NOTABLE MOVES

As of Wed, Jan 30, 08:00 Singapore Time zone UTC+8

USDJPY, +0.07%, $109.43

EURUSD, -0.01%, $1.1433

GBPUSD, -0.71%, $1.3070

USDCAD, +0.03%, $1.3268

AUDUSD, -0.16%, $0.7154

NZDUSD, -0.04%, $0.6827

S&P500, -0.15%, 2,640.00

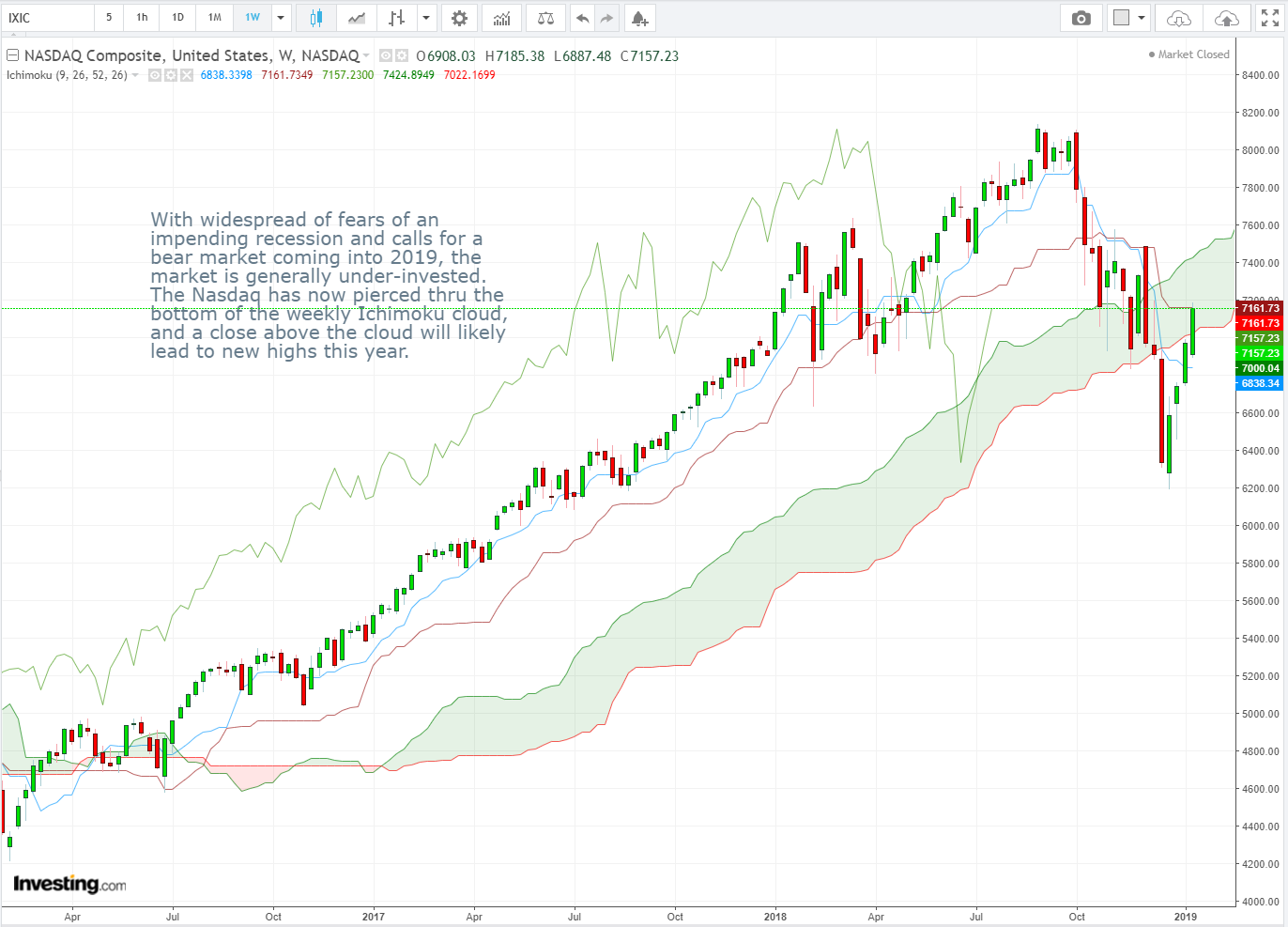

Nasdaq, -0.81%, 7,028.29

Nikkei Futures, +0.21%, 20,682.5

CURRENCY MARKET WRAP

- The Conference Board’s Consumer Confidence Index dropped to 120.2 in January (consensus 125) from a downwardly revised 126.6 (from 128.1) in December. The key takeaway from the report is that it showed that the outlook among consumers was dampened by the volatility in financial markets and the government shutdown, which threatens to register in consumer spending data that would be a drag on first quarter GDP.

- U.S. Treasuries edged higher, pushing yields lower across the curve. The 2-yr yield decreased one basis point to 2.57%, and the 10-yr yield decreased three basis points to 2.71%. The U.S. Dollar Index gained 0.1% to 95.82. WTI crude rose 2.4% to $53.22/bbl.

- UK Parliament backed an amendment to renegotiate a Brexit deal, according to Bloomberg. The outcome produced little effect on U.S. markets, but the voting was seen as a victory for UK Prime Minister Theresa May. The offset to the news is that the EU has said the Brexit deal is not renegotiable, particularly with respect to the Irish backstop worked out previously in the Withdrawal Agreement.

STOCK MARKET WRAP

- Wall Street closed on a mixed note on Tuesday, with the S&P 500 losing -0.15%, ahead of a big batch of earnings reports. The S&P 500 communication services (-1.1%), information technology (-1.0%), and consumer discretionary (-0.8%) sectors underperformed the broader market. Conversely, the industrials (+1.4%), materials (+1.1%), and real estate (+0.8%) sectors outperformed.

- Dow component 3M (MMM 196.95, +3.75, +1.9%) for its part lowered its fiscal 2019 guidance, in part due to slowing segments in China. The stock outperformed, though, helped by an earnings beat and by the view that its guidance cut was better than feared. Fellow Dow components Pfizer(PFE 40.77, +1.24, +3.1%) and Verizon (VZ 53.28, -1.79, -3.3%) also reported better-than-expected profit estimates and issued underwhelming guidance. Pfizer guided fiscal 2019 earnings and revenue below consensus, and Verizon issued mixed guidance for fiscal 2019. In other earnings news, Xerox (XRX 27.07, +2.77, +11.4%), Corning (GLW 33.72, +3.36, +11.1%), andWhirlpool (WHR 136.49, +12.03, +9.7%) all climbed after impressing investors with their corporate results.

- Apple shares jump after barely beating on earnings. Earnings per share for the December quarter came in at $4.18, slightly above a $4.17 consensus. Revenue came in at $84.3 billion, above an $83.97 billion consensus after the tech giant forecast on Jan. 2 that it expected revenue of about $84 billion, roughly $7 billion less than expected, largely due to disappointing sales in China. For the March quarter, Apple said it expects revenue of $55 billion to $59 billion, slightly less than a $58.98 billion consensus.

- Revenue for the company’s services segment — that includes Apple Pay, Apple Music and iCloud storage — topped $10.9 billion. Marking a 19% YoY increase. Apple reported a gross margin in its services segment of 62.8%. A growth rate of 19% for the category is at the lower end of recent growth rate. Apple grew services revenue year over year by 17% last quarter, and 18% in the year-ago quarter, but has seen growth rates as high as 34% within the last year and a half. Chief Financial Officer Luca Maestri said on the company’s earnings call that Apple now has 900 million installed iPhones in use around the world, and 1.4 billion total installed devices. Apple indicated it will start reporting installed device numbers on a more regular basis. Shares were rose 5.3% to $163.27 after-hours on Tuesday.

BLOCKCHAIN & CRYPTOCURRENCY NEWS

Nvidia Decreases Q4 Revenue Estimates Citing Crypto Mining Decline, Conditions in China

Taiwan-based computer hardware producer Nvidia updated its financial estimates for Q4 for the fiscal year of 2019. The company is reflecting weaker forecasted sales in its gaming and data center platforms, which comes from excess mid-range channel inventory following the slump in cryptocurrency markets. Q4 revenue is expected to be at $ 2.20 billion, opposed to the previous projection of $2.70 billion according to a statement released by Nvidia on Jan 28. Jensen Huang, Nvidia founder and CEO, said in the press release, “Q4 was an extraordinary, unusually turbulent, and disappointing quarter.” In addition to a lack of crypto-related business, Nvidia also cites “deteriorating conditions” in China as a indicator of lower-than-expected revenue from gaming GPU sales in Q4. The company had experienced a massive sell-off of stocks at the end of 2018, which sank the company’s stock price by 54 percent.

Desktop Crypto Asset Manager Ledger Live Launches Mobile App Version

French cryptocurrency hardware wallet manufacturer Ledger has released a dedicated mobile app for some of its products. Dubbed Ledger Live, the app previously available for desktop is now available for Android and iOS mobile devices, the company reports. The app allows users of Ledger Nano X wallets to use their wallet without the need for a cable via their mobile device and a Bluetooth connection. The company promised full functionality would roll out to all users at a later date, but in the case of Nano S, they would have to use an Android phone to communicate with their wallet. In the future, Ledger Nano S users (Android smartphones only) will be able to transact as well through the use of an OTG cable. Ledger’s app shares some similarities with competitor offerings such as Trezor’s Bridge interface, which the company rolled out across its wallet family last year.

BitTorrent Tokens Sold Out in Under 15 Minutes, Netting Over $7 Mln

The BitTorrent token (BTT) sale on the Binance Launchpad platform concluded, netting $7.1 million dollars with the sale of 50 billion tokens in under 15 minutes. Binance announced the conclusion of the sale in an official blog post. BitTorrent is a protocol for peer-to-peer file sharing, allowing users to distribute files such as music or videos over the internet.BTT is based on a Tron TRC-10 token, and will be used on the platform to “transact in computing resources shared between BitTorrent clients and any other participating service requesters and service providers.“The BitTorrent tokens were sold in two simultaneous sessions on Binance Launchpad, one for buyers using Binance’s native token, Binance Coin (BNB), and the other for buyers using Tron (TRX). Each token was priced at $0.00012. Binance CEO and founder Changpeng Zhao said that the sale would have ended much sooner, had technical issues not surfaced on the Launchpad website.