WHAT HAPPENED YESTERDAY

As of New York Close 20 May 2020,

FX

U.S. Dollar Index, -0.19%, 99.18

USDJPY, -0.10%, $107.60

EURUSD, +0.52%, $1.0980

GBPUSD, -0.13%, $1.2236

USDCAD, -0.29%, $1.3903

AUDUSD, +0.84%, $0.6592

NZDUSD, +1.17%, $0.6147

STOCK INDICES

S&P500, +1.67%, 2,971.61

Dow Jones, +1.52%, 24,575.90

Nasdaq, +2.08%, 9,375.78

Nikkei 225, +0.79%, 20,595.15

COMMODITIES

Gold Spot, +0.15%, 1,747.74

Brent Oil Spot, +4.08%, 34.45

SUMMARY:

Dollar fell to a more than two-week low against the Euro as the common currency enjoyed a boost from the recently announced proposal for a common fund that could move Europe closer to a fiscal union as it tries to counter the economic hit from the Covid-19 pandemic. The Euro also found strength from survey data on Tuesday that showed German investor sentiment improved much more than expected in May. Pain was the order of the day as AUD and NZD continued to charge higher despite obvious problems for the currencies. China’s unhappiness with Australia and RBNZ’s intent to be extremely dovish are not going away anytime soon. Eventually those factors will take a toll on AUD and NZD respectively.

The Dollar found little support from the release of the minutes of the U.S. Federal Reserve’s most recent policy-setting meeting, which showed that policymakers agreed to use their tools “as appropriate” to support the economy and re-upped a pledge to keep interest rates near zero.

S&P 500 gained 1.7% on Wednesday in a broad-based advance to close at its highest level since March 6. The Nasdaq Composite (+2.1%) and Russell 2000 (+3.0%) increased more than the benchmark index, while the Dow Jones Industrial Average rose 1.5%. U.S. 2yr yield fell 1bp to 0.16% and U.S. 10yr yield fell 2bp to 0.68%.

In Washington, the Senate passed the Holding Foreign Companies Accountable Act, which requires certain foreign companies listed in the U.S. to certify that they are not owned or controlled by a foreign government. Failure to provide appropriate certification could result in de-listing.

The increased scrutiny on Chinese companies pressured shares of Alibaba (BABA 216.79, -0.41, -0.2%) and Baidu (BIDU 108.52, -1.23, -1.1%), while the broader U.S. market was barely bothered by the bill’s potential to worsen U.S.-China tensions. Facebook surged more than 6% Wednesday to a record high of about $230 per share on its announcement a day earlier that it would roll out Facebook and Instagram shops starting Wednesday.

U.S. TO SELL TAIWAN $180 MILLION WORTH OF TORPEDOES

U.S government has notified Congress of a possible sale of advanced torpedoes to Taiwan worth around $180 million, a move likely to further sour already tense ties between Washington and Beijing, which claims Taiwan as Chinese territory.

The proposed sale serves U.S. national, economic, and security interests by supporting Taiwan’s “continuing efforts to modernise its armed forces and to maintain a credible defensive capability”, the agency said.

The announcement came on the same day Taiwan President Tsai Ing-wen was sworn in for her second term in office, saying she strongly rejected China’s sovereignty claims. China responded that “reunification” was inevitable and that it would never tolerate Taiwan’s independence. US Secretary of State Pompeo, being the first US Secretary of State to call the Taiwanese President to congratulate her for her re-election, did not help matters.

IMPACT: The United States, like most countries, has no official diplomatic ties with Taiwan, but is bound by law to provide the democratic island with the means to defend itself. China routinely denounces U.S. arms sales to Taiwan. The U.S. seems to be taking every opportunity to aggravate China, from disrupting Economic Incentives via Trade War and stock listing restrictions, to the WHO fiasco and now selling Taiwan weapons during a sensitive period. Expect retaliation from China and risk assets like the AUD and NZD to turn on a whim as volatility explodes. The path of least resistance remains to be long Gold and Silver amidst an uncertain future.

MEXICO REGISTERS RECORD ONE-DAY COVID-19 DEATH TOLL WITH 424 FATALITIES

Mexico’s health ministry on Wednesday registered 2,248 new Covid-19 infections and an additional 424 fatalities, a record one-day death toll since the start of the pandemic.

The new infections brought confirmed Covid-19 cases to 56,594 and 6,090 deaths in total, according to the official tally.

IMPACT: Mexico has had a tumultuous couple of days on the virus front and this is after reopening its economy on Monday, which does not seem like such a good idea after all. With the first wave not under control, a second wave of outbreak in Mexico is inevitable and the same fate awaits many countries who are nonchalant towards this risk. This will weigh on the domestic currency in the case of emerging markets, and on global risk sentiment should developed markets see a second outbreak. Safe Havens such as the JPY, CHF, and Gold should be considered on pullbacks.

BRAZIL READY TO INCREASE FX INTERVENTION

Brazil stands ready to dip into its large pool of foreign exchange reserves and continue intervening in the currency market if needed, but any bond market intervention is likely to be far smaller in size, central bank President Roberto Campos Neto said on Wednesday.

Brazil’s real has lost around 30% of its value and is one of the worst-performing currencies against the dollar this year. A combination of record-low interest rates, a sharply deteriorating economy because of the Covid-19 pandemic and political uncertainty have pulled capital out of the country.

IMPACT: Global coronavirus cases surpassed 5 million on Wednesday, with Latin America overtaking the United States and Europe in the past week to report the largest portion of new daily cases globally. Latin America accounted for around a third of the 91,000 cases reported earlier this week. Europe and the United States each accounted for just over 20%. Cases in Brazil are now rising at a daily pace second only to the United States. Further weakness in the already battered BRL is expected, unless Brazil shows it can flatten the curve, any monetary intervention will be faded quickly and the BRL will resume its downward trajectory.

DAY AHEAD

The Eurozone’s flash PMI readings for the month of May will hit the markets tomorrow, likely showing a reviving business sector as most member states moved forward with their reopening plans. The data are expected to contribute to the bullish atmosphere of the German-Franco deal for a virus relief fund created for the euro this week, exposing the currency to fresh buying pressure. On the same day, the ECB meeting minutes could clarify if there is any willingness for more monetary stimulus.

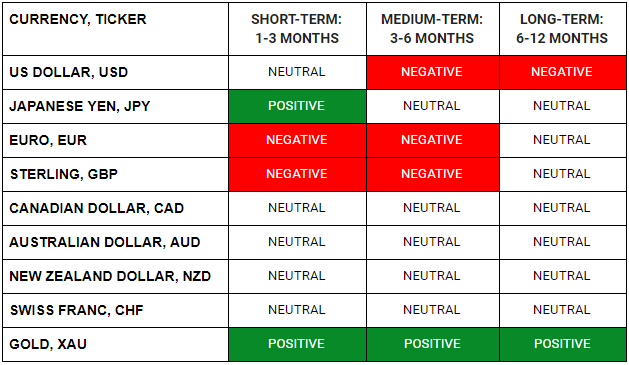

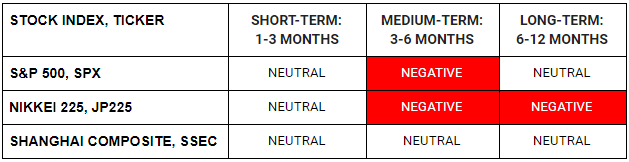

SENTIMENT

OVERALL SENTIMENT:

On a generally quiet day, stocks tried again to break to new highs, but failed. USD weakened against almost all the developed currency except the JPY. Subscribed trades such as short GBP and NZD got squeezed as stops were triggered. With the weak hands out, the strong hands will likely prevail as fundamentals eventually reassert themselves.

FX

STOCK INDICES

TRADING TIP

Don’t Poke the Sleeping Giant

This should be sound advice for everyone to follow and yet, this is what Australia and Taiwan seem to be intent on doing. Just when the world is going through the biggest economic crisis of our lifetime, and for any respectable economic rebound to take place smoothly, it would seem obvious to all that you should be on good terms with your biggest trading partner. Obvious to us, but not so much to the politicians of these countries as they continually antagonise China with their words and actions.

US is leading the charge in anti-China rhetoric, but the EU is also trying to get involved by passing legislation to prevent Chinese companies from buying any European companies that have become cheaper during this Covid-19 crisis. Preventing foreign entities from gaining a controlling stake in key companies is not a novel idea but this is specifically targeted at China.

Eventually China will react and when it does, it will not be pretty for the ones who will need to bear the brunt of the pent-up fury. So far, China has only acted against Australia, and it is likely Australia will continue to be made an example of. The worst is yet to come.