WHAT HAPPENED YESTERDAY

As of New York Close 18 May 2020,

FX

U.S. Dollar Index, -0.77%, 99.63

USDJPY, +0.33%, $107.39

EURUSD, +0.91%, $1.0914

GBPUSD, +0.77%, $1.2199

USDCAD, -1.20%, $1.3940

AUDUSD, +1.70%, $0.6524

NZDUSD, +1.79%, $0.6039

STOCK INDICES

S&P500, +3.15%, 2,953.91

Dow Jones, +3.85%, 24,597.37

Nasdaq, +2.44%, 9,234.83

Nikkei Futures, +2.99%, 20,640.0

COMMODITIES

Gold Spot, -0.46%, 1,734.93

Brent Oil Spot, +9.55%, 33.83

SUMMARY:

A jump in oil prices lifted commodity currencies such as the NOK and the CAD against the U.S. Dollar on Monday as optimism about a reopening of economies stifled by the Covid-19 pandemic boosted risk appetite. USD started out strong in Asia with Gold and Silver breaking higher aggressively. However, that soon turned around when stocks started to power higher just prior to NY start. Fundamentals remain intact, and patience is a requirement in this market. On the UK front, GBP made new lows, but managed a reversal (+0.97%) due to USD weakness when markets turned risk on. The problems that plague the GBP remain, this temporary reprieve is likely to be just that.

Italian government bond yields fell to their lowest level in over a month after France and Germany on Monday proposed a 500 billion euro ($543 billion) recovery fund offering grants to regions hit hardest by the Covid-19 crisis. The proposal moves the EU more in the direction of a transfer union and is likely to please countries like Italy or Spain which have long called for more joint action in response to the crisis. But offering grants rather than loans could be hard to swallow for some of the frugal northern countries of the 27-nation bloc, like the Netherlands, Finland, and Austria.

S&P 500 rallied 3.15% on Monday, as reopening hopes were fueled by a positive vaccine update from Moderna (MRNA 80.00, +13.31, +20.0%). The small-cap Russell 2000 outperformed with a 6.1% gain, followed by the Dow Jones Industrial Average (+3.85%) and Nasdaq Composite (+2.44%). U.S. 2yr yield rose 2bp and U.S. 10yr yield rose 9bp to 0.73%.

Prior to the open, Moderna announced that a Phase 1 study for its COVID-19 vaccine candidate yielded positive interim clinical results. The company was hopeful that a Phase 3 trial could begin earlier than expected in July, and it started scaling up its manufacturing capacity so it can produce as much vaccine as possible if approved.

The news provided an added boost to the market, which was already trading higher following Powell’s “60 Minutes” interview with CBS. Powell assured the market that the Fed is still not out of ammunition and suggested Congress should do more. Powell also said that a full economic recovery could take more than a year and will likely require a vaccine.

The timely vaccine update, then, coupled with the Fed’s support and an increase in nationwide reopening efforts, helped ignite a rally in risk assets, this inadvertently caused safe havens like Gold and Silver to be sold.

NEW ZEALAND CENTRAL BANK COULD EXPAND, EXTEND QE

New Zealand’s central bank could expand its government bond-buying programme further though it hopes to have more certainty in about three months’ time on whether to go harder or ease back stimulus, a top official said on Tuesday.

On Tuesday, RBNZ Deputy Governor said negative rates were one of many monetary policy options available to the RBNZ. “We will evaluate negative rates alongside other options,” he said. “For now, we think the best thing we should be doing is large scale asset purchases and we’ve expanded that. We could expand it further if needed.”

IMPACT: The RBNZ has been the clearest among developed world central banks, which have yet to implement negative rates, about its intent to use negative rates and accommodative policies to boost its economy should things turn south. This makes the RBNZ (NZD) along with BoE (GBP) the most dovish developed central banks and their currencies a good underlying to sell into any spikes should their stance remain and the effect of the virus remain protracted as we have suggested.

MEXICO BEGINS REOPENING DESPITE COVID-19 FEARS

Mexico issued guidelines for restarting operations in the automotive, mining, and construction sectors on Monday, pushing ahead with reopening the economy despite a growing national toll from the Covid-19 pandemic and concerns about unsafe work sites.

With Mexico’s coronavirus death toll having surged past 5,000, and known cases set to surpass 50,000, officials are wrestling with how to restart key industries without triggering greater spread of the virus. The moves to loosen restrictions follow growing pressure from the United States to reopen factories that are vital to supply chains of U.S.-based businesses, especially in the vast automotive sector.

IMPACT: On May 12, Mexico reported a record number of deaths in a single day with 353 fatalities. That grim news was followed on Friday by a reported 2,437 new coronavirus infections, a one-day record rise in cases since the start of the pandemic. Critics, including some within Lopez Obrador’s own ruling MORENA party, worry that restarting factories too soon could exacerbate the spread of the virus before it has been brought under control. A second-wave of infection (highly likely) will put pressure on the Mexican Peso (MXN).

NASDAQ TO TIGHTEN LISTING RULES, RESTRICTING CHINESE IPOs

Nasdaq Inc is set to unveil new restrictions on initial public offerings (IPOs), a move that will make it more difficult for some Chinese companies to debut on its stock exchange, people familiar with the matter said on Monday.

While Nasdaq will not cite Chinese companies specifically in the changes, the move is being driven largely by concerns about some of the Chinese IPO hopefuls’ lack of accounting transparency and close ties to powerful insiders, the sources said.

The new rules will require companies from some countries, including China, to raise $25 million in their IPO or, alternatively, at least a quarter of their post-listing market capitalization, the sources said.

IMPACT: At a time of escalating tensions between the United States and China over trade, technology, and the spread of the Covid-19, Nasdaq’s curbs on small Chinese IPOs represent the latest flashpoint in the financial relationship between the world’s two largest economies. Expect more trade and geopolitical volatility going forward, which will keep Safe Haven currencies like the Japanese Yen (JPY) at a premium relative to its counterparts, especially trade sensitive currencies like the Aussie (AUD) and Singapore Dollar (SGD).

DAY AHEAD

A raft of economic data is due out of the United Kingdom this week, starting with the labour market report on later today and the consumer price index on Wednesday. Following last week’s dire GDP figures, traders should be braced for more depressing readings on the economy, with the March jobs numbers stealing the limelight early in the week. But as if things weren’t critical enough with the Covid-19 pandemic spreading mayhem on the global economy, the UK also has to contend with Brexit, adding to GBP woes.

SENTIMENT

OVERALL SENTIMENT:

Stocks powered ahead after pharmaceutical firm Moderna reported “positive” data on early-stage covid-19 vaccine trial. If you run any pharma firm, it makes sense to be chasing a vaccine or treatment, do trials and report any “positive” data you see as it causes massive spikes in your stock price!

Gold started the day shining bright but tumbled for no good reason except to frustrate gold bugs as the market went full risk on. This is a trade for the long haul and not for the faint-hearted!

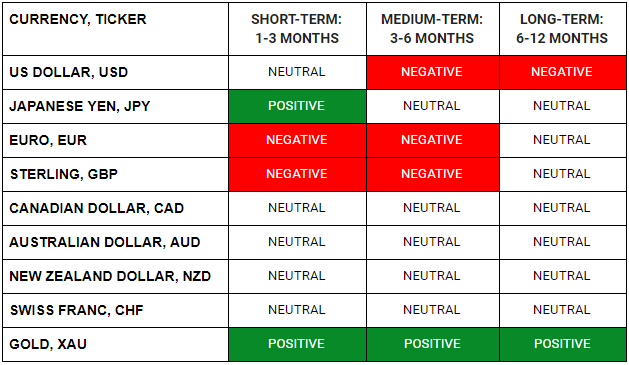

FX

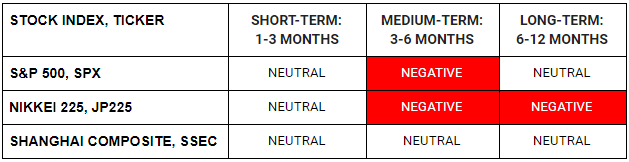

STOCK INDICES

TRADING TIP

Higher Volatility Lurks

As geopolitical tensions rise and governments warn about the protracted effect the virus has on the economy, there seems to be a mismatch between expectations of market participants (“v-shaped recovery”) and the real world. The exuberance of incessant money printing is being front-loaded in recent times, but the motivations between both parties (Central Planners and Market Participants) in this can’t be more different. Central Planners are acting out of fear and overcompensating for it with actions, while market participants are buying in “hope”. The stark contrast in intent is troubling, and we suspect central planners have the upper hand in terms of understanding economic reality.

With the fate of Wall Street diverging further away from the dire reality of Main Street, expect volatility in time to come.