- U.S. JOLTS Job Openings at 7.14M vs expected 6.90M. Industrial Production m/m at 0.3% vs expected 0.2%. Treasuries barely moved, subduing current fears of rising interest rates for now. The Fed-sensitive 2-yr yield added one basis point to 2.86%, while the benchmark 10-yr yield declined one basis point to 3.16%. Risk-appetite returned on Tuesday as upbeat earnings buoyed sentiment. USDJPY up 0.50%, $112.34.

- German ZEW Economic Sentiment at -24.7 vs expected -12.3. E.U. ZEW Economic Sentiment at -19.4 vs expected -9.2. Euro down -0.03%, $1.1576.

- U.K. Average Earnings Index 3m/y at 2.7% vs expected 2.6%. Unemployment Rate inline at 4.0%. In Brexit, Germany’s Europe Minister Roth, said that they are close to a Brexit deal, but added that they shouldn’t rule out the chance of a no-deal. Irish PM Varadkar also made headlines, saying that there will be no withdrawal agreement without a legally binding backstop, while EU’s Chief Negotiator Barnier later said that the Irish border issue remains unsolved and that they may need more time to reach an agreement. Sterling held on to gains despite EU’s Tusk later comments that a no-deal is more likely than ever before. Sterling up 0.27%, $1.3188.

- Chinese CPI y/y inline at 2.5%. USDCAD down -0.43%, $1.2936. N.Z. CPI q/q at 0.9% vs expected 0.7%. Kiwi up 0.49%, $0.6583.

- S&P 500 up 2.15%, 2,809.92. Nasdaq up 2.94%, 7,276.43. Nikkei up 1.25%, 22,549.24.

- Investor sentiment was buoyed after several financial and health care giants reported upbeat earnings. Goldman Sachs (GS 221.70, +6.48, +3.0%) and Morgan Stanley (MS 45.94, +2.47, +5.7%) helped boost the financial sector (+1.6%) after reporting better-than-expected top and bottom lines. Asset management firm BlackRock (BLK 408.00, -18.94, -4.4%) weighed on the sector, though, after missing revenue expectations. BlackRock’s pain worsened when CEO Larry Fink said that the company saw more than $30 billion of institutional non-ETF index equity outflows that were driven by client de-risking. Fink added that he thinks clients will continue to de-risk.

- Health care sector (+2.9%) components Johnson & Johnson (JNJ 136.56, +2.61, +2.0%) and UnitedHealth (UNH 272.57, +12.32, +4.7%) contributed to the group’s strong performance after better-than expected results. The health care sector is the second-best performing group this year with a 2018 gain of 12.5%; tech leads with a gain of 13.9%. Adobe Systems (ADBE 260.67, +22.66, +9.5%) had a very strong performance after it reaffirmed fourth quarter guidance and said it expects FY19 revenues to be up 20%. Likewise, chip stocks outperformed, as the Philadelphia Semiconductor Index climbed 3.3%. Notable gainers included Intel (INTC 45.94, +1.41, +3.2%), Qualcomm (QCOM 66.12, +1.95, +3.0%), and NVIDIA (NVDA 245.83, +10.45, +4.4%).

Telegram to Debut ‘Test Version’ of Blockchain Platform TON ‘This Autumn,’ Say Investors

Encrypted messenger service Telegram will release a test version of its blockchain-based TON platform “this autumn”. Investors “confirmed” the authenticity of a circular sent to participants in TON’s Initial Coin Offering (ICO) at the start of September. Once in operation, TON will also make use of its in-house cryptocurrency, Gram, and will form a “new way of exchanging data.” Telegram attracted considerable attention earlier this year when it raised almost $1.8 billion in investments for TON and its current messenger app via two private ICO presales. Following the success of the fundraising, in May executives subsequently cancelled the planned public phase of the ICO.

Kenyan Gov’t to Use Blockchain in New Affordable Housing Project

Kenya’s government plans to deevelop blockchain technology to manage a government housing project of 500,000 units. The government of Kenya aims to build 500,000 units by 2022, and assist contributors earning less than 100,000 Kenyan Shillings ($992) as they cannot afford hypothec. Blockchain technology will be used to ensure the proper distribution of housing to deserving participants in the program and address issues of graft from both legislators and beneficiaries. The project will reportedly be financed by the National Housing Fund under the Finance Act of 2018, to which Kenyans will contribute 1.5 percent of their salary that will be matched by their employers. Kenya will use blockchain technology to ensure the rightful owners live in government funded housing projects.

Fifth Largest Crypto Exchange Huobi Lists Four USD-Backed Stablecoins, Following OKEx

Starting Friday, Oct. 19, crypto exchange Huobi will start accepting deposits of four USD-backed stablecoins – Paxos Standard (PAX), TrueUSD (TUSD), USDCoin (USDC), and Gemini Dollar (GUSD). The stablecoins are already available on Huobi Wallet, while the launch time and other details are set to be announced at a later time. OKEx has already launched deposits in the four stablecoins, with withdrawals available starting from today. Also on Oct. 15, blockchain trust company Paxos announced it had issued about $50 million worth of its stablecoin Paxos Standard Token. The Ethereum (ETH) blockchain-based stablecoin has received regulatory approval from the New York State Department of Financial Services (NYDFS) on September 10, together with another stablecoin Gemini Dollar that was launched by Winklevoss brothers. Yesterday, BitPay also launched stablecoin support, enabling merchants to receive settlements in Gemini Dollar and Circle USD Coin (USDC).

- U.S. Core Retail Sales m/m at -0.1% vs expected 0.4%. Retail Sales m/m at 0.1% vs expected 0.7%. The 2-yr note yield ticked one basis point higher to 2.85%, and the 10-yr note yield rose two basis points to 3.16%. Risk-aversion sentiment returns on Monday with markets starting the week soft, USDJPY down -0.38%, $111.78. Euro up 0.28%, $1.1583.

- In Brexit, May told the House of Commons on Monday that neither Brussels nor London could allow the disagreement to “derail the prospects of a good deal and leave us with a ‘no-deal’ outcome that no one wants”. She insisted she believed a deal was still “achievable” and that the UK and EU were “not far apart”. Sterling up 0.40%, $1.3155.

- BOC survey showed strong investment intentions and a tight labor market. WTI crude prices were relatively subdued on Monday, settling 0.6% higher at $71.83/bbl. USDCAD down -0.28%, $1.2987.

- S&P 500 down -0.59%, 2,750.79. Nasdaq down -1.24%, 7,068.67. Nikkei down -1.87%, 22,271.30.

- Financial sector was unable to impress after an underwhelming response to Bank of America’s (BAC 27.92, -0.54, -1.9%) better-than expected earnings report. Charles Schwab (SCHW 47.64, -1.37, -2.8%) also fell after reporting earnings that were in-line with top and bottom estimates. United States-Saudi Arabia tensions brewed over the weekend following the disappearance and alleged murder of Washington Post columnist Jamal Khashoggi. In response, Trump threatened to impose sanctions on the world’s largest oil producer if it was found to be guilty; however, Trump said today that Saudi King Salman strongly denied to him any involvement in Khashoggi’s disappearance.

- In other corporate news, L3 Technologies (LLL 220.91, +25.13) rose 12.8% after announcing an all-stock merger of equals with Harris Corp. (HRS 173.25, +18.38, +11.9%). The combined company, L3 Harris Technologies, will be the 6th largest defense company in the U.S. and a top 10 defense company globally. Separately, retailer Sears Holding (SHLD 0.31, -0.10, -23.8%) filed for Chapter 11 bankruptcy. That was not a surprise to the market, as it had been widely speculated, yet the news itself generated a sentimental story line given the retailer’s storied operating history.

Bitcoin (BTC) Daily Candlesticks & Ichimoku Chart – LONG

Bitcoin (BTC) jumped to hit highs of 7700-7800 within minutes yesterday before falling back to below 7000. A decisive close above the cloud could get very interesting.

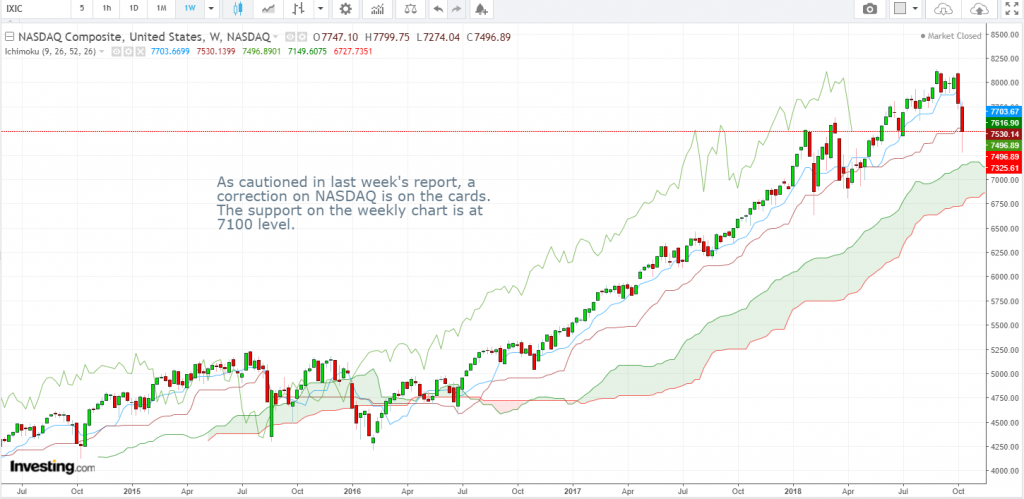

NASDAQ Index Weekly Candlesticks & Ichimoku Chart

As cautioned in last week’s report, a correction on NASDAQ is on the cards. The support on the weekly chart is at 7100 level.

Vee, our Founder/CIO highlights patterns/formations on selected chart(s) every week which may have the potential to turn into trading opportunities. These charts are extracts of our weekly subscription product – “CIO’s Week Ahead Update” which provides analysis for the week ahead, first sent out on Monday of the week.

Let us know what you think in the comments below!

Disclaimer: The views and opinions expressed in this material do not constitute a recommendation by TrackRecord Pte. Ltd. that any particular investment, security, transaction or investment strategy is suitable for any specific person. No part of this material may be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission of TrackRecord Pte. Ltd

Price of Tether Stablecoin Tanks to 18-Month Low

The price of the tether stablecoin (USDT) has fallen to an 18-month low Monday, despite a general rise in the wider crypto markets. The tether-US dollar exchange rate (USDT/USD) fell to $0.925284 at 07:00 UTC – the lowest level since April 27, 2017 – and was last seen trading at $0.967296, representing a 2 percent drop on a 24-hour basis. The slide in the USDT price has pushed up the premium carried by bitcoin (BTC) prices on the Bitfinex exchange above $600. on Bitfinex, BTC is changing hands at $7,055, meaning prices are trading at a premium of $438 to the BPI. The leading cryptocurrency rose as high as $7,788 on Bitfinex, which operates Tether LLC, the firm that developed the USDT token.

Hong Kong’s Security Watchdog to Propose Crypto Regulation, Chairman Says

Hong Kong’s securities and futures commission (SFC) is planning to introduce crypto regulation to protect investors, the SFC chairman said. Chairman Carlson Tong Ka-shing said in an interview that the watchdog is not considering a ban on cryptocurrency platforms as the Chinese mainland has done, adding that they don’t think that a total ban is “necessarily the right approach”. A legal framework to regulate crypto exchanges is absolutely necessary, noting that the SFC is going to consider the approach carefully as such platforms are “new technologies” and cannot treated as securities. According to the SMCP, the exchanges that are working in Hong Kong’s market have welcomed the move.

Binance Launches Its First Fiat-Crypto Exchange in Uganda

Major international crypto exchange Binance has announced that its fiat-to-crypto exchange will open in Uganda this week. As per Binance Uganda’s press release, the new branch will officially start accepting deposits and withdrawals of Ugandan shillings (UGX) Wednesday, Oct. 17. Binance Uganda notes that exchange has already begun its know-your-customer (KYC) procedures. Uganda’s national fiat can only be traded with Bitcoin (BTC) and Ethereum (ETH), but that the exchange is planning to add more pairs soon. Allegedly, Binance has plans to open several fiat-to-crypto exchanges. Binance is the largest international crypto exchange by 24-hour adjusted trading volume, seeing almost $1.8 billion in trades on the day to press time.

Europe Getting Serious About Distributed Ledger Technology

On April 10, 2018, 21 EU member states and Norway signed up to create the European Blockchain Partnership. By bringing distributed ledger technology (DLT) to European infrastructure, the Partnership hopes to make cross-border services safer and more efficient. The Partnership’s membership is currently at the very early stage of negotiating just what kind of blockchain-based public services to develop. According to Finland’s representative to the Partnership, Kimmo Mäkinen, a senior advisor at the Department of Public Sector Digitalization, the most recent meeting took place on September 17. The main topic was to discuss about the most prominent cross-border blockchain use-cases that had been proposed by member states and by the commission.” the Partnership’s 27 member nations have effectively declared that they believe DLT is here to stay and that it has genuine applicability to a range of areas. If the Partnership implements blockchain-based cross-border infrastructure, this will only have positive ramifications and knock-on effects for wider blockchain adoption elsewhere. All of which means that the future of blockchain adoption in Europe looks increasingly bright.

Bitcoin Markets Comprise Imminent Alternative to Foreign Exchange

A report authored by researchers from the Henryk Niewodniczanski Institute of Nuclear Physics has found that Bitcoin is maturing. The report, courtesy of the Polish Academy of Sciences in Krakow, concludes that Bitcoin carries “concrete potential of imminently becoming a regular market” and “an alternative to the foreign exchange.” According to Professor Stanisław Drożdż, one of the researchers who worked on the study, the most important statistical parameters of the Bitcoin market indicate very clearly that for many months now it has met all the important criteria of financial maturity. In the case of other cryptocurrencies, it will be possible to expect a similar transformation. If this happens, the world’s largest market, the Forex market, can look forward to very real competition.

Hacker Livestreams 51% Attack on Bitcoin Private

On Oct. 13, ethical hacker “Geocold” promised he would 51 percent attack an altcoin to prove how easy it was, and he did, but the attempt did not run as smoothly as he might have hoped. Over 750 viewers were tuned in, and the likes of Jackson Palmer live-tweeting the spectacle, when Twitch suddenly pulled the plug. Despite the ethical hacker having no intention of attempting to double spend coins, such as by depositing them into an exchange wallet and swapping them for BTC, the streaming provider pulled the plug, presumably in response to members of the Bitcoin Private community reporting his channel. When Geocold returned on Stream.me half an hour later, he lasted a little over 15 minutes before the same thing happened. At the second attempt, Geocold dominated BTCP’s hashrate, producing a steady 10 MSol/s versus the rest of the network’s 6 MSol/s. The evening started as an exercise on the ease of controlling low hashrate PoW coins and ended as a demonstration of the need for censorship-resistant platforms.

- U.S. CPI m/m at 0.1% vs expected 0.2%. Core CPI m/m at 0.1% vs expected 0.2%. The helped temper concerns about rising inflation for the time being, yet with total CPI and core CPI running above the Fed’s longer-run inflation target of 2.0%, it still left little reason to think the Fed is going to back away from a rate hike in December. Risk-off sentiment in markets continue to keep safe-haven Yen bid. Dollar was broadly weaker on Thursday. USDJPY down -0.17%, $112.09.

- In ECB Minutes, policymakers ultimately concluded that the domestic economy was showing enough resilience to consider risks broadly balanced, even if some argued that the factors behind the recent slowdown may not be temporary as earlier thought, the ECB said in the accounts of the Sept 13 meeting. Policymakers also concluded last month that domestic cost pressures continued to build and broaden, indicating that inflation would rise, moving back toward the bank’s target of almost 2% after undershooting it for over five years. Euro up 0.61%, $1.1590. Sterling up 0.29%, $1.3234. USDCAD down -0.28%, $1.3032.

- S&P 500 down -2.06%, 2,728.37. Nasdaq down -1.44%, 6,964.03. Nikkei down -3.96%, 22,587.50.

- At session lows, the S&P 500 was down -2.7%. Stocks were able to reclaim some losses in the final hour of trading following a Washington Post report that Trump and Chinese leader Xi Jinping have agreed to meet at next month’s G-20 summit in Argentina with hopes of resolving their trade conflict.

- Yields on longer-dated issues fell quite a bit more than yields on shorter-dated issues, leading to a flattening of the yield curve; the yield on the 2-yr Treasury note slipped one basis point to 2.85%, while the benchmark 10-yr yield fell nine basis points to 3.13%. That yield curve flattening weighed on lenders, which depend on the interest-rate differential between what they pay for deposits and what they make on loans. The S&P 500’s financial sector lost -2.9% and Trump blamed the recent selling on the Fed, which he says has “gone crazy” with its rate hikes. When asked if he is considering firing Jerome Powell, who he appointed, the president said he wouldn’t, adding that he’s “just disappointed.”

South Korea to Announce Its ICO Stance in NovemberSouth Korea to Announce Its ICO Stance in November

South Korean government will probably announce its official position on Initial Coin Offerings (ICOs) in November. South Korea first banned ICOs back in September 2017, saying that the practice of raising funds via the issuance of cryptocurrency tokens was almost “a gamble.” Hong Nam-Ki has revealed that the government has held a survey, because some companies are still trying to conduct ICOs despite a country-wide ban. The results of the poll are expected to be ready by late October. South Korea has recently launched a six-month youth training programme that includes courses on blockchain and other technologies. The announcement came after the news of the government’s plans to invest $4.4 billion in a number of areas of the domestic economy, including blockchain.

Crypto Exchange Bitfinex Suspends Fiat Deposits, Expects to Resume ‘Within a Week’

Major crypto exchange Bitfinex has temporarily suspended all fiat wire deposits for the Euro, U.S. Dollar, Japanese Yen and Pound Sterling. The exchange has recently been prompted to officially respond to online rumours that claimed Bitfinex was insolvent and/or facing banking issues. The exchange’s statement was partly prompted by reports that its banking partner, Puerto Rico’s Noble Bank International, is now seeking a buyer and had lost both Bitfinex and affiliated firm Tether as clients. Bitfinex’s history of banking relationships began in April 2017, when U.S. Wells Fargo & Co. allegedly refused to continue operating as a correspondent bank. Bitfinex then filed a lawsuit against the bank that was quickly dropped. Bitfinex is currently the 4th largest exchange globally by daily traded volume, seeing a 154 percent increase over the 24-hour period to see almost $633.4 million in trades on the day.

Regulators Sue ICO Company That Falsely Claimed SEC Approval

The Securities and Exchange Commission said Thursday that it secured an emergency court order against an initial coin offering and its organizer who had claimed to have received approval from the agency. Ringgold and BlockVest, the agency said, “were using the SEC seal without permission, a violation of federal law, and falsely claiming their crypto fund was ‘licensed and regulated. ” Blockvest and Ringgold also allegedly misrepresented Blockvest’s connections to a well-known accounting firm, and continued their fraudulent conduct even after the National Futures Association (NFA) sent them a cease-and-desist letter to stop them from using the NFA’s seal and from making false claims about their status with that organization, the SEC said in a statement.

- U.S. PPI m/m inline at 0.2%. Core PPI m/m inline at 0.2%. Japanese Core Machinery Orders m/m at 6.8% vs expected -3.9%. Risk aversion fears escalated on Wednesday as markets plunged, Yen remained strongly bid against the Dollar. USDJPY down -0.76%, $112.09.

- Euro up 0.37%, $1.1533. U.K. GDP m/m at 0.0% vs expected 0.1%. Manufacturing Production m/m at -0.2% vs expected 0.1%. In Brexit, Barnier claimed that near the 85% of the Brexit deal has been agreed, although adding that they still need to agree on the Irish border issue. Furthermore, he said that the EU found many points of convergence with UK PM May’s Chequers plan. Sterling up 0.46%, $1.3205. Hurricane Michael made landfall in the Florida Panhandle as a Category 4 storm. The storm has disrupted crude production in the Gulf of Mexico, but oil prices fell notably on Wednesday nonetheless, retreating from the four-year high hit earlier this month. WTI crude dropped 2.5% to $73.09/bbl. USDCAD up 0.82%, $1.3053.

- S&P 500 down -3.29%, 2,785.68. Nasdaq down -4.44%, 7,044.50. Nikkei down -3.24%, 22,757.00.

- Stocks tumbled on Wednesday as bond yields held steady at multi-year highs and amid continued concerns about economic and earnings growth prospects. FANG names, which have been key leadership stocks for this bull market, got pummelled on Wednesday; Netflix (NFLX 325.89, -29.82) lost -8.4%, Amazon (AMZN 1755.25, -115.07) lost -6.2%, Facebook (FB 151.38, -6.52) lost -4.1%, Apple (AAPL 216.36, -10.51) lost -4.6%, and Alphabet (GOOG 1081.22, -57.60) lost -5.1%.

- Interestingly, the equity sell off did not lead to higher demand for “risk-free” U.S. Treasuries. In fact, bonds declined with stocks on Wednesday, with investors presumably opting to go to cash instead. The benchmark 10-yr yield, which moves inversely to the price of the 10-yr Treasury note, advanced two basis points to 3.23%, closing near a seven-year high

China Should Consider Launching its Own Stablecoin, Central Bank Expert Says in Op-Ed

An expert from the People’s Bank of China (PBoC), Li Liangsong, and professor of Fudan University Wang Huaqing wrote an article called “Analysis of Digital Stable Coins” for CN Finance, in wich he noted that The Chinese government should consider launching its own yuan-backed stablecoin despite the current ban on cryptocurrencies. The authors suggested that China should analyze other companies’ experience and “double its efforts” to create a local stablecoin, and other digital currencies have to stay prohibited in China. The Chinese government first started its anti-crypto campaign in 2017 by closing all of the country’s cryptocurrency exchanges and banning Initial Coin Offerings (ICO). The People’s Bank of China has then warned citizens about the risks of crypto trading. Despite the crypto ban, the country has actively been exploring blockchain solutions.

Crypto Exchange Hack Losses Already 250% Higher Than 2017, Q3 Report Shows

The Australian federal government is exploring the use of blockchain-based “smart money” for use in its National Disability Insurance Scheme (NDIS). The trial, dubbed “Making Money Smart,” has been developed by the Commonwealth Bank of Australia (CBA) and Data61. The latter is a digital innovation center that forms part of the Commonwealth Scientific and Industrial Research Organisation (CSIRO) which is an Australian government corporate entity that undertakes scientific research to advance diverse local industries. Data61 says that NDIS was chosen for the proof-of-concept as it “involves highly personalised payment conditions,” outlining how under NDIS, individuals and their carers receive specified amounts of funds to spend on various goods and services provided for by the scheme. Using a Smart Money scheme would automate and secure the process, relieving users and service providers from needing to process cumbersome paperwork or administrative receipts.

Korean Crypto Exchange Sued for Controversial Token Schemes

South Korean law firm Aone filed a complaint with Seoul Central District Court on Oct. 5 against Newlink Co. Ltd., the owner of crypto exchange Cashierest. Lawyer Kim Dong-joo at Aone’s Seocho branch explained that his firm is pursuing charges against the crypto exchange for deviating from the public interest in order to restore the health of the cryptocurrency market. The suit alleges that Cashierest has committed two illegal acts by issuing its “dividend coin [called] cap (CAP)” on the capital market – first is a violation of the securities issuance procedure, as defined in Article 119 of the country’s Capital Markets Act, and the second is a violation of Article 178 which prohibits unfair trading. The law firm plans to expand the lawsuit to other exchanges such as Bithumb, Coinbit, and Coinzest. At the heart of the lawsuit is CAP, the exchange’s own token.