- There were no notable U.S. prints on Tuesday. An overnight spike in U.S. Treasury yields spooked investors in early U.S. trading, as the benchmark 10-yr yield rose as high as 3.26%. However, renewed buying interest drove prices up and yields down, which eased some of the early angst. The 10-yr note yield settled Tuesday’s session at 3.21%, down three basis points from Friday. Risk-Aversion overhang lingers as markets continue to be soft. USDJPY down -0.19%, $113.02.

- German Trade Balance at 18.3B vs expected 15.9B. Deputy PM Salvini was again crossing the wires through the European morning, saying that the government won’t backtrack on the budget even if local yields keep soaring. He also said that the country is not planning to leave the EU, but would like to see a change in Union rules. Euro up 0.12%, $1.1506. In Brexit, according to diplomats familiar with the matter, both economies have narrowed the gap on the Ireland border issue, but some differences remain. Also, that an agreement on the future trade relationship could be done by November, while the divorce terms could be out next Monday. Sterling up 0.51%, $1.3157. WTI crude climbed 0.8% to $74.86/bbl, as some oil production has been shut down in the Gulf of Mexico in anticipation of Hurricane Michael. USDCAD down -0.21%, $1.2939. Aussie up 0.51%, $0.7114.

- S&P 500 down -0.14%, 2,880.34. Nasdaq up 0.26%, 7,371.62. Nikkei down -1.34%, 23,502.00.

- Stocks were confused on Tuesday amid concerns about growth, rising interest rates, and the impending arrival of Hurricane Michael in Florida’s panhandle. The broader market seemed reluctant to make a decisive move in any direction, as the S&P 500 index crossed back and forth across the unchanged line numerous times during the trading session. Markets looked to have gotten caught up on economic and earnings growth concerns that were fostered by the the International Monetary Fund (IMF) cutting its 2018 and 2019 global growth outlook to 3.7% from 3.9% and a third quarter earnings warning from specialty chemicals company PPG Industries (PPG 98.56, -11.02, -10.1%), which pinned some disappointing guidance on currency pressures, cost inflation, softer demand in China, and a lower end-user demand in Europe and the U.S. PPG’s warning rattled the materials sector, which plunged -3.4%. Several sector components finished trading at their 52-week lows.

Swiss Financial Watchdog Issues Country’s First Crypto Asset Management License

The Swiss Financial Market Supervisory Authority (FINMA) has issued the country’s first cryptocurrency asset management license to a crypto investment fund, Crypto Fund. Crypto Fund is a subsidiary founded in 2017 by Zug-based Crypto Finance AG. The new license will permit the firm to legally offer a wide spectrum of collective investment products that track Bitcoin (BTC) and other crypto assets, including domestic funds and allows the firm to provide investment consultancy services for institutional clients. This summer, local companies partnered with the Zug, known in the crypto industry by the moniker, “Crypto Valley,”to trial a blockchain-based municipal voting system. Switzerland is proactive when it comes to regulating the new crypto space. In February, FINMA published detailed guidelines on ICOs, according to which many projects will be regulated under securities laws, while payment tokens fall under the Swiss Anti-Money-Laundering (AML) Act.

Dubai Government – Backed Digital Currency Will Get Its Own Payment System

Consumers in Dubai will soon be able to use digital currency to pay for goods, services, and utilities following a new government partnership. The deal between emcredit, a subsidiary of the Dubai Department of Economic Development, blockchain payment provider Pundi X, and its partner Ebooc Fintech & Loyalty Labs LLC will facilitate point of sale (PoS) payments in emcredit’s emcash currency. Ebooc will provide PoS terminals for in – store payments, while Pundi Ks plans to increase 100,000 units globally over the next three years. Dubai continues to position itself as a blockchain innovator at state level, with multiple schemes ongoing as part of its goal of becoming a fully blockchain-powered city by 2020.

Mastercard Patent Hints at Plan for Multi-Currency Blockchains

Mastercard has won a patent for a proposed system that would allow for the launch of different kinds of blockchains – including those that support multiple currencies. The patent explains that a group or company may need to store different types of transaction information on a single platform – something that is currently difficult to do on a single blockchain. There is a need for a technological solution to provide a partitioned blockchain that is capable of storing multiple transaction formats and types in a single blockchain, reducing the computing resources and processing power required for deployment and operation of the blockchain, while also providing for enhanced usage of permissions for permissioned blockchains. The patent adds that an appropriately partitioned blockchain can receive information about transaction types from different computing devices.

- There were no U.S. prints on Monday. Japanese and Canadian banks were closed. Chinese banks are open again after their “golden week” holiday. Note, the bond market was closed in observance of Columbus Day. Yen continues to remain bid against the Dollar due to continued risk-aversion, fuelled by trade war rhetoric and Italian government politics. USDJPY down -0.52%, $113.12.

- German Industrial Production m/m came in at -0.3% vs expected 0.4%. Italian government bond yields surged to over 4-year highs, with Italian Salvini pointing a finger on Brussels for the bond sell-off and Deputy PM Di Maio claiming that anti-austerity views will grow stronger across the continent. Euro down -0.26%, $1.1494. The optimism about the EU offering a “super-charged” free-trade deal faded on comments from UK PM May’s spokesman, who said that there is a big difference between optimistic talks and a done deal and that there can’t be no withdrawal agreement without a price future framework. Additionally, it was reported that US Brexit Secretary Raab won’t be heading to Brussels this week. Sterling down -0.26%, $1.3093.

- S&P 500 down -0.04%, 2,884.43. Nasdaq down -0.62%, 7,352.82. Nikkei down -0.48%, 23,553.0.

- Concerning headlines overseas weighed on U.S. markets early. In China, Secretary of State Mike Pompeo traded jabs with China’s foreign minister, Wang Yi, regarding trade disputes. Yi accused the United States of meddling with domestic affairs, and Pompeo retorted that the two simply had a “fundamental disagreement.” In Italy, the government continued its feud with the European Union over its budget deficit plan, with Italy’s Deputy Minister Matteo Salvini referring to two EU leaders as “enemies of Europe.”

- In corporate news, Google’s parent company Alphabet (GOOG 1148.97, -8.38) announced that account information of 500,000 of its users was exposed due to a bug, and General Electric (GE 13.61, +0.43) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Barclays. Alphabet shares lost -0.7%, while GE shares climbed 3.3%.

Binance Labs, the incubator wing of the Binance cryptocurrency exchange, has invested in a smart contract and blockchain audit startup, the company announced Monday. Called CertiK, the firm seeks to help secure smart contract and blockchain platforms through a formal verification process. The team has already begun working on ensuring existing blockchain platforms do not contain bugs that could lead to a loss of funds or other vulnerabilities. The investment “signals the recognition of the importance of formal verification in the blockchain industry. This technology includes CertiKOS, which has already been used in both enterprise and military programs, and is one of the tools used by the U.S. Defense Advanced Research Projects Agency (DARPA).

2. Binance Announces All Listing Fees Will Be Donated to Charity

The CEO of world’s largest cryptocurrency exchange Binance said he “hoped others would follow” his decision to donate all listing fees to charity after a sudden announcement Monday, October 8. According to the announcement, Binance will not only donate all such fees to charitable causes for the “greater good,” but also allow developers themselves to name the amount they pay, without demanding a minimum fee. Binance CEO Changpeng Zhao claimed the material was fake, he argued that it was the quality of the asset which was clinched the listing process, avoiding details about Binance’s mysterious listing fee structure. Binance is currently the world’s largest crypto exchange by daily trade volumes, seeing about $806.5 million in trades over the past 24 hours to press time.

3. Venezuela Mandates Passport Fees Must Be Paid in Controversial Cryptocurrency Petro

Venezuelans can only use the state-backed cryptocurrency, the Petro, to pay for passport fees starting next week, the country’s vice president Delcy Rodriguez said in a press conference. The average monthly minimum wage in Venezuela is four times less than the cost of the raised passport fee. Venezuela has sought to combat the side-effects of rampant inflation and a failing economy by embracing the use of cryptocurrency to circumvent capital controls. Petro, President Nicolas Maduro’s purported solution to the country’s economic crisis, has consistently courted controversy, with accusations last week claiming its developers copied the whitepaper of altcoin Dash. Along with the passport fees shake-up, Rodriguez also announced the formation of a dedicated migration police force, ostensibly designed “to preserve citizen security and migratory control.”

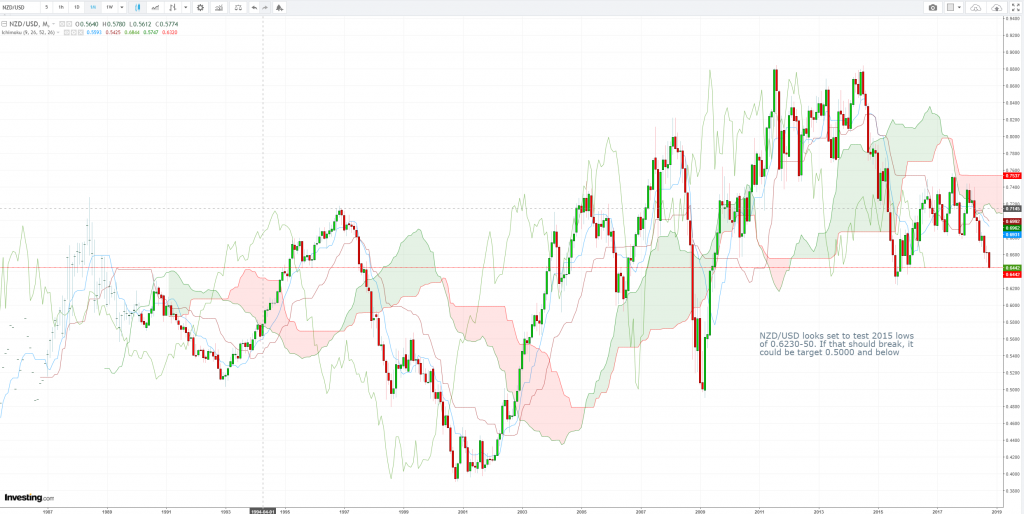

NZD/USD Monthly Candlesticks & Ichimoku Chart

NZD/USD looks set to test 2015’s lows of 0.6230-50. If that should break, it could be targeting 0.5000 and below.

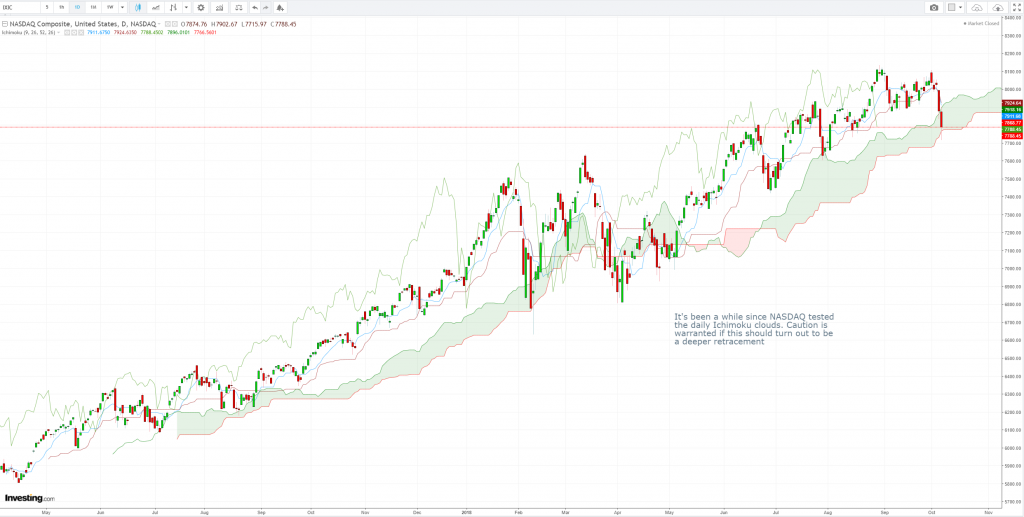

NASDAQ Index Daily Candlesticks & Ichimoku Chart

It’s been a while since NASDAQ tested the daily Ichimoku clouds. Caution is warranted if this should turn out to be a deeper retracement.

Vee, our Founder/CIO highlights patterns/formations on selected chart(s) every week which may have the potential to turn into trading opportunities. These charts are extracts of our weekly subscription product – “CIO’s Week Ahead Update” which provides analysis for the week ahead, first sent out on Monday of the week.

Let us know what you think in the comments below!

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte. Ltd. that any particular investment, security, transaction or investment strategy is suitable for any specific person. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte. Ltd

- U.S. Average Hourly Earnings m/m inline at 0.3%. Non-Farm Employment Change at 134K vs expected 185K. Unemployment Rate at 3.7% vs expected 3.8%. Japanese Average Cash Earnings y/y at 0.9% vs expected 1.3%. U.S. Treasuries extended their weekly losses following the release of the jobs report, pushing yields higher across the curve. The 2-yr yield advanced one basis point to 2.88%, and the benchmark 10-yr yield jumped three basis points to 3.23%, extending its weekly gain to 16 basis points and marking its highest close since 2011. JPY remained bid against the Dollar on the back of continued risk-aversion in U.S. equity markets. USDJPY down -0.18%, $113.72.

- German PPI m/m at 0.3% vs expected 0.2%. Euro up 0.08%, $1.1524. Headlines indicated that the EU is willing to offer the UK a “super-charged” free-trade deal. According to the report which cited EU officials, Brussels’ proposal will be presented to the UK news Wednesday. Not much detail was known, except that it covers between 30 to 40% of UK PM May’s demands. Seems unlikely that UK authorities will give up to most of the Chequers’ plan to agree with this upcoming idea, but in the meantime, market players believe that both parts will work hard to avoid a no-deal. Sterling up 0.79%, $1.3123.

- Canadian Employment Change at 63.3K vs expected 25.0K. Unemployment Rate inline at 5.9%. USDCAD up 0.09%, $1.2937.

- S&P 500 down -0.55%, 2,885.57. Nasdaq down -1.21%, 7,399.01. Nikkei down -0.58%, 23,821.50.

- In corporate news, Costco (COST 218.82, -12.86) lost -5.6% despite reporting above-consensus earnings, and Tesla (TSLA 261.95, -19.88) dropped -7.1% after Elon Musk seemingly mocked the SEC in a late Thursday tweet, just days after agreeing to a settlement with the agency over securities fraud allegations stemming from his failed bid to take the company private.

Sidechains Are Bringing ICOs to Bitcoin – And That Might Change Crypto Funding

By the end of the year, an initial coin offering, or ICO, will be launched on Bitcoin. While Ethereum, the second largest blockchain by market cap, and other smart contract protocols, have been the choice for the majority of entrepreneurs interested in creating new crypto tokens, with a sidechain created by RSK, Bitcoin will now have the ability to host the new fundraising mechanism as well. And sometime in late November, Temco, a South Korea-based blockchain startup targeting supply chain management, will take advantage of both the seminal idea and RSK’s technology, launching a public token sale with the goal of raising $19 million.

Venezuela Mandates Passport Fees Must Be Paid in Controversial Cryptocurrency Petro

The country’s vice president Delcy Rodriguez said in a press conference Friday, Oct. 5. that Venezuelans can use only the Petro, the state-backed cryptocurrency to pay for passport fees starting next week. Rodriguez confirmed that as of Monday, Oct. 8, fees for all passport applications will only be payable in Petro, and will cost an increased amount: 2 petros for a new passport and 1 petro for an extension. The average monthly minimum wage in Venezuela is four times less than the cost of the raised passport fee. Rodriguez also stated that in the case of Venezuelans who are abroad, until the first day of November the cost will be $200 for issuance and $100 for extensions. Rodriguez also announced along with the passport fees shake-up, the formation of a dedicated migration police force designed “to preserve citizen security and migratory control.”

Yale University Invested in New $400 Million Crypto – Focused Fund

Ivy League U.S. university Yale has helped to raise $400 Million for a major new cryptocurrency-focused fund. The fund, dubbed ‘Paradigm,’ was reportedly created by Coinbase co-founder Fred Ehrsam, former Sequoia Capital partner Matt Huang, and Charles Noyes, formerly of stalwart crypto fund Pantera Capital. Allegedly, Yale, whose $30 billion endowment is reported to be the second-largest among U.S. higher education institutions has made an investment of an undisclosed size in Paradigm and 60 percent of Yale’s assets for the fiscal year 2019 are earmarked for “alternative investments” including “venture capital (vc), hedge funds and leveraged buyouts.” The fund reportedly plans to invest in “early-stage” crypto-focused projects, new blockchains and digital asset exchanges.

1. Bitcoin Startup Acinq Raises $1.7 Million to Double Down on LightningBitcoin Startup Acinq Raises $1.7 Million to Double Down on Lightning

Acinq, one of the leading startups working on the lightning network, a top-level layer aiming to boost the number of transactions bitcoin can support, has closed a $1.7 million funding round led by Serena Capital, with participation from Talend co-founder Bertrand Diard, Sebastien Lucas, Alistair Milne and Snapcar founder Yves Weisselberger. As a result of the funding, Lightning Labs is no longer the only startup solely dedicated to lightning that’s been able to rake in money for its efforts. With the funds, Acinq also plans to hire three to four “highly technical” developers over the coming weeks and months. To do its part in the effort, Acinq plans to take its operations to a larger scale. This means working with other developers on standards for lightning.

2. SBI Ripple Asia’s MoneyTap App Has Launched in Japan

MoneyTap, a consumer-focused blockchain money transfer app built by SBI Holdings and Ripple, has now gone live. A new website for the product has also been launched indicating that the app is able to make bank-to-bank money transfers in “real time” using Ripple’s xCurrent payments product. Available for both iOS and Android devices, the product allows users to send funds to others using just their telephone numbers or a QR code, and utilizes devices biometric log-in features, such as fingerprint scanning, for security. Currently, the service is only able to remit between accounts held at the three participating Japanese banks – SBI Sumishin Net Bank, Suruga Bank and Resona Bank. Payments are being offered at no charge and can be sent in Japanese yen or foreign currencies.

3. Chinese Energy Outfit to Support Spanish 300 MW Crypto Mining Farm

Chinese energy company Risen Energy has partnered with a Spanish cryptocurrency mining farm will to develop capacity of up to 300 megawatts (MW) of photovoltaic power. Several months after CryptoSolarTech confirmed it was building two farms near the city of Malaga using energy-efficient technology, Risen will develop and take on engineering, procurement and construction (EPC) responsibilities for the projects. In June, CryptoSolarTech released its own token via an ICO to assist in financing its operations, the token raising a reported $68.2 million and last month CryptoSolarTech had raised 60 million euros ($69 million) from its first two months of existence, along with concluding a power supply contract with Barcelona-based Respira Energia. Since the culmination of the ICO, the company’s token has lost the vast majority of its value, making it into the top ten ICO ‘losers’ in research released late September.

Takuya Hirai, a member of the ruling Liberal Democratic Party (LDP) and one of the architects of a law legalizing crypto exchanges in Japan last year, has been proactive in promoting blockchain as part of his role as chairperson of the Liberal Democratic Party’s IT Strategy Special Committee, as well as chairperson of the Fintech Promotion Parliamentarians’ Federation. Hirai is credited for his role in drafting Japan’s basic cybersecurity law, which was enacted in 2015. Hirai’s advisory role at Tama University has shown that the study group publishes a broad list of regulatory guidelines and full legalization of ICOs in the country, which will be officially considered by Japan’s Financial Services Agency, and could eventually be passed into law in the next few years. The guidelines included rules for anti-money-laundering (AML), know-your-customer (KYC) measures, tracking project progress, and protecting existing equity and debt holders.

IBM Awarded Patent for Secure System Based on Blockchain

Tech conglomerate IBM has recently been awarded a patent for a blockchain-based secure system. The patent filing was published on U.S. Patent and Trademark Office (USPTO) website Tuesday, October 2. The technology enables the detection of security breaches within a network by connecting all the monitors to a chain configuration, which registers all events in the network. This, in turn, might help to prevent different sorts of hacks. Within a blockchain security system, a hacked monitor can be found immediately, as in such a case synchronized monitors won’t have consensus. The use of blockchain technology in monitor systems will therefore help create “a less vulnerable” network and provide more security, IMB states.

Crypto Trading Platform BitMEX Appoints Veteran Hong Kong Regulator as COO

Major crypto trading platform BitMEX has appointed a veteran Hong Kong regulator as its chief operating officer (COO). BitMEX was founded in 2014 and sees almost $1.8 billion in daily traded volume, making it one of the world’s largest crypto exchanges. It works as a “peer-to-peer trading platform that offers leveraged contracts that are bought and sold in Bitcoin. Reportedly, Angelina Kwan will become its COO with immediate effect. Kwan is a certified public accountant and served as managing director and head of regulatory compliance for Hong Kong Exchanges and Clearing (HKEX) for almost three years prior to accepting the BitMEX post. Earlier, she was reportedly a covered enforcement and market supervision as part of her role as director of Hong Kong’s Securities and Futures Commission and she also worked at domestic brokerage firms including Reorient and CLSA. She has noted that proactive regulators have given the green light to crypto futures trading on leading platforms CME Group and CBOE.

1. Italian Banking Association Completes First Test of Blockchain-Based Interbank System

The Italian Banking Association (ABI) has revealed they successfully passed the initial phase of testing their blockchain-powered interbank system. By applying distributed ledger technology (DLT), the group of 14 Italian banks is planning to improve interbanking processes. Specifically, the association intends to boost the processing time of operations, increase the transparency of banking information, and enable the verification and exchange of information directly within the application. According to the report, the association has successfully completed 1.2 million movements on an infrastructure of 14 nodes distributed by the banks. Based on the positive results of the first stage of the test, the banks will now start applying the blockchain-powered application for the recording of daily operations.

2. Bank of America: Blockchain Market Could Hit $7 Bln, Will Give Boost to Amazon, Microsoft

The Bank of America (BoA) has estimated that blockchain could be a $7 billion market and provide a major boost to corporate giants such as Microsoft and Amazon. BoA research analyst Kash Rangan emphasized that while many potential use cases for blockchain have been widely recognized, “full products/services have not yet been built out and are not used in production,” leaving the technology’s capacity to generate real-world capital still unproven. Among other high-profile beneficiaries poised to benefit from blockchain, BoA included Oracle, IBM, Salesforce.com, and VMware, as well as major players from the real estate and mortgage industries such such as Redfin, Zillow, and Lendingtree.

3. Blockchain Could Be Solution to Irish Border Trade Issue After Brexit

British finance minister Philip Hammond announced that the issue of trade across the Irish border after Great Britain leaves the European Union (EU) might be solved by deploying blockchain technology. The United Kingdom (UK) and the EU agreed to leave the border between the Northern Ireland and Republic of Ireland open but the parties are still looking for a method to make it possible. The UK intends to leave the EU Customs Union, which would require border controls between Northern Ireland, a part of the UK, and the Republic of Ireland, which will stay in the EU. The implementation of blockchain could be a tool for resolving the Irish border issue, as the technology enables products’ movement to be recorded transparently and without changes.