.7%), industrials (+1.6%), and financials (+1.6%) leading the advance. Conversely, the real estate (-0.7%) sector was the lone group to finish with a loss.

- Facebook (FB 165.04, -0.75) was a notable laggard, losing -0.5% after California Governor Gavin Newsom proposed a “digital dividend” that would require technology companies to share profits with consumers in exchange for collecting information, according to Bloomberg.

BLOCKCHAIN AND CRYPTOCURRENCY UPDATES

Bithumb Partners With Blockchain VC Firm Nvelop to Launch Exchange in UAE: Report

South Korean cryptocurrency exchange Bithumb will open a new platform in the United Arab Emirates (UAE). The UAE-based platform will allegedly be developed in partnership with Abu Dhabi-based firm Nvelop and will function as a springboard for Bithumb to expand into other countries in the Middle East. The partnership with Nvelop will enable them to build a foothold in the Middle East as a global exchange. Nvelop is a joint project from Abu Dhabi-based E11 Investment Fund and Taiwanese venture capital outfit Trill Ventures Group. The joint venture was reportedly established to fund and develop blockchain initiatives in the Middle East and North Africa. Bithumb joins a steadily increasing trend of major crypto exchanges opting to pursue international expansion plans amid challenging market conditions.

SEC Commissioner Suggests Excessive Crypto Regulation Hurts Growth

A commissioner at the US Securities and Exchange Commission (SEC), Hester Peirce, has said that the official regulation of cryptocurrencies could actually stunt the technology’s development. Those comments come at a time when the SEC has been accused of acting contrarily and gives hope to those wanting governments to take a step back to prevent over-regulation. Peirce said that she would keep an eye on ensuring no laws harm crypto projects, citing stablecoin Basis, which is shutting down and returning its $133 million in capital to investors due to the difficulty of complying with securities regulations. Peirce’s comments come at a time when the SEC’s views on cryptocurrencies haven’t been wholly clear. Last year the SEC rightly took enforcement action against initial coin offerings and other crypto companies perpetrating fraud. But, as Peirce noted, this doesn’t mean regulators and government agencies should be automatically skeptical about everything to emanate from the cryptocurrency sector.

Binance’s Decentralized Exchange Is About to Launch for Public Testing

Binance, the world’s largest cryptocurrency exchange by adjusted trading volume, is about to release its decentralized exchange, Binance DEX, for public testing. The firm’s CEO Changpeng Zhao tweeted Tuesday that the firm is targeting a date of Feb. 20 for the public testnet release of Binance Chain – the native public blockchain being developed to support the DEX. According to Cao, the firm has already given early access to a few “selected partners,” including wallet developers and blockchain explorers, who will be integrating tools into the decentralized platform. Ledger’s hardware wallet, the Nano S, is already integrated while the Nano X and wallets from Trezor and KeepKey will come on board in the future. Binance DEX will be available on all platforms, including Windows, Linux, Mac OS, iOS and Android, as per the AMA. There will be a listing fee of about $100,000 for tokens listed on Binance DEX – a high entry hurdle that he said was set to reduce the number of “spam or scam projects.” Binance Chain was unveiled in March 2018, with the firm saying at the time that it is being built to offer “low latency, high throughput trading, as well as decentralized custody of funds.”