WHAT HAPPENED YESTERDAY

As of New York Close 13 May 2020,

FX

U.S. Dollar Index, +0.24%, 100.17

USDJPY, -0.20%, $106.93

EURUSD, -0.24%, $1.0821

GBPUSD, -0.18%, $1.2239

USDCAD, +0.09%, $1.4091

AUDUSD, -0.26%, $0.6453

NZDUSD, -1.34%, $0.5996

STOCK INDICES

S&P500, -1.75%, 2,820.00

Dow Jones, -2.17%, 23,247.97

Nasdaq, -1.55%, 8,863.17

Nikkei Futures, -0.86%, 20,115.0

COMMODITIES

Gold Spot, +0.94%, 1,718.68

Brent Oil Spot, +0.66%, 27.54

SUMMARY:

Dollar edged higher against a basket of currencies on Wednesday, after Federal Reserve Chair Jerome Powell rejected the idea of using negative interest rates as a stimulative tool, even as he sounded a gloomy note about economic growth. Traders of short-term U.S. interest-rate futures reduced bets the Fed will take the unprecedented step of pushing interest rates below zero. Yet futures contracts maturing in April 2021 and later still signalled expectations for negative rates, according to CME Group’s FedWatch tool.

S&P 500 lost 1.75% on Wednesday in a broad-based decline, as investors accounted for some cautious commentary from Fed Chair Powell. The Dow Jones Industrial Average declined 2.17%, the Nasdaq Composite declined 1.55%, and the Russell 2000 declined 3.3%. U.S. 2yr yield fell 1bp to 0.16% and U.S. 10yr yield fell 5bp to 0.64%.

In his speech prior to the open, Fed Chair Powell said the economic outlook remained highly uncertain and subject to significant downside risks, adding that recovery may take some time to gather momentum. Powell also said the Fed can do more to help the financial system but dismissed the notion of implementing negative interest rates.

Adding to U.S.-China tensions, the FBI confirmed that China-affiliated cyber actors have targeted U.S. organizations conducting Covid-19-related research. Also, a report out of China indicated that Beijing is mulling punitive countermeasures on the U.S. as a result of lawsuits that are seeking Covid-19-related damages.

Separately, valuation concerns were voiced by a couple of influential names. Legendary investor Stanley Druckenmiller said the risk-reward for equity is maybe as bad as he’s seen it in his career. Appaloosa Management’s David Tepper told CNBC that he hasn’t seen the market this overvalued since 1999.

RBNZ MONETARY DECISION

The RBNZ said it would almost double its bond-buying programme to $60 billion to help stimulate the economy as it goes through a Covid-19 driven downturn. The bank’s previous bond-buying, or quantitative easing (QE), limit had been set at $30 billion of Government bonds and $3 billion of local authority paper. As expected, the bank kept its official cash rate unchanged at 0.25 percent.

The bank’s Monetary Policy Committee said it was prepared to use additional monetary policy tools “if and when needed”, including reducing the OCR further, adding other types of assets to the QE programme, and providing fixed-term loans to banks. It also said that it was advising financial institutions to be prepared for negative rates because although they have no plans to implement it at this time, it is an option at a later date if required.

IMPACT: The Kiwi fell in the aftermath of RBNZ’s decision as the central bank signaled that they will do whatever it takes to support the economy. It was one of the only central banks that openly considered negative interest rates should the crisis worsen, and that is especially significant because RBNZ used to eschew QE and ultra-easy monetary policies. As geopolitical and trade tensions continue to increase, the NZD and AUD will continue to be pressured.

AS COVID-19 EBBS, EU SEEKS TO UNLOCK BORDERS FOR SUMMER

The European Union pushed on Wednesday for a safe reopening of borders, while insisting on protective measures such as masks on planes, to try and salvage the ravaged tourism sector for the lucrative summer season as Covid-19 infections recede. Though wary of new waves of COVID-19, the EU executive wants to revive what it can do for the June-August season normally worth 150 billion euros ($162.59 billion).

IMPACT: Consistent with our repeated warnings, better to face the lesser evil by being cautious now then to face a tsunami of infections should things go awry in the bid to boost the economy in the near term. Coupled with a fractured EU, the risks go beyond economic but include social and political upheaval if the crisis is not handled well. All these do not bode well for the Euro and more downward pressure is inevitable in the long run.

POWELL WARNS OF PROLONGED ECONOMIC WEAKNESS, CALLS FOR MORE FISCAL SUPPORT

Powell, in a sober review of where the U.S. economy stands on the cusp of its reopening, warned on Wednesday of an “extended period” of weak growth and stagnant incomes, pledged to use more of the central bank’s power as needed, and issued a call for additional fiscal spending.

Powell made clear, however, that the Fed won’t push interest rates below zero, as traders had been increasingly betting. Negative interest rates, he said, are “not something that we are considering.”

IMPACT: Powell became the latest in a parade of US policymakers to brush off the notion that they might push rates into negative territory after Fed Fund futures began pricing a small chance of sub-zero U.S. rates within the next year. His comments provided some support for the weak Dollar. U.S. data on weekly jobless claims due later today and a survey on U.S. manufacturing due Friday should offer more clues about the economic outlook and drive Fed Funds futures pricing for rates.

DAY AHEAD

Germany will publish its preliminary GDP growth readings for the first quarter tomorrow. Although the Eurozone’s initial estimates have already revealed a 3.8% contraction for the aforementioned period, markets could still pay some attention to the German numbers as a concerning report out of the largest EU economy could drive Berlin’s skeptical response to the EU’s Covid-19 stimulus policies that are so desperately needed by the most-infected member states.

A worse-than-expected GDP reading out of Germany on Friday could pressure German lawmakers to relax their strict judgment on EU’s policies, keeping some floor under the battered Euro if the country indeed shows some willingness to collaborate in the near future. Otherwise, an upside surprise in the numbers may strengthen Germany’s negotiating position, prolonging its dispute with Brussels.

SENTIMENT

OVERALL SENTIMENT:

Stocks started the early Asian hours weak but crept higher throughout the day. The rally at the start of NY session fizzled out as a reality check from Fed Chair Powell put a damper on things. Multi-billion dollar hedge fund Appaloosa’s David Tepper added his voice to the many high profile investors warning of the lofty stock prices, saying current markets are the most overvalued he’s seen since that of 1999. Reality is finally biting.

Despite Fed Chair Powell pushing back against market pricing of negative Fed Funds rates, Gold ended close to the highs of the day. This positive price action could be a sign that the corrective phase of Gold price is almost over.

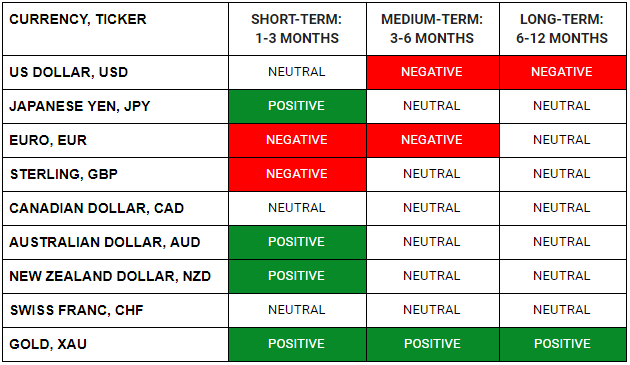

FX

STOCK INDICES

TRADING TIP

Reality Bites

For the longest time, and even now, many financial forecasters and even policymakers spoke of V-shaped recoveries and quick bounce backs in economic growth. As the economic realities set in, these hopeful delusions are being recognised for what they are. Many businesses and even industries will not only find it hard to regain past glories but may even cease to exist altogether.

People who fear for their livelihoods do not rush out to ramp up their consumption just because there are avenues to consume again. The buoyant stock market may seem to indicate that all is going well again but it will soon prove to be an illusion as reality starts to bite.